MOAT ETF: Here’s why I bought it for my other half

Moat is one of the punchlines we hear whenever we dive deep into investing. Sometimes I find myself guilty of using that word too frequently as well.

Moat is the shortened form of economic moat, which is often attributed back to legendary investor Warren Buffett.

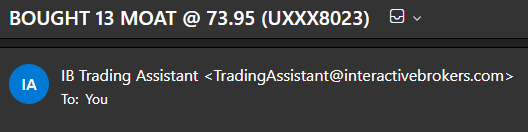

To understand why I chose to buy MOAT as a birthday present for my other half, I think we all need to fully understand what the ETF is all about.

Introduction to Morningstar Wide Moat Focus Index (MWMFTR)

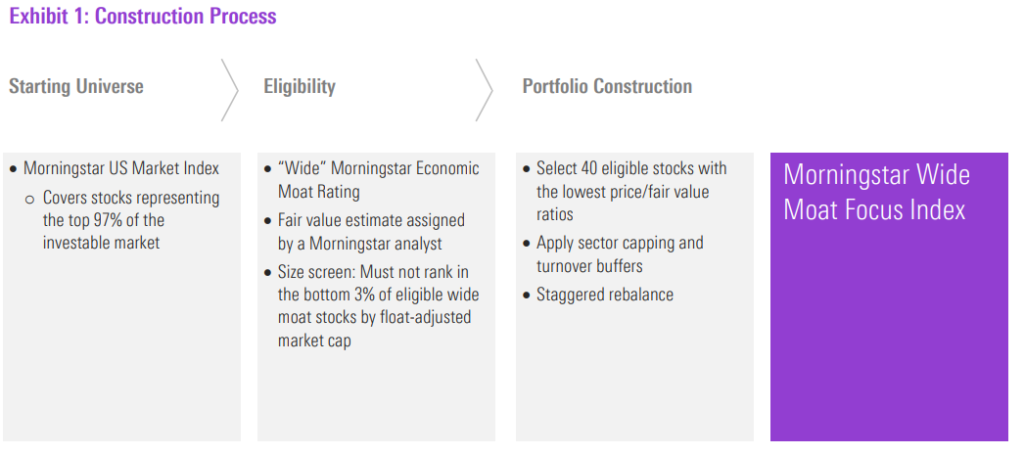

VanEck Morningstar Wide Moat ETF (MOAT®) ( BATS: MOAT) seeks to replicate as closely as possible, before fees and expenses, the price and yield performance of the Morningstar® Wide Moat Focus IndexSM (MWMFTR).

The punchline of the stock selection is simple – attractively priced companies with sustainable competitive advantages according to Morningstar’s equity research team.

The gritty parts, lie in the rule book which you can find here.

Some key rules on the stock picking criteria are as exhibited – companies are given a Moat rating and a fair value estimate.

There is also a sector capping, where the maximum weight of an individual sector in each sub-portfolio is capped at its corresponding weight in the benchmark + 10% or 40%, whichever is higher.

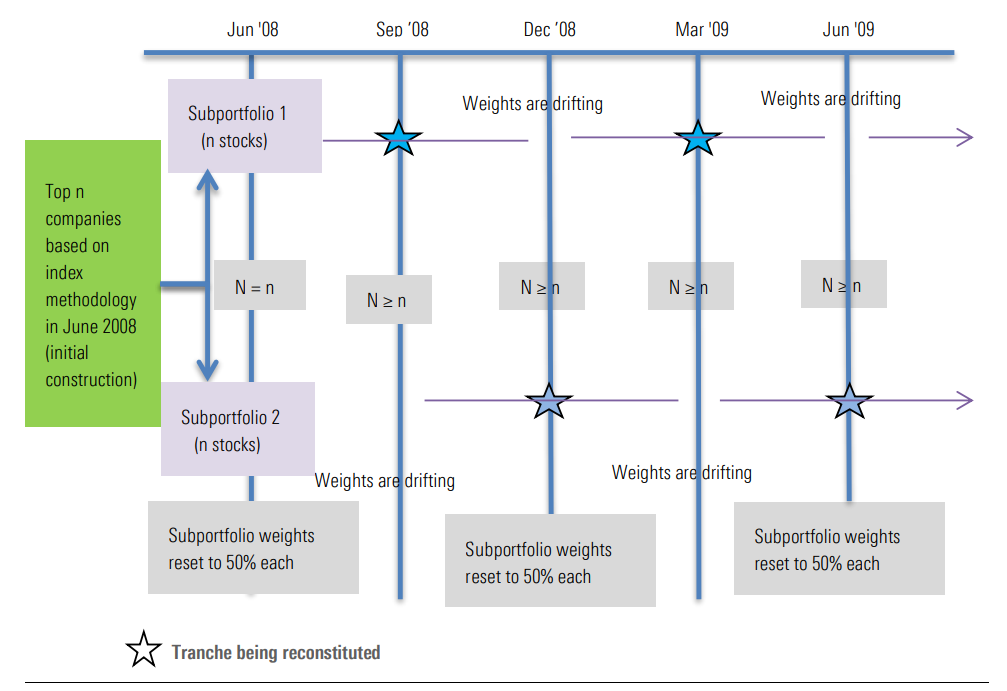

What most people are unaware, of is that MWMFTR consists of two sub-portfolios, reconstituted on staggered quarters, which each target 40 companies based on a transparent ranking system subject to selection and eligibility criteria at reconstitution.

Each quarter, either one will be reconstituted, and every half-yearly, the sub-portfolios weights

reset to 50% each.

Why competitive advantage?

Morningstar has identified five attributes that may contribute to a company’s moat: switching costs, intangible assets, network effect, cost leadership, and efficient scale. Companies that undergo each attribute for ratings, can either obtain a grade of none, narrow or wide.

A wide moat rating is given to a company that has a high probability to sustain its competitive advantage for at least the next 20 years. A narrow moat rating means a company is likely to do so for at least 10 years. A company with no moat has either no advantage or one expected to dissipate relatively quickly.

Time is an important factor for companies with a moat to work their magic and grow. Thus, it is a direct buy-and-hold strategy with quarterly balancing according to a set of rules.

Introduction to VanEck Morningstar Wide Moat ETF

The VanEck Morningstar Wide Moat ETF (MOAT ETF), seeks to replicate as closely as possible, before fees and before fees and expenses, the price and yield performance of the Morningstar® Wide Moat Focus IndexSM (the “Wide Moat Focus Index” or the “Index”).

Replication does not really mean holding on to the same stocks, but at least 80% of its total assets in securities that comprise the Fund’s benchmark index. So there could be some tracking risks here.

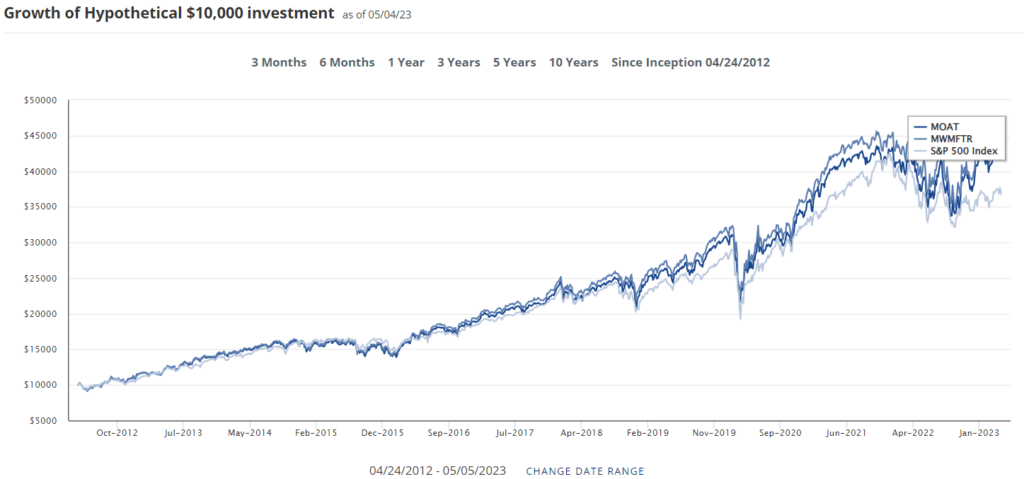

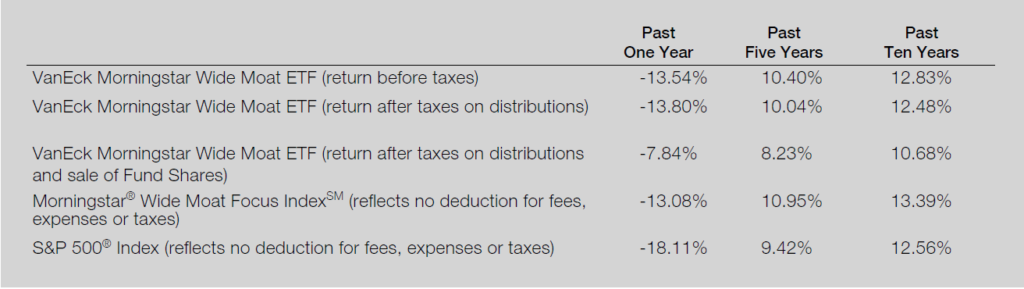

But judging based on the historical tracking and returns, we can safely assume that MOAT does mimic MWMFTR quite accurately. And most importantly it does outperform the S&P500.

Else, there shouldn’t be any vindication not to go for the normal S&P500 index.

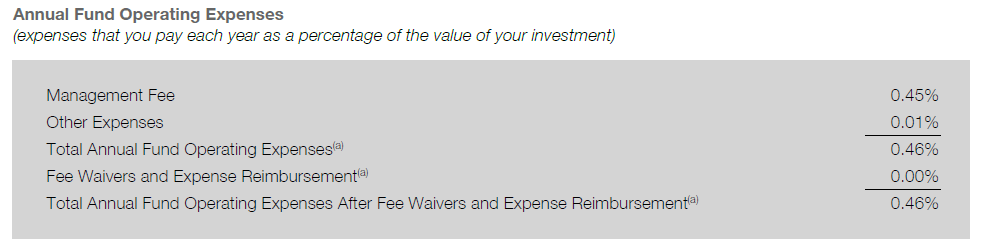

Expense ratio

Letting someone else manage your money, even if it is an index-tracking ETF, is not free lunch.

Thankfully, the fees of MOAT are considerably low at 0.46%.

This is where another factor comes to play in picking MOAT. Not only historically its returns outperform the S&P500, but the fees are affordable.

The low fee helped piped MOAT up versus other choices, e.g. StashAway.

What about performances AFTER fees?

Some sharp-eye readers might ask, well what are the returns post fees and expenses? Does it still beat the S&P 500?

The simple answer is not every time.

But that should not dissuade you to come to a premature conclusion.

Looking back at the snapshots of historical performances, you would notice that there are some periods of time where MOAT does beat the S&P500, but not an S&P500 ETF.

All ETFs come with fees and expenses. And chances are if you compare MOAT against SPY, MOAT should eke out a consistent outperformance.

Performance benchmarking & comparison

My preference when it comes to judging a stable ETF is this: you want an ETF that is steady, and tanks lesser during market uncertainties.

There are thematic ETFs that can be much more volatile. But when it is solely around general investing ETFs, it needs to be stable.

Stable enough for you to manage your emotions, to continue Dollar-Cost Averaging (DCA) even during market downturns.

Comparing SPY and MOAT side by side via ETF.com, we can see that MOAT (right hand side) usually tanks lesser on relative to SPY.

It also tends to outperform SPY even when markets are on uptrends.

So this side-by-side comparison of SPY and MOAT should put doubters to rest when it comes to relative performance.

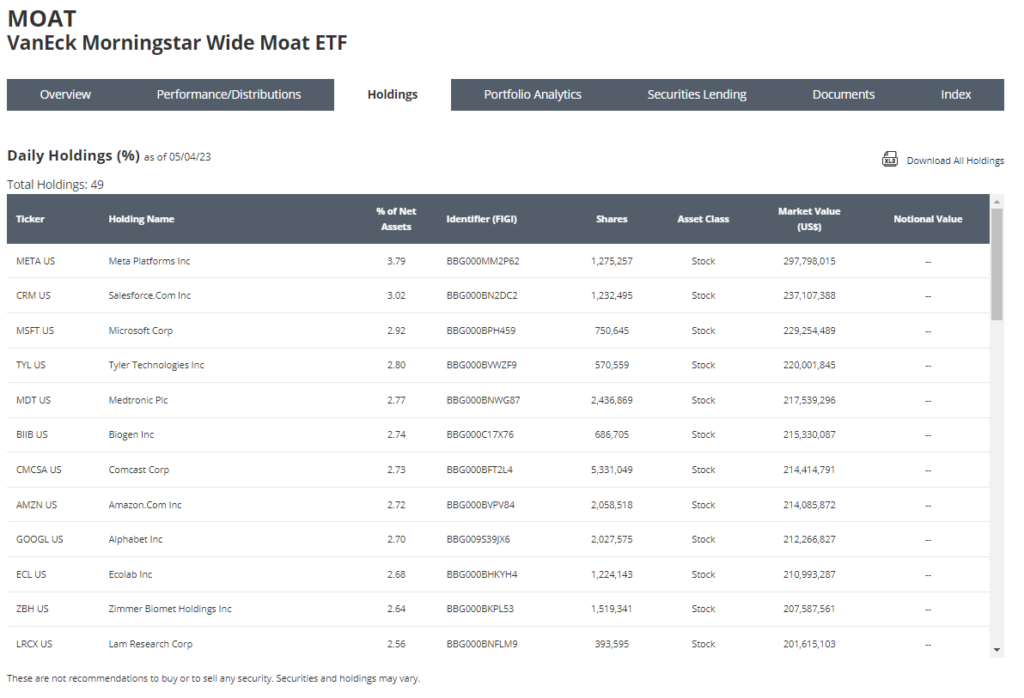

MOAT Holdings as of the time writing

Most of the holdings are well-known companies. As an investor who stock picks, I might not agree with all the stocks on the list.

But it not only picks stocks with good economic moats but considers the valuation as well. As valuation is subjective, and due to its historical outperformance, there really is nothing much to nitpick.

Moat itself is symbolic

All companies and businesses have life cycles. Not all companies can live on for years. Some do not even get past the initial 5 years.

In many aspects, it is the same as the interhuman relationship.

But when you come across someone who you think holds a special place in your heart, you would want that relationship to go on and on.

Standing through the test of time.

Just like the economic moat of a great business, there are some relationships that we want it to be a wide moat.

The timing, naming, and correlation of MOAT were uncanny and befitting.

Thus, after much consideration, and comparisons, this is why, I bought MOAT for my other half.

Are you a MOAT ETF holder? Let me know in the comments!