My E.G. Services (MYEG): Fundamentally good, but why not for value investing?

My E.G. Services Berhad (KLSE: MYEG) boasts one of the best fundamentals when it comes to stocks listed on the Bursa Malaysia exchange.

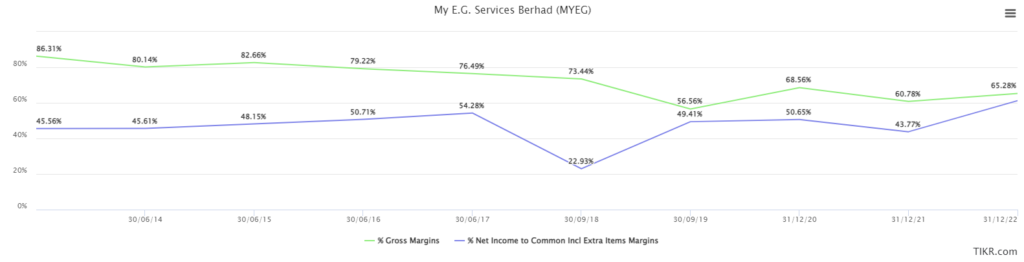

Companies with a past track record of high gross and net margins are very uncommon on the Malaysia stock exchange.

MYEG’s gross margins have been consistently above 50%, and trending at above 60% over the last 10 years.

Its net margins are also superior, trending at above 40% most of the time for the last 10 years.

The superior margin track record qualifies the stock for multi-bagger status. So long as there is a runaway for growth, and profits are reinvested back to grow the company, MYEG would have been in the mouth of every growth and value investor practitioner in Malaysia.

Sadly, this is not the case. So why is MYEG a stock that growth and value investors should shy away from?

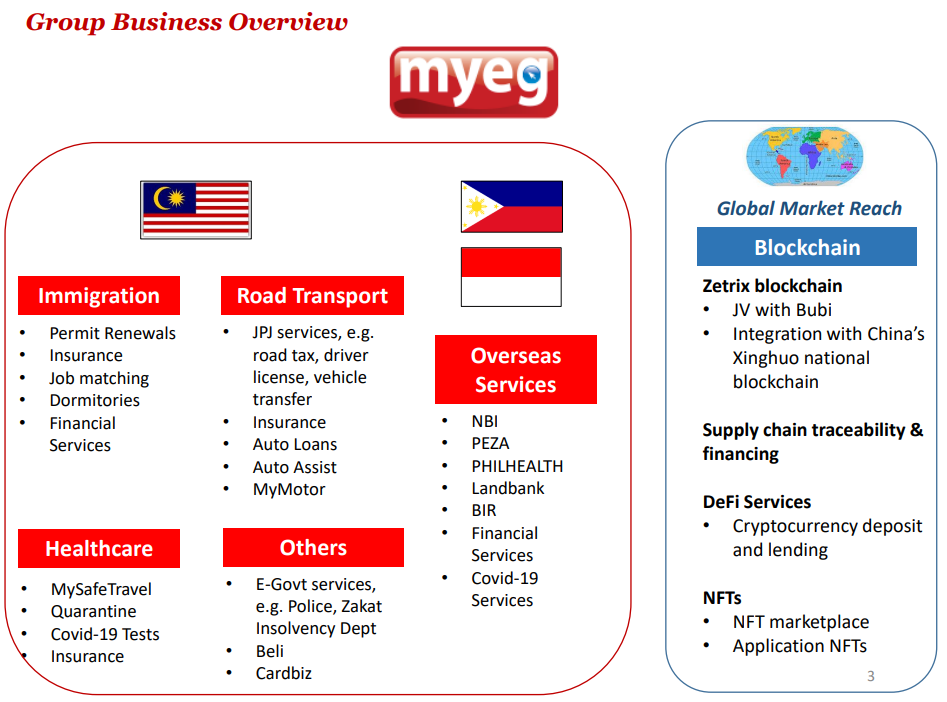

1. Geographically concentrated in Malaysia

MYEG’s principal business is in the development and implementation of the Electronic Government Services project and the provision of other upstream and downstream related services for the Electronic Government Services project.

Its value proposition is in the ability to obtain and maintain government contracts for operating services. These contracts and services can be related to immigration, road transport healthcare, and other E-government services.

It boasts of having overseas services and a global market reach. But most, if not all of its activities are operating wholly in Malaysia.

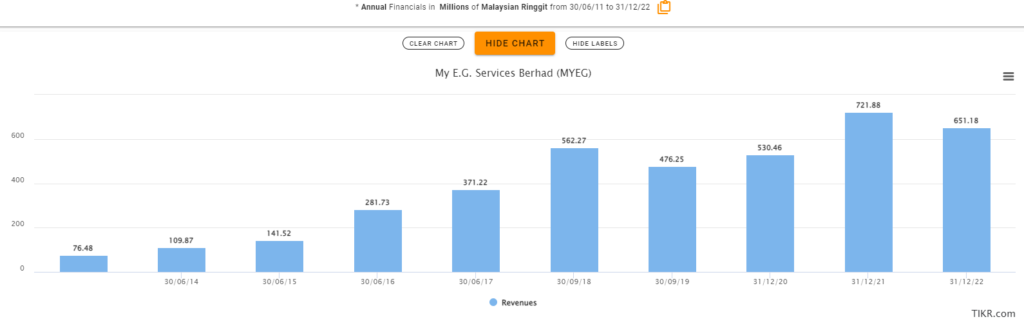

High-margin businesses which are not scalable out of Malaysia spell limited possibilities for prospects and catalysts. Although revenue has been on long-term growth for MYEG, its share prices have never grown in tandem with its fundamentals.

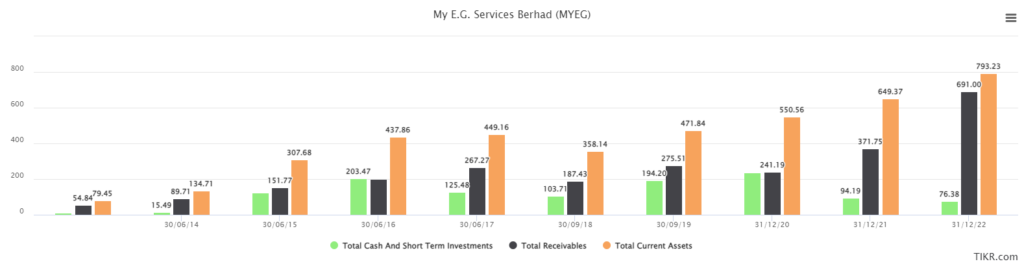

2. Total receivables are growing higher and faster

One of the key concerns about MYEG is its ever-growing receivables. Receivables, especially current receivables are payment obligations that the company is anticipating payment from prior to recategorizing as cash in the account upon receipt.

A higher amount might suggest difficulties in ensuring the timely payment of MYEG’s clients, in this case, the Malaysian government.

In their latest FY 2021 balance sheet, total receivable contributes to more than 87% of MYEG’s total current assets. A further increase in the total receivables in the coming quarters will not look good at all.

3. Losses of contracts are unpredictable and huge

Having a contractual base business model means that it takes additional effort to maintain existing contracts in hopes of renewal. But should the opposite happens, it can be detrimental to MYEG’s prospects.

On February 2023, it was announced that MYEG will not be involved in immigration processes by 2025.

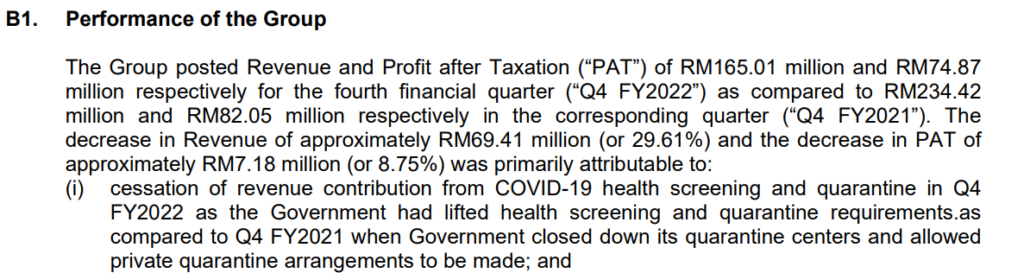

Also, with the relaxation of COVID-19 travel rules and protocols, the COVID-19 health screening and quarantine business provided by MYEG also ceases as well.

MyKayaPlus Verdict

The general financial figures of MYEG no doubt make it a screaming buy. High margins, growing earnings and dividends, and even a cheap valuation by historical levels make it a screaming buy.

However, looking into other figures, certain shortcomings and concerns arise that might make fundamental investors shy away from this stock.

Hopefully, this might make you think twice prior to making any hard decisions on MYEG.

If you are eager to learn these skills that we utilize to analyze stocks, head over to join our bespoke Kaya Plus Premium Club. We further display and utilize simple-to-understand terms and techniques to spot great companies and also detect problematic companies like MYEG.