How To Differentiate A Growth Stock V.S. A Dividend Stock?

It is slowly coming to the end of the year 2019. If I were to ask for the best dividend stock for the year 2019, a lot of people would have answered AirAsia Group Bhd. That one-off special dividend of RM0.90 per share would have easily given a 36% one-off dividend yield.

But the truth is, is AirAsia Bhd really considered a dividend stock?

Tip: Before proceeding on, if you want to read our detailed AirAsia Bhd analysis, please click here.

There are a few criteria that dictate what makes a good dividend stock. A good dividend stock has to have good revenue growth, high profits, and a fantastic track record of paying dividends.

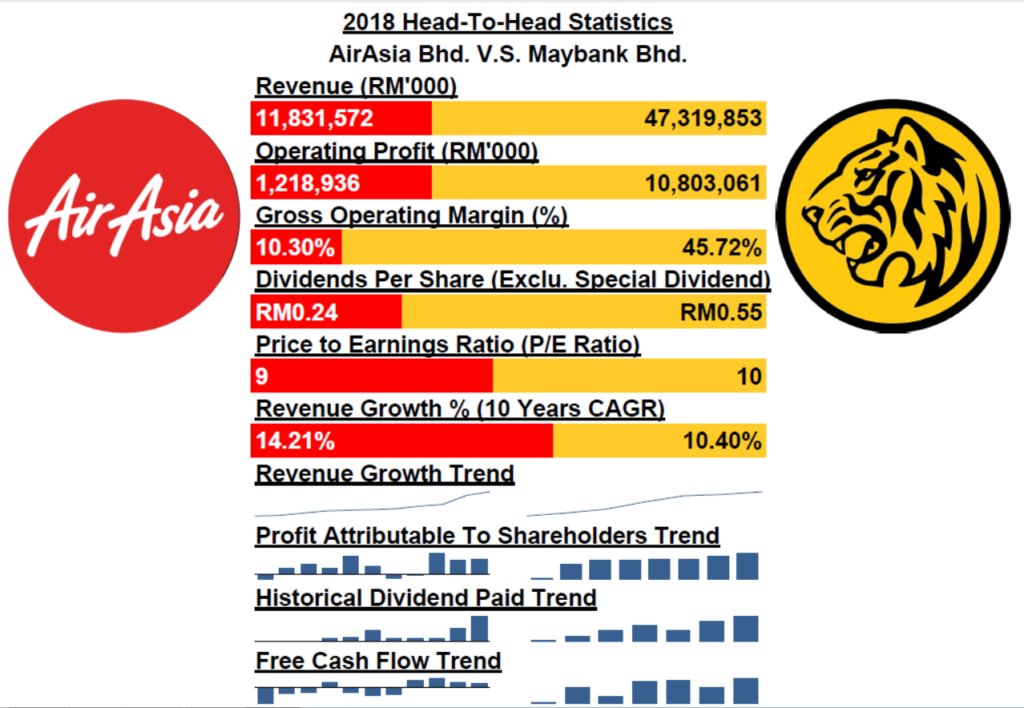

So, does AirAsia Bhd qualifies itself as a good dividend stock? Let us compare it with a well-known dividend stock – Malayan Banking Berhad (Maybank Bhd)?

Tip: If you would like to read our Maybank Bhd analysis, please go here.

1. Revenue Trend Comparison

Both companies see an uptrend in their revenue growth YoY. AirAsia Bhd particularly sees huge spikes upwards in its revenue growth trend. Maybank Bhd, on the other hand, sees a smoother upward trend.

Verdict: Both AirAsia Bhd and Maybank Bhd have a good track record of growing its top line successfully.

2. Profit Trend Comparison

Here is one of the key determining factor of a good dividend stock. A good dividend company has to CONSISTENTLY generate profits. Then only it will be able to pay out a portion of its profits to shareholders as dividends.

AirAsia Bhd’s profit has been choppy. One key factor that impacts their earnings is the ever-fluctuating fuel costs. And AirAsia Bhd operates in the low-cost airline business segment, where cheap air tickets against its competitors give it the edge to grow its business. That is why even when fuel prices go up significantly, you rarely see ticket prices go up in tandem (Plus you still get free seat promo from AirAsia every year without fail!).

Maybank Bhd shows a consistent uptrend in its profit attributable to shareholders. Quite simply, if they register more operating revenue, shareholders are entitled more profit and most likely higher dividend payouts.

Verdict: AirAsia Bhd unable to generate consistent profits, while Maybank Bhd has a proven track record of registering consistent and increasing profits.

3. Gross Profit Margin Comparison

A good dividend-paying company has high profitable business model/s. They are able to command premium prices when offering their product and services. So a large chunk of these profits will eventually end up as retained earnings attributable to shareholders.

AirAsia Bhd’s 2018 gross profit margin stood at around 10%. That means for every RM100 of tickets AirAsia Bhd sells, it retains RM10 after minus off the fuel costs, salaries of its aircrew, aircraft leasing expenses, so and so forth.

Maybank Bhd, on the other hand, has a gross profit margin close to 50%! That means for every RM100 of sales Maybank registers, it retains almost RM50 of gross profits, after minus off interest expense from its lending business, net insurance claims from its insurance business!

Verdict: Maybank Bhd’s gross profit margin is far significantly higher than AirAsia Bhd. Maybank Bhd has high tendencies to retain more profit and payout a portion of it as dividends

4. Historical Dividend Payout Comparison

This is the metric where it all gets unveiled. How much cash dividend does a company actually pays out to its shareholder every year?

AirAsia Bhd does pay out dividends, but looking at its historical trend the amount paid out is rather inconsistent. A lot of those sudden spikes in dividends paid out are special dividends paid out after selling their air crafts to leasing companies. Minus off the one-off special dividends, AirAsia Bhd doesn’t look like an attractive dividend stock after all!

Maybank Bhd comparatively, has a proven track record of paying out increasing dividends YoY. Imagine getting more dividends every year for buying a good dividend company! Buy once, collect dividends every year, forever (or until you decide to sell off the company!)

Verdict: AirAsia Bhd’s dividend payout is inconsistent. Maybank Bhd’s dividend payout is consistent and increasing YoY

5. Operating Cash Flow Trend Comparison

Cash is king. Not only good dividend companies have to show a profit on its Income Statement, but there must also be a steady influx of cash flow, which we can judge by looking at their Cash Flow Statement

AirAsia Bhd’s free cash flow trend has been inconsistent. There were times when it breaches the negative mark. It would be very difficult for AirAsia to keep paying out more and more cash dividends if it does not have a stable and increasing free cash flow trend.

Maybank Bhd however, shows a pretty consistent upward trend in its free cash flow trend. By being able to maintain or increase its free cash flow, will be able to potentially increase its dividend payout to its shareholder.

Verdict: Maybank Bhd shows an increasing trend for its free cash flow trend while AirAsia Bhd’s free cash flow trend is choppy

MyKayaPlus Verdict

Quite contrary to the news headline, AirAsia Bhd does not really fit and qualify well to be a great dividend stock. Nevertheless, it is an exciting growth company venturing into multi-facet businesses under the stewardship of Tan Sri Tony Fernandes. It is definitely an exciting company in terms of growth and expansion plans!

Maybank Bhd, on the other hand, shows consistent and convincing increasing trends in generating profits and cash flow from its high margin business portfolios. Judging from the head to head comparisons, we think Maybank Bhd fits very well to be considered an attractive dividend company!

Do you agree with us? Let us know in the comments below!