5 Things I Learnt After Studying Top Glove Corp. Bhd’s Share Buyback

Top Glove Corporation Berhad ( KLSE: TOPGLOV) has been very aggressive with its Share Buy Backs. This is after the bumper bonus issue from a windfall profit drive by the pandemic.

Usually, if a company undergoes Bonus Issues or Share Buy Backs, it points towards value creation to shareholders. But these corporate exercises are usually separate from each other.

But when it is done together, it does raises some eyebrows. Hence, here are 5 things we noticed after tabulating Top Glove Corp Bhd.’s share buyback post bonus issue. This could explain in our opinion why we opine that their recent corporation exercises are not of shareholders’ interests.

To ensure that we set the basics right, we tabulate the Share Buy-Back announcements from 24th February 2021 (latest as of the time of writing) back to 9th September 2020, post Bonus Issue.

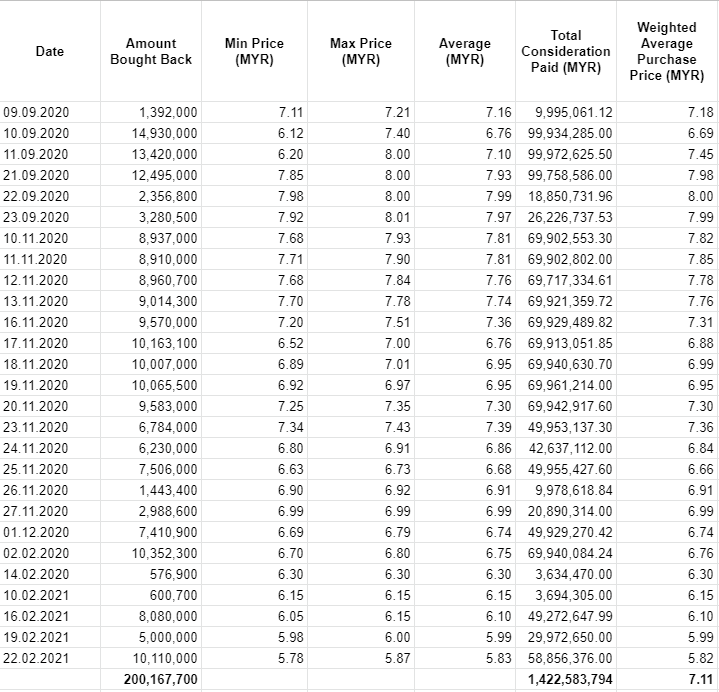

1. Top Glove Spent A Total of RM 1.42 Billion During Sep’20 till Mar’21

We noticed that Top Glove spent RM 1.423 billion for share buybacks ever since post bonus issue. Over the course of several months, share prices have been trending down. And almost 50% of the buyback happens at a weighted average share price of more than RM 7 per share.

Hence, the weighted average share price of the entire share buyback is RM 7.11 per share. Thus, with a total of 200,167,700 shares bought back, the total consideration sum is RM 1.423 billion.

2. Share Buy-Back Amount is 27% of 1H’21 Net Profit

For the latest 1H’21 of Top Glove, net profit attributable to owners of the company amounts to RM 5.23 billion.

The first share buy-back activities start on the 4th of September. Thus, that means the tabulated info is within the same fiscal year of 1H’21. Out of the net profit of RM 5.23 billion, RM 1.423 billion was utilized was share buybacks.

That translates to around 27% of 1H’21 net profit being channelled to do share buybacks.

3. RM 1.423 Billion Is 40% Of Top Glove Bhd’s current Property, Plant and Equipment

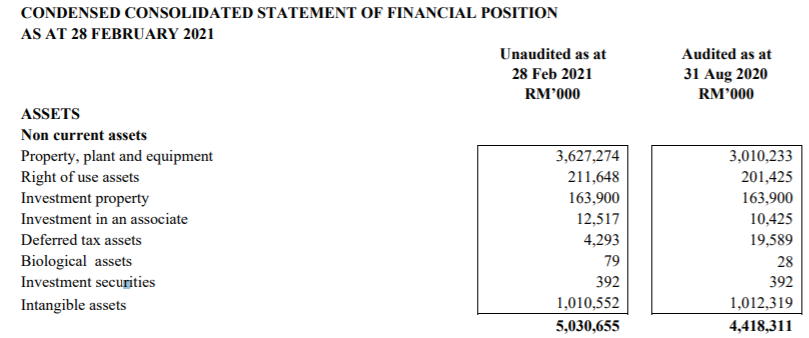

For its latest Q2’21 balance sheet, Top Glove registered a book value of RM 3.63 billion worth of property, plant and equipment.

The share buyback amount of RM 1.423 billion is around 40% of Top Glove’s current long term assets. If the retained earnings are not utilized to proceed with share buybacks, Top Glove could have utilized the bumper earnings to undergo capital expenditure.

And mathematically, it could have increased their capacity by roughly 40%, which would be a shrewd move. Assuming that glove consumption stays high post-pandemic, undergoing an aggressive expansion would have been a better choice.

4. Total Mark To Market Loss of the Weighted Average Share Buy Back Amounts to RM 382 million

As of the time of writing, the share price of Top Glove Berhad closed at RM 5.20 a share.

With a weighted average purchase price of RM7.11, the share buyback is currently at a mark to market loss of -26.83%. Hence, for the share buyback of 200 million shares, the mark to market loss is at RM 382 million.

5. Contradictory Bonus Issue and Share Buy Back Corporate Exercise

Bonus issue of shares and share buybacks are some of the many ways to create value.

But when executed together, it will contradict and even destroy shareholder’s value easily.

When Top Glove initiates a share bonus issue of 2 bonus share for every 1 existing share, they actually intend to hold on to the retained bumper profits. Back then, when sentiments and prospects of glove utilization are bullish, it makes sense to retain the profits and reward shareholders with bonus shares.

But, after issuing the bonus issue, Top Glove went on to spend up almost 27% of its net profit of 2H’21. Is it all according to the master plan for Top Glove to increase its liquidity by threefold and then buy back its shares?

MyKayaPlus Verdict

A company that can continue its sales and profits is one of the easy points to spot a good company.

But, how retained profits become a great capital allocation to grow shareholder’s value and interests is another point of aspect.

Bonus issue of share and share buybacks are some of the corporate exercises that can benefit and create value for shareholders.

However, when used collectively, firstly increasing the outstanding shares available and then using profits to do share buyback can be quite suspicious.

What are your thoughts and opinions of the corporate exercises?

Does this mean the bonus issue were meant to increase liquidity, bring down share price and so to reduce the cost of the share buy back eventually..?

The main purpose of a bonus issue is to conserve cash but still reward shareholders with more shares. The increased liquidity meant that the tendency for the share price to go up to increase as much as for the share to go down.

Now the average cost of shares bought back is around RM7. And it is at a mark to market loss.

Dear KayaPlus,

1. Does shares that bought back will get dividend as well?

If yes, the $ will back to shareholder equities, right?

2. Will the shares be part of the dual listing IPO share?

If yes, then $ will back to TG ac too….HK15.00?

Hence, TG got attention from Northern Asia investors, goodwill, and capital for future productions expansion….

While Mr & Mrs Dr Lim, family member and major shareholders gets…..

Correct me if I am wrong….Thanks

Hi Jeet Yuan,

1. Only dividends are paid out to outstanding shares.

2. Yes.

The rationale here is all the corporate exercises are counter-intuitive. The questions that you should ask is

1. Why use retained earnings to buy back shares at a loss? The retained earnings could be straight away be used for CapEx instead of the unnecessary corporate exercise

2. What we want to portray here is that if the entire event is put together, it does raise a few eyebrows. If you selectively pick out pay dividends good or bad (good), IPO good or bad (good), then we are not on the same page. If you need money to do CaPex there shouldn’t be any share buybacks. If the share buybacks are at low prices and share prices appreciated, then there is no argument. But as of today, bought back shares are at a Mark To Market Loss.

3. Getting attention from Northern Asia. There are companies that have did a dual listing and have failed to command a premium. Till today, the price discrepancy between the HK and MY stock is there.