The Red Flag of Luckin Coffee’s Fraud – Shady Management

After going through the report detailing the fraudulent proofs of Luckin Coffee Inc, we now head to the management allegations.

Tip: You might want to check out a summarised version of the business fraud claims here

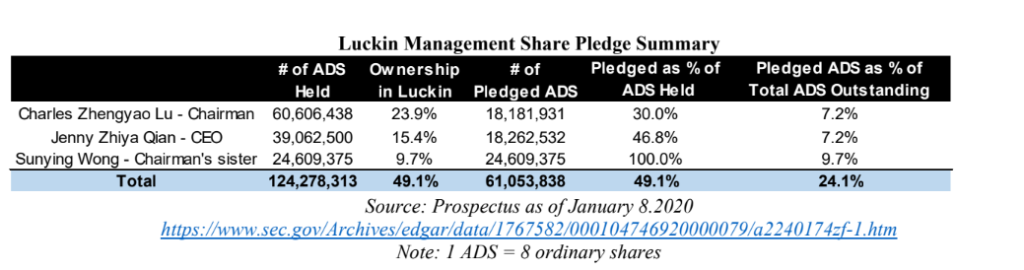

1. Red Flag 1: Luckin’s management has cashed out 49% of their stock holdings through stock pledges

It is horrifying to know that the management of a company actually took stock pledges. A stock pledge is a financing option, where management obtains financing by pledging company shares as collateral.

When pledged shares fall in value, lenders demand that borrowers post more cash or collateral. If borrowers cannot repay, lenders can sell shares to recoup the owed amount. This would further depressing stock prices and prompting additional demands for collateral.

Problem is, are all stock pledges a negative sign? No. But a pledge of 49.1% of total ADS is.

In the event of a selldown of Luckin Coffee share, it would trigger a margin call to the management team. Failure to address the margin call would result in force selling of pledged shares. This would further increase the selldown.

Verdict: Retail investors should be able to snuff out this red flag

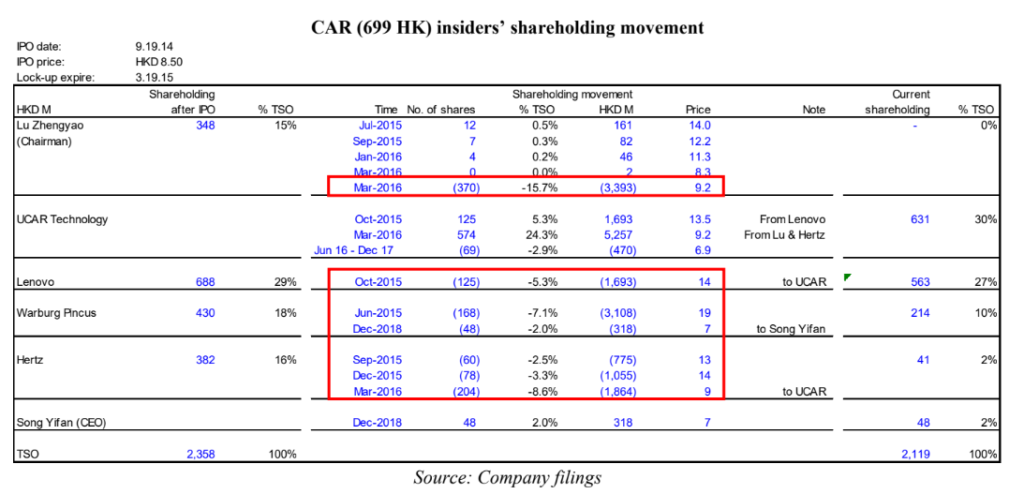

2. Red Flag 2: Chairman and his shady group of closely-connected investors with CAR (699 HK)

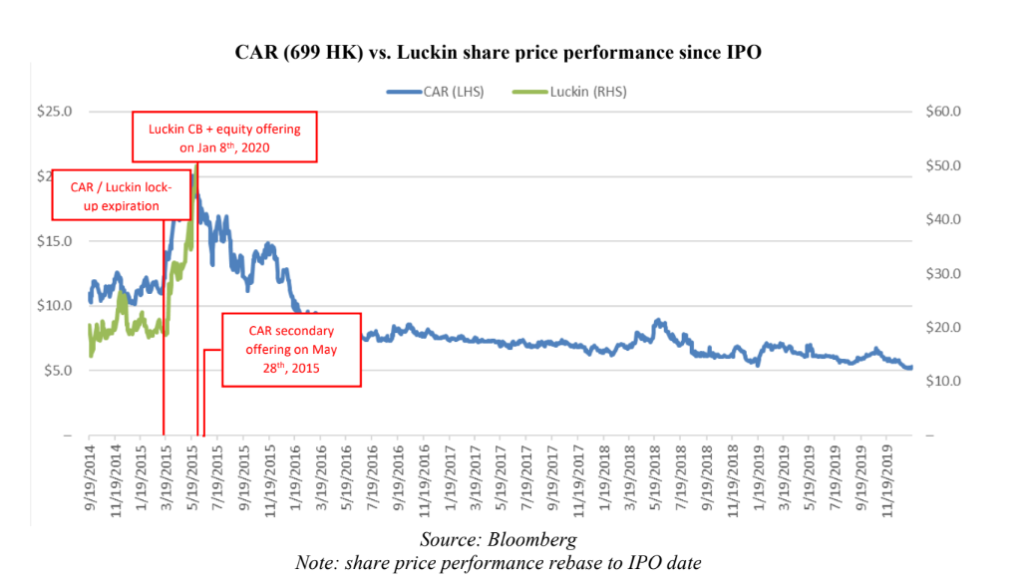

Before Luckin, Charles Zhengyao Lu founded a Chinese auto rental company called China Auto Rental (CAR, 神州租车). CAR filed for NASDAQ listing but failed in 2012. It eventually listed in the HKEX in 2014.

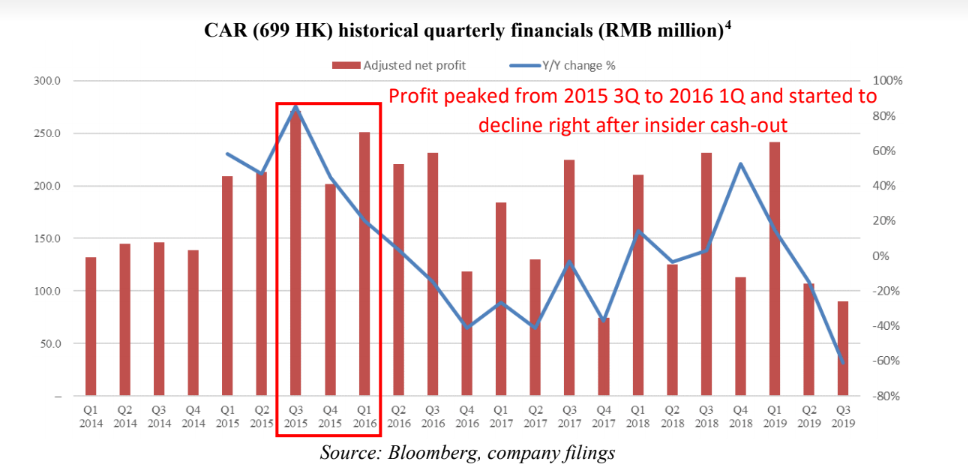

The share price surged to a high of HK$ 20 before Charles and pre-IPO shareholders started dumping their holdings.

Of course, company performance started to deteriorate after the mass dumping.

The eerie situation is when the same group of people are involved in CAR’s share dumping is now within Luckin Coffee.

Verdict: If homework was done against Charles Lu, it would have also provided enough caution

Red Flag 3, 4 & 5: Unscrupulous Transactions of Charles Lu from UCAR, Luckin Coffee’s “unmanned retail” strategy & shady independent board member

Red flag 3 illustrates out the shady transactions of Charles Lu’s UCAR business, which keeps showing the same people that are involved in both CAR and Luckin. It is a detailed account of several transactions including the sales of troubled German carmaker Borgward.

Perhaps after all the questionable actions Charles Lu and his associates did in CAR, one can’t help but be more curious. The report theorizes a possible way for the management to siphon cash from the company by buying vending machines from related party transactions.

It takes more than one person to tango. A deep dive to the associates cooperating with Charles found out that one particular Sean Shao, who has served on the board of 4 US-listed Chinese companies accused of fraud.

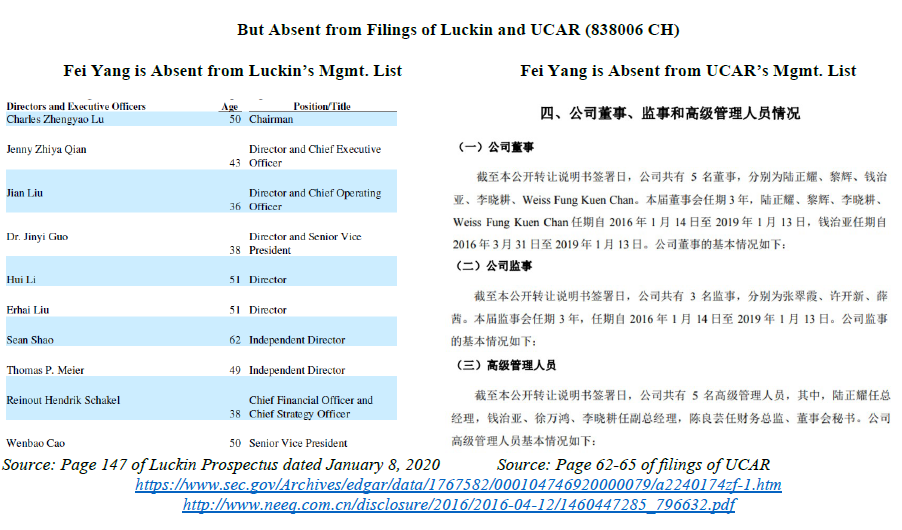

Furthermore, the co-founder and Chief Marketing Officer, Fei Yang had been previously sentenced to 18 months’ imprisonment for crime of illegal business operations. Present in multiple company occasions, but never black and white mentioned on the board of directors and management

Verdict: Enough of diligence in digging could uncover this massive flaw

MyKayaPlus Verdict

Though not having the resources, time and effort to launch an operation to proof Luckin Coffee’s fraudulent numbers, retail investors could focus on the management.

With information all available on our fingertips, chances are we could have sensed something amiss with the Management team, from the pledged securities to having questionable individuals as management.

Management integrity, vision and mission play a huge role in ensuring a company’s profitability and long term growth plans.

Luckin Coffee may have the highest number of outlets but in terms of product quality and atmosphere, we all know it is hard for a kiosk to go head to head against a cafe.

Perhaps apart from looking at the management’s integrity, the whole Luckin Coffee scandal also teaches us one more lesson. It is the business model and the actual profits that count too, not the number of noises and news!