IGB Commercial REIT IPO – 8 Things You Need To Know

IGB Commercial REIT will be the latest office REIT to IPO on the Malaysia stock exchange. It will join its sister REIT, IGB REIT to be listed in a market that seems to be REIT-shy.

Commercial REITs are REITs that usually invest in office buildings. REITs that focus more on malls are usually the retail REITs. Since IGB REIT is already a pure retail REIT, the future pipeline of growth of both REITs will be distinct. IGB REIT will focus on retail properties, while IGB Commercial REIT will be on office buildings.

Here are things that you need to know about IGB Commercial REIT before even considering subscribing to the IPO or even buy it on the open market.

1. There will be a total of 10 investment properties

REIT is all about property investing but more capital friendly. So it is crucial to understand what properties a REIT will be holding.

IGB Commercial REIT will be holding a total of 10 office buildings when it goes on IPO. 7 of these properties will be in Mid Valley City, while another 3 will be in Kuala Lumpur.

2. IGB Commercial REIT will be sharing the same REIT manager and sponsor as IGB REIT

A REIT manager plays a vital role in ensuring the growth of a REIT in favour of the unitholders. Since REIT investing is a relatively passive way to embark on a property investing journey, REIT managers have the responsibility to manage the REIT.

Thankfully, the same REIT manager of IGB REIT will also be managing IGB Commercial REIT. And due to the stellar performances of IGB REIT, many are banking this as a catalyst for IGB Commercial REIT’s potential.

Similarly, IGB Berhad will be the sponsor for IGB Commercial REIT. Having IGB Berhad as a sponsor means having an access to a number of potential properties that the commercial REIT has a First Right of Refusal. That gives an indication of the REIT’s prospect in the coming years.

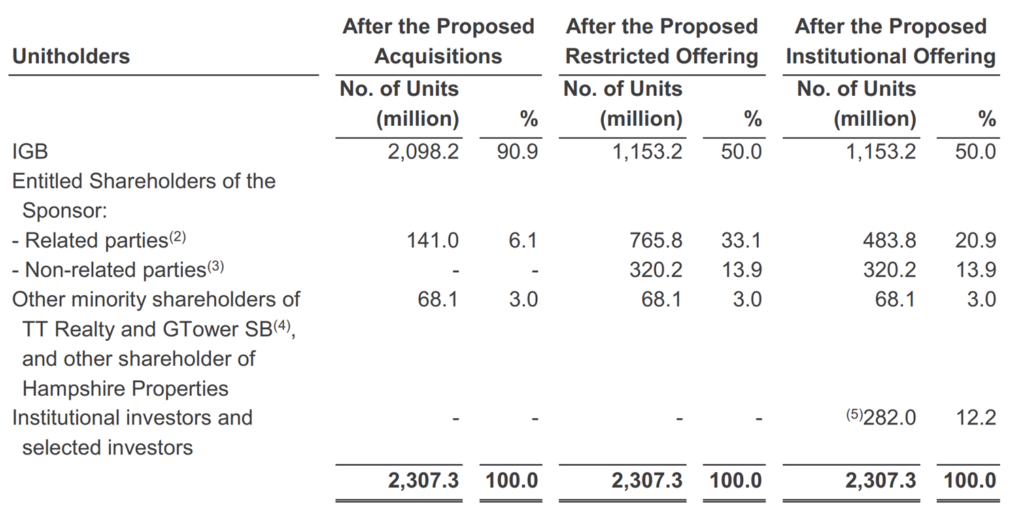

Even post listing, IGB Berhad will still remain as the biggest shareholder, with a holding stake of 50% of the commercial REIT.

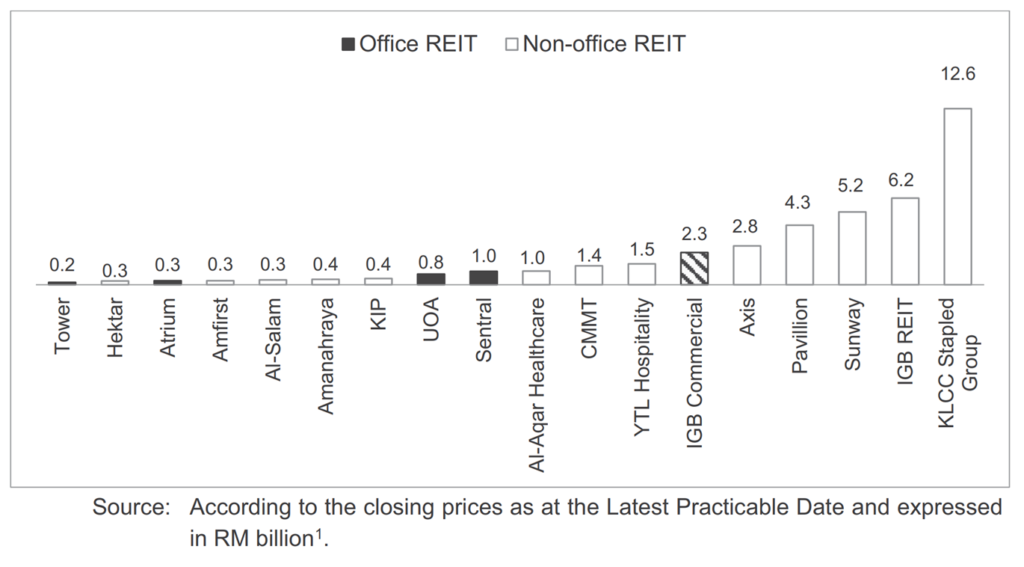

3. It will be Malaysia’s largest standalone office REIT by market cap

Upon its successful listing, IGB Commercial REIT will be Malaysia’s largest standalone office REIT by market capitalization.

Even though KLCC Stapled Group has a higher market capitalization, however, due to its stapled structure, it is not considered a standalone office REIT. The other REITs larger than IGB Commercial REIT will be the retail REITs and AXIS REIT.

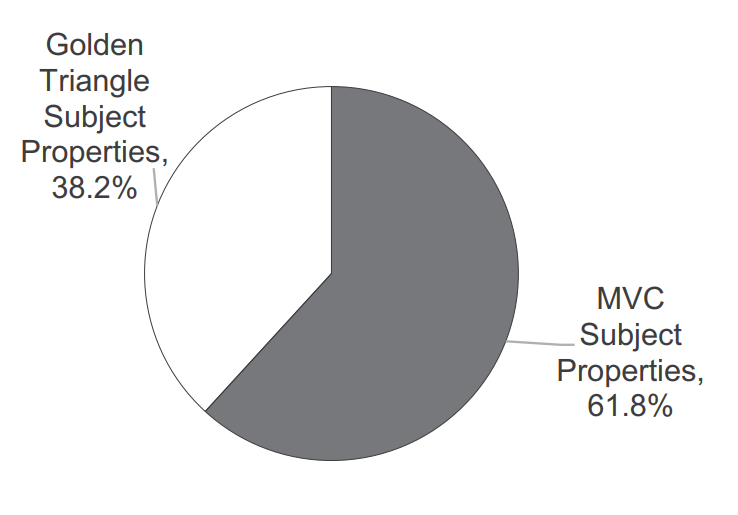

IGB Commercial REIT will derive a major of its value from the 7 properties in Mid Valley City. which is around 62%. The remaining 38% will be the 3 properties situated in the Golden Triangle of Kuala Lumpur.

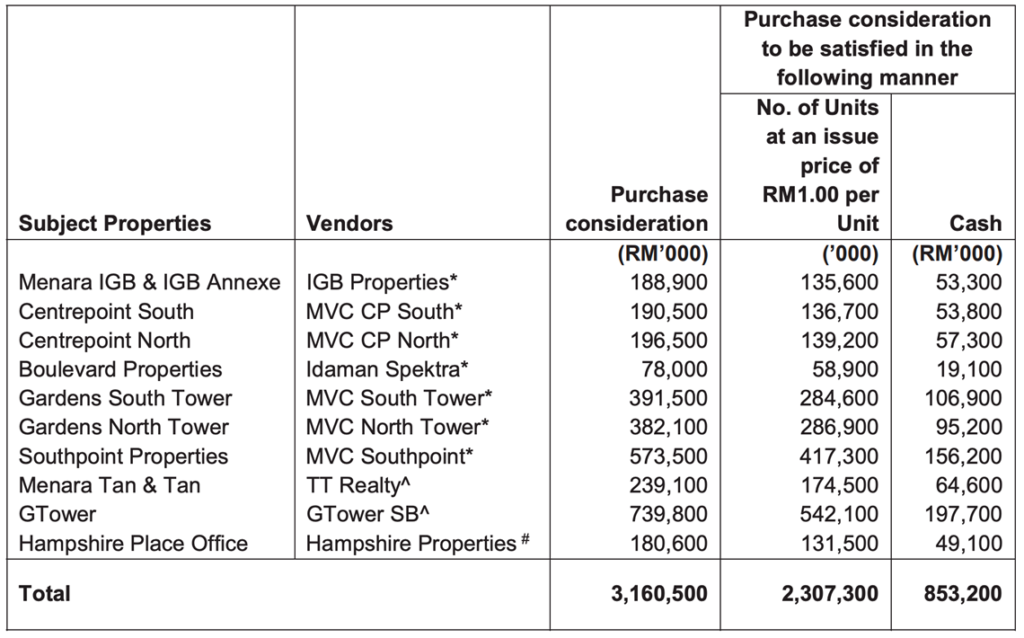

4. The IPO will cover most of the funds needed for the 10 properties

The consideration value of the 10 properties to be under the REIT will be RM 3.16 billion. Out of the total amount, RM 2.31 billion will be via proceeds from the IPO. The balance amount of RM 848 million ringgit will be debt in the form of Medium Term Notes.

Hence, the gearing ratio will only be around 26% if divide the debt over the total assets.

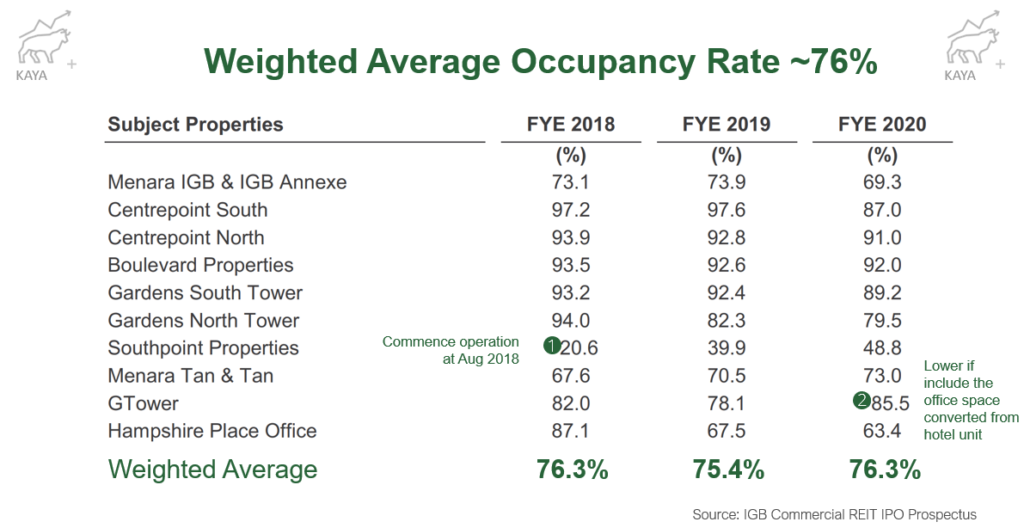

5. The weighted average occupancy rate for the past 3 years is around 75%

REIT investing is just like any other property investing. Occupancy rates dictate a significant impact of a REIT’s prospect and risks.

IGB Commercial REIT manages around 76-76% of its weighted average occupancy rate for the past 3 years. This means on average only around 75% of the total net lettable area of all the properties are leased out and collecting rental.

The balance 25% remains vacant for potential growth, but investors would want to take a closer look at potential reasons preventing a growth in the occupancy rates.

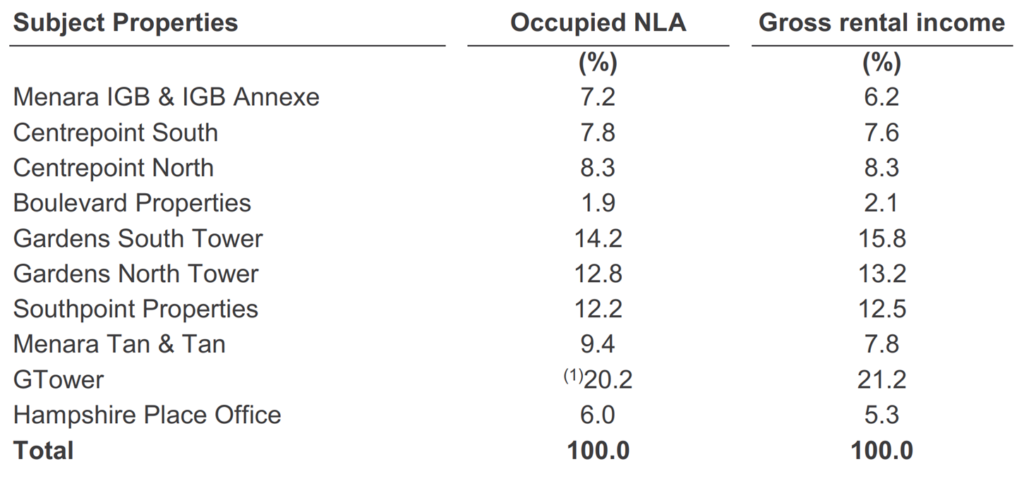

6. The top 4 highest occupied properties contribute to 60% of total NLA and gross rental income

Some properties within the portfolio actually contribute to higher occupancy and hence higher gross rental income.

The top 4 properties in terms of occupancy and gross rental income contribution are GTower, Gardens North & South Tower and Southpoint Properties. These 4 properties contribute to around 60% of the total Net Leasable Area (NLA) and gross rental income.

Due to its significant contribution, any underperformance of these 4 properties will impact the REIT’s overall performance.

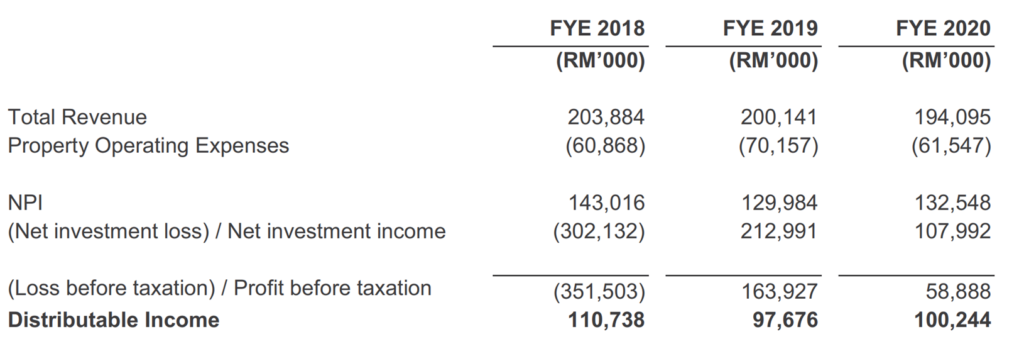

7. Gross rental income is on a slight decreasing trend

For the past few years, gross revenue has been on a decreasing trend. The latest FY 2020 results are presumably due to the impacts from the COVID-19 pandemic. But even for prior years, revenue is also on a decreasing trend.

One consolidation though is that due to better expense measurement for FY 2020, the net property income actually improves versus FY 2019. But investors might need to ascertain that the total revenue does not have a continuous slump.

8. IPO deal favors IGB Berhad shareholders more than normal IPO applicants

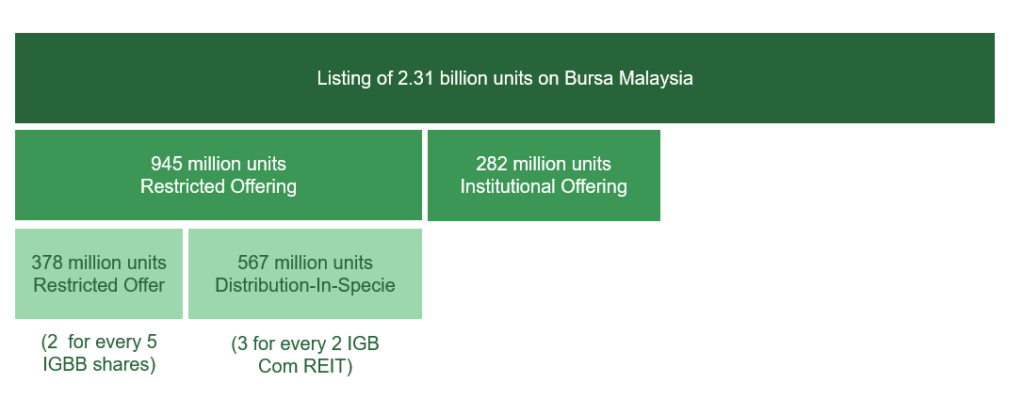

IGB Commercial REIT will IPO at RM1 per unit. Hence, to raise RM 2.31 billion, there will be the same amount of listing shares on Bursa Malaysia.

Out of the total 2.31 billion units, 945 million units will be categorized as Restricted Offering to existing IGB Berhad shareholders. This means that existing IGB Berhad shareholders as of 3rd of Jun 2021 will have a guaranteed offer to either subscribe to 2 units of IGB Commercial REIT at RM 1 per unit for every 5 IGB Berhad shares they own.

Compare to the external IPO applicants, IGB Berhad shareholders are guaranteed to get the restricted offering should they choose to take up the offer. External IPO applicants will need to go through the usual IPO balloting process, which can be hit-or-miss.

Furthermore, for each of the 2 units of IGB Commercial REIT IPO unit offer acceptance, IGBB shareholders are also in line to accept a Distribution-In-Specie. The normal process of receiving special dividends is usually in cash dividends. However, for a distribution-in-specie arrangement, distributions will be fulfilled in terms of more units of IGB Com REIT.

For every 2 units of IGB Com REIT, IGBB shareholders will receive 3 more units of IGB Com REIT units as distribution-in-specie.

Hence, the weighted average per unit of IGB Com REIT for an IGBB shareholder will only be at RM0.40 per unit. By paying RM2 for 2 units and getting another 3 for free, the weighted average price to be RM0.40. This is calculated by dividing RM2 by 5 units of IGB Com REIT.

MyKayaPlus Verdict

Is IGB Commercial REIT going to be as successful as its sister REIT? Many of those who are applying for the IPO definitely would hope so. The REIT managers and sponsors have a long history of track record in growing IGB REIT, and it is a feat and accomplishment that many other M-REITs.

But for those who have attended Dividend Gems, most of us would still be on the fence about the near term prospects and some vital KPIs of IGB Commercial REIT.

A forecast yield of 3.90% for a REIT priced at a price to book ratio of 1 time might be great on paper. But we would want to see improvements in some aspects first.

But what do you think? Is IGB Commercial REIT’s forecast 2021 results still a buy at the IPO price?