Why Am I Selling Off 9% Dividend Yield Bursa Malaysia Berhad?

Bursa Malaysia Berhad (KLSE: BURSA) had one of its best financial performances in 2021. Riding on top of the glove trading frenzy, its topline grew by almost 60%.

Bursa boasts a pledge to pay out 75% of its profit after tax (PAT) as dividends to shareholders. On top of operating in a regulated and monopolizing sector, all looks too good for Bursa. If you had invested in Bursa Malaysia Berhad, you would have enjoyed a 9% dividend yield, relatively risk-free. This is assuming you have done your research well.

So why have I decided to sell my stake in Bursa Malaysia Berhad? Isn’t it a good dividend company? Let us divulge a bit on our Dividend Gems blueprint that helps us make the call to divest Bursa.

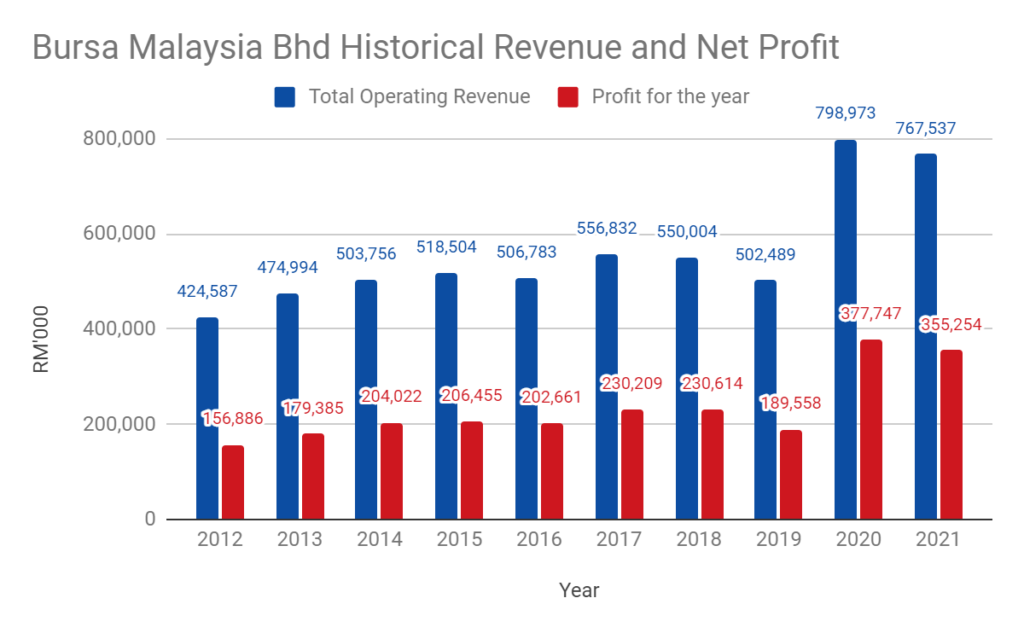

1. Flattish topline ex-FY2020

No doubt that Bursa’s financials had a bumper year in FY2020 and FY2021. But zooming out and looking at a historical 10-year performance, Bursa’s topline remains flattish. Prior to FY2020, its revenue grew at just a paltry 2.44% 7-year CAGR (from FY2021 – FY 2019).

A topline that does not grow consistently, would mean that the company would face some challenges in increasing its dividend payouts.

Thus, if you are looking for companies that grow their dividends year in year out, Bursa Malaysia might not be a great candidate.

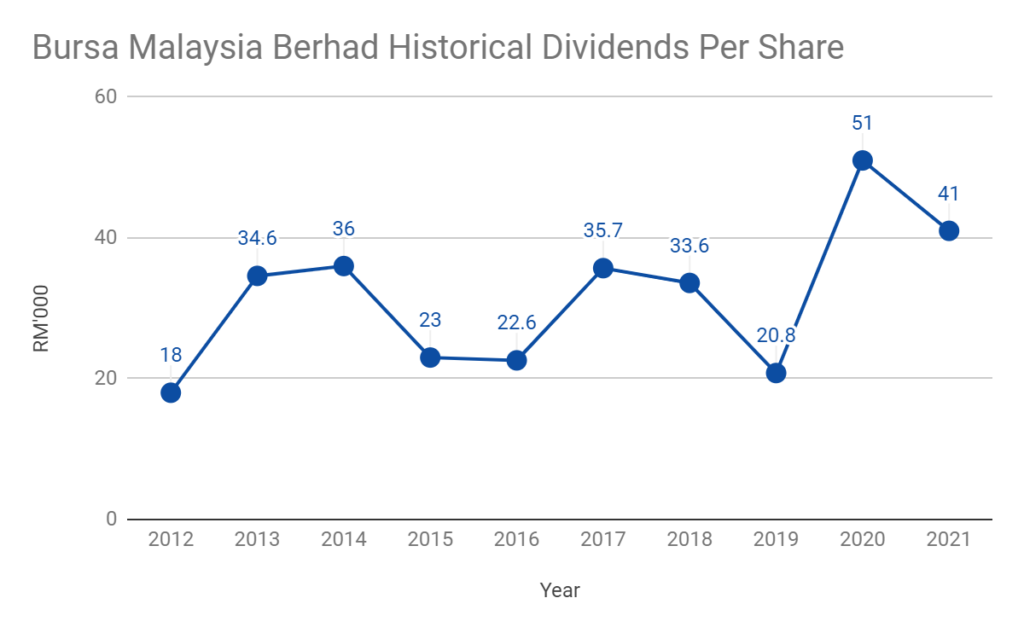

2. Flattish dividends per share track record ex-FY2020

Usually, if a company has challenges growing its topline, the dividend per share payout will follow suit. Hence, you can observe the trend from the historical dividend payout of Bursa Malaysia. Over the past 10 years, its dividend per share hovers around RM0.20 to RM0.36. Only during its bumper year earnings, a special dividend of RM0.08 per share was paid out.

Its dividend per share did not maintain momentum coming into FY 2021. An RM0.41 per share payout is still above its 10-year average. But knowing that the coming quarters will not be as robust as its pandemic trading periods, it will be hard for Bursa to continue paying an averagely higher dividend per share.

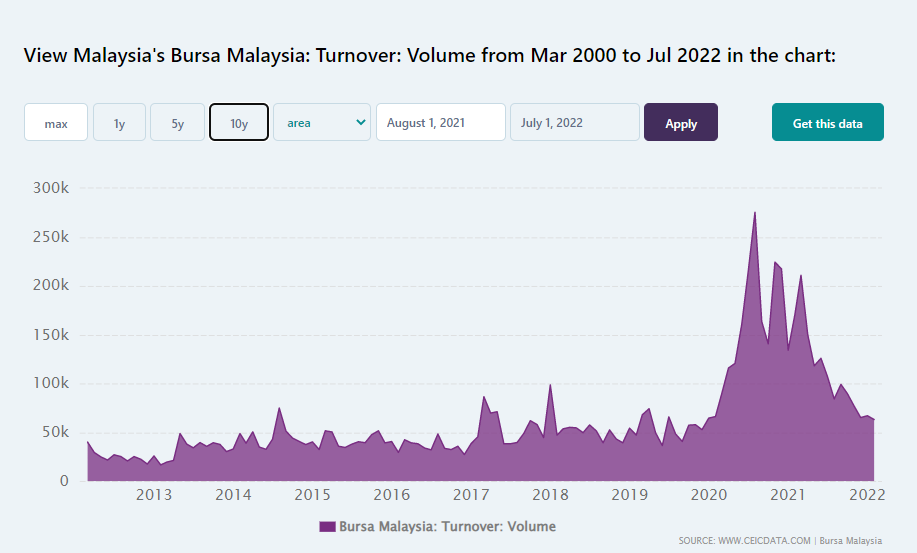

3. Flattish turnover volume

For every trade executed, Bursa Malaysia earns a trading and clearing fee. The more trades, the more Bursa Malaysia derives and grows its toplines. Thus the turnover volume plays a significant leading indicator of Bursa’s performance.

Amidst the pandemic-induced trading frenzy particularly on glove stocks, Bursa Malaysia’s trading volume surged to unnaturally high levels. With the brutal selloffs of glove stocks and an uncertain period ahead, their turnover volume slumped down to almost pre-pandemic levels.

This could be a key indicator of the normalization of Bursa’s upcoming quarters.

4. Home and listing choice to legacy businesses only

Bursa Malaysia might not have an economic moat as wide as it seems. It is true that it regulates and governs the Malaysian securities and derivatives market.

But that does not mean homegrown companies cannot list their shares outside of Malaysia!

Although every year there are new IPOs of companies in the Malaysian market, these companies are usually, if not all, legacy businesses. Innovative companies with disruptive technology can list in the US markets or outside of Malaysia.

Why so? As an owner of a company going public, it is in their best interest to fetch a premium or higher valuation of their company. And there is no better place than the US markets as a prime choice to garner attention and premium listing valuations.

Carsome, a homegrown company in the used car business, will seek dual-listing in the US and Singapore markets. This comes with a silent slap that Singapore Exchange is chosen as its 2nd market to do a dual listing, ahead of Bursa Malaysia. Singapore Exchange is considered South East Asia’s more robust market, is also home to many international companies and REITs.

We all know that new companies will always garner more attention and hence trading volume. Should the Carsome listing be one of the many upcoming examples of local companies shunning listing on Bursa Malaysia, this should not bode well for Bursa’s prospects.

MyKayaPlus Verdict

That said, Bursa Malaysia Berhad is not a bad dividend company. If you are comfortable investing just within the Malaysian market, it is still a good choice.

However, if you look at investing from a global point of view, Bursa Malaysia is definitely not a great dividend stock.

Thus, after considering and utilizing our Dividend Gem framework, I decided to divest my stake in Bursa Malaysia. I got a respectable 9% dividend yield last year and got back some capital gains.

This Bursa trade was a profitable trade from both dividend and capital gains with the help of our Dividend Gems rule-based checklist.

You too can utilize this blueprint to find your dividend stock all around the world! This checklist is applicable to companies all around the world. If you are interested in upping your investing game, we urge you to join our Dividend Gems Masterclass here!