Gold Investing: Is it Really To Hedge Your Portfolio?

Gold.

The shiny precious metal that not only drove men to perilous journeys and expeditions in the past. But it is still precious metal that adorns the necks, ears and hands of women these days.

It is still the de facto asset class or instrument as a safe haven. Or as of recent, many people have been advocating it as a hedging instrument to your portfolio.

Is it really that effective as a hedge to your portfolio?

Let’s go back to the history, the numbers, facts and principles on investing.

1. History of Gold

Gold has always had an elevated status since ancient times. Favoured due to its shine and lustre, it has inspired many adventures and expedition. Be it going through the thick South American jungle in search for El Dorado, or braving the torrential seas in search of sunken treasure, gold has captivated expeditions and lore.

2. Historical Price of Gold

Even though the price chart stretches back to the historical 1980s, we all know that gold played a big part in ancient history and is still relevant as of today. From playing a role as a mode of payment as coins, bar and bullion and even as artefacts, it has been recorded since the ancient times in many forms.

Today, gold becomes part of an asset class touted as a hedge to investments and currencies. It is also tradable as a metal commodity with live prices. Historical price of gold has indeed risen and will continue to rise. This is perfectly normal, as gold is a finite resource, and demand will slowly push up its price.

3. So if its a surety that it will go up, why don’t we put all of our money in gold?

Good and fair question right?

The world has since evolved and improved. We no longer use gold as a mode of payment these days. Quite simply because it is troublesome to carry around physical gold. And the fact is that it is never a long term solution.

Even looking at the historical price, there is a long time frame, from the year 1980 until 2007. Locking up your net worth into gold means that there is no capital or net worth appreciation. Though you might consider yourself pretty immune to the financial crises.

Gold eventually went on a galloping rally, going up as high as USD$ 1,800 ever since the year 2007. The rally was due to many reasons. First, of course, it is attributable to the subprime mortgage crisis. The rally is also due to a time period where the mass market finally switches to smart devices, which consumes quite an amount of gold.

4. How true is it that Gold hedges your portfolio?

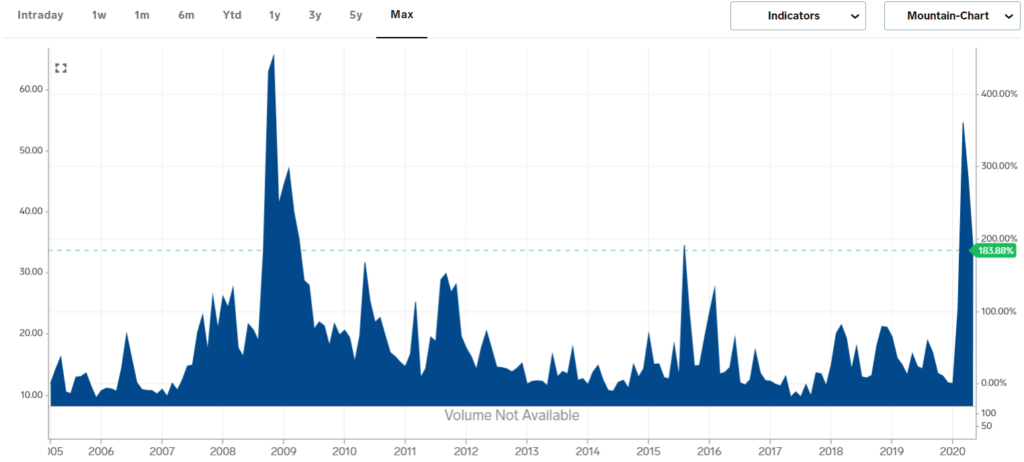

Referring to the VIX charts, gold prices naturally have lower volatility compared to the Dow Jones Index. Being relatively stable and non-reactive makes it an excellent asset class to SMOOTHEN OUT the fluctuations of the irrational market behaviour. It does serve as a hedge to the price fluctuation!

5. What about hedging from a value perspective?

Assuming if you have USD$ 2,000 by the start of the year 2016. And you invested half of it into the Dow Jones Index while the other half into gold. As of today, probably the part where you have invested in gold would have given you roughly a 50% gain. The other portion invested in Dow Jones would have returned 23%, but previously was outperforming gold by a mile. Due to COVID-19, the markets did come down quite a bit. So gold does protect and safeguard your portfolio within a 5 years time period.

What if the time horizon is pulled back a bit further, let’s say 10 years? Even though the market has corrected due to COVID-19, but looking at the 10-year price history, the correction is nothing but a small blip. The Dow Jones Index actually trounced gold by a mile, a 104% gain versus 23% gain

If we venture back further, say 30 years time horizon, you would see that the Dow Jones Index has beaten gold by a mile.

The same observations apply to the Hang Seng Index of Hong Kong.

For the Kuala Lumpur Composite Index though, we’ll need to go back a bit further. Given enough time, the equities market are able to outperform gold prices, even though being more volatile.

So in essence, if indices have always proven to be able to beat gold prices, why do we still invest in precious metals? What is there to hedge, if our investments horizons are for the very long term?

6. Gold hedges our emotions more than our portfolio performances

Being a retail investor vested in the markets, we will definitely see our investment portfolio go up and down. Sometimes the ride may be too volatile for our personal liking. This is where gold comes to our aid, by absorbing the partial volatility.

Rather than hedging or helping our portfolio in the very long run, it actually provides a placebo effect that at any moment our portfolio is down, it is not as severe as a portfolio with 100% equity exposure.

The age-old analogy that the market and indices will always go up. And given enough time it will further outperform gold prices more and more.

MyKayaPlus Verdict

How long is your investment horizon? What market do you plan to invest in? Is your emotional strength strong enough to handle the wild market volatility?

All of these questions determines whether gold should play a part in your portfolio or not. But if you plan to invest for 20 years or more, and invest in a global market, you should be aware by now, that gold only helps to hedge the short term volatility of an investor’s emotions.

Long term wise, the market will always outperform. So our advice is to stay invested for the longest period of time. That is when the power of compounding will aid you!

Our strategy for 2021 (a portfolio of 10 quality stocks to help us achieve market-beating returns) worked out as we crushed the Dow Jones Index with a 24.5% annualized return. Our picks for 2022 is out as well! Sign up to our Premium Club to get access instantly!