9 Things You Need To Know Before Investing In Bilibili Inc.

Bilibili Inc. ADR (NASDAQ: BILI) looks likely to be the YouTube of China. But, it does also share some elements, offerings and services that are similar to Netflix and Twitch.

Video streaming platforms like Netflix Inc. (NASDAQ: NFLX) and YouTube are some of the exciting tech companies that investors can invest in. However, as most of the streaming players in the US starts to grow and become well established, growth investors might want to look at the next Netflix and YouTube.

Bilibili is a video streaming platform that sees China as its home base. So far it is showing impressive growth and has exciting business verticals. Here are 9 things you need to know about Bilibili before you consider investing in them.

1. The Chairman of the Company Founded The Company As A Student

Bilibili’s rise was not originally planned. Prior to the existence of it, China already has a well-known video streaming platform catering to the growing Anime, Comic and Game (ACG) community. AcFun was the de-facto platform where like-minded fans from the ACG community gather to view and create content. Due to the name starting with an A and also being the first of its kind, AcFun is also known as Station A (A 站)

But, due to the instability of the server and website, which sometimes can go down for months, an ACG enthusiast by the name of Xu Yi (徐逸) decided to create an alternative site that would come in the support of AcFun when it goes down.

Xu Yi named the website Mikufans.cn and would eventually rebrand it to Bilibili. Bilibili being the 2nd in line after Station A, would also go on to be known as Station B (B 站). Xu Yi continues to serve as the Company Chairman as of today.

2. The CEO of Bilibili is Chen Rui (陈睿)

Chen Rui needs no introduction. In fact, he is one of the well-known tech entrepreneurs in China. His experiences include stints with Kingsoft Corporation (SEHK: 3888) and founding Beike Internet (Beijing) Security Technology.

An anime fan himself, Chen Rui sought out Yu Xi to offer funds for investing to Bilibili. His connection in the China tech scene also qualifies him to become a consultant, and lastly, he joined the key management team of Bilibili.

Under Chen Rui, Bilibili grew with further investments from Venture Capitals and opportunities. In the year 2018, Bilibili’s shares were listed on the NASDAQ stock exchange.

3. Bilibili’s Business Consists of 4 Key Segments

Even though well known for being a video creation and streaming platform, Bilibili is more than that.

Its core revenue comes from being a game distributor. It is the key distributor of the Chinese version of Fate/Grand Order (命运/大订单) in China.

Gaming contributes to 40% of Bilibili’s FY 2020 revenue. Fate/Grand Order, being a gacha game, where players pay real money to get a certain character by chance, became a key revenue generator for Bilibili’s gaming revenue.

4. Bilibili’s Video Content Is Now More Than ACG

Bilibili’s video contents are now more than ACG. It also has licensed variety shows, dramas, documentaries and many more Professional Generated Content (PGC).

Apart from being strong in PGC, Bilibili manages to convince the young millennial generation to opt for its platform to grow its User Generated Content (UGC). With the proliferation of the internet and video creation, normal individuals now have a platform to create their videos and share the same attention and limelight as PGC.

UGC usually encompasses LIVE streaming of individuals singing and dancing or can even be in the form of gameplay streaming, which is currently the rage in China.

5. Advertising and E-Commerce Contributes 28% of its FY 2020 Revenue

By building a website and app that can drive users to visit, it makes sense to also convert it into an advertising space. Ad spaces can be tweaked and enhanced when users visit or search for a particular video genre, which could increase the tendency for companies to advertise on Bilibili.

Also, by building and nurturing a strong User Generated Content culture, key opinion leaders are able to pivot into E-commerce which is also Bilibili’s exciting complimenting service.

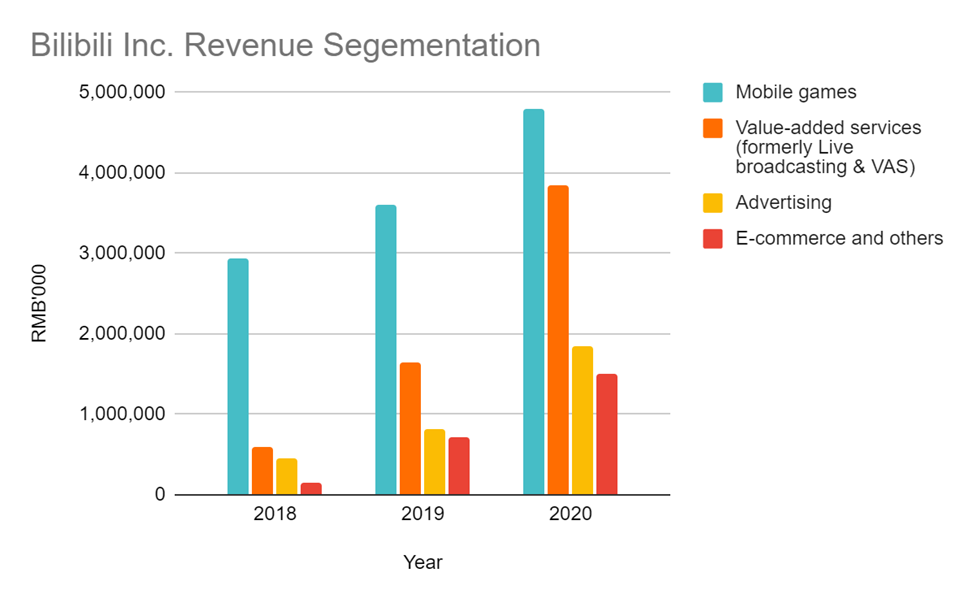

6. All Revenue Segments Are Growing Rapidly

Bilibili is very reliant on its gaming pillar. But over the years, its Value-added services, Advertising and E-commerce all have grown tremendously and the two segments have made Bilibili more diversified.

In FY 2018, gaming contributes to almost more than 80% of its total revenue. As of FY 2020, the contribution of gaming decreases to 40%.

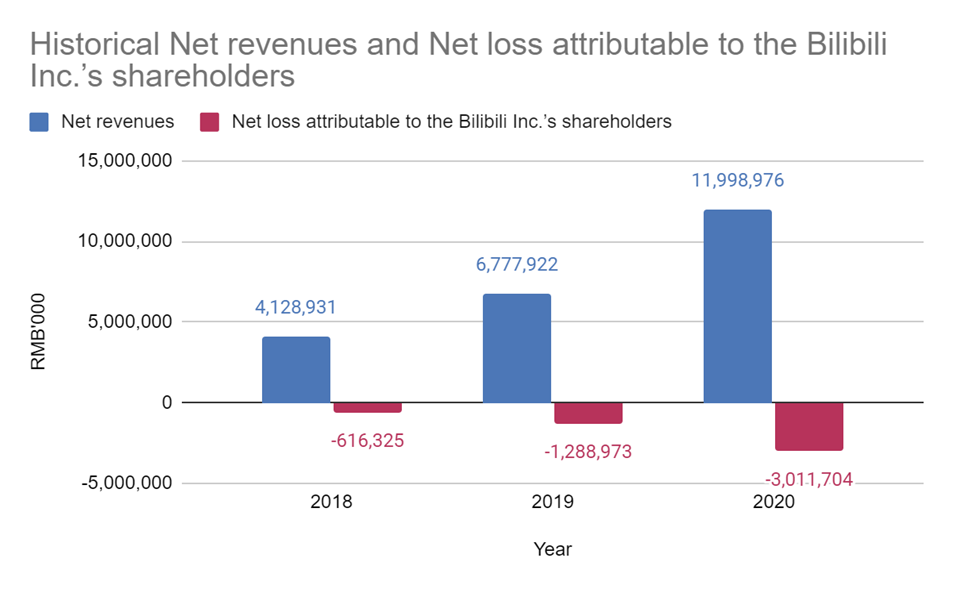

7. Revenue Is On An Explosive Growth, But with Cascading Losses

Even though the growth of Bilibili has been exciting, its net loss might raise a few eyebrows. Its profit continues to cascade downwards year-on-year. Loss attributable to shareholders increased by CAGR 121% in 2 years.

As Bilibili is still an explosive growth company, it would need a significant amount of cash to be reinvested into the business. This can be either in the form of Sales and Marketing expenses and also Research and Development. Thus, it would be quite some time to anticipate the breakeven point for Bilibili.

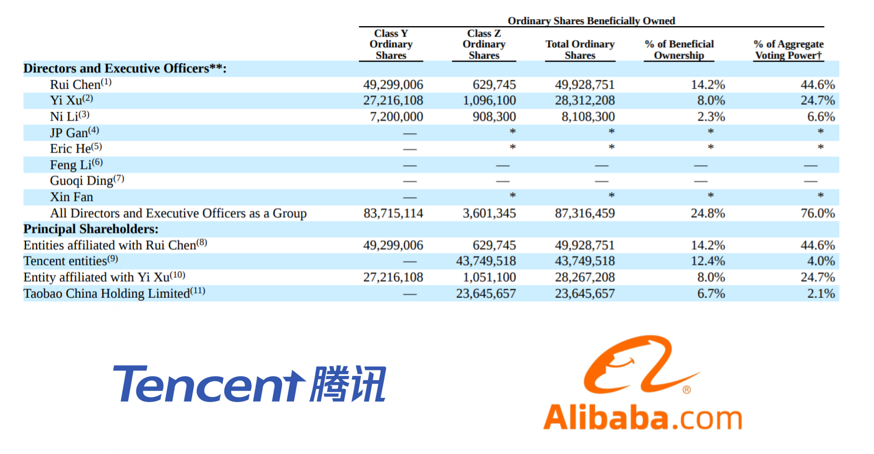

8. Both Tencent Holdings Limited and Alibaba Group Holding Ltd Are Principal Shareholders

Bilibili is one of the very few companies that manage to court investments from China’s largest tech companies.

Both Tencent Holdings Limited (HKEX: 700) and Alibaba Group Holding Ltd (HKEX: 9988) have invested in Bilibili. Tencent has a higher stake as it has started investing in Bilibili much earlier.

Alibaba on the other hand, invested in Bilibili just in the year 2019.

9. Bilibili Will Seek For Secondary Listing On The Hong Kong Stock Exchange

Like most of the Chinese ADRs, Bilibili will be seeking a secondary listing in the Hong Kong Stock Exchange.

Bilibili will be joining the likes of Alibaba, JD.com, Inc. (HKEX: 9618) in entering a dual listing after initially listing in the US. The HK IPO will raise around USD$ 3 billion. Cash raised will definitely of great use as the company continue to grow in a tightly competitive scene.

MyKayaPlus Verdict

Bilibili Inc. is certainly an exciting growth company that is worth taking a deeper look at. Even though it started off as a video streaming platform, it has grown a lot and managed to stand out in a competitive space in China.

Nevertheless, that does not mean it is a clear winner. The multiple verticals it plans to grow faces big established players. In most circumstances, Bilibili will be David going against the Goliath.

But that is sometimes what small and agile companies are good at. Being nimble and able to change its strategy along the way. And it certainly would take some time to see Bilibili becoming a more established tech company that could be the next hot stock.

Are you excited about Bilibili?