MY V.S. SG Disposable income – Far apart

EDIT: This article has been tweaked from the first version after reader Leong Chee Hsiang pointed out that income taxable should be after compulsory EPF and CPF contributions.

It is not true that I have never dreamt of going back to Malaysia and settling down.

But every time I relook into this possibility, I am always challenged by the maths. Budgeting for life in Malaysia is not straightforward or easy.

This article does not revolve around how strong the Singapore Dollar is, or how weak the Malaysian Ringgit is.

It is purely the cashflow management exercise that determines the survivability should Malaysians working in Singapore currently opt to go back for good.

In essence, the disposable income.

Disposable income is the net income, net of taxes, and also net of any obligated retirement contributions like Employees Provident Fund (EPF) or Central Provident Fund (CPF).

So to set out my arguments, I will first walk you through the EPF and CPF comparison. After that, we will touch base on the income tax tiers of both Malaysia and Singapore.

Setting the baseline salary for comparison

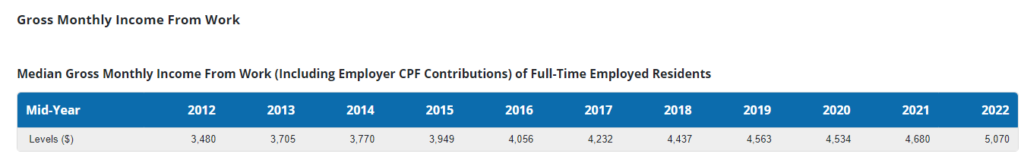

According to Singapore Manpower Research & Statistics Department, the median gross monthly income from work (including Employer CPF) of full-time employed residents is SGD 5,070 in the year 2022.

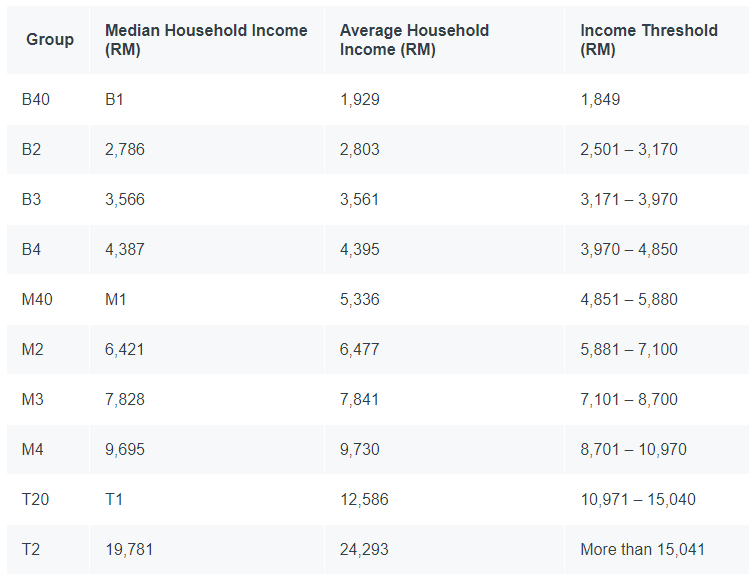

While for Malaysia, due to a lack of updated publication and data, let’s pick M4 from the M40 segment, with a median of MYR 9,695.

And to also ensure apple-to-apple comparisons and validity, there will be no bonuses and increment factors.

CPF VS EPF

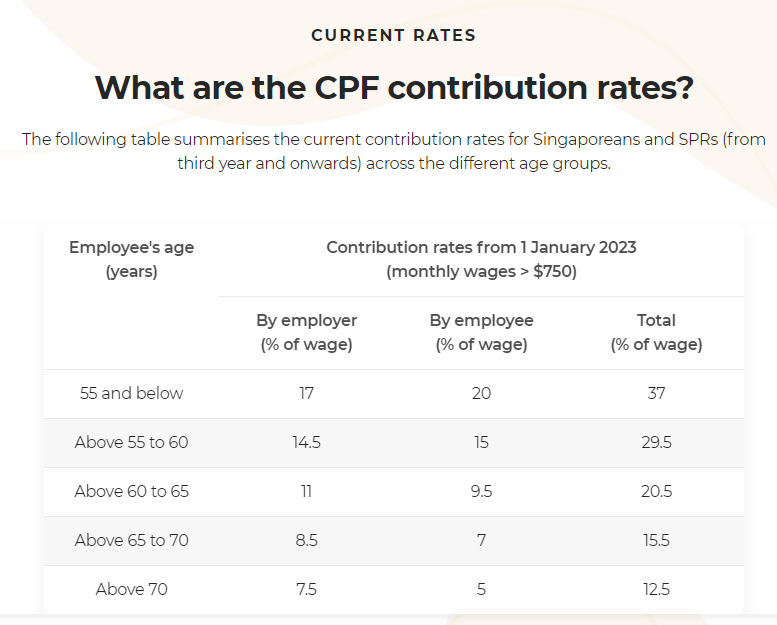

The CPF contribution rates have a few tiering systems by age.

For those who are 55 years old and below, 20% of your monthly pay will be automatically contributed to CPF. Employers will pay an additional 17% of your monthly wage. Thus the total % that goes to your CPF will be 37% of your total wage.

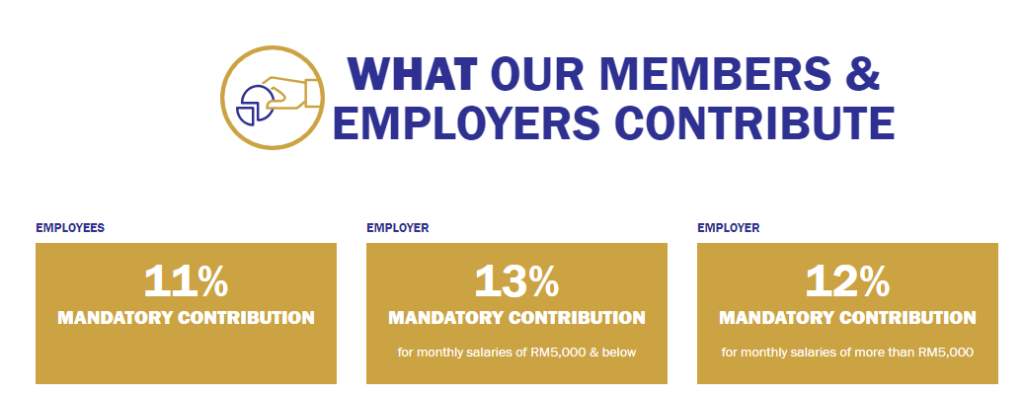

As for Malaysians, their mandatory contribution portion of their monthly pay is 11%, 9 points lesser than Singaporeans. But the total contribution together with employer contribution, would add up just to 23%.

Income Tax Tiers

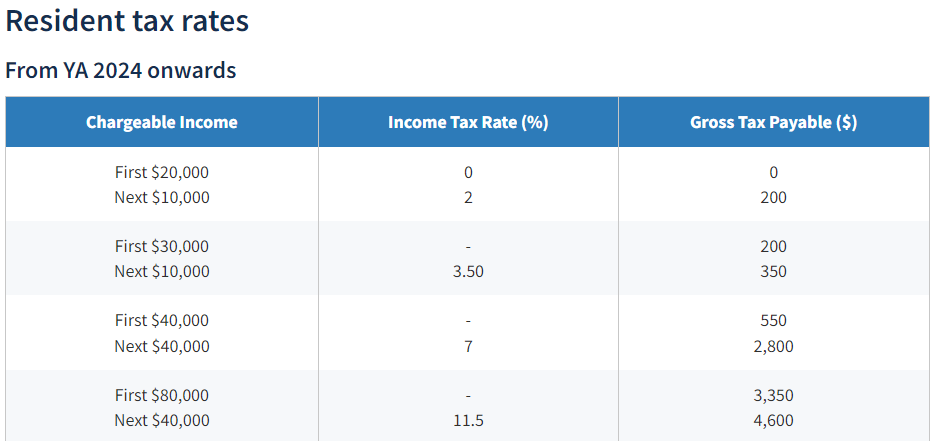

The Singapore resident tax rates are as below. A Singaporean earning a net chargable income SGD 4,056 (after netting off the 20% CPF contribution, SGD 48,672 per annum), will fall in the First SGD 40k and next SGD 40k segment.

The first SGD 40,000 will be a flat tax of SGD 550, while the remaining SGD 8,672 will be subjected to a tax rate of 7%. This yields around SGD 607.04. That sums up to a total of SGD 1,157.04, which is 2.3% of gross salary.

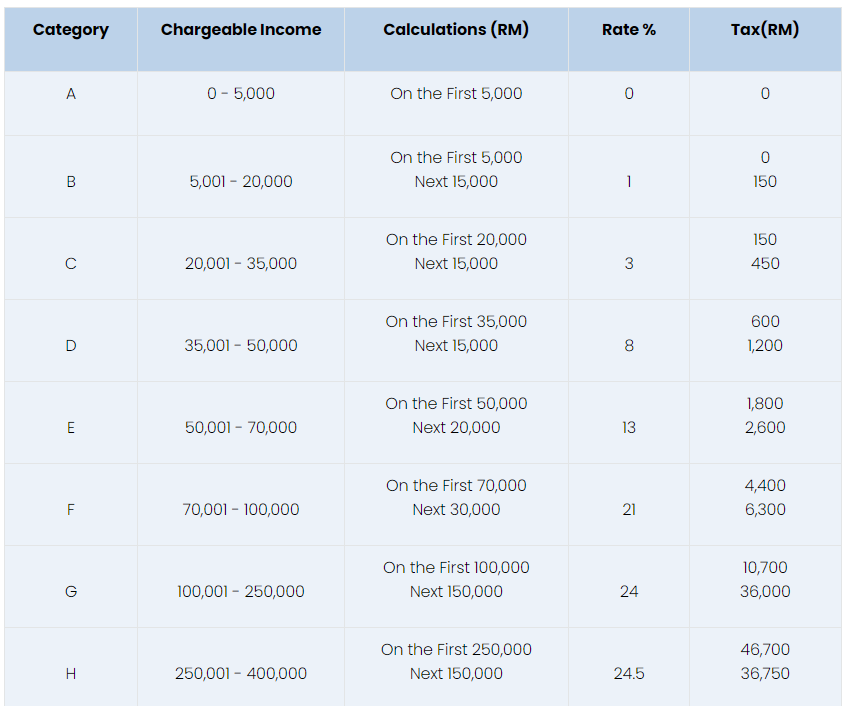

Where else for the Malaysia income tax band, a Malaysian earning MYR 9,695 per month (after netting off the 11% mandatory EPF contribution, MYR 103,542.60) will fall under category G. The first MYR 100,000 will be a flat rate of MYR 10,700, while the balance of MYR 3,542.60 will be taxed at a rate of 24%, which is MYR 850.22.

A total tax of MYR 11,550.22. That is 9.93% of the total gross salary!

So what’s the net disposable income for a median income earner in Singapore and Malaysia?

Let’s round up the figures from the tax portion and pension fund contributions

Singapore: 20% from CPF, 2.4% on taxable income = Total 22.40%

Malaysia: 11% from EPF, 9.93% from income tax, = Total 20.93%

Now, I know the % may seem close, but there are additional 2 aspects to consider

Net disposable income for someone working in Singapore will be SGD 3,934.32 per month post the 22.40% deduction.

For someone working in Malaysia, it would be MYR 7,665.84 post 20.93% deduction.

Is SGD 3,934 and MYR 7,665 enough to live in Singapore and Kuala Lumpur?

Having lived in Singapore for the past 7 years, I can confirm that SGD 3,934 is enough. The caveat is provided you are not engaged in a hard-to-maintain lifestyle.

Reasonable average monthly living expenses total up to SGD 2,500. This is inclusive of rental, meals and flight tickets back to Kuala Lumpur monthly.

The balance of SGD 1,400 can either be invested or saved up for vacation. That is the equivalent of MYR 4,760 using a conversion rate of 3.4.

As for life in Kuala Lumpur, you might need to fork out MYR 5,000 a month for all living expenses. That nets you MYR 2,665 in savings.

Savings %

If you are earning SGD 5,070 a month, you could end up saving 28% of your salary after netting off taxes, pension fund contributions, and living expenses.

On the other hand, earning MYR 9,695 would yield you a savings rate of 27%. You would be able to save up to MYR 2,665 monthly.

The rate of savings might be similar, but the absolute amount saved is close to 44% more than what a Malaysian can save.

This is assuming a typical monthly expenditure in Kuala Lumpur as a ballpark figure.

Will you have the same net savings if you secure a job with the same converted pay in Malaysia?

Let’s tweak the scenarios a bit. Assuming a median income earner secures a job back in Malaysia with the same pay SGD 5,070 (MYR 17,238) per month.

After 11% of EPF contribution, he or she will be left with MYR 15,341.82. Annualize and we get MYR 184,101.84

He or she would fall under group G, with a total annual income tax of MYR 30,884.44. That would be a hefty 15% of their total gross salary.

Adding on the 11% of EPF contribution, almost 26% or a third of their spending power is gone.

Assuming no lifestyle creep and the same inflation rates, going back to Malaysia with the same pay as you get in Singapore does seem doable.

But do take note of some points. Going back to Malaysia would mean that buying a house is inevitable. Compared to staying in Singapore where the only affordable option is to continue renting.

If you do buy a house in Singapore, you can still service the monthly installments via your CPF OA account.

Not so straightforward, but yet a bit of a disadvantage of going back to Malaysia with the same salary as you are getting in Singapore.

Money ending up as tax or pension fund contribution is different

Malaysia is notorious for its relatively high-income tax bracket, while Singapore’s CPF might also garner the same.

But tax is something paid out as an expense. EPF and CPF are still parked under assets, which is also part of our net worth.

How viable it is to go back and enjoy relatively cheaper housing and living expenses while potentially sacrificing a nearly solid retirement plan via CPF?

There is no right and wrong in what tax bracket and how much to contribute to the pension fund.

But it makes Malaysians working in Singapore nearly impossible to go back to Malaysia in their prime years.

MyKayaPlus Verdict

I always knew that a take-home paycheck is just a means of surviving and to finance my retirement. But it’s more than that.

Idle savings should be put to work so that they are given a long time frame to generate returns that are above average.

How fast you are on track to achieve it, lies on how aggressive one is.

The thing is, the same individual would be achieving it much faster in Singapore, in comparison to Malaysia.

Maybe quality retirement and the speed of attaining are not everything?

Food for thought

Do you realised you took a national tabulation for household income, but took the monthly living expense of just Kuala Lumpur? This might not be a good apple to apple comparison.

True. But since we are comparing it with Singapore, taking any place apart from KL would also be not an apple-to-apple comparison?

If someone opts to leave Singapore to go back to a smaller town in Malaysia with lower living standards, then yes the math might work favorably

Your discussion of tax is wrong… The chargeable income is less CPF and epf, not the total income….

Thanks for the reminder. We will rework the calculations.