CIMB GROUP HOLDINGS BERHAD V.S. MALAYAN BANKING BERHAD

Malayan Banking Bhd (Maybank Bhd) and CIMB Group Holdings Bhd (CIMB Bhd) are 2 of the largest banks in Malaysia. Both banks are also listed on the mainboard of the Kuala Lumpur Stock Exchange (KLCI) mainboard, which provides us with the opportunity to be the owners of them!

Banks have been proven to be a favourite component of a dividend investor’s portfolio due to their advantageous business model of earning interest income by lending money. The bulk of its asset is usually based on cash and very liquid derivatives (e.g. bonds, high-interest bearing investments and savings, investment in stable blue-chip companies).

So the next question Malaysians tend to ask is, which of the 2 banks is better?

Let’s take a look at them on a head to head battle!

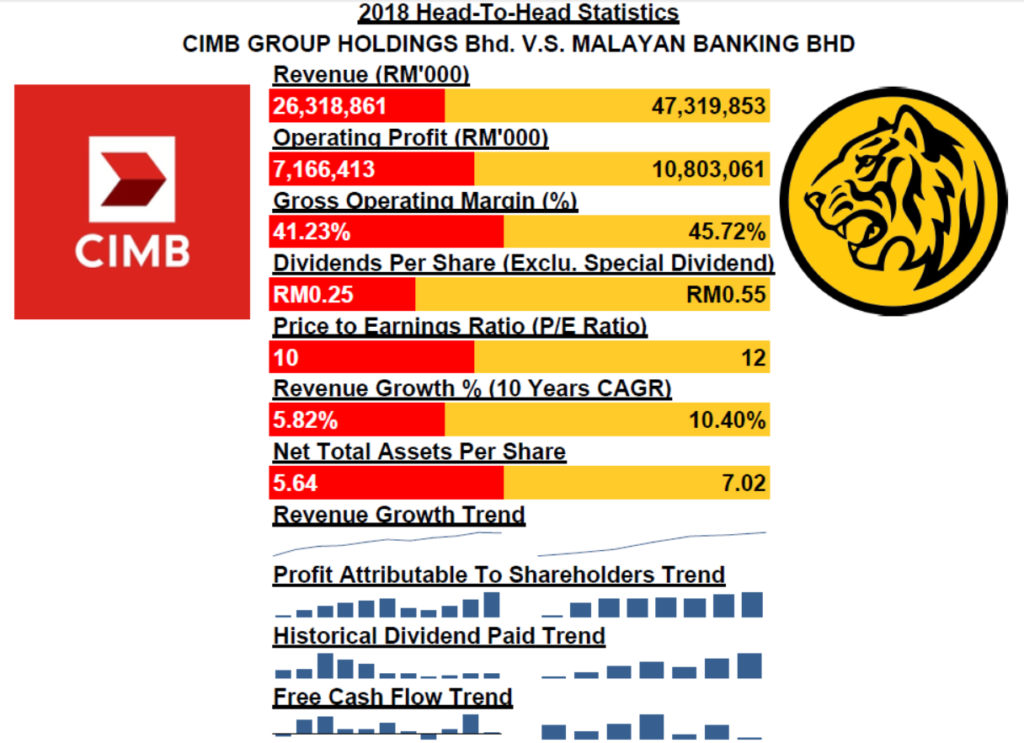

Gross revenue of Maybank Bhd is approximately 2 times of CIMB Bhd. Although being the second largest bank in Malaysia, we do see there is a big gap for CIMB Bhd to cover if it were to surpass Maybank Bhd in terms of gross revenue.

Looking at the Net Interest Margin (NIM) between both banks, Maybank Bhd has a NIM % of 52.05% while CIMB Bhd is closely behind with 51.87%. By comparing the NIM % of both banks, we are confident that both of the biggest banks have quite a close NIM %, in which if either bank continues to lower their interest expense would surely boost their NIM % significantly.

Operating profit-wise, Maybank Bhd has achieved approximately RM 10.8 billion while CIMB Bhd is at approximately RM 7.2 billion. The operating profit gap between Maybank Bhd and CIMB Bhd is significantly closer than the revenue gap, due to the fact that CIMB Bhd has lower overheads expense compared to Maybank Bhd.

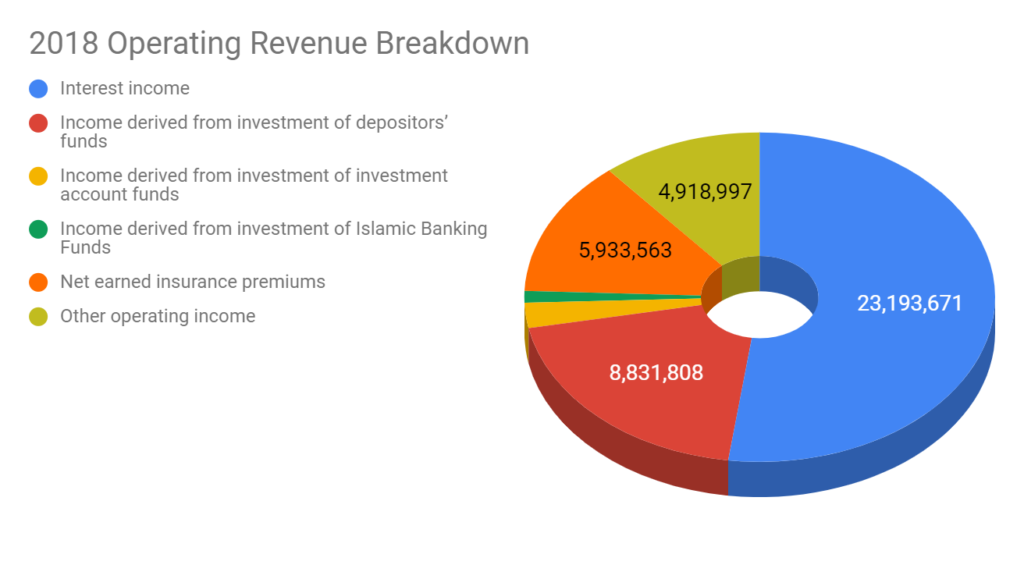

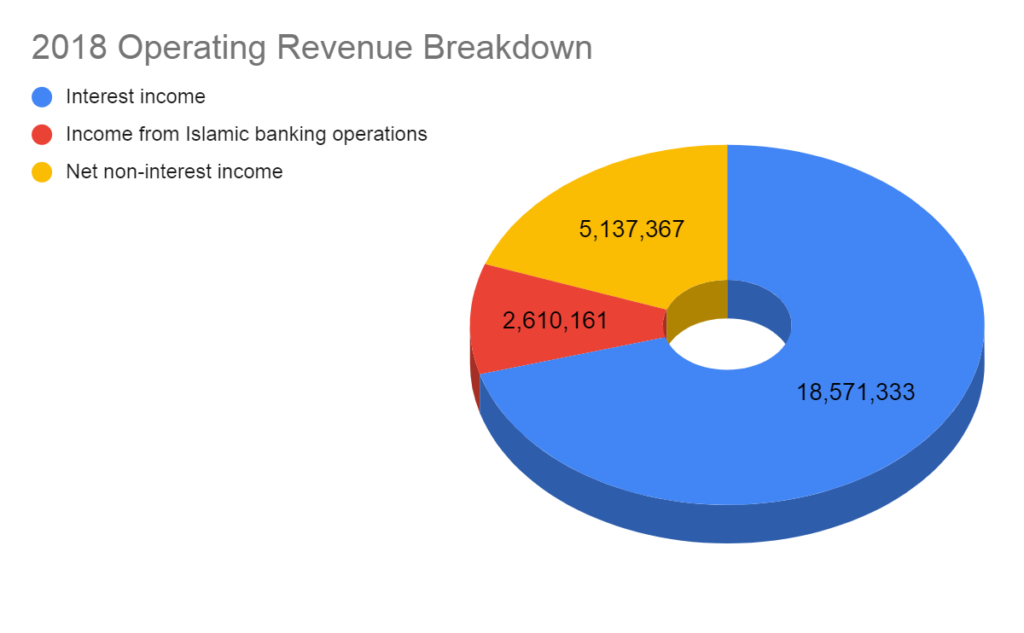

Revenue streamwise, we notice that Maybank Bhd has multiple income streams, compared to CIMB Bhd

CIMB Bhd is very heavily reliant on interest income, contributing to more than 71% of total gross revenue. Maybank Bhd, on the other hand, has multiple streams of income from its Etiqa and Takaful insurance segment, investment accounts. Interest income contributes to 49% of gross revenue. A bank’s NIM is heavily connected to Bank Negara’s Overnight Policy Rate (OPR), the interest rate at which a depository institution lends immediately available funds (balances within the central bank) to another depository institution overnight. Having a myriad of multiple income streams not attributable to the interest rate will protect a bank’s earnings from potential fluctuating OPR.

Dividends wise, CIMB Bhd’s total dividend for the year 2018 was RM0.25 per share, while Maybank’s Bhd dividend for the year was RM0.55 per share. Comparing the dividend yield at the time of writing, CIMB Bhd has a trailing dividend yield of 4.18% per annum while Maybank Bhd has a trailing dividend yield of 6.6% per annum. Both banks actually have decent dividend yield with of course Maybank Bhd showing a greater yield.

Both banks are also currently valued at a Price to Earnings ratio of a region of 10-12x. Maybank Bhd, given its status as the biggest bank and with more income stream, holds a more premium PE at 12, while CIMB is closely behind with a PE of 10. So it’s up to investors to decide whether they would opt for a lower PE and lower dividend yield CIMB Bhd or higher PE and higher dividend yield Maybank Bhd.

Both banks show consistent and year-on-year revenue growth trends. Even though being stable blue-chip companies, CIMB Bhd and Maybank Bhd still show growth in their businesses. Banking is an essential need and requirement in our lives, so we are positive that Maybank Bhd and CIMB Bhd are here to stay, running their businesses day in day out like clockwork.

Profit attributable to shareholders also increases in tandem with revenue growth. From the trend, we are certain that as revenue grows, the profits too will also trend upwards. Historical cash dividend paid out for CIMB Bhd saw a huge dip in the year 2013, where CIMB Bhd decides to provide an option for shareholders to reinvest around 50% of their dividends into shares at a discount under the Dividend Reinvestment Plan (DRP). Maybank Bhd on the other hand also does offer DRP but at a lower apportioned rate. Hence the cash dividends paid out is on a steady rise as compared to CIMB Bhd.

If you are a dividend investor, Maybank Bhd and CIMB Bhd would definitely be good components in your portfolios, given their track record and size in the banking industry. Not only are they active in their home country Malaysia, but both banks also have huge presences in South East Asia too.

We hope we have provided a simple comparison between both of Malaysia’s biggest banks to help you kickstart a more thorough analysis and comparison between the 2 banks to find out the most ideal addition to your portfolio!

Which bank is your favourite? Or are there any other banks in your mind that you think could be a better investment than Maybank Bhd and CIMB Bhd? Let us know in the comments section below!