TOP GLOVE CORPORATION BERHAD V.S. HARTALEGA HOLDINGS BERHAD

The glove-making sector has always been a favourite business segment that Malaysian investors love.

It is one of the few business segments that we enjoy a 63% GLOBAL market share. Malaysia has a handful of glove manufacturers that produced around RM 18 billion worth of gloves. That means more than 1 out of 2 gloves produced worldwide is made in Malaysia.

The glove industry is so big, that even non-investors are familiar with the bigger glove companies in our country. And of course, the famous duo powerhouses when it comes to glove manufacturers are none other than Top Glove Corporation Berhad (Top Glove Bhd) and Hartalega Holdings Berhad (Hartalega Bhd).

Both companies are the kings of glove-making in Malaysia. Top Glove Bhd and Hartalega Bhd both contributed close to 50% of Malaysia’s glove export market. But who is the biggest and better between both giants?

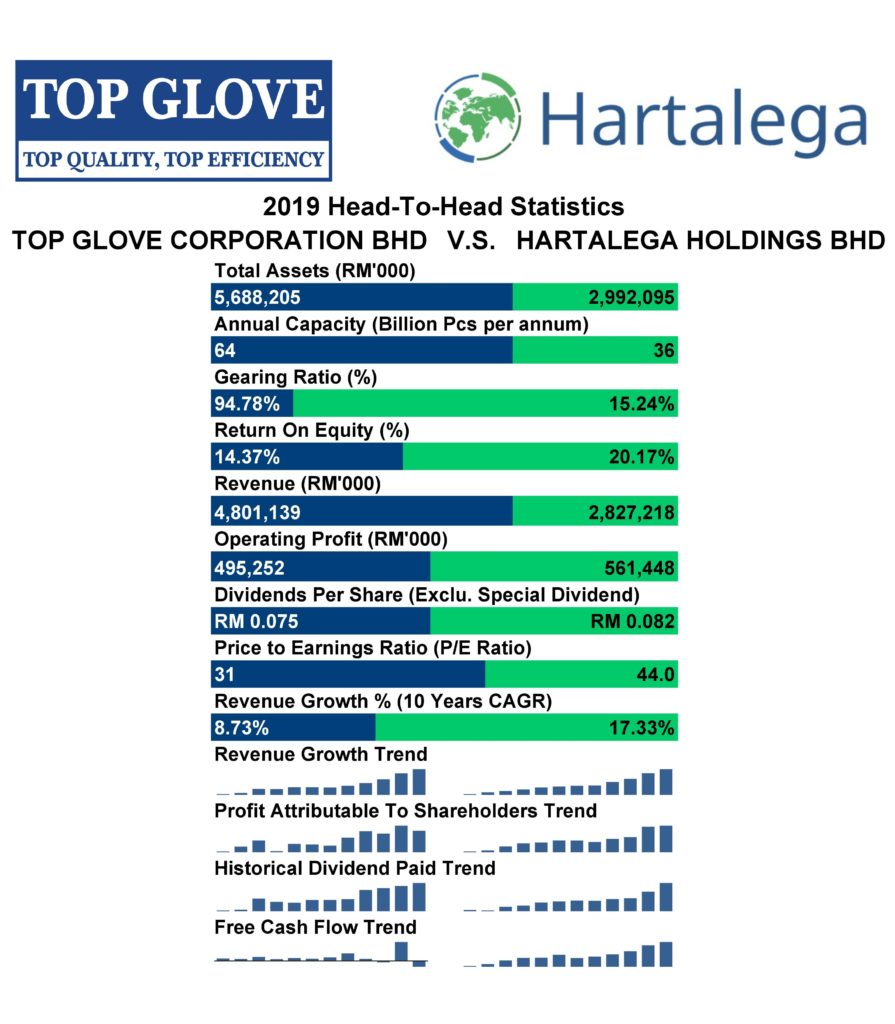

Let’s take a look at a head-to-head comparison of both Top Glove Bhd and Hartalega Bhd!

Assets & Annual Capacity

In terms of size, Top Glove is humongous! As of 2019, Top Glove Bhd has a total asset value of RM 5.7 billion! Put side by side against Hartalega Bhd’s asset size, it does seem a bit surreal that Hartalega Bhd’s asset size is only half of Top Glove Bhd at RM 2.9 billion!

Capacity wise, Top Glove Bhd is able to churn out 64 billion pieces of gloves as of their plant set up in 2019. This also overshadows the annual capacity of Hartalega Bhd, which clocked a capacity of 36 billion pieces per annum as of 2019.

In terms of size, the king is Top Glove Bhd!

Revenue & Profitability

With its size and capacity, it is no surprise that Top Glove comes out with blazing guns. As of its latest 2019 annual report, Top Glove registered its historical best revenue of RM 4.8 billion. Hartalega Bhd also registered its best-ever revenue record which stood at RM 2.8 billion. But notice that the big difference we saw when comparing the asset sizes of both companies has reduced quite a bit! Ratio-wise, Top Glove Bhd registered RM 0.89 worth of sales for every RM 1 of assets, while Hartalega Bhd achieves RM 0.96 worth of sales for every RM 1 of its assets

Moving on to the profitability is where we noticed a surprising change! Hartalega Bhd, with lesser sales, recorded an operating profit of RM 561 million for 2019, while Top Glove Bhd managed RM 495 million. Hartalega Bhd had a superior profit margin that enables it to register a higher profit than its counterpart Top Glove Bhd! It’s no wonder that Hartalega hence has a Return on Equity of 20% while Top Glove registered a Return on Equity of 14%

Balance Sheet Strength

Although Top Glove Bhd is way superior in asset size, upon checking their latest report we noticed that it is a majority is funded by debt, hence giving it a very high gearing ratio! Hartalega Bhd, on the other hand, has a significantly lower gearing ratio at just 15%.

Rather than pinpointing and making quick conclusions that higher gearing is unfavourable, it is better to understand the growth plans and methods of both companies. Top Glove Bhd usually increases its capacity size and growth by acquisition of smaller glove companies. To have the financial muscle to pull off company acquisitions, Top Glove would have to take on loans and borrowings on top of the cash it generates from its business to further fund its growth. Top Glove Bhd has a current ratio close to 1 as of 2019, hence I would not be that afraid on its cash flow management and liquidity!

Hartalega Bhd grows its business via investments made to its National Glove Complex (NGC). Hartalega Bhd built its state of art glove manufacturing complex in Sepang. The company has the engineering know-how and technical knowledge to build and design their line from scratch, hence giving them better control and understanding when it comes to sizing up its plants and increasing efficiency. This is why even though with lower revenues, Hartalega Bhd is still able to register a way higher profit than Top Glove Bhd!

Dividends, Valuation and Trend

Glove business is surprisingly a cash-generating business. Even though most glove-making companies are very aggressive in their capacity expansions, most of them are still able to pay out consistent dividends to shareholders. Top Glove Bhd announced a dividend per share of RM 0.075 for the year 2019. Hartalega Bhd distributed a dividend per share of RM 0.082 per share.

Even though both Top Glove Bhd and Hartalega Bhd have shown consistency and increasing trends in distributing dividends year-on-year, the dividend yield of both companies is actually very little. At the time of writing, the dividend yield of both companies is in between 1.5-1.7% per annum. This is again further supported by the fact that both companies are trading at high Price to Earnings ratio, with Top Glove Bhd having a PE ratio of 31 and Hartalega Bhd with a PE of 44!

Why are both stocks trading at such a high premium compared to other listed companies? This is because both companies have a proven track record of ever-increasing sales and profits for the past 10-year plus time horizon! Top Glove Bhd has grown its top line at a fantastic rate of 8.73% (10 years CAGR), while Hartalega Bhd’s 10 CAGR stood at a mind-boggling 17.33%!

Given its higher margin and higher CAGR growth, it is no wonder that Hartalega Bhd is trading at a higher price to earnings ratio compared to Top Glove Bhd.

Verdict

Both companies are considered the crown jewels of Malaysian equities that have rewarded their shareholders generously with dividends and mind-boggling capital gains. Both companies are actually great paying dividend companies as they have a dividend policy to pay out 45%-50% of their profit to shareholders, while also having a solid track record to perform regardless of macro-economic changes.

It is, however, the high valuation and price that both companies are currently trading at that drive down the dividend yield and potential upside capital gains. This does reaffirm the popular saying that good stocks aren’t really that cheap and cheap stocks aren’t really that good!

Do you currently hold any shares in either Hartalega Bhd or Top Glove? Do you think the growth has come to an end or that it will go on and on and on?

Let us know in the comment section below!