SEA LIMITED: Q2’21 Escalating Loss But A Worthy Investment?

Sea Limited (NYSE: SE) might not be a company that many are familiar with. But its services gain huge traction ever since its founding under the name of Garena, a game developing and publishing company.

In the year 2015, the company ventured into e-commerce under Shopee and has since grown into a South-East Asian powerhouse. Amidst the pandemic stricken year, both of its gaming and e-commerce, categorise as Digital Entertainment and Ecommerce saw a combined triple-digit growth.

To complement everything, a digital financing service is launched. Sea money is Sea Ltd’s digital financial services to help with various transactions within its entertainment and e-commerce applications. Its services are gaining huge traction in countries like Indonesia, the Philippines and other South-East Asian countries.

Tapping onto games, e-commerce and digital financing, it’s no wonder that Sea Ltd is an exciting company. Hence this does explain Sea Ltd growth at an alarming rate.

But, on the other side of its growth, is also the growing losses that Sea Ltd is reporting. So, is Sea Ltd actually a hype or an opportunity? Here are a few points that could help shape our perspectives on this company.

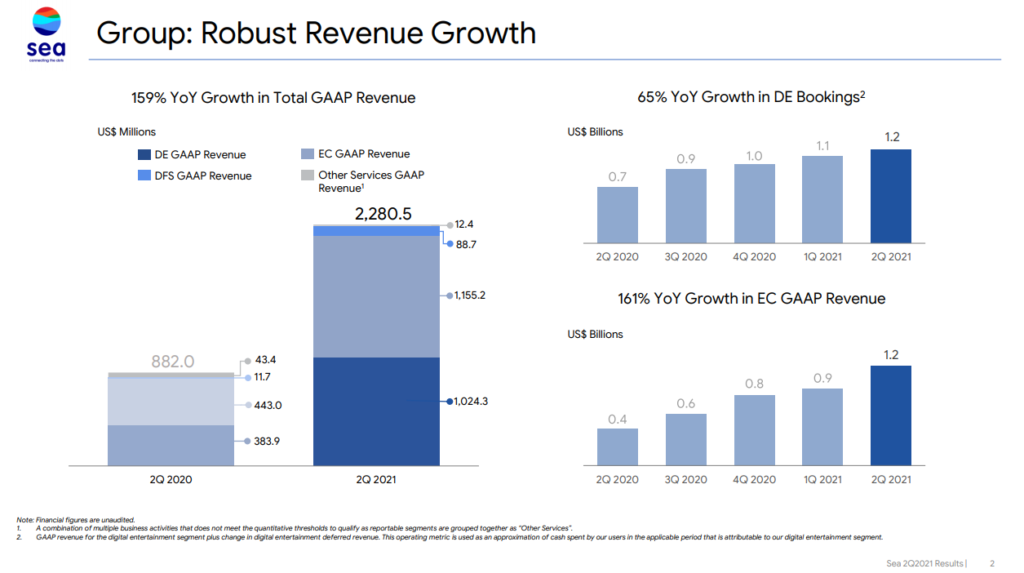

1. Strong growth from Digital Entertainment and Ecommerce for Q2’21

Garena might be 12 years old at the point of writing, but it is still growing at an impressive 65% YoY. However, Ecommerce’s growth takes the spotlight with an impressive 161% YoY growth. Shopee has been making the headlines with its quirky advertisements and collaborations with megastars.

Since e-commerce is in some ways a winner takes all platform, each existing player would need to outperform its peers and competition. This might not only be from a price point perspective of items sold, but also on the discounts and services. Entertaining and bright advertising helps funnel users into the app, while a competitive selling price and delivery lead time help online marketplaces to clinch successful purchases.

Its self-developed and published game Free Fire also became one of the top-grossing battle royale games. The reception of the game is so good that it even surpasses PUBG mobile developed by Krafton, in which Tencent Holdings Limited (HKEX: 700) has a stake.

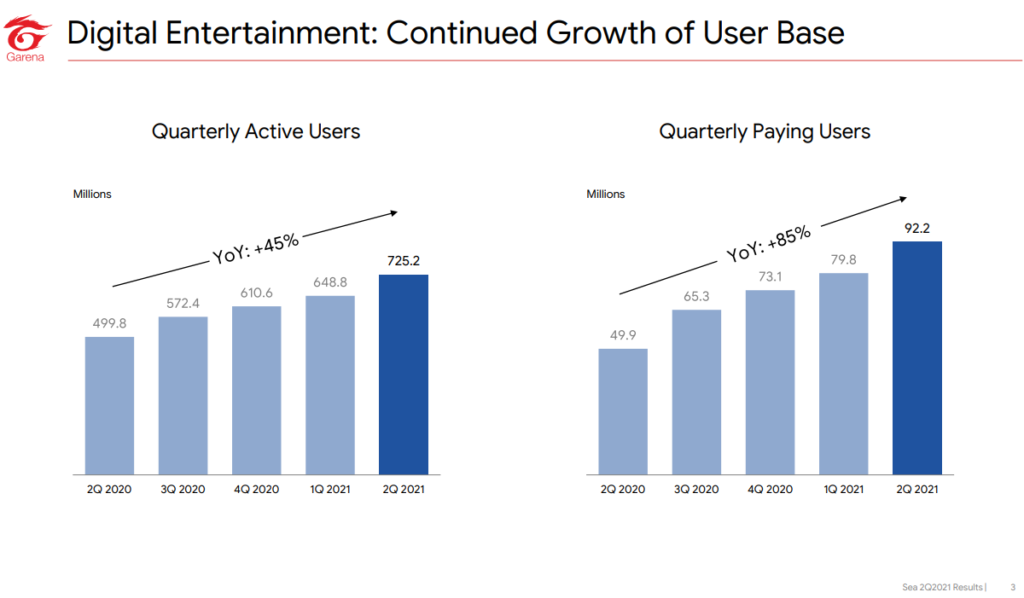

2. Higher quarterly paying users % for Digital Entertainment

Digital entertainment continues to chart up great growth with more and more quarterly active users. Not only that, but quarterly paying users are also on the rise as well.

A quick ratio analysis by dividing quarterly paying users with the quarterly active users also show an increase in % in quarterly paying users. This gives a slight indication that more and more users are willing to spend on in-game microtransactions. Since Free Fire is a free-to-play game, these in-game microtransactions can accumulate and grow, as long as the active users continue growing.

Join the premium club to unlock the article and enjoy the list of pro features below:

- Invitation to a private Facebook group for interesting discussion, reading materials

- Bi-monthly digest on top ideas & investing insights

- Trade Alert: Get insights and info whenever we plan to buy/sell any stocks.

- Premium access to stock analysis

- Stock Plus 2022 & Beyond – Handpicked top 10 stocks to kick start your investing journey

- Thematic Events and Webinars to up your investing game

- Furnished Dividend Gems report based on subscriber’s preference

DISCLAIMER

The information available in this article/report/analysis is for sharing and education purposes only. This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned; nor can it be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. If you need specific investment advice, please consult the relevant professional investment advice and/or for study or research only.

No warranty is made with respect to the accuracy, adequacy, reliability, suitability, applicability, or completeness of the information contained. The author disclaims any reward or responsibility for any gains or losses arising from direct and indirect use & application of any contents of the article/report/written material