Why This Market Rebound Might Not Be A Bull Run?

It’s the start of August 2022. The markets have rallied well ever since the brutal and irrational selloffs in May 2022.

Humans, programmed with the recency bias, will tend to forget how brutal was the selldown back then. Cryptocurrencies crashed back to Earth, with some firms rug pulling or going down. Equities, especially hyper-growth stocks, followed suit.

Nevertheless, the market has been on an uptrend for a solid 2 weeks. A 3rd-week beckons. Everyone is screaming the bottom is here, get in now and enjoy the ride.

But, if you think of it from a logical point of view, what fundamentals actually warrant a market recovery? There are unfinished wars. Ever heightened geopolitical tensions. The list goes on.

Here is why this market rebound might not be a bull run.

This is a Premium Club Premium article made free to view for the public. Sign up for our Premium Club subscription to get premium analysis, articles and also access to Stock Plus 2022

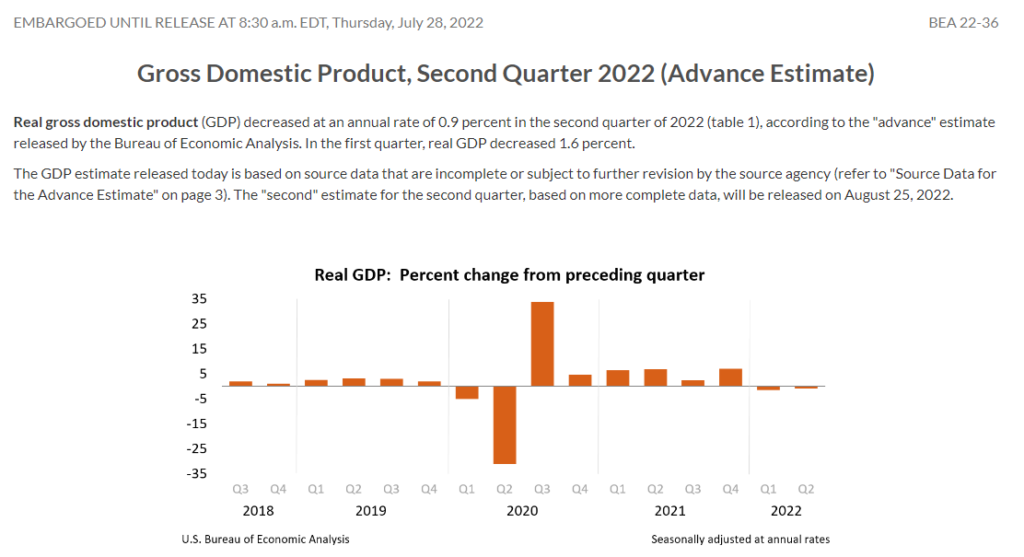

1. Successive 2 Quarters Of Negative GDP Shrinkage

Gross Domestic Product (GDP) is the go-to barometer for measuring economic growth. Put simply, the government sets a target of how much a country’s GDP will grow, and it gets monitored on a quarterly basis.

You can see it as how a country reports its economic results, similar to listed companies. For the United States, it has not been too well, as they are in a successive second quarter of GDP shrinkage. The US might already be the world’s largest and most matured economy, but it still needs to grow.

A contraction in GDP can be a potential red flag of an impending recession.

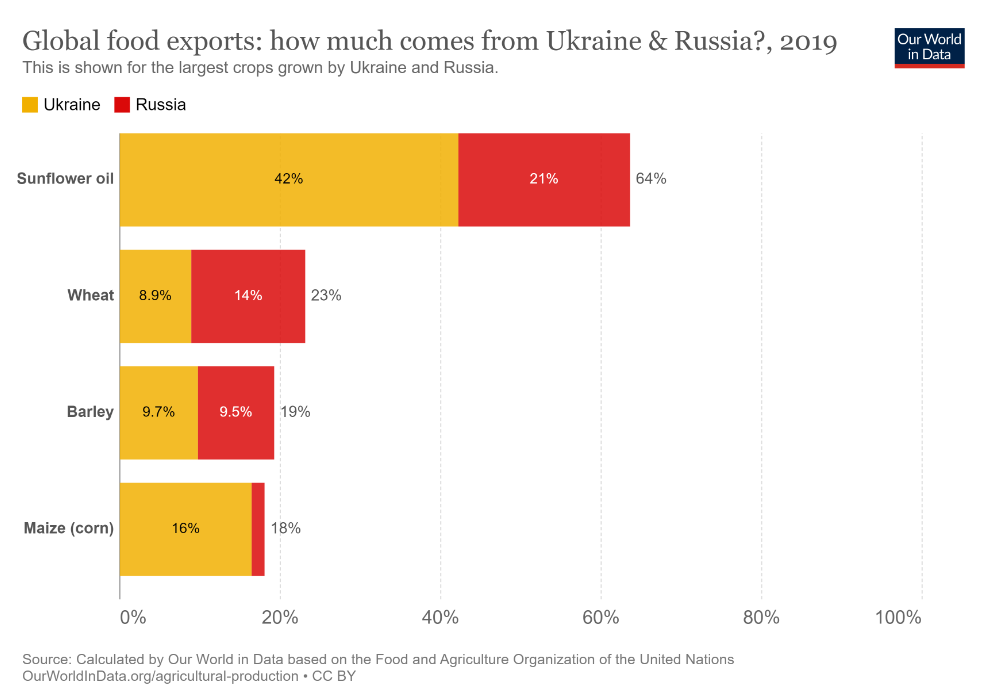

2. The Russian-Ukraine War Is Not Over

The 24th of February, 2022, might seem ages from now, August 2022. It was the day when Russia launches a military assault on Ukraine.

Fast forward to today, the war is still ongoing. The tabloids and media might have gone bored of reporting it, but nothing has changed. Ukraine exports mainly steel, coal, fuel and petroleum products, chemicals, machinery and transport equipment and grains like barley, corn and wheat.

As war and uncertainty ravage, so will the supply-demand mechanism of what the world depends on in Ukraine.

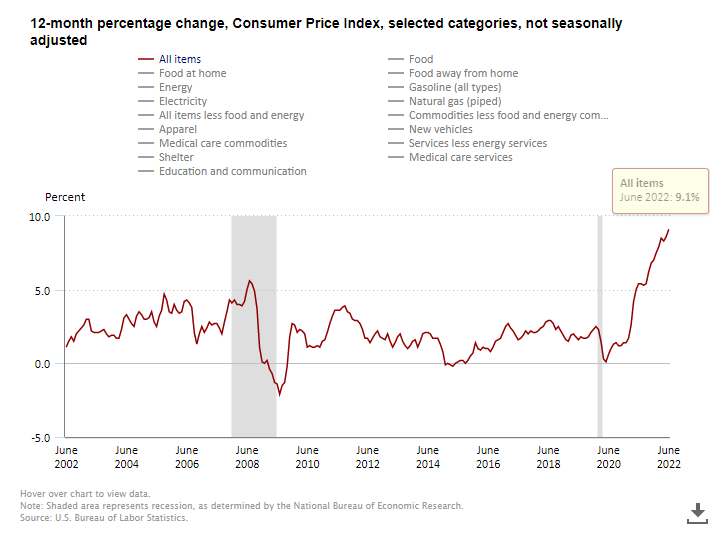

3. Stagflation is here

If you came across our article on inflation and stagflation, you would have noticed that by piecing the news from the US consumer price index (CPI) together with the Gross Domestic Product (GDP), stagflation is here.

Stagflation is an occurrence where prices of materials continue to go up without growth in GDP. A stagnant economy but ever-increasing prices of materials is never good for an economy.

Countering inflation usually involves a hawkish stance on rising interest rates. But with the economy already contracting, increasing the interest rates will not stimulate but rather further slow it down.

So to continue rising rates or maintain rates? It’s a balancing act that no one has seen before for a very long time!

4. Heightened geopolitical tensions

Most of us are living peacefully wherever we are. But a few years back, the US and China’s rhetorics aggravated to heightened levels. From chip sanctions, arrests of Chinese nationals and citizens of strong US allies have jittered the market from time to time.

This time around, with US House Speaker Nancy Pelosi visiting Taiwan, it has further ruffled not only the feathers of Beijing but also the global attention.

Regardless of which side you are on, the visit is seen as a provocation, and the world waited anxiously in fear of any unwanted outcomes.

China proved itself to be a gentleman, but would not be glad over the visit. Just like an ongoing real-life Game of Thrones, everyone tends to anticipate faceoffs whenever both powerhouses come so closely to each other.

Any misfiring or wrong steps, with either US or China catching a cold, the rest of the world will suffer together.

MyKayaPlus Verdict

The numbers do not lie. Growth has slowed down and has even shown signs of contraction. Inflation might have peaked, but more data is needed to justify that.

Even if inflation is quelled by the recent rate hikes, inducing GDP growth amidst an ongoing geopolitical fracas is close to mission impossible.

The worst might not be here yet. But that does not mean you should do nothing.

Sign up for our Kaya Plus Premium Club, as we are divulging our game plan for the rest of 2022. Learn how to analyze sturdy and growth stocks that pay you great dividends even in such uncertain times.

Also, learn to position your buying as some great technology companies have seen their stock prices correcting downwards.

It is now or never to ride on the next growth frontier for the next 5 years!