Bad News! You need luck to be successful in investing.

I chanced across this study a few weeks back when it was mentioned by a well-known Mandarin-speaking YouTuber Lao Gao.

This particular YouTube centers around how most of us understate the role of luck in success.

Tip: If you are well-versed in Mandarin, you can head over to the video here.

Alternatively, you can head on to this video in English by Veritasium but this was prior to the paper being published, which will center around the discussion of this article.

It got me thinking (and a bit depressed) about life as I slowly digest and thought about it for the next few days.

I do think I feel better now. But knowing and accepting luck would play an important role in my life, especially in retirement, spooks me a bit.

All these years, I was quite confident in managing life post-retirement. But now, I am skeptical since I might need lady luck.

The Background

Sometimes, there just isn’t any logical way to explain how great things happen to other people rather than ourselves.

Why are most of the founders of listed tech companies, who are worth billions, University dropouts, while those who diligently finished their degrees end up in the workforce?

What are the real factors, that determine your wealth accumulation or creation?

Is it down to IQ or academic capability?

If so, why are not the Nobel prize winners the richest in the world?

This article will center around the paper, titled “Talent Versus Luck: The Role Of Randomness

In Success And Failure“, published by Alessandro Pluchino, Alessio Emanuele Biondo & Andrea Rapisarda.

This study has empirically proven that luck plays a more vital role than talent in wealth accumulation. It has also gone on to win the Ig Nobel Prize 2022.

But to truly understand why the need for the study, let’s revisit 2 laws in statistics.

The conflicting 2 laws that govern and quantify us

While I know many would have forgotten these two important laws in statistics, here is a refresher.

One of them is the Gaussian law of normal distribution. The normal distribution is a statistical distribution that is widely used to describe real-world phenomena. It is a continuous probability distribution that is symmetric around its mean (average) and has a bell-shaped curve.

A lot of aspects and traits of humans, particularly by nature are governed by the Gaussian law of normal distribution.

Height, weight, and IQ, all adhere to the normal distribution curve.

In the past, we use to characterize the rich as smart as well.

We might want to rethink this notion. Are the world’s richest, really the smartest? Is investing knowledge and aptitude, the only aspect to guarantee your investments and retirement funds?

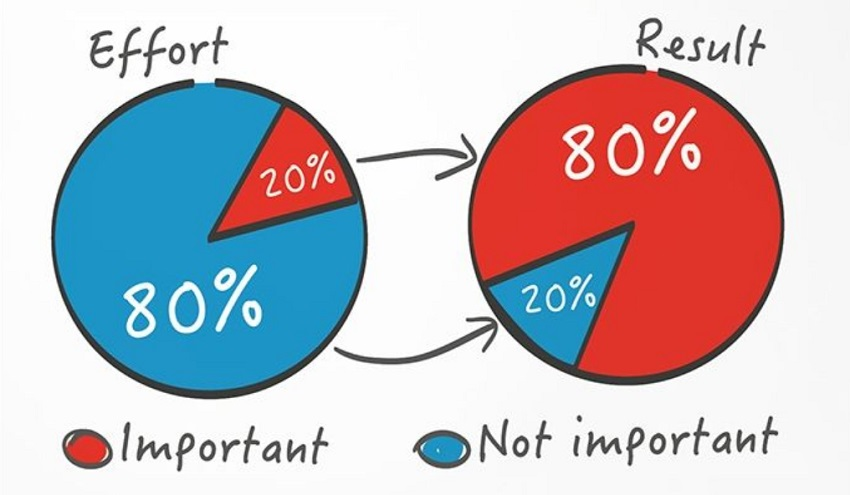

Because, when it comes to wealth or anything where it is a “winner-takes-it-all”, there is a second law – the Pareto Principle, more commonly known as the 80-20 rule.

Originally observed by Italian economist Vilfredo Pareto, 80% of the land in Italy was owned by 20% of the population. The same phenomenon occurs throughout many places outside of Italy.

Also applicable to other aspects are client focus and problem-solving. If you are sales, you are mostly going to divert your time to the top 20% of customers. Because most likely they are the ones who are contributing 80% of the total sales.

Likewise, solving the top 20% of the most pressing problems will eliminate 80% of hiccups as well.

The Gaussian law and Pareto Principle have governed and quantified a lot of aspects of our lives, but why is not wealth, a normal distribution, if it all boils down to talents and IQ?

Why is wealth, following the 80-20 rule, even though the IQ of the human population is conforming to the Gaussian normal distribution?

Talent versus Luck experiment

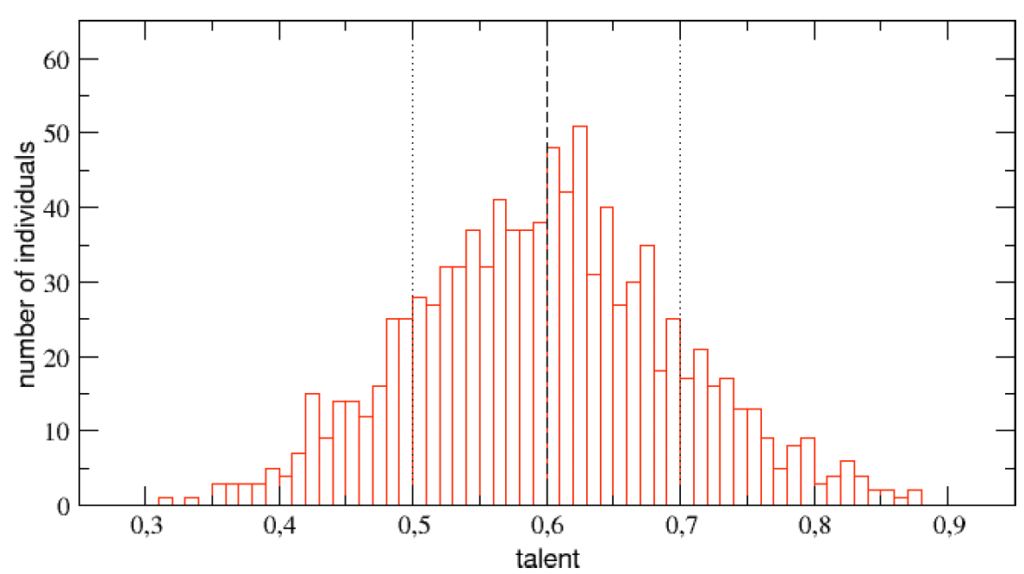

The model experiment suggested in the paper is intriguing yet straightforward. 1,000 people are randomly placed in a square box as below. Each and everyone is assigned a talent that conforms to the normal distribution curve. Each and every individual will start off with 10 units of wealth.

The end goal is to simulate whether talent plays a crucial role in compounding wealth in a 40-year timeframe simulation, which is of course sped up.

On top of that, there will be random moving green dots and red dots simulation within the square as well.

Green dots will represent chances and opportunities for an individual to double up his wealth. The probability and chances for wealth doubling to occur are tied to the talent level.

Whenever a random green dot touches an individual, the individual has the opportunity to double his wealth, based on his or her talent level.

The higher the talent level of that individual, the more likely he or she will double their wealth.

Conversely, if a red dot, which represents an accident or calamity event, touches an individual, his or her wealth will decimate by 50%. Accidents and calamities represent bad events that happen in our lives, that in most circumstances, cannot be mitigated by high intelligence.

The precise description of the experiment is in the details of the paper. This is only the simplified version in case you think its TL;DR.

The results

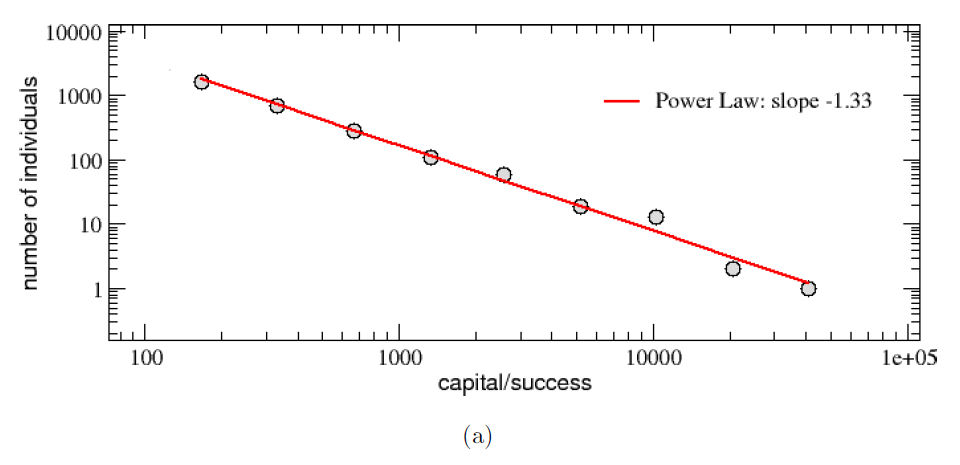

Just like the actual world we live in, after running the experiment in a single run and also multiple runs, capital and wealth compounding results in a power law slope. Wealth is not a normal distribution curve but turns out to be close to Pareto’s Principle.

The rich become richer.

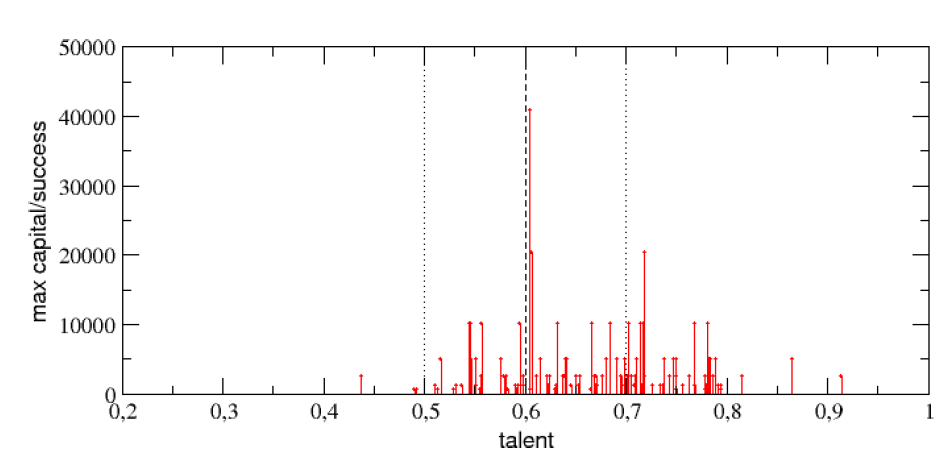

Perhaps the most shocking part, is that after so many iterations and multiple runs, the probability of a high-IQ individual ending up being the richest out of the 1,000 is strikingly low.

People with a medium-high talent result are, on average, not only more successful than people with low or medium-low talent but also more successful than individuals which are highly talented. A highly talented individual, would not be able to double their net worth, should there be no opportunity or event for them to do so.

Imagine an individual being blessed with a high IQ, but being born in a war-torn country. Chances are that person would not live to see himself becoming one of the richest in the world.

To summarize, in spite of the experiment’s simplicity, the Talent Vs Luck model seems to be able to account for many of the features characterizing and explaining the largely unequal distribution of wealth and success in our society.

The IQ levels of human beings might be a bell-shaped curve, but that does not mean wealth and success obeys the Gaussian law as well.

Tying back the experiment and study to investing

This is where I got anxious. I put a lot of work and effort into stock analysis, crafting content while trying to up my investing mastery. Only to be told that luck will still play a big part in my future returns. It can be unsettling and even incite fear.

Of course, over the years, I have come across plenty of investors and KOLs who had made it big by going into Tesla stocks, and crypto in the nascent days. These people not only do not look or act like Warren Buffett, Charlie Munger, or even Ray Dalio but are often loud speaking and flamboyant.

Yes. It is easy to say that all it took was insights to spot a potential 4-digit bagger back then. But on the other side of every coin, there are also those who got burned.

FTX, Luna, and even meme stocks like AMC. and recently BBBY are failure stories that did not get amplified.

Many, if not all, have understated how luck played a part in generating that one-off huge amount of returns. But when it comes to explaining losses, it’s easy to blame it all on bad luck.

But what about the other class of investors who chose the proper value investing route? The slow and steady way to compound wealth over the long run?

Even with the time and effort sacrificed, do we still need a sheer touch of lady luck to retire comfortably?

Do not forget the talent portion of the experiment

Most parts of the experiment highlight how even the most talented one can succumb in due to lack of luck.

It also thoroughly explains how someone, who might be much more financially illiterate, can score big wins in stocks and crypto punting.

It’s down to luck.

In an alternate reality, he or she could be burned badly. But in this reality, he or she gets to goad and boast.

But that does not mean that we should all sit and wait for money to come pouring down from the sky. It is also not for you to put all your savings into something high-risk.

Nor should you chuck all your savings into fixed deposits and hope for a jackpot for your retirement.

You still need to put in the effort and hard work.

To put it simply, you still need to buy a ticket for a shot at a jackpot.

No matter how lucky or unlucky you are.

You still need to put in hard-earned money and savings into good quality stocks and hope for some bit of luck for it to go up. You can do higher-risk stuff, but you will eventually need more luck.

Even if our decisions turn out to be right, the share price does appreciate. Apart from methodology, patience, and all other intrinsic factors, there is still the element of luck.

How has it changed my perspective?

I am still a firm believer in talent, input, and effort. But after digesting and accepting that luck plays an important role in everyone’s life, it gave me two points to ponder.

Firstly, it creates more uncertainty in how I view my future and build my retirement funds. I can make decisions, and tweak my portfolio along the way. But luck can either amplify and accelerate my returns, but also decimate it as well. And when I overthink it, I do get a bit depressed.

On the other hand, it helps rationalize high-risk high-return kind of investments. Not to the extent of “go big or go home”, but it does encourage me to go to realms where my understanding is still lacking.

This includes not only high-risk investments like crypto but also thinking out of the box, i.e. entrepreneurship.

I wonder what you think about it? Does it provides you with more comfort knowing that luck can play a significant role in your investment returns, or are you terrified by it?

I guess deep down we all know that luck is a hidden yet important element. After doing all the due diligence and analysis, only we put in our money to buy a stock. We are betting that the prices of the stock will go up.

But the fact that we are not too sure WHEN the prices will finally move up, shows that this is the element of luck we might have oversight?

Food for thought!

DISCLAIMER

The information available in this article/report/analysis is for sharing and education purposes only. This is neither a recommendation to purchase or sell any of the shares, securities, or other instruments mentioned; nor can it be treated as professional advice to buy, sell or take a position in any shares, securities, or other instruments. If you need specific investment advice, please consult the relevant professional investment advice and/or for study or research only.

No warranty is made with respect to the accuracy, adequacy, reliability, suitability, applicability, or completeness of the information contained. The author disclaims any reward or responsibility for any gains or losses arising from the direct and indirect use & application of any contents of the article/report/written material