Great Q4’22 Results? Time to Grab some Grab stocks?

Grab Holdings Ltd (NASDAQ: GRAB) share prices has not been great ever since it went IPO.

But its latest set of results might spell a change in fortune.

Here are some key notes from its latest quarter results.

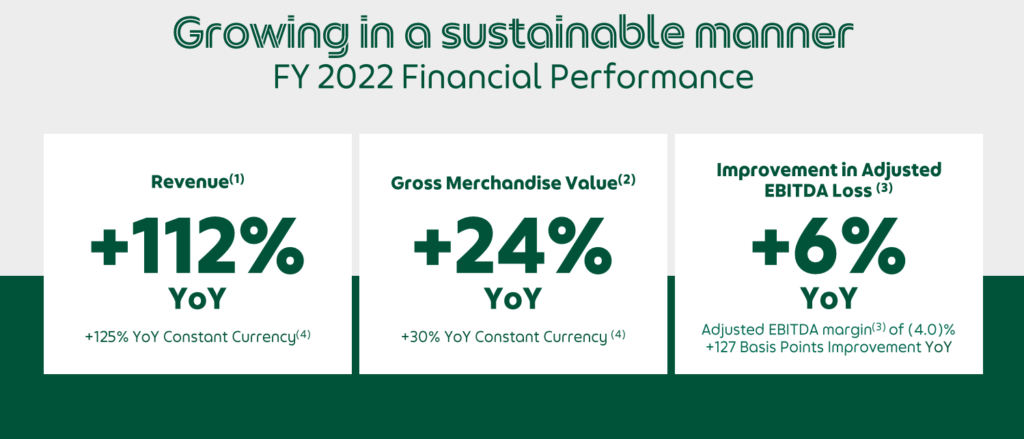

1. Improvements & growth in key metrics

Grab has slowly evolved from a pure mobility app to also incorporate e-commerce, making it a Super app. On top of good revenue growth, it also needs to ensure that Gross Merchandise Value (GMV) is growing as well.

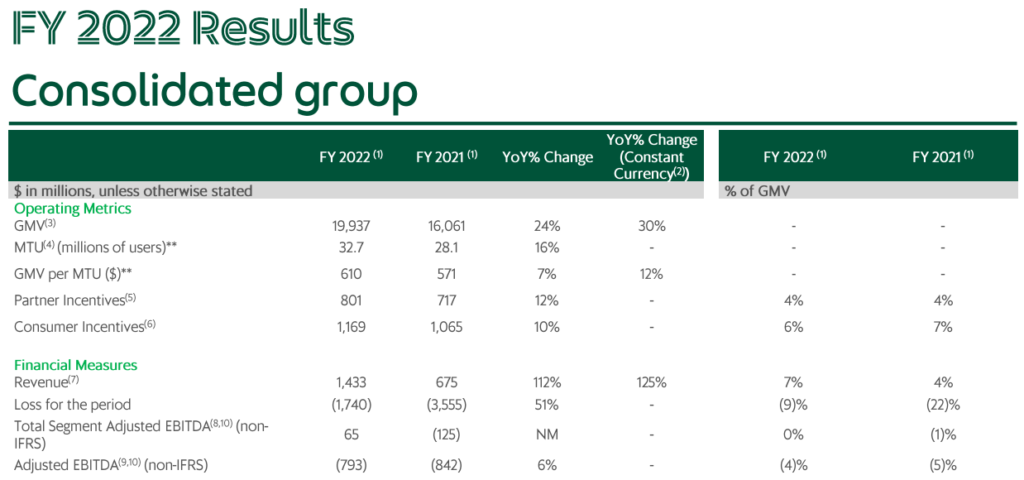

Revenue was higher by 112% YoY, with GMV continuing to grow by 24%.

With higher borrowing costs, the race for profitability for all tech companies became a key aspect. Grab’s EBITA loss improved by 6% YoY or a +127 basis points improvement YoY.

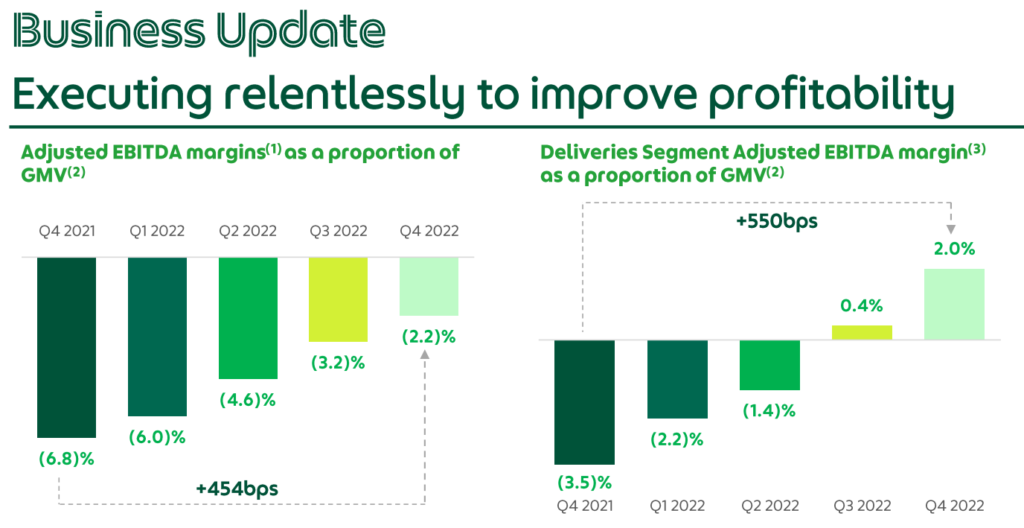

2. Improving EBITDA margins each successive quarter

Grab’s adjusted EBITDA margins over its GMV have been improving successively for the past few quarters.

This does look promising, but do note that adjusted EBITDA as specified by Grab in the footnotes does not include net income or expenses, depreciation, amortization, and stock-based compensation.

This trend though does suggest that from an operating perspective, at least Grab is cruising toward operating profitability.

3. Increasing Monthly Transacting Users (MTU)

All successful apps and platforms will share either their daily active users, monthly active users, or both. For Grab, its FY 2022 monthly transacting users (MTU) increased from 571 million to 610 million, which is a 16% growth.

GMV per MTU also eked up higher by 7%. That means that an average monthly transacting user can spend up to USD 610 on Grab!

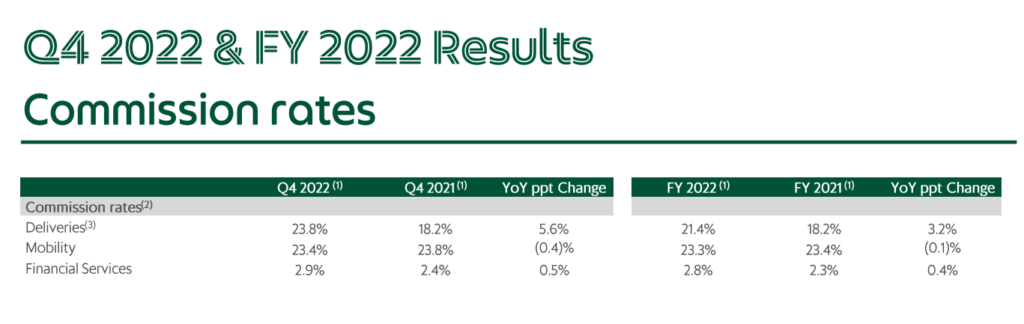

4. Relatively higher commission rates

One way Grab can enhance and expedite its profitability is to increase its commission rates. Deliveries commission rates increased by 320 bps YoY from a fiscal year perspective, while financial services eked up 40 bps.

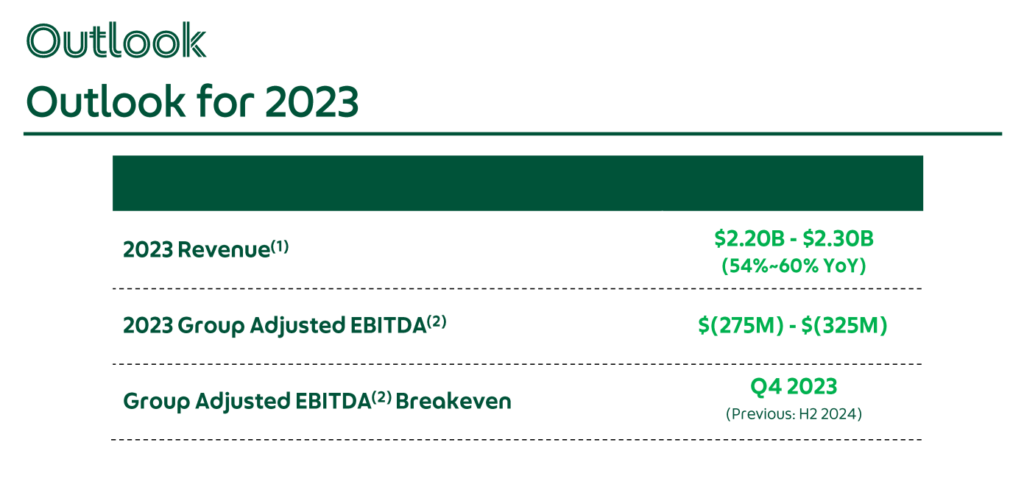

5. Promising 2023 forecast

For FY 2023, Grab will try to scale for a 54-60% growth in revenue, The adjusted EBITDA will be a loss in between USD 275 million and USD 325 million. This is a significant jump from its adjusted EBITDA of FY 2022, which came in at a loss of USD 793 million.

In fact, the Group adjusted EBITDA breakeven has been brought forward to Q4’2023, from a previous target of 2H’2024.

MyKayaPlus Verdict

Grab has certainly come a long way, from its humble origins to becoming South East Asia’s super app. Its pivot and rapid growth during the pandemic have been a perfect combination.

Even post-pandemic, the convenience that many of us enjoyed still sticks with us. Why spend time and money, when money alone can buy convenience and save time?

Perhaps a breakeven fiscal year is all that Grab needs, to see share prices going back up to its glory days?