How to Complete your Corporate Exercise via SGX CDP?

I always treat corporate exercises of stocks and REITs that I hold as one-off case studies.

Given the opportunity, I would love to cover all of the corporate exercises. I believe I have the skills and communication to clearly dissect everything.

But with so many obligations and tasks, my focus and time are usually on stocks and REITs that I own. And not to forget other tasks and obligations that I have on hand.

That said, I am always amazed at the improvements in corporate exercises of SGX stocks and REITs.

My latest discovery is that rights issues and preferential offerings can be executed via the CDP.

So here is a step-by-step of how to do it if you encounter your next corporate exercise.

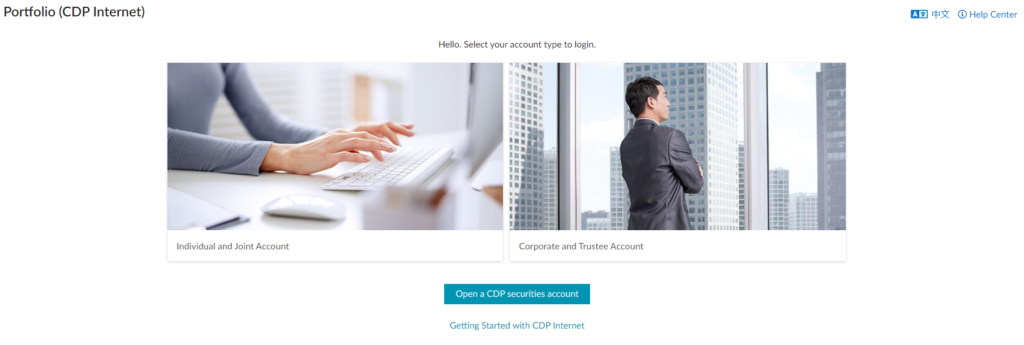

1. Log in to your SGX CDP

The first step is logging in to your CDP account. It will be either via Singpass or a username and password.

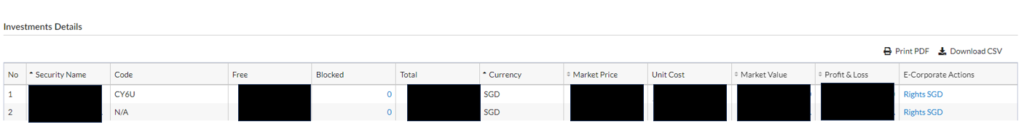

2. Access to your rights in the “Investment Details” section

Once you are in, head to the Investment Details section. Any holdings that you have with E-Corporate Actions will have a clickable link.

Click on the link.

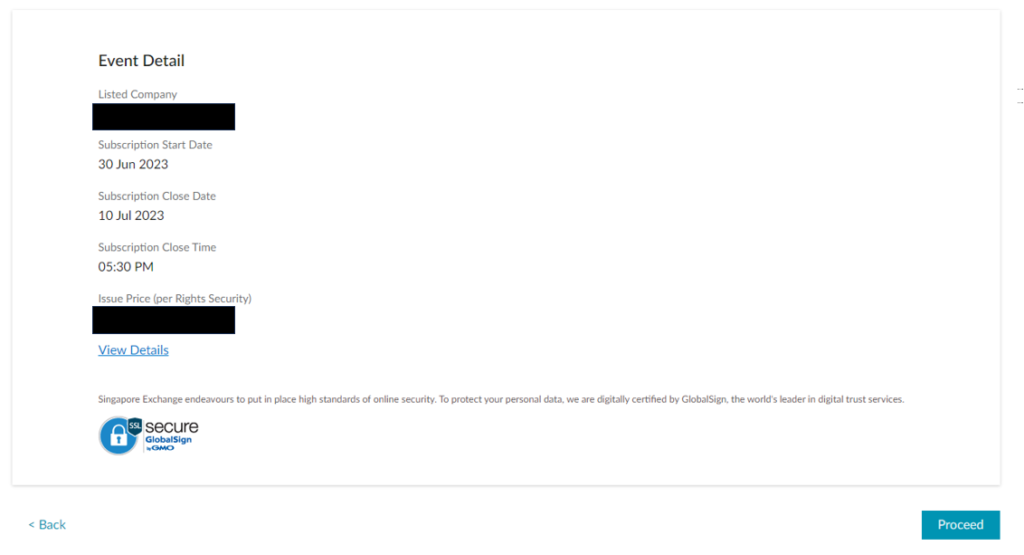

3. The event detail spells out all the key details

The name of the company, the start and end date of the subscription, and the issue price will be clearly stated.

Click Proceed to proceed.

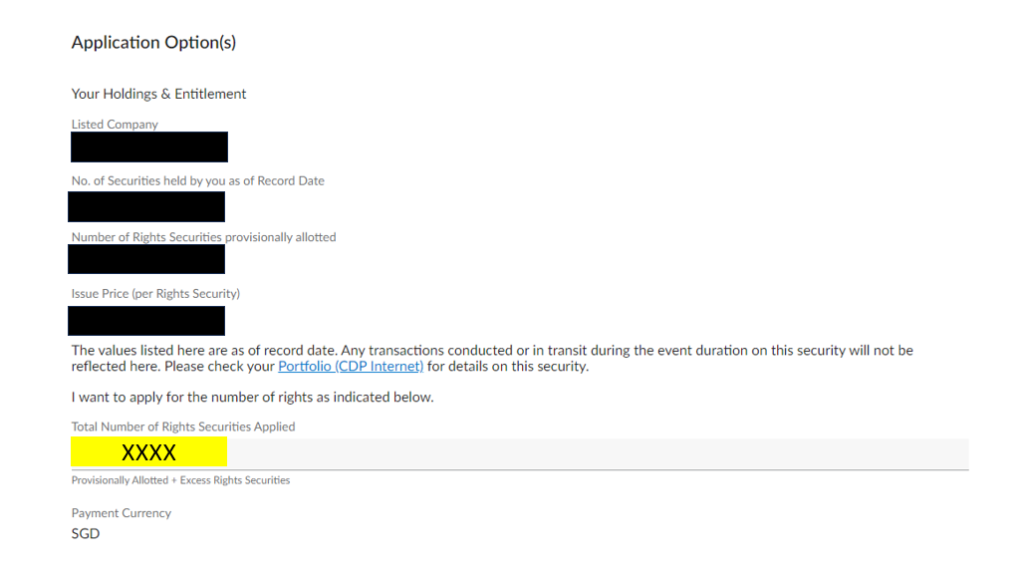

4. Input the amount that you wish to apply/oversubscribe

Your holdings and entitlement will be shown on this page. You can either subscribe partially, or fully or over-subscribe your allocation after doing your due diligence.

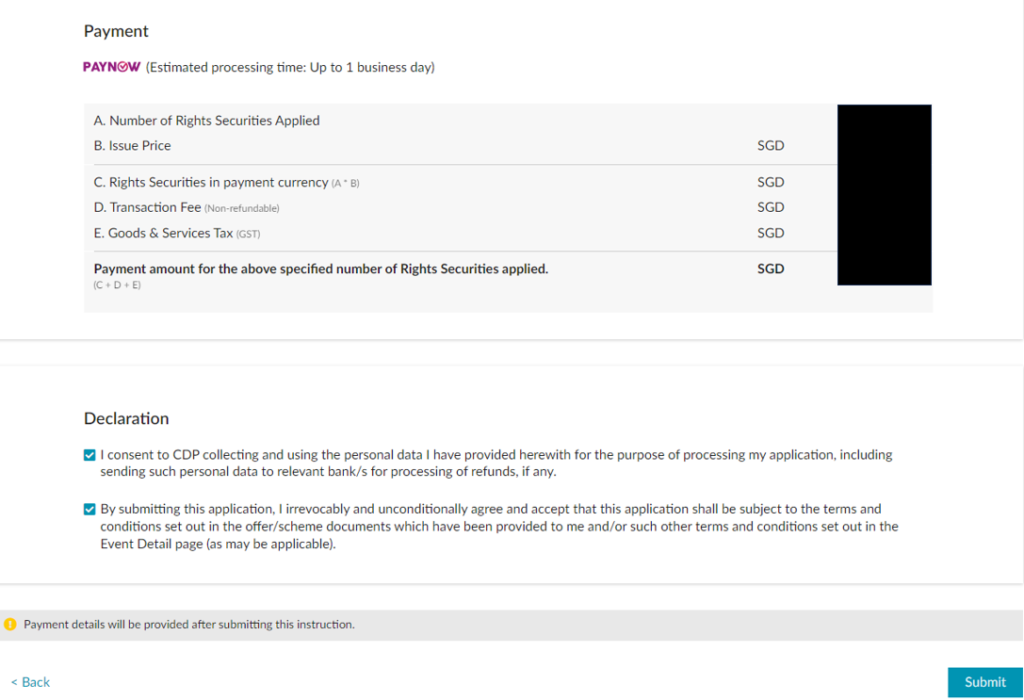

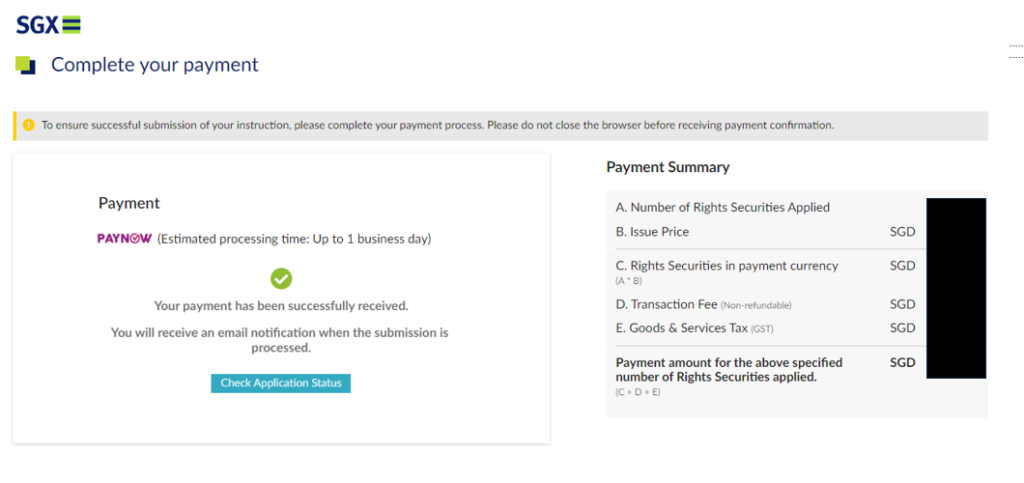

5. Payment

After that, all that is left is just payments. A PayNow QR code for your transaction will be shown. Just scan the QR code with your banking app, transfer the amount and everything will be completed.

6. Email confirmation

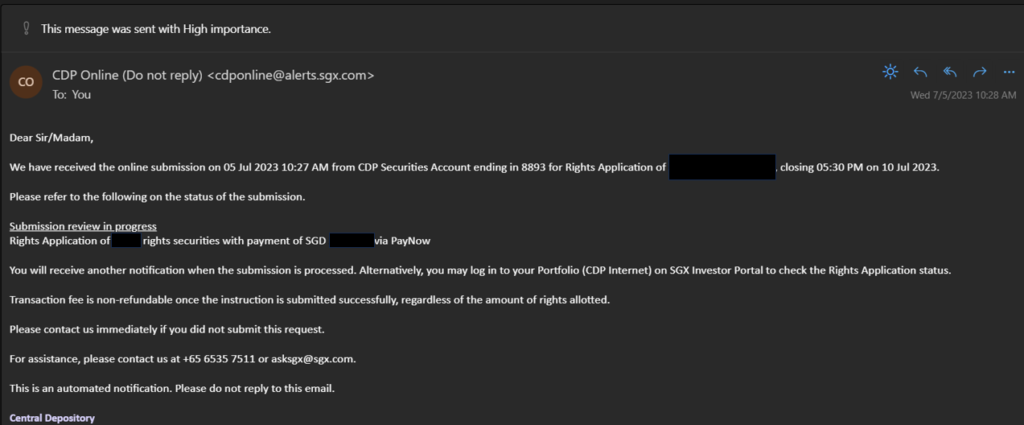

You will also receive an email confirmation of the transaction.

You can check CDP for the status of any over-allotments or over-subscriptions, or wait for the official notification.

MyKayaPlus Verdict

Corporate exercises when done right after careful due diligence can turn out to be major game changers.

Usually, rights, preferential offerings, and even dividend reinvestment plans offer units at an issue price which is at a discount.

Should the fundamentals of the stock or REIT be intact and promising, it provides an investor a one-off opportunity to add on to their holdings at a cheaper price than the market.

Kudos to the Singapore Exchange for the continuous improvements in corporate exercise procedures.

It can be done anywhere in the world, so long as there is a stable internet connection.