ETFs – When to do it, and when not to?

Exchange Traded Funds – ETFs are always a love-hate relationship.

But let’s lay down the facts first. ETFs are still one of, if not the best way, to compound wealth over a long time period, with reasonable risks.

But why the huge contrasts in opinions? Well, let us provide the context of both sides and help you come to a conclusion.

Understanding ETFs

ETFs are investment funds that are available on the stock exchanges, similar to individual stocks. An ETF’s aim is to track the performance of a specific index or asset, such as a stock index, bond index, or commodity. This is achievable by holding a diversified portfolio of underlying assets.

In simpler terms, it’s just a fund that holds a portfolio of stocks. The objective of the ETF can vary from each other, but each ETF has a factsheet of its investment objectives.

ETFs versus Mutual Funds

Many could confuse ETFs with mutual funds.

ETFs and mutual funds are already different from the buying and selling part. Buying or selling a mutual fund requires one to liaise with the fund company directly. Buying and selling usually take place at the end of the trading day at a price determined by the net asset value (NAV).

On the other hand, ETFs are traded on an exchange throughout the day. Their prices fluctuate just like individual stocks. You can buy or sell them through a brokerage account.

ETFs and mutual funds also differ in terms of fees. Usually, ETFs have lower expense ratios versus mutual funds due to the passive nature of ETFs. This translates to lower operating costs. Moreover, ETFs typically have lower taxes than mutual funds. as ETFs can be structured in a way to minimize capital gains tax liabilities.

Another key difference between ETFs and mutual funds is transparency. ETFs are required to disclose their holdings on a daily basis. On the other hand, mutual funds only disclose their holdings on a quarterly basis. This is also where the term window-dressing is coined, where funds may load up on good stock holdings prior to reporting.

With ETFs, investors can see exactly what they are investing in without any reporting time lags.

Reality and past performances of ETFs

There are plenty of ETFs to choose from. The usual ones track indices returns while there are thematic ones as well.

To make things straightforward, let’s just consider the mainstream index trackers – the SPDR S&P 500 ETF Trust (NYSEARCA: SPY) and the iShares Russell 2000 ETF (NYSEARCA: IWM).

To manage expectations, both index trackers SPY and IWM are holding most equities. And equities are volatile in a short time period.

But over a 10-year performance track record, we can observe that an index tracker ETF provides an average return of 8-12% per annum. To make things simple, let’s assume 10%.

Other trackers that track the S&P 500 would have provided similar returns, albeit a small difference.

Is 10% return per annum enough?

This is where things start to get interesting. To some, 10% compounded over more than 10 years is more than enough. To some, 10% per annum is insufficient.

This is where the camp starts to split.

To clearly help you determine whether 10% is sufficient for you or not, it all boils down to how much are you committing to invest.

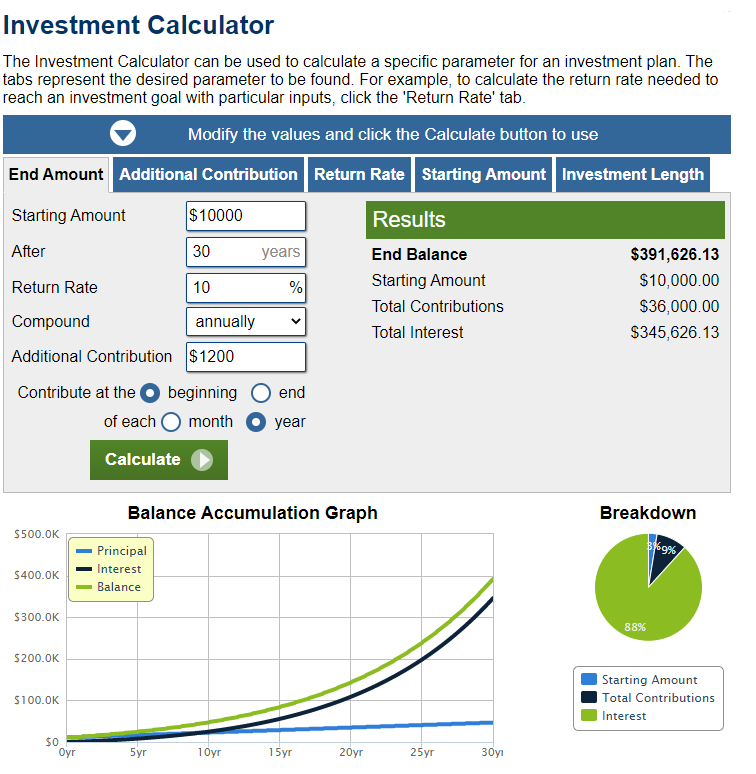

Scenario 1: Starting off with $ 10,000 capital, topping up an additional $ 1,200 per annum for the next 30 years

I think most of us have our quarter-life crisis by the age of 30 years old. You would be desperate to find either a higher-paying job as you start to have a family, and you start to think seriously about retirement.

Assuming you start off with an initial capital of $ 10,000, topping up diligently an additional $ 1,200 per annum for the next 30 years until you reach 60 years old.

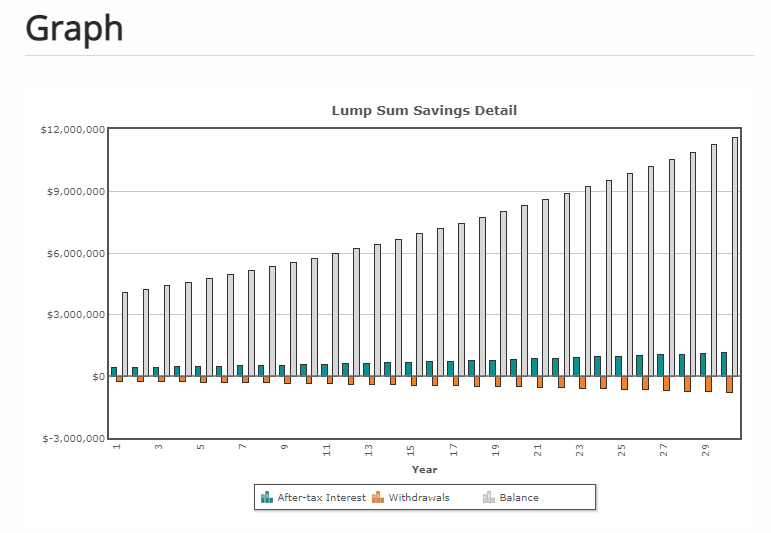

This would be the simulation of wealth compounded and accrued across that 30 years.

Depending on where you are from, having $ 392,000 by 60 years old might or might not be sufficient to retire.

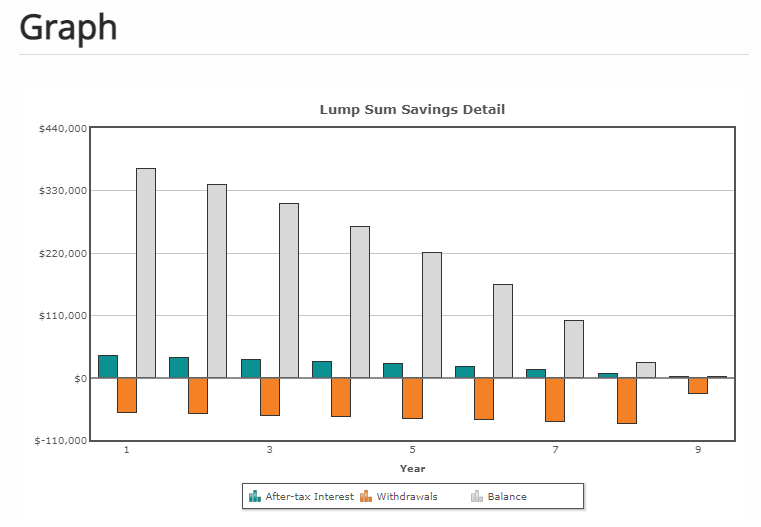

Assuming a $ 5,000 withdrawal per month (increase by 4% per annum to adjust for inflation), with your investments still generating an average of 10% returns, your drawdown rate will decimate the entire pool by year 9. If you live beyond 70 years old (assuming retirement at 60 years old), you run out of retirement funds.

ETF bear camp point validated.

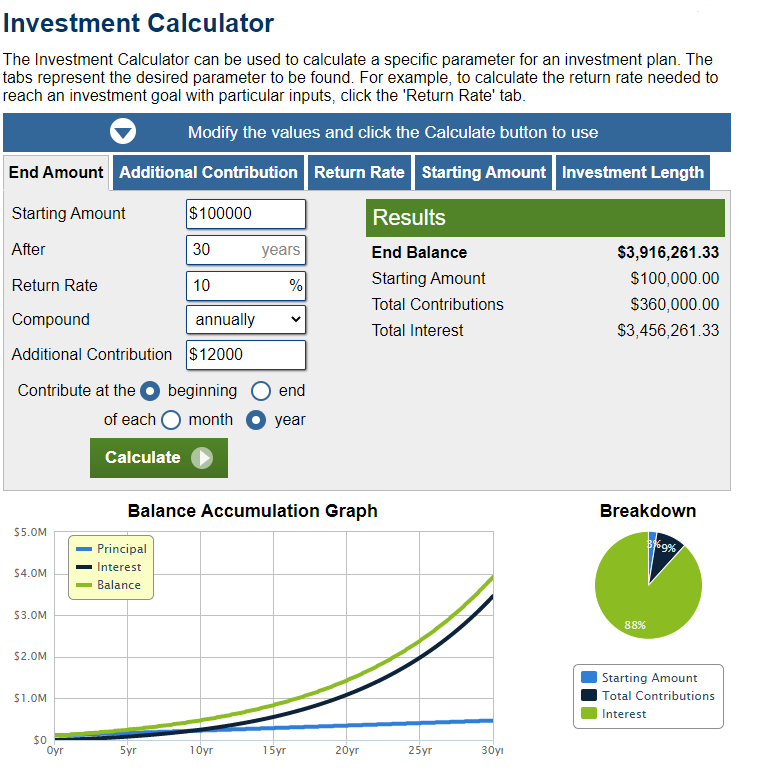

Scenario 2: Starting off with $ 100,000 capital, topping up an additional $ 12,000 per annum for the next 30 years

Let’s spice things up.

In scenario 2, you start off with an initial capital of $ 100,000. And for the next 30 years, you inject an additional contribution of $ 12,000 per annum ($ 1,200 per month) at the start of every year.

The 10% returns will turn out to be rather significant.

By the time you reach 60, you will end up with a total accrued balance of close to $ 4 million.

Even with an assumption of a $ 20,000 withdrawal monthly (increasing by 4% per annum adjusted for inflation), an ongoing compounding annual return of 10% of your accrued $ 3.92 million, you would still be unable to deplete your retirement funds.

That ongoing 10% return per annum is more than sufficient to fund your retirement life lavishly.

ETF bull camp trumps!

Points for you to ponder if you are in Scenario 2

Many would kill to have such a retirement fund built up. For me, the progress and process of building that $ 3.92 million is what matters more.

Think about it.

If you have a great paying job, that allows you to invest $ 100,000 and contribute $ 12,000 per annum for the next 30 years, you do not really need to do stock pick.

That means in the prime years of your life, you can spend your weekends how you want to spend it. Dining out, chilling, spending time with your family.

Anything.

Your wealth generated from your job, diligently invested for that 30 years passively, and assuming that the capital markets mimic their historical returns, are more than enough for you to retire comfortably.

You can opt to be pro-ETF. Stock picking might increase your wealth drastically, but why waste the time for more money if money is not your life’s happiness and agenda? Stock analysis can be time-consuming. Chances are if you are pulling in that kind of salary, your weekends would be spent winding down and relaxing.

Just do pure ETF passive investing and countdown to your retirement. If things turn out well, you might even opt for early retirement. You can definitely do a lot with $ 3.9 million or even $ 2 million.

Points for you to ponder if you are in Scenario 1

Conversely, if you are currently in Scenario 1, ETF investing is definitely not for you.

I am terribly sorry.

But life is much easier for the rich, even when it comes to investing in the same instrument. Everyone gets the same 10% per annum.

But a 10% return on $ 100 and a 10% return on $ 1 million, is heaven and earth.

You would need to pick up stock picking to further complement and even elevate your retirement fund returns.

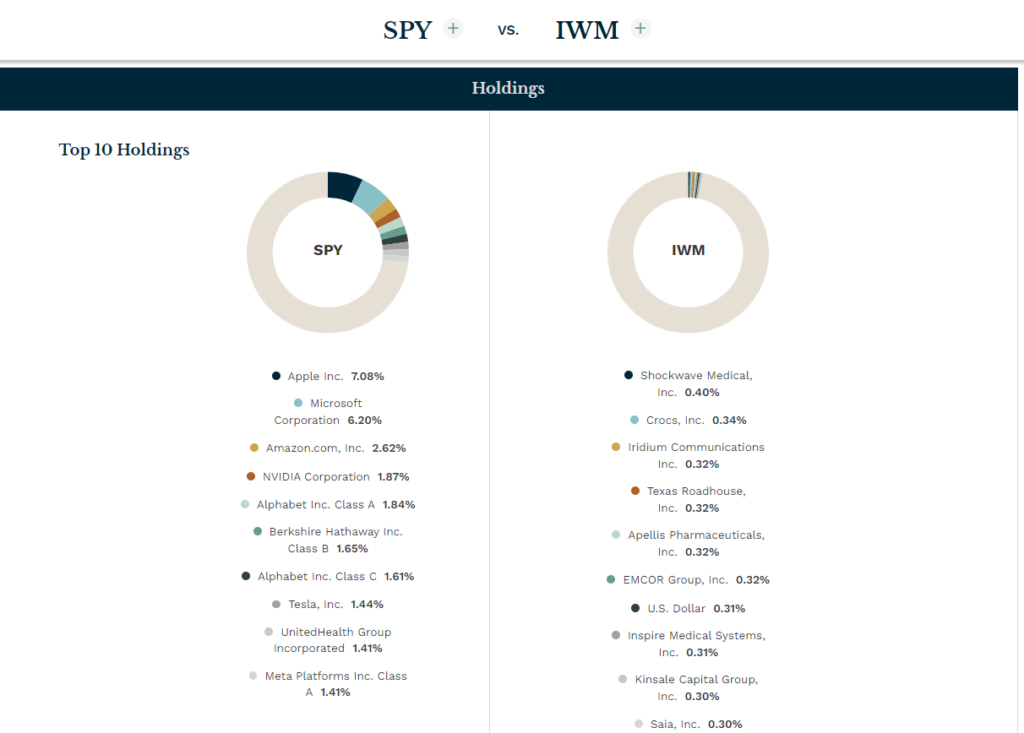

However, do note that it’s not too bad to get started in stock picking. By looking at what SPY and IWM hold, you can roughly get an insight into how these ETFs produce an annual 10% return over a long time frame.

The largest top 5 holdings of SPY are rather well-known companies – Apple Inc. (NASDAQ: AAPL), Microsoft Corporation (NASDAQ: MSFT), and Amazon.com, Inc. (NASDAQ: AMZN).

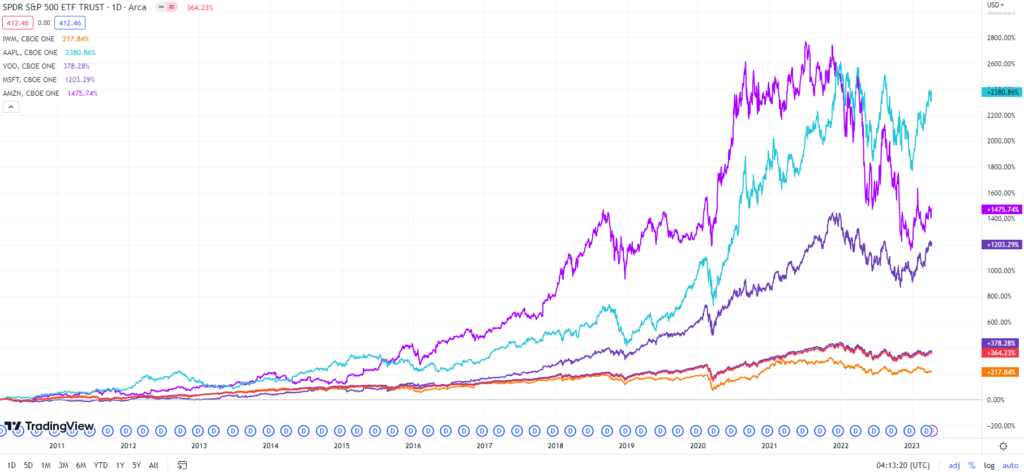

And when we plot the returns of just the top 3 companies, you would notice how outperforming their returns are against SPY.

These companies are the outliers and outperformers that can potentially boost up your alpha (alpha refers to excess returns earned on investment above the benchmark return)

Picking the right stocks that can compound and outperform index funds or ETFs, can win you a shot at a better retirement fund.

Conclusion? What is your ideal retirement life?

If it all boils down to just purely retirement planning, go for ETF and passive investing if you are well-to-do, and earning a higher average income than most people.

Capitalism and passive investing have it all sorted out.

On the flip side, if you are not taking home a CEO or top managerial pay, individual stock pickings is one of your golden tickets to potentially enjoying retirement life.

Word of caution: hindsight is 20-20. It is easy to see big tech’s outperformance against SPY and IWM looking back at historical returns. Whether big tech remains relevant for the next 30 years, and allows your bets to pen out perfectly as the simulation is still a question mark.

That’s why you would need to pick up stock picking. Learn to know your risk appetite, and craft and actively manage your investment portfolio.

Perhaps when the returns accrued to a significant amount similar to your high-flying peers who can comfortably opt for passive index investing, only then you can switch over to a more passive style to further let your returns compound to an amount where you can retire comfortably.

Another point of view to look at things: if you do not require a lavish retirement lifestyle, just recalculate how much you need when you retire. And if passive investing in ETFs, albeit a small amount still can get you to where you want to be, just go for it!

Life is never about chasing after more money, but to be at peace and happy. This is especially at the moment when you choose to retire.

Side note: On top of index-tracking ETFs, there are also thematic ETFs. You can further complement your investment style and strategies to invest in stocks + thematic ETFs or in any other ways that suit your investment and risk appetite.

DISCLAIMER

The information available in this article/report/analysis is for sharing and education purposes only. This is neither a recommendation to purchase or sell any of the shares, securities, or other instruments mentioned; nor can it be treated as professional advice to buy, sell or take a position in any shares, securities, or other instruments. If you need specific investment advice, please consult the relevant professional investment advice and/or for study or research only.

No warranty is made with respect to the accuracy, adequacy, reliability, suitability, applicability, or completeness of the information contained. The author disclaims any reward or responsibility for any gains or losses arising from the direct and indirect use & application of any contents of the article/report/written material