Dividend Payout Ratio: Not Too Much, Nor Too Little Is Best

Successful businesses grow year in year out. When more profits roll in, share prices go up.

Eventually, earnings and cash from business operations will increase the company’s cash pile.

Solving The Increasingly Idle & Growing Cash Pile Problem

There are typically two things a company can do with its earnings or profits. Firstly, to reinvest the earnings into the business for expansion and growth. Secondly, they can opt to distribute the earnings as dividends to its shareholders.

So, what is the correct option to make you might ask? Actually, it all boils down to the company’s size and management. For example, a newly established business would likely keep most of its earnings for growth in the nascent years. Conversely, steady mature businesses would keep only a portion of earnings for growth and working capital. The rest would be distributed to its shareholders.

Dividend Payout Ratio: Measuring How Much Earnings Are Paid Out

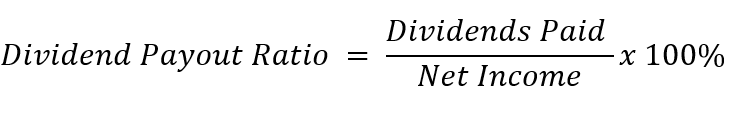

The most common ratio to measure how much dividends a company pays out is Dividend Payout Ratio (DPR). Put simply, we take total dividends paid over net income of the company. This gives us the DPR, expressed as a %.

This formula is a straight forward ratio between the Dividends Paid versus the Net Income:

What Is The Golden Ratio fo a Dividend Payout Ratio?

DPR is quite industry-specific. For example, Real Estate Investment Trusts (REITs) usually have a DPR of at least 90% and above. For every net dollar the REIT earns, they would have to distribute 90 cents back to unitholders.

But, there are no specific guidelines for other industries. Hence, the company’s management may set a policy to indicate future dividend payouts.

At the end of the day, DPR may not be a useful ratio for growth investors. However, it is particularly useful for an income investor. Why? This is to ensure the company has a sustainable plan in distributing dividends. This is on top of other fundamentals like revenue growth, profitability and liquidity.

Breaking Down The Dividend Payout Ratio

The Dividend Payout Ratio can be calculated easily in just 2 steps.

- Search for “dividends” or “dividends declared” in a company’s annual report.

- Look for Net Income under Income Statement

- Calculate Dividend Payout Ratio by taking Total Dividends over Net Profit

- Alternatively, search for “dividend payout ratio” in the report. Some reports have this stated by default.

Alternately, you can take the dividend per share (DPS) and divide it by the earnings per share (EPS).

Measuring The Management’s Cash Allocation

At the end of the day, it is the management in charge of the company that makes decisions on the company’s earnings. The Dividend Payout Ratio not only measures the liquidity aspect of a company for sustainability. It also measures the management’s shrewdness into balancing the act of company growth and rewarding shareholders.

A good dividend payout ratio is justified by a few factors. For example, a company’s operating cash flow and future growth plans. It doesn’t make sense for a company to overpay its dividends in view of future upcoming capital expenditures. Conversely, a company with no future growth plans yet hogging onto a huge cash pile should also raise your eyebrows too.

MyKayaPlus Verdict

The Dividend Payout Ratio should be analysed and justified after knowing the company in and out. Only then we can put ourselves in the shoes of the management. Put simply, its more of judging the management’s shrewdness in managing the company’s coffers.

Lastly, ever wondered why you end up investing in so-called “high dividend yield” investments and yet see the share prices of the company decrease? Perhaps your investing methodology is not robust enough to detect this potential shortfall.

Luckily, we will be divulging our Dividend Gems blueprint in the coming months to actually get your kickstarted to invest in the best in class dividend stocks. Learn how to value great dividend companies, and see increasing dividend payouts on top of increasing share prices as well.