AL-AQAR HEALTHCARE REAL ESTATE INVESTMENT TRUST

Business Summary

Al-‘Aqar Healthcare REIT(KLSE: 5116) or more commonly known as Alaqar REIT, is a real estate investment trust that is in the business of hospital rental. It is the only healthcare-centric REIT in Malaysia that collects rental from its portfolio of buildings, which are mainly hospitals and healthcare centres! It is also the world’s first Islamic REIT. Its sponsor is KPJ Healthcare Bhd (KLSE: KPJ), a healthcare service provider company also listed in the Kuala Lumpur Stock Exchange. Alaqar REIT rents out it’s building back to KPJ Healthcare Berhad, who runs it as hospitals and healthcare centres.

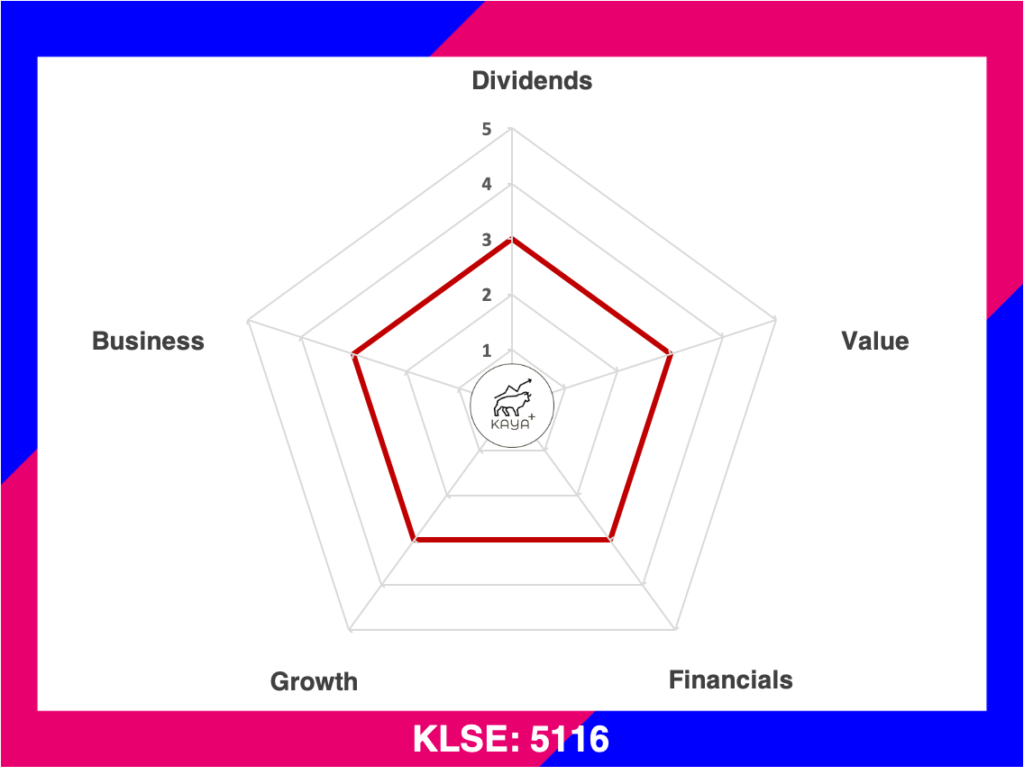

Dividends (3/5): ⭐ ⭐ ⭐

Value (3/5): ⭐ ⭐ ⭐

Financials (3/5): ⭐ ⭐ ⭐

Growth (3/5): ⭐ ⭐ ⭐

Business (3/5): ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Investment Property Portfolio

As of 2019, Alaqar REIT currently has 23 properties, comprising 17 hospitals, 3 wellness/health centres, 2 colleges and 1 aged care and retirement village. Most of its properties are predominantly in Malaysia, but the care and retirement village is located in Australia.

Management and Major Shareholders

The current CEO and Executive Director of Alaqar REIT is Mr Wan Azman Bin Ismail. He has been with JCorp group, a government-linked company ever since the year 1999. His career took him to various subsidiaries and companies within the JCorp Group. Currently, he is also the Vice President of JCorp.

Also, most of the Executive and Non-Executive directors have been with the JCorp group for plenty of years. Ultimately, JCorp is the major shareholder of Alaqar REIT, hence it controls the hiring of the Executives within its portfolio of companies.

Johor Corporation, or more commonly known as JCorp, is the major shareholder of Alaqar REIT with a holding power of 36.58%. The rest of the substantial shareholders include fund houses like Lembaga Tabung Haji, Employees Provident Fund (EPF) and Amanah Saham Bumiputera.

Financial Performance

Alaqar REIT has been steadily growing its portfolio of investment properties for the last 10 years. In its peak, it had 25 units of investment properties, which was the same period of time it recorded its highest-ever annual operating revenue.

Revenue dipped marginally after Alaqar REIT divested 3 units of investment property since 2015 (2 properties in Indonesia and 1 property in Malaysia). In Aug 2019, ALAQAR REIT has just announced they will be planning to acquire KPJ Batu Pahat Specialist Hospital in Johor for a cash consideration of RM 78 million. hence, this would bring its number of properties to 23. However net profit attributable to unitholders corrected downwards, due to lower fair value gain on investment properties.

Return on Assets and Equity wise, both are pretty stable around the region of 5% and 7% respectively.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Unit Holder’s Fund (RM’000) | Current Ratio |

| 2019 | 1,674,352 | 715,839 | 958,513 | 1.94 |

| 2018 | 1,580,468 | 632,670 | 947,798 | 4.71 |

| 2017 | 1,556,424 | 633,135 | 923,290 | 0.16 |

| 2016 | 1,611,214 | 715,144 | 896,068 | 3.73 |

| 2015 | 1,594,382 | 714,556 | 879,826 | 1.46 |

As of FY 2019, Alaqar REIT has total assets of RM 1.67 billion, liabilities of RM 716 million and unit holder’s funds (equity) of RM 956 million. Increased in assets is due to revaluation gain of its current investment properties.

Liabilities also had an uptick due to an increase in Islamic Financing. This is because the REIT took on additional financing to acquire KPJ Batu Pahat Specialist Hospital. This also means that the gearing ratio increased to 43.54% in FY 2019, which is close to the max of 45%.

Net Asset Value

Asset value-wise, Alaqar REIT has been showing a YoY steady increase in its net assets, even though with the previous disposal of 3 assets along the years, Alaqar REIT managed to grow its asset value to offset the divestment of investment properties.

Operating Cash Flow and Distributions Paid Out

Although Alaqar REIT shows growth in its gross revenue, its net income distribution for Alaqar REIT has been flattish for the past 5 years. Furthermore, distribution Per Unit fluctuates from around RM 0.04 per unit to RM 0.09 per unit. Since ALAQAR REIT is the sister company of KPJ Healthcare Berhad, the number of hospitals ALAQAR REIT stands to hold under its portfolio of properties will be directly correlated to KPJ Healthcare Berhad’s future growth plans.

Price

MyKayaPlus Verdict

Alaqar REIT is one of the few M-REITs that is active in acquiring new properties. Moreover, it is the only healthcare REIT that is listed in Malaysia. The other health care REIT would be IHH Healthcare Bhd (KLSE: IHH) hospital REIT but listed in the Singapore Exchange under Parkway Life REIT (SGX: C2PU).

With its concentration of hospitals predominantly in Malaysia, Alaqar REIT stands to grow along with sister company KPJ Healthcare Berhad. But private healthcare is also a highly competitive business as there are a few players in the Malaysia private healthcare segment.

Would you like to own hospitals instead of shopping malls and office buildings? Let us know in the comments below!