Is Micro-Mechanics still a great dividend stock?

Micro-mechanics Holdings Ltd. (SGX: 5DD) is a company listed on the Singapore Stock Exchange. It was founded in 1983 and specializes in the design, manufacture, and marketing of high-precision tools, parts, and equipment for the semiconductor industry.

Micro-Mechanics products are essential for producing a wide range of semiconductor devices, including those used in smartphones, computers, and other consumer electronics. It has a global presence with manufacturing facilities and sales offices in several countries, including the United States, Malaysia, China, and the Philippines.

Micro-Mechanics operates in a highly competitive and technologically advanced industry, requiring constant innovation and investment in research and development to stay at the forefront. The company’s success is largely dependent on the overall growth and health of the semiconductor industry, which can be influenced by global economic conditions, technological advancements, and industry-specific factors.

Its share price has dropped close to 50%, from a high of SGD 3.91 per share to SGD 2.01 per share.

So is Micro-Mechanics still investable?

Here are points to take note of.

1. Micro-Mechanics is in the business of producing high-quality consumable parts and toolings for the semiconductor industry

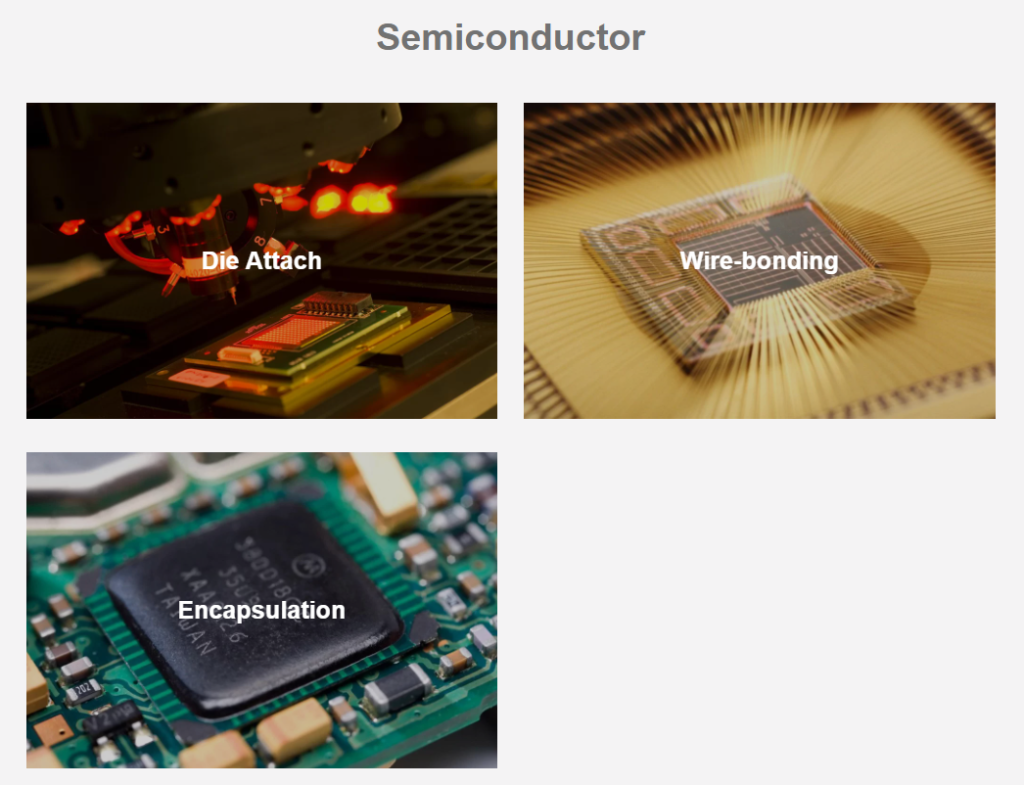

The semiconductor industry can be a long and complicated value chain. Micro-Mechanics’s business is involved in the backend portion of the manufacturing process, specifically in the packaging and assembly of semiconductor devices.

This involves the integration of the semiconductor chips into packages that can be easily mounted on printed circuit boards or other electronic devices. The company’s precision engineering solutions would be used to fabricate and assemble the components required for wafer-level packaging.

2. Revenue & net profit are on long-term uptrend growth

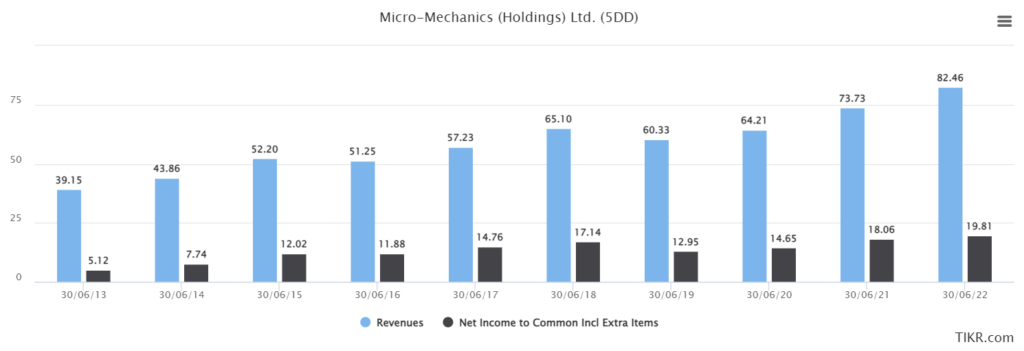

As a company servicing semiconductor clients, the cyclicality of the industry does show up in Micro-Mechanic’s historical revenue trend.

Throughout the last 10 years, revenue has dipped when compared to the previous FY, for FY 16 and FY 19. However, if viewed from FY 2013 to FY 2022, revenue has grown from SGD 39.15 million to SGD 82.46 million.

That is a 9-year CAGR growth of 8.63%

Net income is also on an uptrend in tandem with revenue growth. But net profit growth experiences a 9-year CAGR growth of 16.2%.

3. Highly profitable margins

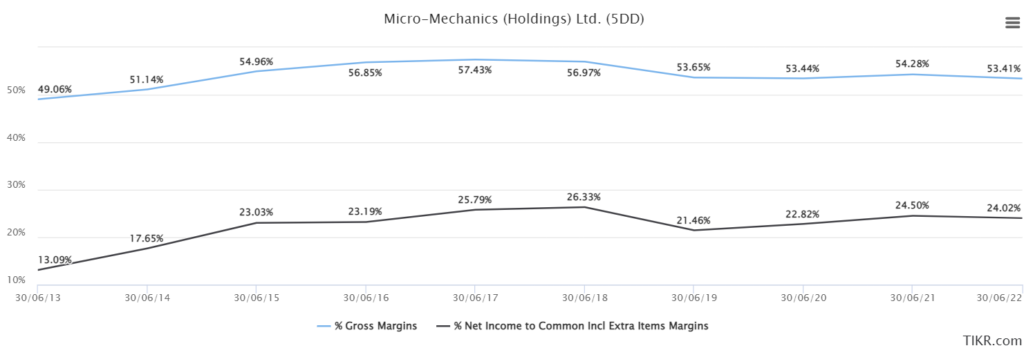

On top of its great track record, Micro-Mechanics also has very impressive margins.

For the last 10 years, gross margins have been on average above 50%, while net margins are above 20%.

High margins imply 2 key points. Firstly, the company is a price-setter. It sets the prices of the goods and services it sells, and customers pay up.

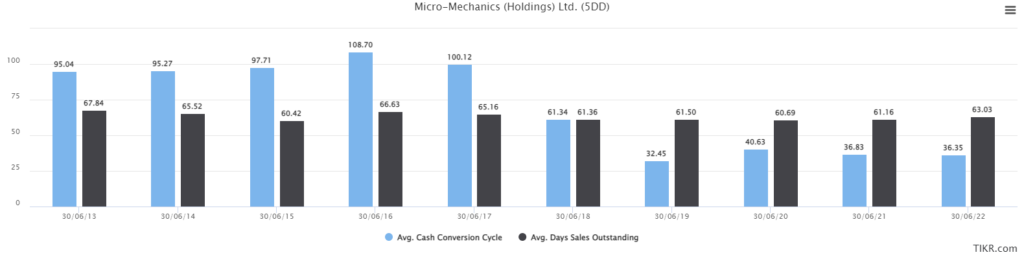

Secondly, it can also dictate payment terms. Cash and payment collection will hardly run into delinquencies as customers would also have to stick to the payment terms set out by Micron-Mechanics.

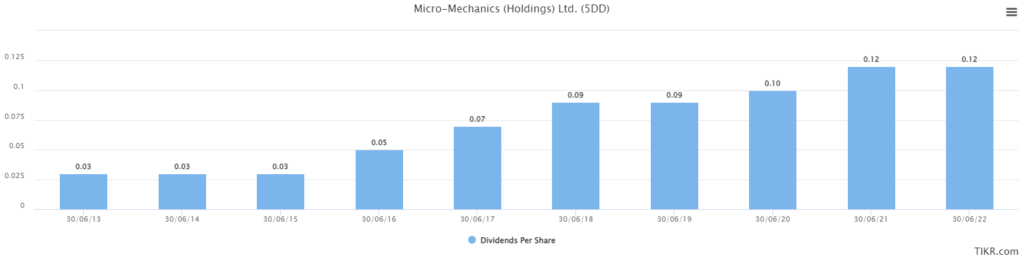

4. Growing dividends per share

Micron-Mechanics’ great track record and impressive margins may make it a good investment. The company can reinvest earnings to scale and grow the company, or opt to return them as dividends to shareholders.

Over the last 10 years, dividends per share have risen from SGD 0.03 per share to SGD 0.12 per share.

That means that every share held back in 2013 has become more valuable. Dividends for each share paid out have increased by a CAGR of 22% over the last 9 years.

MyKayaPlus Verdict

It all might seem good, but what actually causes the selloff of Micro-Mechanics?

Could it be the cyclicality of the semiconductor nature?

Or are there any sinister reasons at play?

Well at Kaya Plus, we utilize a systematic framework to screen out potential pitfalls of traps prior to investing in dividend-paying companies.

We call it the Dividend Gems framework.

This framework is almost fool-proof and can safely help identify safe and potential dividend companies while helping you detect problematic companies to avoid.

It does not have to be a guessing game or a bet. Once you master this framework, you too can pick dividend stocks like a pro.