Mapletree Commercial Trust & North Asia Commercial Trust Merger Vote Guide

Mapletree Commercial Trust (SGX: N2IU) and Mapletree North Asia Commercial Trust (SGX: RW0U) are the latest S-REITs undergoing merging. Unitholders of Mapletree Commercial Trust (MCT) would have received their proxy form and relevant documents.

If you are still unclear about the overall merging of both REITs and how to vote, here is a comprehensive guide. Due to the excessive yet concise amount of information, this article and guide will be numbered subtitles. Kindly proceed to the relevant numbered subtitles depending if you are an MCT holder, MNACT holder or both.

1. What is Happening?

MCT and MNACT, 2 sister S-REITs, are merging together to form Mapletree Pan Asia Commercial (MPACT)

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 2

The merger involves merging MNACT into MCT. MNACT unitholders will have scheme options to choose from in this merger (Refer to subtitles 2, 3, and 4 for detailed explanations). Only MCT unitholders can only vote “FOR” or “AGAINST” the merger (Refer to subtitle 7 for a detailed explanation). To understand the risk and rewards of the merger, kindly refer to subtitles 5 & 6 for detailed explanations prior to jumping straight to subtitle 7)

2. Mapletree North Asia Commercial Trust Unitholder Options – What Can You Do?

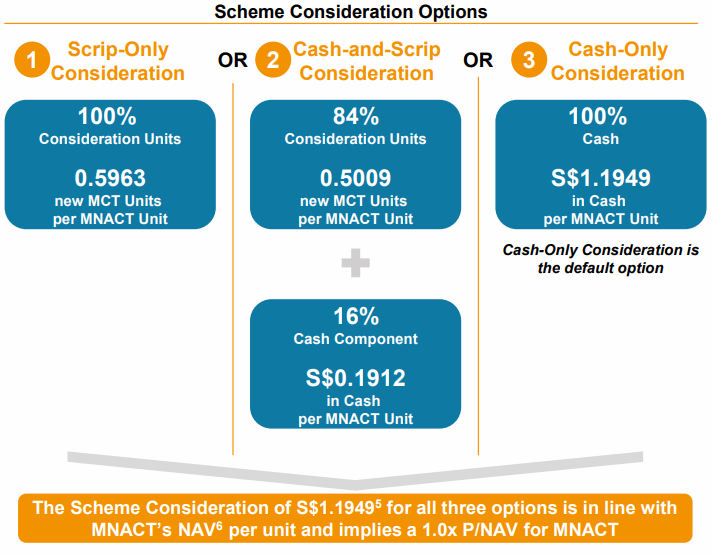

Should MCT holders eventually vote for the merger to proceed, what will MNACT unitholders need to do? One, MNACT holders cannot resist the merger. But, MNACT unitholders can choose their scheme options if the merger gets voted through. MNACT unitholders can choose one of the 3 scheme options below:

- Receive a 100% Scrip-Only consideration of your MNACT units to be converted to MCT units. 1 MNACT unit = 0.5963 MCT unit.

- Receive a Cash-and-Scrip consideration of your MNACT units. 84% of MNACT will be converted into MCT on the basis of 1 MNACT unit = 0.5009 MCT units. The balance of 16% will be a cash component of S$0.1912 per MNACT unit.

- Cash-only consideration. Receive S$1.1949 for every MNACT unit you are holding. This is the default option if you choose to do nothing.

3. Mapletree North Asia Commercial Trust Unitholder Options – What Should You Do?

The decision-making process for MNACT unitholders is straightforward. Here are some basis and questions that you should answer prior to making any decision.

- Do you believe in the synergy of the merger of MCT & MNACT?

- Do you think that the valuation and conversion of MNACT units to MCT units is fair?

- Are you in it for the long term and you are confident in the long term prospects of MPACT?

If you answer “Yes” to all 3 questions, chances are you would vote for Option 1 – Scrip-Only consideration. You are happy to continue becoming a unitholder of the merged entity, and the offer on the table is right for you.

If you answer “Yes” to questions 1 & 3 or are unsure of question 2, you can either ask for more opinions or opt for Option 2 – Cash-and-Scrip. Valuation is subjective to everyone. Hence having the option to choose from a mix of cash-and-scrip provides the best of both worlds.

If you answer “No” to all questions, then you can just opt for Option 3 – Cash only. This option provides you with the exit route to take 100% cash for your entire holdings in MNACT at a price of S$1.1949 per unit.

4. Mapletree North Asia Commercial Trust Valuation – Fair Or Not?

Is the valuation fair? There is initial news of Quartz Capital Management writing in to express their dissatisfaction with the offer price of MNACT. But do know at the end of the day, MNACT has always been trading at a steep discount regardless of the bullish points highlighted. Valuation is not just pure maths but takes other risk factors into play. The best-case valuation highlighted in FY 2019 before the geopolitical crisis in Hong Kong affecting Festive Walk does not give MNACT holders the self-entitlement for a premium valuation. When the market digests the additional risks attributed to MNACT, it not only drives down MNACT’s valuation, but also MCT’s valuation. The merged entity of MPACT will take over the prospects and risks of MNACT. Thus, MCT holders too should not complain about the relatively lower valuation offered to MNACT holders for the conversion.

Eventually, the revised cash-only option of $1.1949 is subsequently accepted by Quartz Capital Management. They have since retracted their letter to MAS and will vote “YES” for the merger.

5. Mapletree Commercial Trust – Understanding the MNACT Merger Benefits

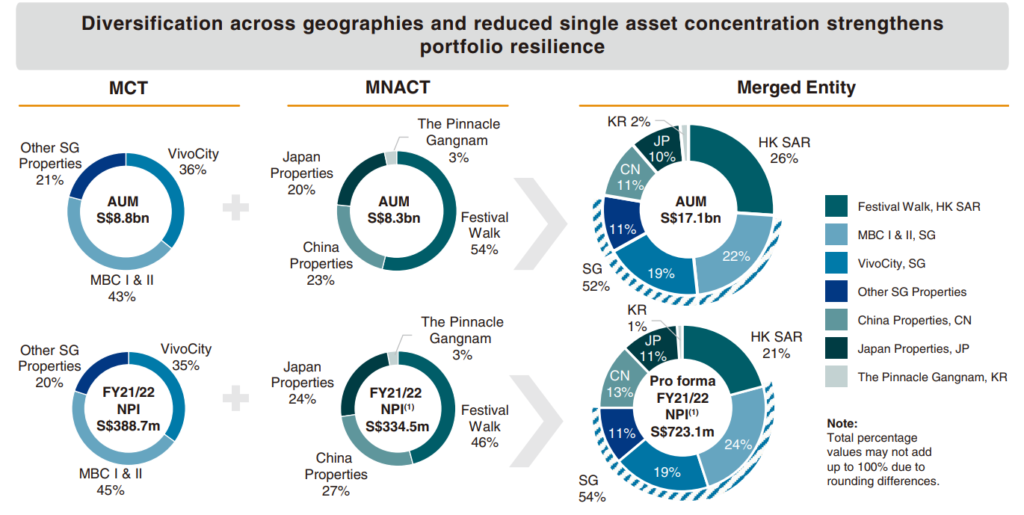

Now let’s shift the focus to MCT holders. MCT is one of the top-performing S-REITs since its IPO that has successfully raised both NAV and DPU per unit. The latest merger could be a boon or bane. Their current existing investment portfolio is 100% Singapore properties. But post-merger, their geographical footprint will include Korea, Japan, Hong Kong and China.

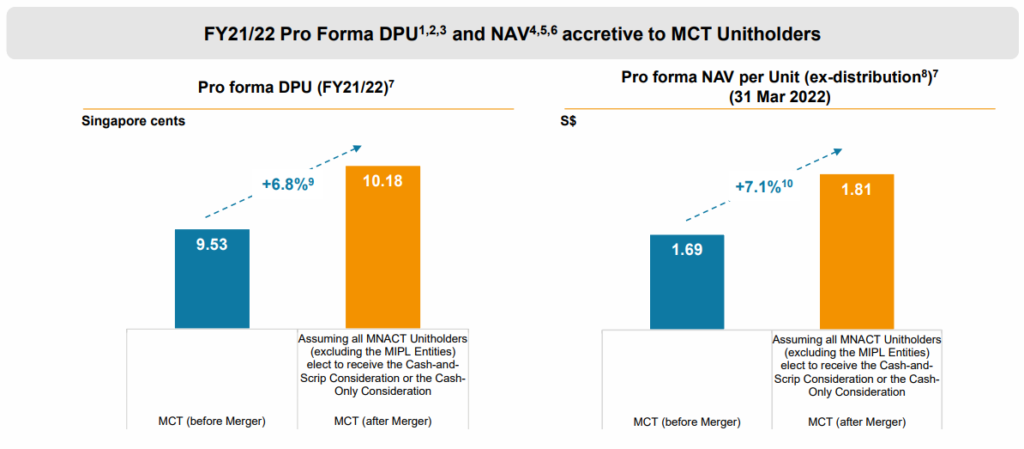

The benefits of the merger? Accretive Distribution Per Unit (DPU) and Net Asset Value (NAV) per unit. Based on the pro forma simulation, assuming the maximum option scheme uptake and potential dilution of outstanding shares, MCT holders still stand to achieve an accretive DPU and NAV per unit.

This means that every unit of MCT you hold would generate a DPU increase of +6.8% before the merger. The NAV per unit would also increase by +7.1%.

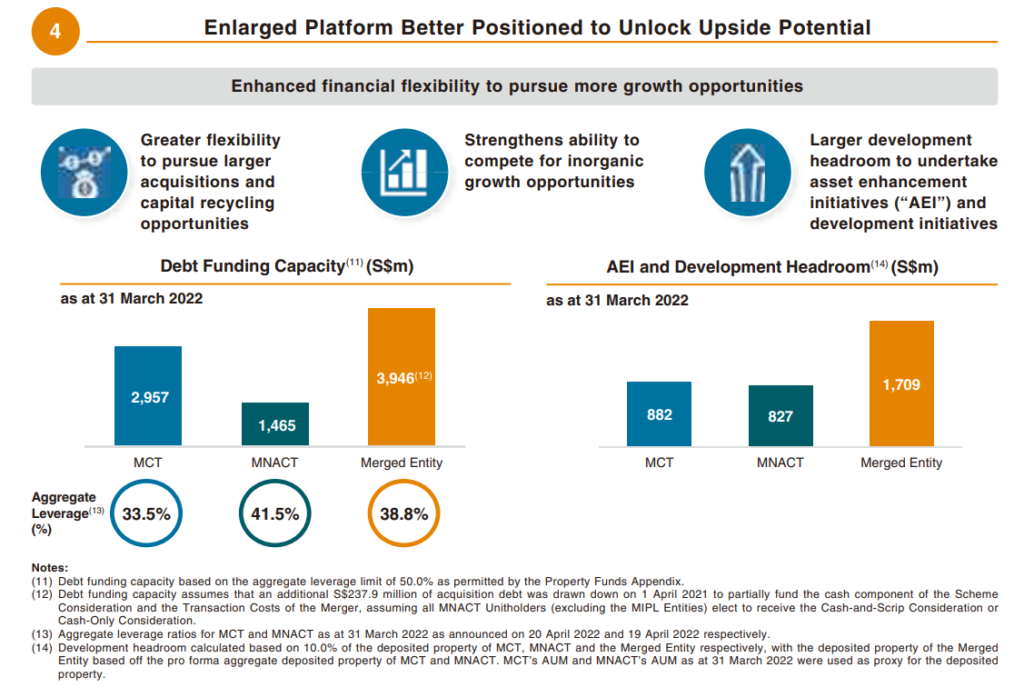

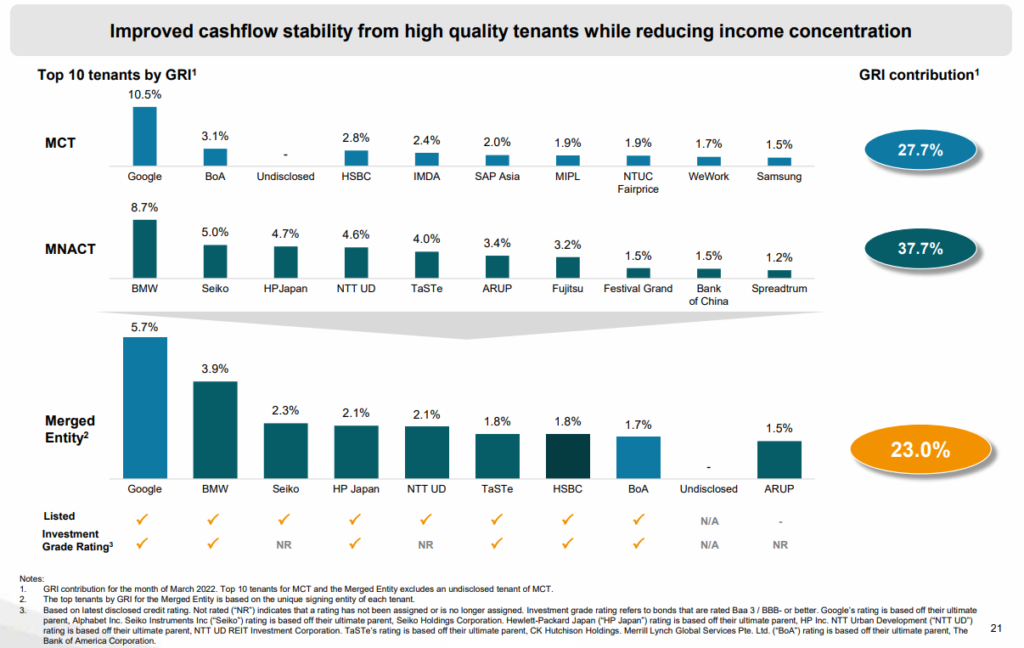

Other key upsides of the merger include a lower tenant concentration for both entities by gross rental income (GRI) and also larger debt headroom plus the geographical footprint expansion.

The acquisition fee will also be waived.

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 9

6. Mapletree Commercial Trust – Understanding the MNACT Merger Risks

Now for the downsides. Even though on paper everything looks convincing and the maths looks enticing, do note that there are risks that come with merging with MNACT.

The elephant in the room for MNACT is Festive Walk and the Hong Kong exposure. MNACT saw its prices gap down when its crown jewel – Festive Walk arson during the 2019-2020 Hong Kong protests.

MNACT is not the only REIT that suffered the aftermath. Another HK-centric REIT – Link REIT (HKEX: 0823), also faced the wrath of the market selldown as early as July’19 when the protest started.

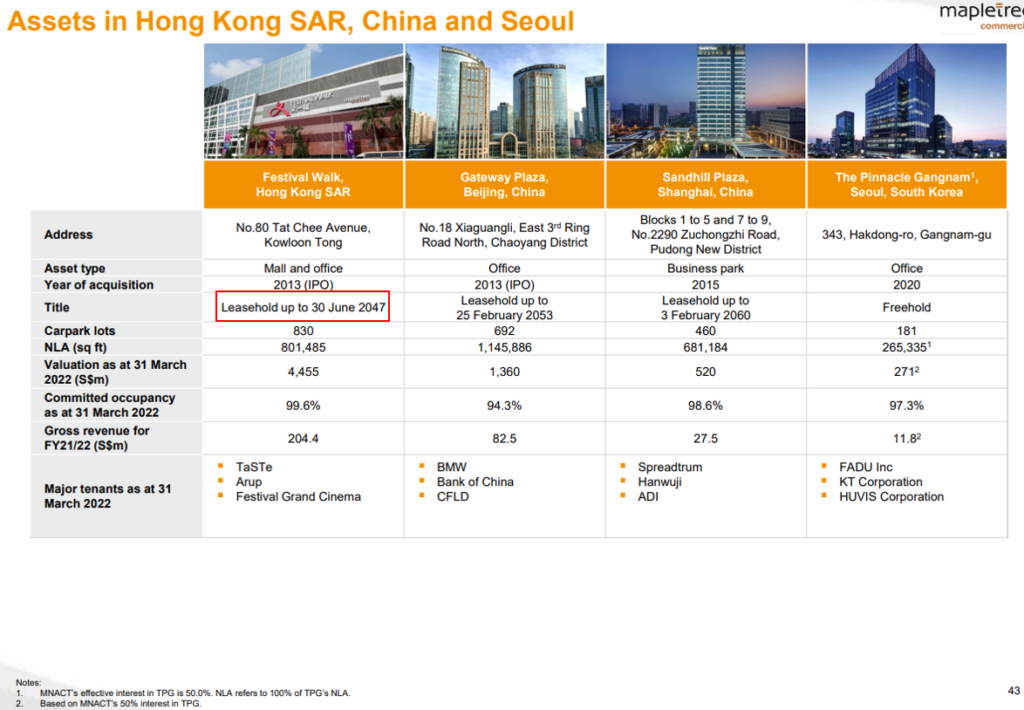

Post-merger, Festive Walk will contribute 26% of MPACT’s total AUM and 21% of the pro forma net property income (NPI). The exposure and risk of Hong Kong property will be inherent to MPACT should the merger goes through.

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 7

Another important point would be the relatively short remaining leasehold of Festive Walk. Festive Walk’s lease will expire by 30 Jun 2047, which is just 25 years from now, 2022.

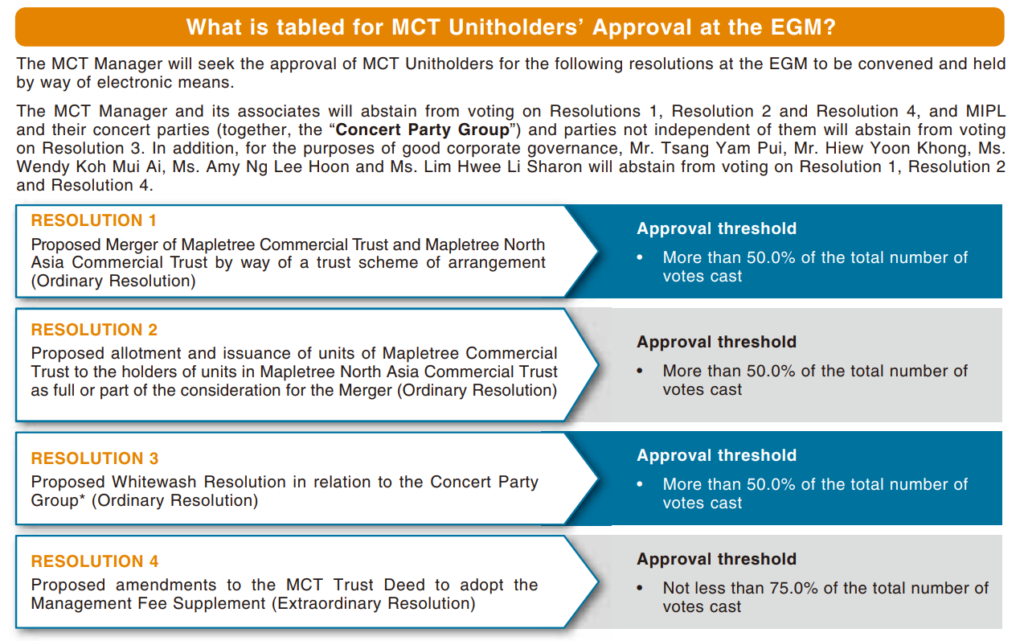

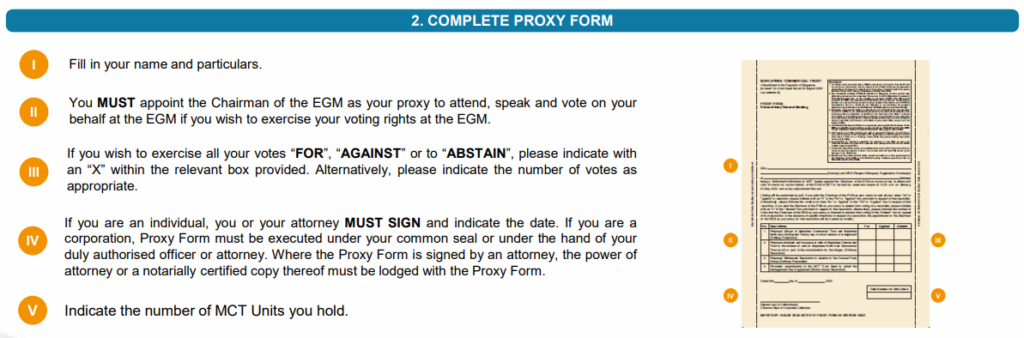

7. The 4 Resolutions and the Proxy Form

Whether the merger of MCT and MPACT will proceed or not lies in the power of MCT holders. Non-independent unitholders, including MCT manager and its associates, will abstain from voting on the resolutions.

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 13

Independent and retail MCT holders will be required to cast their votes to approve or reject the merger

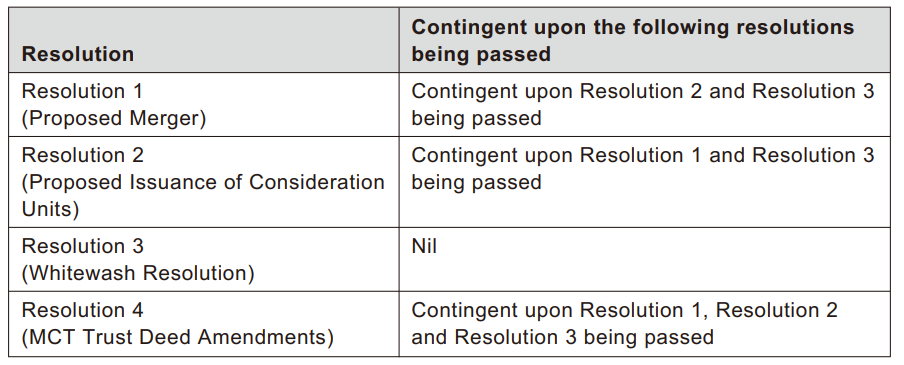

A simplified layman’s version of the Resolutions is as follows:

- Resolution 1: Do you agree to the merger of MCT and MNACT? If yes, vote “FOR”. If no, vote “AGAINST”

- Resolution 2: Do you agree to then, issue units of MCT to holders of MNACT since MNACT holders will be giving up their MNACT units and receive MCT units under the Scrip option or the Scrip+Cash option? (Refer back to Subtitle 2). If yes, vote “FOR”. If no, vote “AGAINST”

- Resolution 3: Whitewash Resolution. Do you agree to waive your rights to receive a mandatory general takeover offer from Mapletree Investment Private Limited (MIPL, also one of the Concert Party Group)? If Yes, vote “FOR”. If no, vote “AGAINST” (Refer to subtitle 8 for a detailed explanation)

- Resolution 4: Do you agree to change the Management Fee Structure? If Yes, Vote “FOR”. If no, vote “AGAINST” (Refer to subtitle 9 for a detailed explanation)

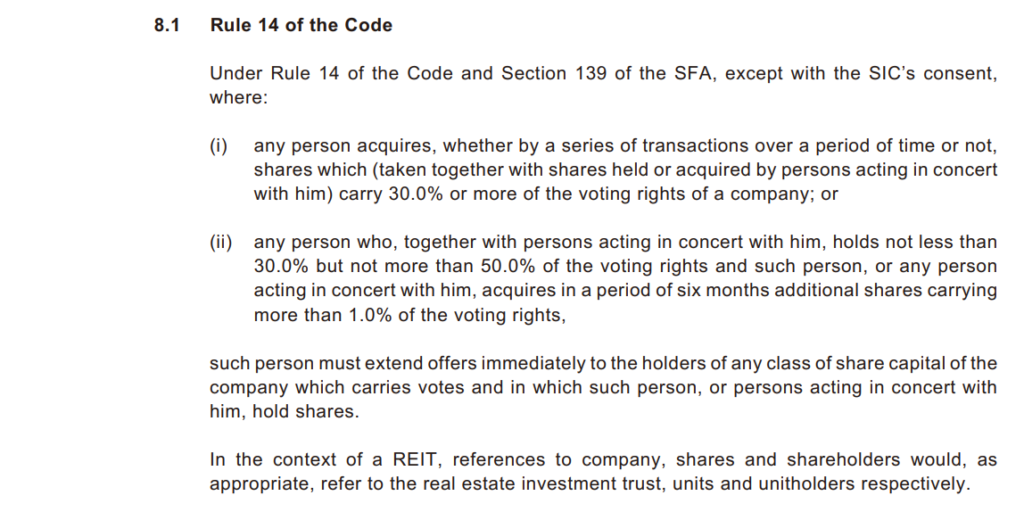

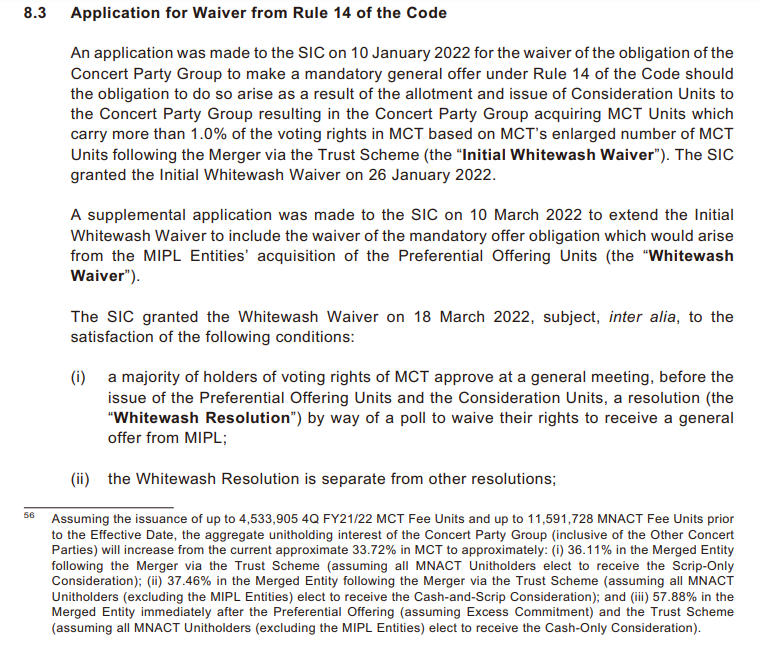

8. Understanding the Whitewash Resolution – Resolution 3

The Whitewash Resolution is the most important prerequisite for the merger to proceed. As shared in the circular, the merger of MCT and MNACT needs Resolution 3 to be voted “FOR” at least more than 50% of the total number of votes cast.

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 26

The whitewashing resolution is due to Rule 14 of the Code and Section 139 of the SFA. Under Rule 14, any person, together with other parties acting in concert with him, who holds at least 30% or more voting rights of a company, must extend a mandatory takeover offer. This usually would end with a company or REIT being privatised and being delisted. (Note: To read more on this, kindly head over here)

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 72

Hence, to fund the merger of MNACT, the sponsors of MCT will fork out the required capital in exchange for more shares of MCT. But the increased holding percentage of MCT units would trigger Rule of 14, which results in a general takeover offer, which both the sponsors and unitholders do not want.

Hence, to circumvent this, an application for a waiver from Rule 14 of the Code comes to play. Unitholders of MCT would need to approve this (Resolution 3) during the EGM. The capital to acquire MNACT by issuing more units to MCT sponsors will not trigger a general takeover since the rights are waived with the approval of Resolution 3.

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 75

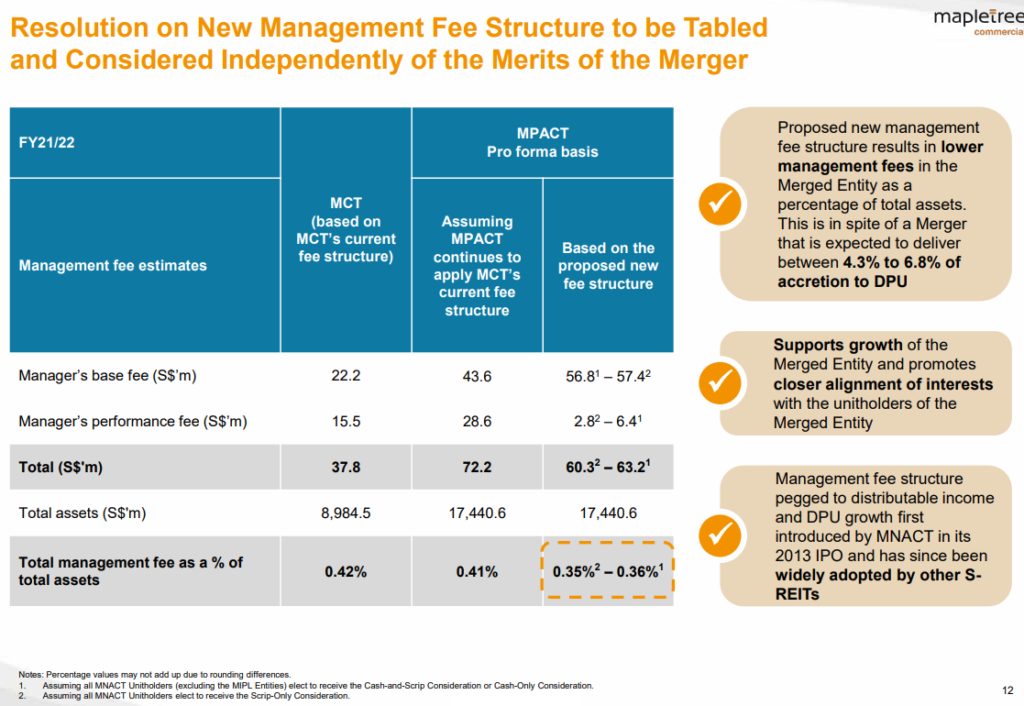

9. Potential Change In Management Fee Structure – Resolution 4

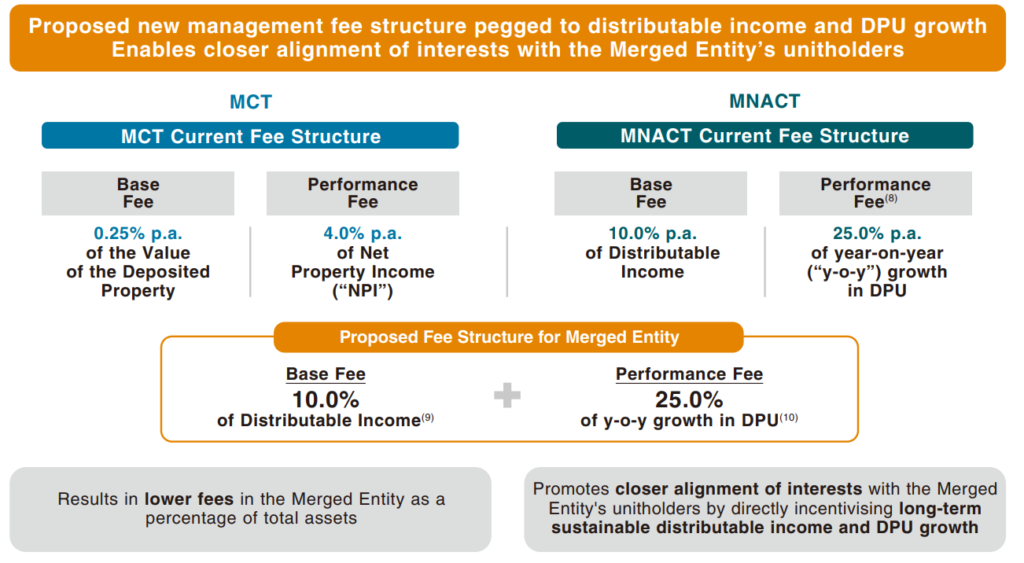

Another key win for the merger is the revision of the MCT trust deed. Currently, MCT’s fee structure comprises a base fee of 0.25% p.a. of the total deposited property value plus a 4.0% performance fee of MCT’s net property income (NPI). In this current fee structure, the management stands to take 4% of the NPI regardless of the per-unit performance. Should new property acquisitions dilute the outstanding available units, DPU and NAV per unit, the management would still be entitled to the NPI growth post-acquisition.

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 4

With the proposal of the new fee structure, the management of MCT’s KPI will skew towards the distributable income portion. Their performance fee will be based on the 25% year-on-year growth in DPU. Hence, any future acquisition and growth must be DPU accretive for MPACT managers to enjoy their performance fee.

In essence, their skin in the game and interest is aligned with the unitholders of MPACT.

Below is a simulation comparing both MCT’s current fee structure versus the revised fee structure. All in all, the management fee in % for the new fee structure ranges between 0.35%-0.36%, compared to 0.41%. Thus, this is a fraction lesser but still favourable to MCT holders.

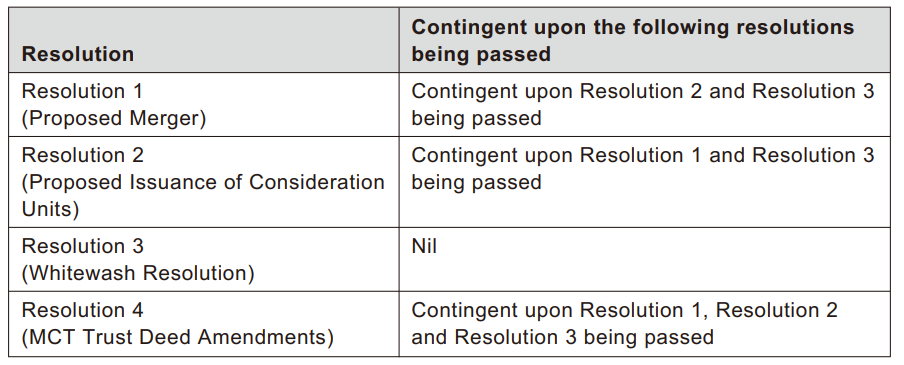

10. Voting On The Proxy Form Resolution & The Outcomes

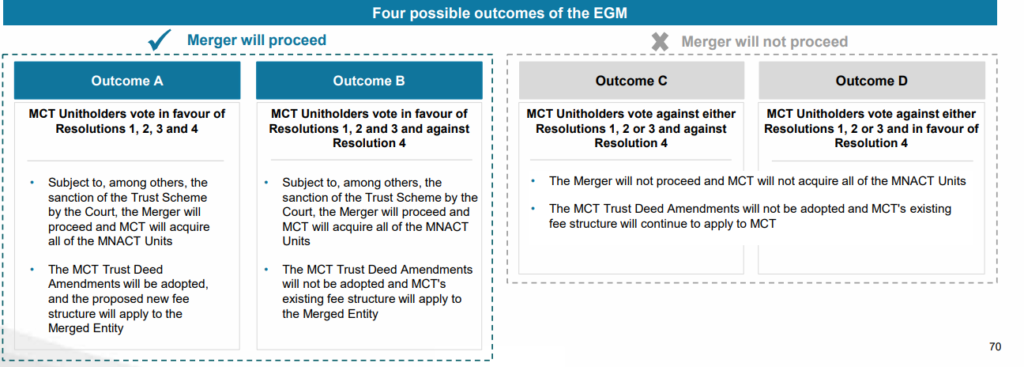

There will only be 4 possible outcomes after the votes are cast.

Outcome A: The merger of MCT + MNACT to form MPACT proceeds with the revised and favourable fee structure. You would need to vote “FOR” for Resolutions 1,2,3 and 4

Outcome B: The merger of MCT +MNACT to form MPACT proceeds, but the current MCT fee structure remains. You would need to vote “FOR” for Resolution 1,2,3 and “AGAINST” for Resolution 4.

Outcome C: The merger of MCT + MNACT to form MPACT does not proceed and the current MCT fee structure remains. You would need to vote “AGAINST” for Resolutions 1,2,3 and 4. Even if you vote “FOR” for Resolution 4, the new fee structure will not come into play as it is contingent upon Resolution 1,2 and 3.

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 26

So to simplify things, if you:

- Want the merger to proceed with favourable terms, just vote “FOR” for Resolutions 1,2,3 & 4

- Do not want the merger to proceed, just vote “AGAINST” for Resolutions 1,2,3. You should still vote “FOR” for resolution 4

Any other vote combinations will likely result in the merger not happening since the merger is contingent on all 4 resolutions to be voted “FOR”. But, if you do not want the merger to proceed, but still prefer the favorable fee structure, you should vote “FOR” resolution 4.

Resolution 4 will pass in the event of a merger proceeding, and will act as a consolation prize for those who are against the merger. At least a favorable fee structure will come into play.

MyKayaPlus Verdict

The information made available for the merger of MCT and MNACT might seem complicated and long-winded at first glance. But at the end of the day, much preparation and simulation are done to ensure that unitholders are made aware of the benefits and risks attributed to the merging of both REITs.

The ultimate goal of investing is to generate sustainable and growing returns. However, throughout the journey, we will be required to make sound decisions whenever corporate exercises or major events surface.

By weighing and looking into everything holistically, only then we can make sound decisions. These decisions, although one-off, would have huge implications in making or breaking our future investment returns.

If this guide has benefited you, we seek your kind gesture by sharing it on your social media, and chat groups in an effort to educate existing MCT, and MNACT holders. It too, can also serve as learnings for other investors as well.

We sincerely hope that this guide will help you make the right decision pertaining to the merger of MCT and MNACT. Exercise your right as a unitholder responsibly!

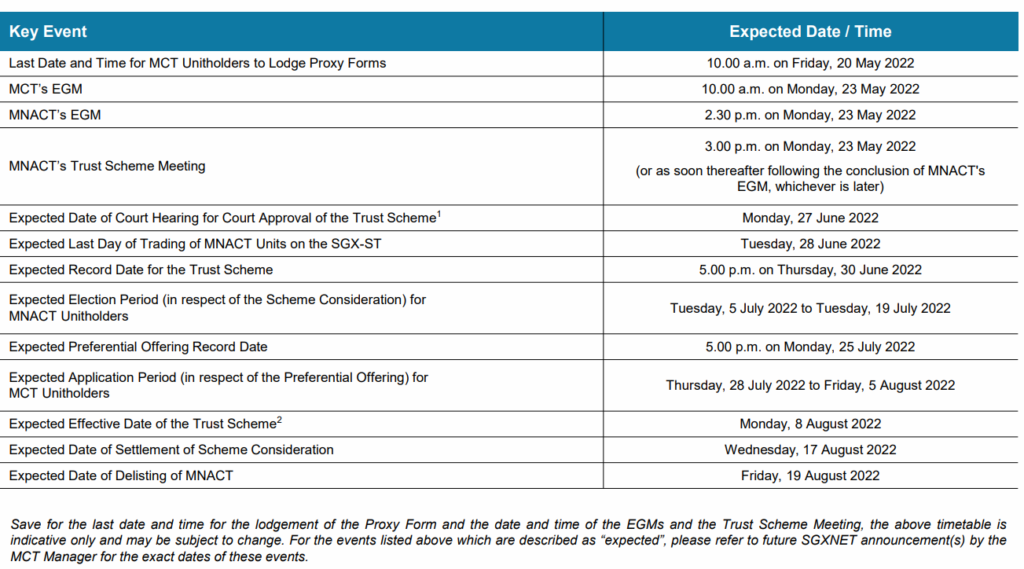

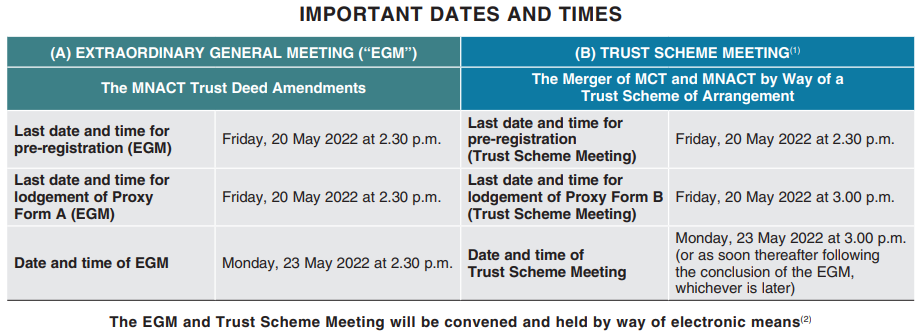

Below are the important dates that you would want to take note of should you intend to cast your votes to meet the dateline.

1 thought on “Mapletree Commercial Trust & North Asia Commercial Trust Merger Vote Guide”