Hartalega Holdings Berhad (Harta) Q4’23 – No light yet

Hartalega Holdings Berhad (KLSE: HARTA) released its Q4’23, and its share price surprisingly rallied.

Many might have thought the worst has come to an end. But after going through their results, I beg to differ.

Harta is still a great company, run by great management, but its economic moat is slowly shrinking.

Here are some vital points that you should take note of.

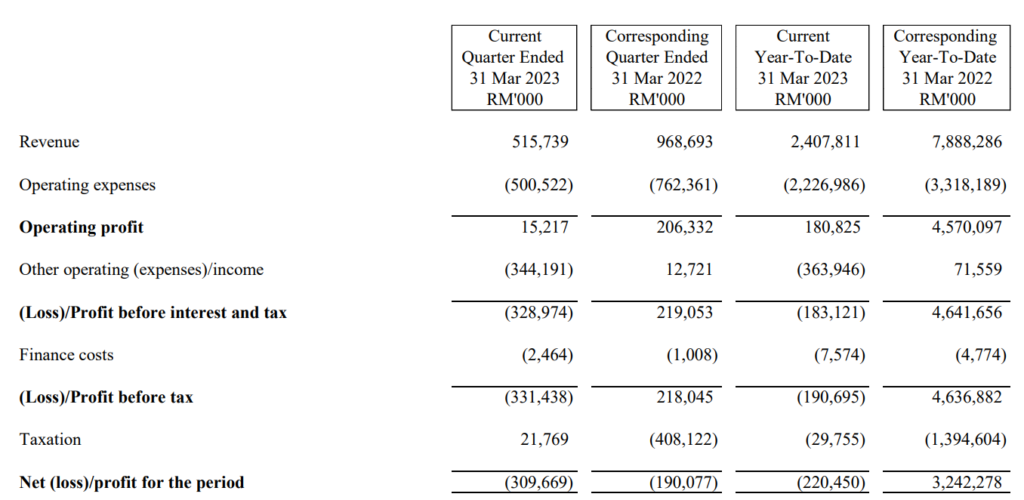

1. Huge drop in Harta’s revenue and slipping into a net loss for FY 2023

Many would argue that the drop in revenue is already a known case. But whether the pull factor that is affecting Harta is still present or not?

Sadly, all the ominous reasons that are pulling down Harta’s profitability are still ever present.

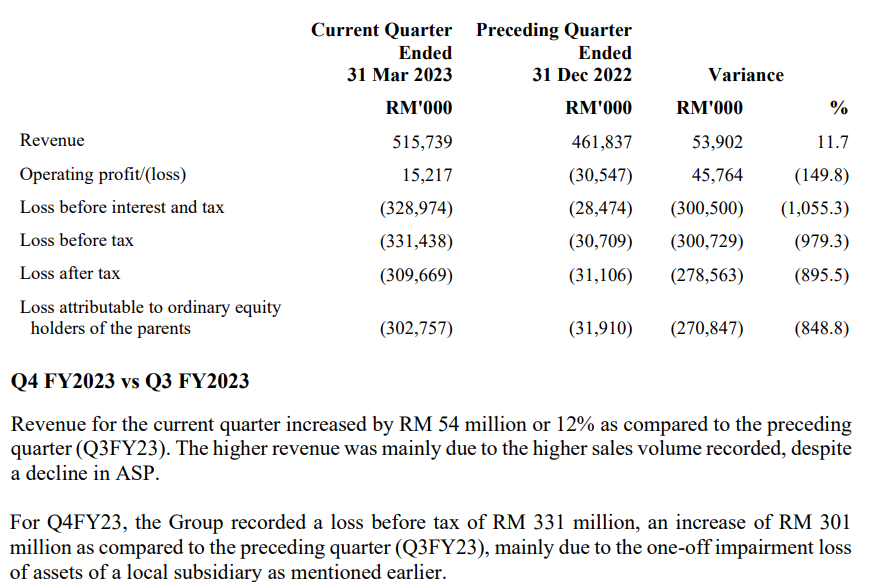

Even though the revenue of Q4’23 grew by 12% against the preceding quarter of Q3’23, it was still buffered by a lower Average Selling Price (ASP).

Growth in a consumable business requires growth in volumes and selling price to achieve the compounding growth effect.

But right now, a glut of supply would be difficult to foresee by when ASPs will stop dropping.

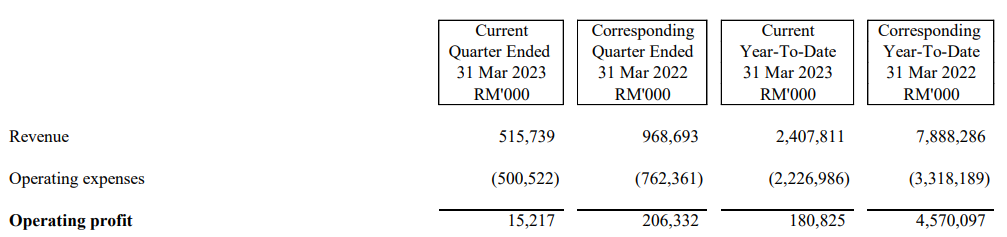

2. It is not easy to reduce Harta’s operating expenses as it’s a large manufacturing company

Revenue growth is tough, but what could be tougher is reducing operating expenses.

Hartelga has already prided itself on being one of the world’s most efficient and profitable glove-making companies. That also yields it the best profitability when compared to its peers.

However, in a manufacturing facility or business, when the business is undergoing a downturn, cost-cutting measures are not just turning off a few machines.

There are also labour and manpower expenses that do not get reduced easily.

Harta has announced its plan to decommission four production plants located in Bestari Jaya, as part of the ongoing operational rationalization exercise.

But that would mean lesser production volume as well, which poses more challenges to growing its revenue.

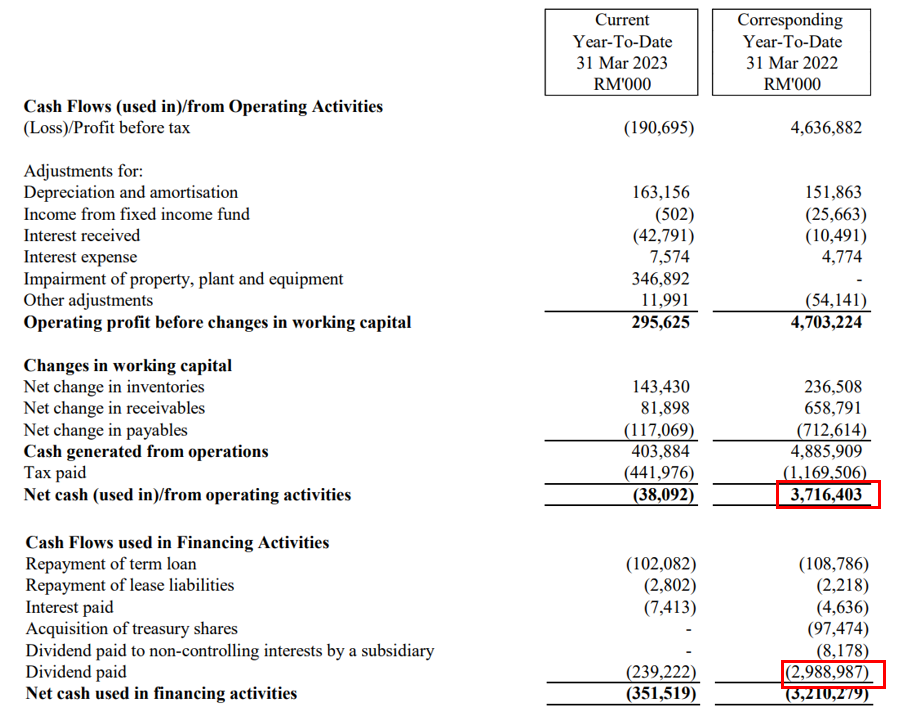

3. Harta’s bumper earnings mostly ended up as cash dividends

Most if not all of Harta’s bumper earnings ended up as cash dividends.

Under normal circumstances, reinvesting the profits should be beneficial for the business in the long run.

But the COVID-19 pandemic has given rise to plenty of other glover makers in other parts of the world, which has severely disrupted the supply and demand mechanics that Malaysian glove makers have been enjoying.

Thus, rather than holding onto the cash generated from their pandemic bumper earnings, giving out most of the dividends seems like to be the only choice.

However, it does pose one vital question: How feasible and strong is the economic moat of Harta if it succumbs to the weakening demand and overflowing supply?

MyKayaPlus verdict

Yes, many would argue that share prices popped after Harta’s results. But I see little to no reason for the share price recovery.

Harta’s economic moat prior to and post-pandemic is strikingly different.

Decommissioning of its Bestari Jaya plants will reduce operating expenses by the end of 2023. But if lower ASP persists, there is simply no rational way for revenue to improve, if production capacity and selling price are both down.

Unless a sudden change of factors, I still see the glove sectors nursing their pain even though the pandemic is almost 2 years behind us now.

Investing is not really that hard. If you are intrigued by learning how to read financial figures like how I demonstrated, do consider signing up for our Kaya Plus Premium Club, where we teach you all the tricks and skills to become a better DIY investor.

Good