Due Diligence Series: Detecting Problematic Companies Pt.1

Of all the skills I obtain since I started investing, none come as close or as cherished as my my ability to deploy scepticism. This might raise a few eyebrows but in the world of investing, deploying scepticism and elimination can help save a lot of time (and capital).

In a short timeframe, great companies, and mediocre or problematic companies trade up and down. It is only looking at a longer time frame, only we see the divergence. As much as everyone would like to buy great companies before every breakout, let’s face it, we are not sages nor harbingers.

So how do scepticism and elimination comes to play? Simple. A stock or the market can only move in 3 directions – Up, down or sideways. Thus, we find as many problems and scepticism about a particular company. If the company manages to address these risks, at least we would be more assured to put our hard-earned money into the stock.

To sum it up, this is usually what venture capitals or private equity call “due diligence”

Here is part 1 of the Due Diligence series: Growth At All Cost

This is a Premium Club Premium article made free to view for the public. Sign up for our Premium Club subscription to get premium analysis, articles and also access to Stock Plus 2022

Why growth at all costs?

The rule of thumb for a growing stock price is straightforward and common sense. As long as a company can grow its profits, it should be more valuable.

And valuable companies (or stuff) should go up in price. Regardless of a company even opting to pay out its profits as dividends, an owner of a profitable company which is still growing would see prices almost certainly going higher over a long time frame.

But, there is much due diligence to consider if you scrutinize net profit. As much as this is required, investors can always choose to look at the top line first to make a first impression of a company.

As long as the business is growing, the company should not do too badly. Because as long as the revenue growth is faster than its expenses or expansion, the net profit will be buoyed to higher levels.

What if there is no growth?

From time to time, we might come across companies with no topline growth. This is where your first due diligence comes to play.

Is the growth halt a temporary hiccup or a long-term concern?

If it is a temporary roadblock, when is the expected timeframe for the company to overcome it?

Does the game plan of the company to nip the problem in the bud make sense?

Because once this concern is addressed, it will either free up our precious time to eliminate this company as an investment candidate or to spend more time prospecting it.

Case Study: ComfortDelGro Corporation Ltd

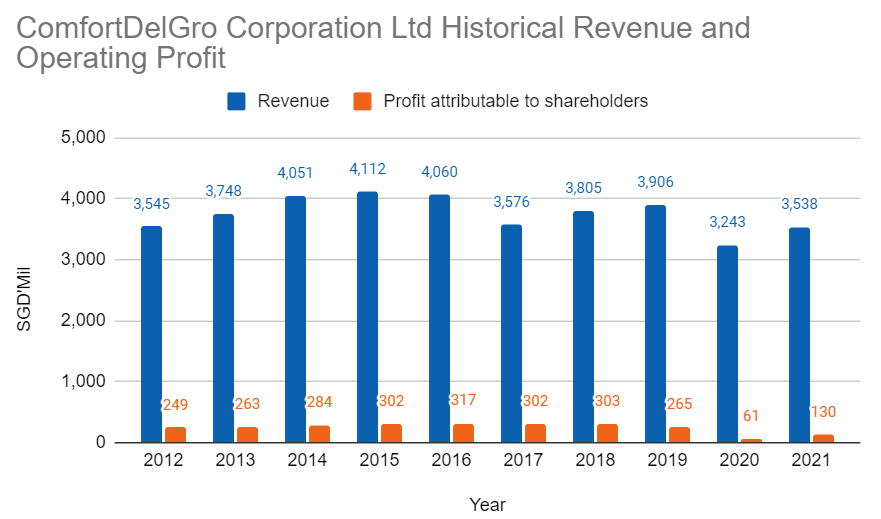

A great example to exhibit this would be ComfortDelGro Corporation Ltd (SGX: C52). Over the last 10 years, revenue has been flattish with no growth.

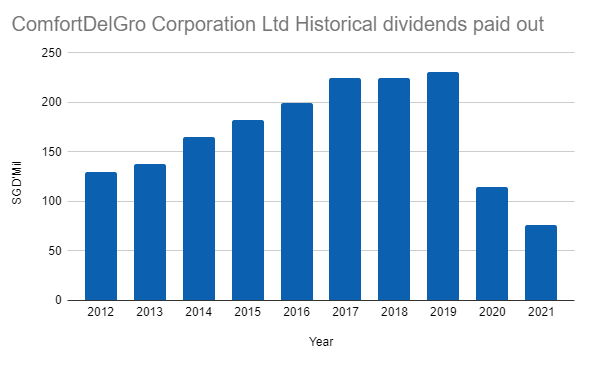

Even though it remains a generous company in terms of dividends paid out, it was not until the onslaught of the pandemic which saw the company reduced its dividends due to uncertainty. Previously it was able to maintain or increase its dividends due to increasing its payout ratio.

But when the company had to tighten its payout, even though it did not enter into a loss during its pandemic-stricken years, the stock price plunged.

MyKayaPlus verdict

Yes, analyzing statements can be difficult without a degree. But if we dissect the entire financial statements and scrutinize important items, we not only can learn where to focus but also save time to prospect potential stocks.

Topline growth is inherent to all types of stocks and REITs. Not growing shows complacency or obstacles that the company and management cannot overcome. It can also be a tell-tale sign that the company’s business can be disrupted.

Unless if its a tangible asset-centric business, using deep value might not even provide a sufficient margin of safety. Due diligence is important in avoiding value traps. But knowing which valuation to utilize is of utmost importance as well.

To learn more on how to dissect statements to avoid problematic companies or spot investment opportunities, we are more than happy to welcome you to our Premium Club membership. Sign up now and make a difference to how you invest and analyze!