Why Long-Term Investing Means Holding A Stock For At Least 5 Years?

Long-term investing is not actually an investing strategy. Rather, it is the blueprint and execution of a value or fundamental investor.

It might seem odd to just buy into a stock, hold and do nothing for the next 5 years.

More accurately, it is an act to be almost certain that after a minimum of 5 years, your thesis pans out, and you achieve a return far greater than the risk-free rate return of the same tenure.

Sounds very much like playing god or a harbinger, theorizing what would be profitable in the next 5 years, while most of us are not sure what meal we would be having tomorrow.

Although there is not a clear rule of thumb on how long should a typical tenure of a long-term investment should be, I come across plenty of answers. This can range from 1 year to 3 years and to 5 years. Some even advocate beyond 10 years.

But if you have just started out investing or are even a pro, here’s why I think the optimum vesting period for long-term investing is AT LEAST 5 years.

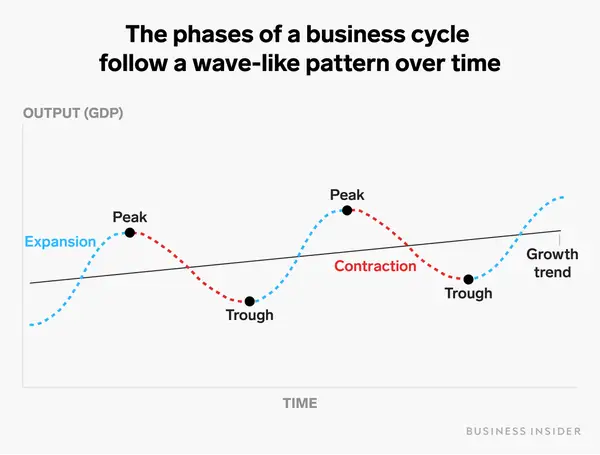

1. A full business cycle is around 5 years on average

One fundamental fact that why 5 years is a minimum time horizon for long-term investing is due to extrinsic reason. Companies, businesses and the global economies are all connected to each other.

According to Forbes, the average length of a growing economy is 38.7 months or 3.2 years. The average recession lasts for 17.5 months or 1.5 years. Adding both numbers gives us a full business cycle, which on average is 4.7 years.

When we invest in a stock for long-term justifications, regardless of which part of the economic cycle we are in, we must be open to accepting the potential downsides caused by recession. Only when the new cycle and growth start, do we stand to profit from being patient.

2. A country’s economic plan is usually a 5-year plan

Coincidentally (or not) to the gyrations of an economic cycle, some countries also practice a 5-year economic plan.

A company’s prospect ties heavily to its country’s economic health and plans. Although democracy-practising countries might not be able to relate to this, China and other countries practice setting and reviewing a 5-year economic plan. This ensures the country’s resources, focus and efforts are in line with what is set out.

How does this jive with your investment thesis? Taking China’s economic plan as an example, the Chinese Politburo has a knack and track record of walking the talk and executing their Five-Year plan. Their plan always outlines the key areas and targets for their upcoming focus.

These areas of focus can provide catalysts and investment bull thesis to companies that could benefit due to their business model. For example, the focus on green development, and continuous development of the Belt and Road initiatives would see clean energy companies, electric vehicle manufacturers and infrastructure companies benefitting in the next 5 years.

So that partially ties back to why a long-term investment horizon is 5 years.

3. Long-term business plans are sometimes 5 years

Sometimes, companies need to undergo major projects. These projects can determine the course of the company for the next few years and can stretch beyond 1 year.

After implementation, there should be also a timeframe for observation, on whether the company’s plan unfolds and plays out accordingly.

Think about it. Some projects will require 1 year of planning, 1 year of research, and 1 year of implementation and marketing. The remaining 1 or 2 years will be the observation stage. So, it might be too soon should you choose to sell off a company when sprouts of prospects are just barely visible before the 5-year time frame!

4. 5 years is a good enough tenure to gauge management

Companies are the vision of the people who run them. But just like a job interview, an employer or employee would not know each other more just from an interview itself.

Hence, just like how an employee undergoes a probation period, the same applies to new management. However, since C-suite executives dictate the future and direction of a company, a longer time frame and monitoring period would be required.

This can tag along with some major projects that we touched on in point 3. A great leader would be able to prove his mettle within 5 years. One great example would be Satya Nadella, who steered Microsoft Corporation: (NASDAQ: MSFT) to pivot into one of the world’s largest cloud companies.

5. 5 years is long enough to ride through any volatility

Lastly, it’s just basic common sense.

The market is always volatile. And uncertain. What is low today, can go lower tomorrow. Uncertainty and volatility are the certainties that the market can guarantee you in a short term.

However, on a long-term basis, the market also guarantees you something else – upside. So long as you stay invested for the long run, you are almost guaranteed an upside.

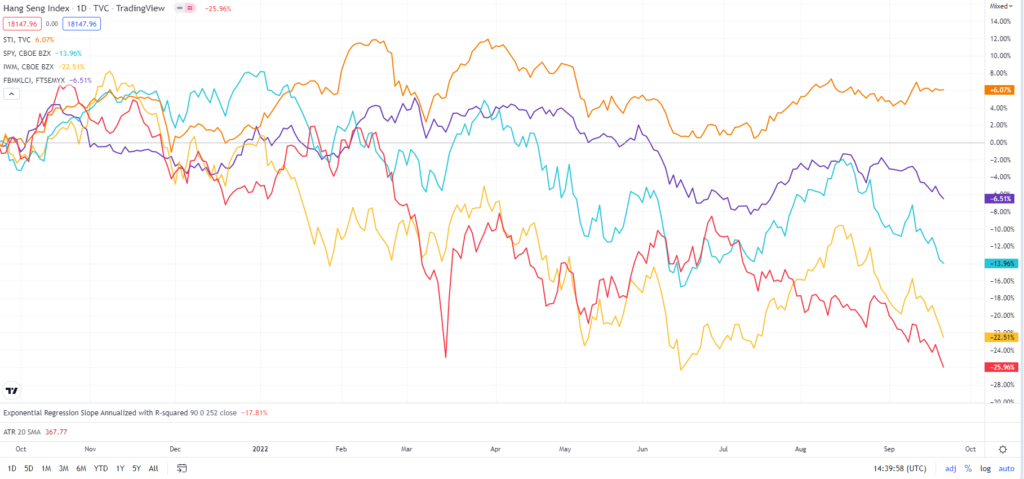

Let me illustrate the actual returns to prove a point.

Below is a chart of collective 1-year returns by major indices for South East Asia, the US and Hong Kong. We have the Kuala Lumpur Composite Index (KCLI), Straits Time Index (STI), Hang Seng Index (HSI), SPY (SPDR S&P 500 ETF Trust) , and IWM (iShares Russell 2000 ETF) . Almost all except the STI is in negative territory.

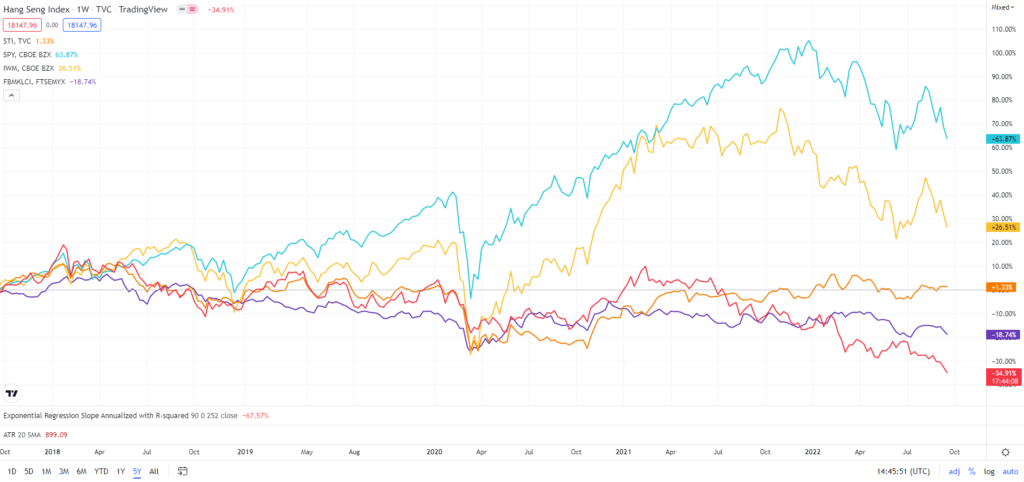

If we look at the last 5-years’ return, most indices are actually positive. This is taking into consideration that the markets plummet during the 2020 COVID-19 selloffs and the current selloffs.

The only indices in negative regions are the KLCI and HSI.

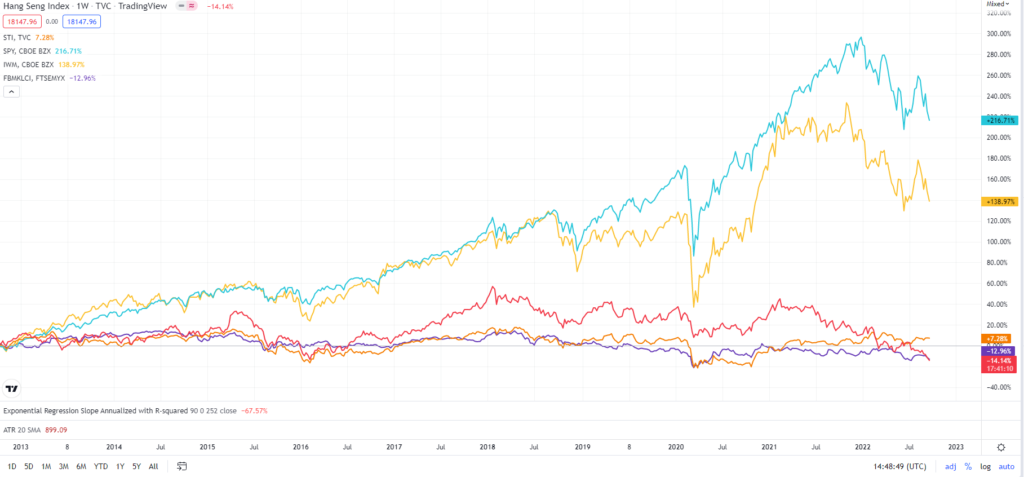

What about 10 years? You would have achieved a 2-bagger return on the SPY while a 1-bagger return on IWM. The STI remains in chalks up a 7% gain, while the KLCI and HSI remain in negative territory.

MyKayaPlus Verdict

Many people think that the markets are deceptive after losing their hard-earned capital and savings. But if you are short-sighted and favoured speculative stocks, you not only will not enjoy any upsides but will bear the brunt of higher volatility as well.

Long-term investing sounds speculative, and not everyone have the patience to hold stocks for at least 5 years. But it is how it is. Why 5 years is the minimum period do not lie. The facts and rationales have proven that long-term investing is not speculative, but rather a certainty.

A wise man once said: “Buying the right stocks is just like a blissful marriage. They seldom give you headaches and heartaches”

In my opinion, knowing what and when to buy a stock and holding on to it indefinitely, sure sounds better and easier than not knowing what to buy tomorrow or the day after.

Good things require patience. Does that mean long-term investing is a good thing? Food for thought for you!

p.s. if you are sold on the fact that long-term investing is the way to invest, but do not know where to start, our Premium Club welcomes you to take hold of your future wealth.

Learn how to pick the best dividend stocks and growth stocks, and see how our blueprints and startegy in Premium Club help you compound your wealth for the next 5 years!