Alibaba Group FY2022 Results – 7 Points You Need To Know

Alibaba Group Holding Ltd (HKEX: 9988) (NYSE: BABA)‘s latest fiscal year results are out. Stock prices of Alibaba have gone through much beating ever since the Politburo’s tech crackdown.

After its fiscal year results, Alibaba’s stock prices popped by 12%. What can Alibaba stockholders expect of the stock? Did Charlie Munger make a mistake selling out his stake too soon?

Here are 7 things you need to know about Alibaba’s FY2022 performances before deciding to buy, hold or sell the stock.

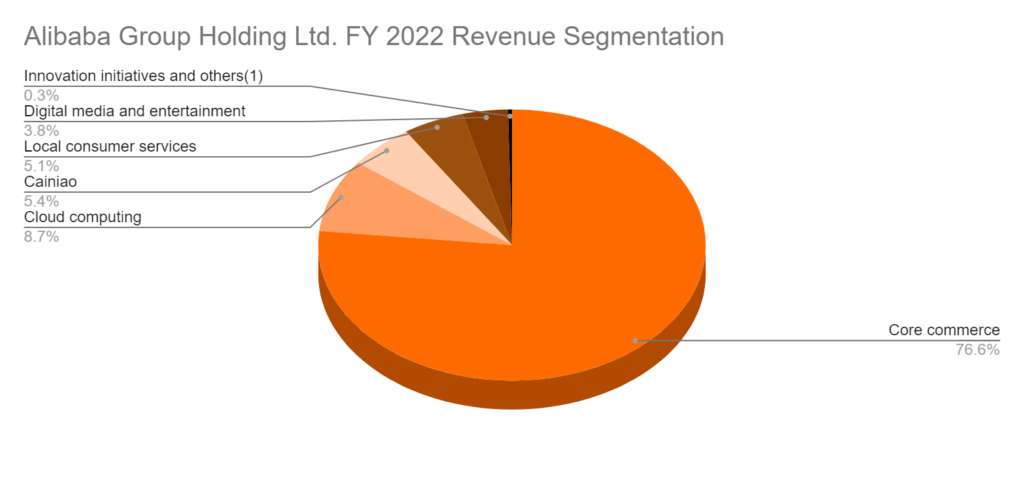

1. Core commerce contributes to 77% of its FY 2022 revenue

Many shareholders might be seeing Alibaba following Amazon.com, Inc (NASDAQ: AMZN)‘s blueprint to pivot into a cloud-centric company. But as of FY 2022, by revenue size, Alibaba is still very much an e-commerce company.

Core commerce contributes to 77% of its topline. Cloud computing is second in place with a contribution of 8.7%, followed by Cainiao, its logistic arm.

Alibaba’s commerce business might have started online. But over the years, it has grown and now covers brick and mortar shops as well. Its China retail commerce counts Taobao, and Tmall as its main revenue contributor. It has also integrated live streaming functions for key opinion leaders to demonstrate and sell products on its apps.

Recently, Alibaba put more focus on its brick and mortar businesses. It launched Freshippo and bought over Sun Art Retail Group in an attempt to also integrate its online e-commerce business with offline outlets.

Their China Commerce grew at a YoY rate of 18%, while International Commerce grew 25% YoY, contributed by stronger growth by Lazada.

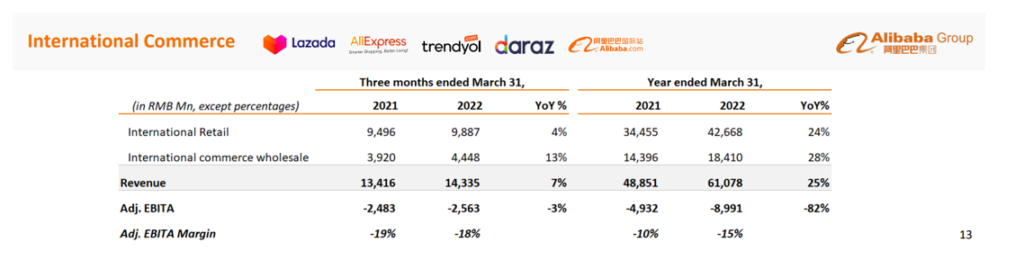

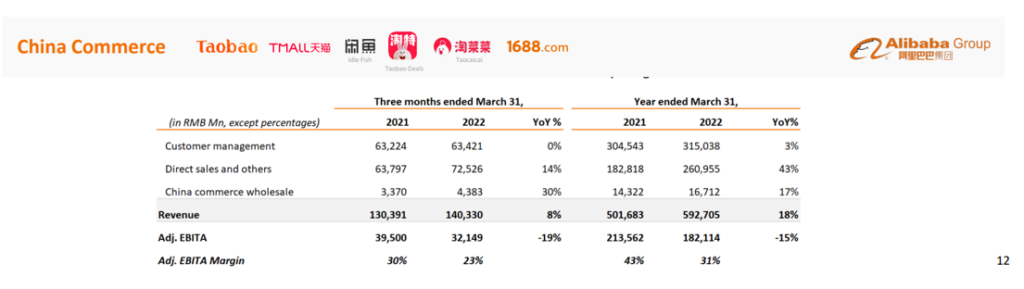

2. Alibaba’s Commerce EBITA dropped YoY

Despite a decent topline growth of 18% YoY for its core commerce revenue, EBITA for its core commerce slumped.

China’s commerce Adjusted EBITA dropped by 15% YoY. But it is due to increased investment in Taocaicai and Taobao Deals, which is a counter-attack measure against its competitors. This is on top of the continuous impact of COVID-19 as well.

Even though Lazada might still be growing well, the same could not be said for Trendyol, Alibaba’s Turkey e-commerce platform. Thus, its China and International commerce EBITA have been dragged down.

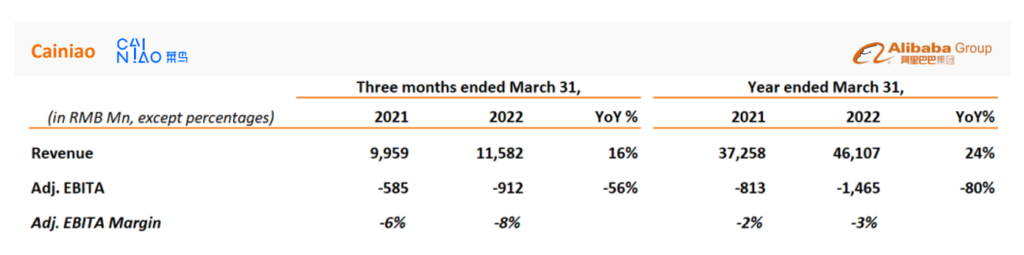

3. Cainiao grew by 24% YoY

Previously, Jack Ma previously proclaimed that his vision for Alibaba is to stay asset-light versus what Amazon was doing. But as time goes on, it became inevitable for e-commerce companies to eventually dip their toes into logistics.

The China commerce retail businesses, such as Tmall, Taobao and Taobao Deals have offset some of the international orders affected by the Russia Ukraine war. YoY quarterly wise, Cainiao grew by 16%, still a bit behind JD Logistic’s growth of 22% YoY.

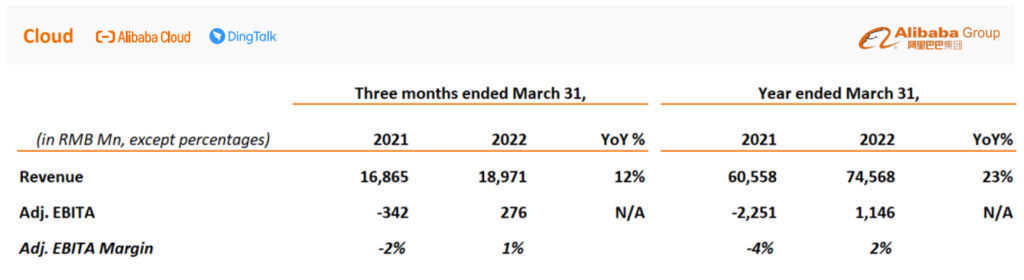

4. Alibaba Cloud only grew by 23% YoY annually

One of the more disappointing verticals of Alibaba is surprisingly its cloud business. In the same period of time where US cloud companies are doing around 30-40% growth per annum.

That said, with the current geopolitics happening, the world is split into 2 factions. It might not be fair and conclusive to compare the cloud growth of Alibaba against its US counterparts.

The silver lining, however, is that the EBITA for cloud finally turned positive.

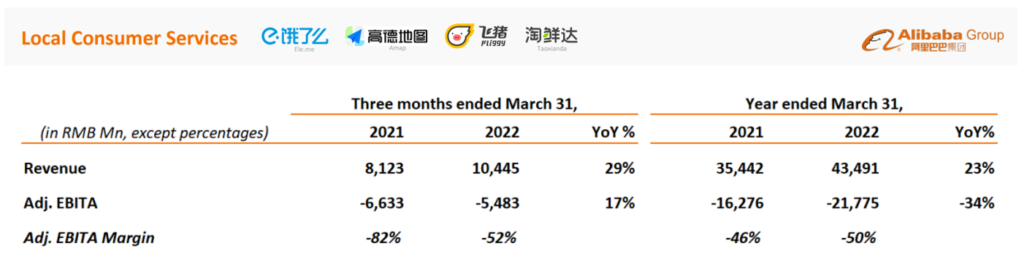

5. Local consumer services showing good growth momentum

As the e-commerce space becomes saturated with stiff competition from other players, Alibaba is not resting on its laurels. On top of launching Taobao deals, it has also put in efforts to grow its other services.

Ele.me, its food delivery services are one important vertical. Even though the local consumer services are still loss-making, growth-wise it is still one of the prospects of Alibaba.

However, in the latest crackdown by Beijing, ele.me together with its competition Meituan (HKEX: 3690) could face strong headwinds in order to grow.

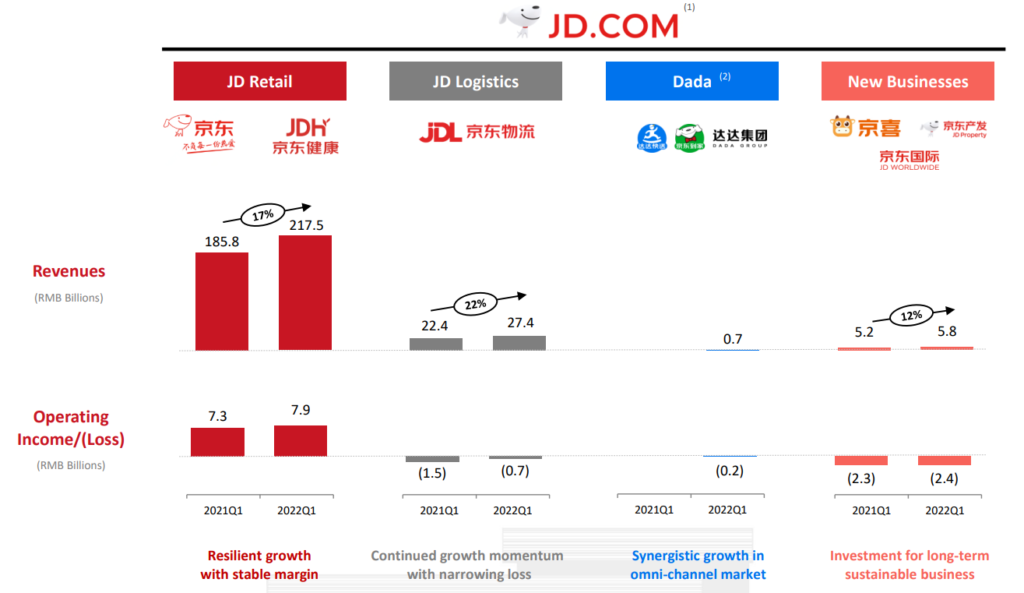

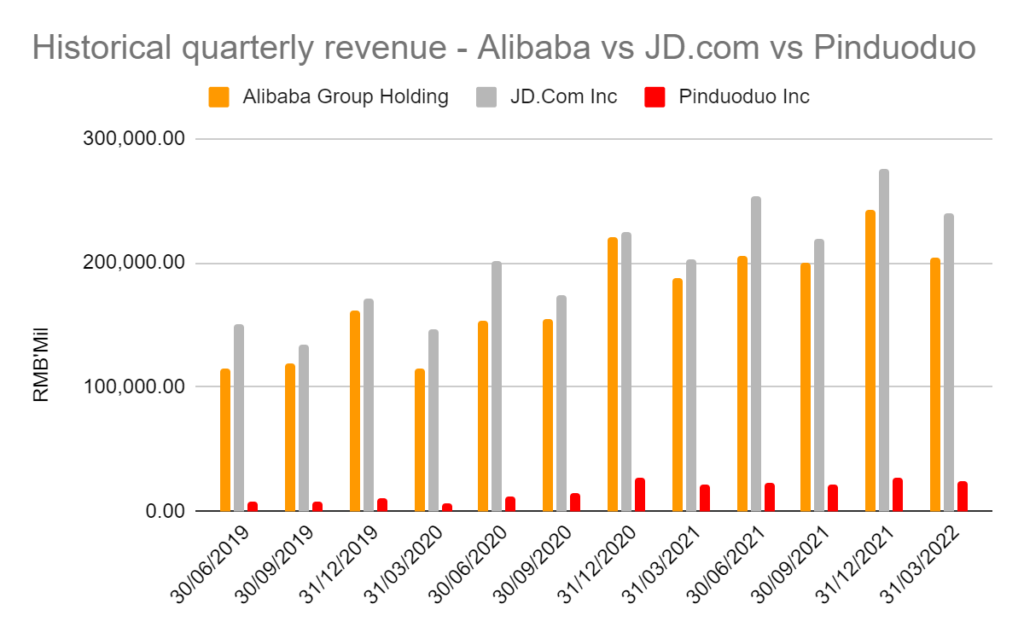

6. Alibaba’s total revenue continues to lag behind JD.com

Contrary to what most people think, JD actually records a total higher revenue than Alibaba. As e-commerce is very competitive in China, existing and new players would have to battle each other out for consumers.

Although there are some instances where Alibaba got within touching distance in terms of total revenue, for most instances, JD.com manages to outgrow its toughest competitor.

JD.com made an earlier shift into logistics and is starting to see a more complete value chain while Alibaba is playing catch up.

7. Alibaba is stepping up its share repurchases

During the quarter ended March 31, 2022, Alibaba bought back 17.8 million of its ADSs (the equivalent of approximately 142.8 million ordinary shares) for approximately US$2.0 billion under their share repurchase program.

In FY 2022, approximately 60.0 million ADS for approximately US$9.6 billion were bought back under the share repurchase program. Moving forward, the share repurchase program will increase from US$15billion to US$25 billion, which will be effective through March 2024.

MyKayaPlus Verdict

Alibaba could still be a great company to invest in. Although total revenue-wise it is lagging behind JD.com, in terms of free cash flow, it is still the most superior e-commerce company.

Of course, the tech crackdown has spooked investors all around the world. Even the legendary Charlie Munger halved his Alibaba position in April. But that does not spell any fundamental shift in Alibaba’s business.

However, due to the pessimism and slowing Chinese economy, share prices can stay at a deep value discount for prolonged times. Time will tell whether Alibaba is currently trading at the best-discounted price or the biggest value trap of all time.

Curious to know how we analyze tech companies and do peer to peer analysis like this article? We have more in-depth and informative content for our Premium Club members. Signup to become a Premium Club member HERE.