Inflation & Stagflation – What You Really Need To Know

Stagflation is perhaps the most common word we come across these days. Although its counterpart – inflation seems to be taking more limelight, there is a severe difference between them.

We might not be the best economists. But we will try our best to put things into perspective. And at the end of it, hopefully, you know the difference.

And why you should be very worried about where we are right now.

What is Inflation?

In straightforward terms, inflation is the devaluation of money or increase in the cost of materials. It is the “oh-this-used-to-cost-just-one-dollar-back-then” but now it’s more than that. It can be your roti canai or roti prata increasing to where it is today versus just RM1 or S$0.7 back then.

Some people resent inflation. I’d be honest. I used to back then.

But after understanding how things work in our world, I become appreciative.

Inflation increases the prices of things. But the reason behind good inflation is a growing economy and population. So long as people around the world work, and generate produces and outputs, salaries need to be paid out. Food needs to be laid out on tables to feed families. Hence, there is a need to print more money due to a growing economy. This is what we call built-in inflation, which factors in higher wages and thus, higher inflation.

Inflation too can be bad if it starts to go out of hand. When there is too much purchasing power, there will be subconscious demand-pull inflation.

Why is inflation such a big deal?

Inflation is a big deal. It measures how fast or slows an economy is growing. Or how fast and slow a currency is depreciating.

In a world where money can solve most of our problems, the power a currency yield is of utmost importance.

Too strong and it might be unfavourable for export-orientated countries. Too weak then the spending power of the people suffer. Thus, central banks and reserves around the world would have their own concerns and mechanism to monitor the inflation levels of their country.

How to control inflation?

Inflation can be controlled in a few ways. It ranges from target price controls, open market operations (buying and selling of Treasury securities), reserve requirements and discount rates.

But none more than other garner the most attention than the Contractionary Monetary Policy. The goal of a contractionary policy is to reduce the money supply within an economy by increasing interest rates. This helps slow economic growth by making credit more expensive, which reduces consumer and business spending.

The law of supply and demand applies too to the strength of a currency. Thus, increasing the interest and borrowing expenses will soften spending and soothe inflation worries. Conversely, decreasing the interest rates opens the floodgates to stimulate consumption and growth.

Hence, central banks or federal reserves have the golden key to make calls to either increase or decrease interest rates after monitoring the inflation data of each respective country.

What is Stagflation?

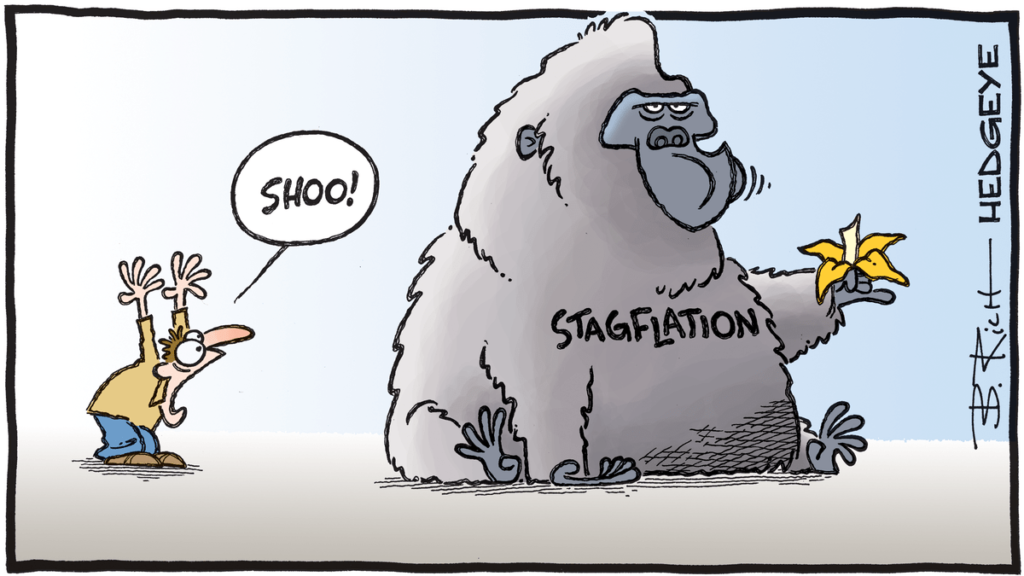

Stagflation, on the other hand, is a much more menacing animal. It combines the worse of 2 words – stagnant and inflation.

Inflation, if managed well and increases as expected, signifies economic growth and is necessary. But when there is stagnant growth and yet still inflation, this is where things start to get out of hand.

Even with stagnant growth, there could still be incidences of uncontrollable inflation. This can be due to various reasons, such as prolonged quantitative easing or major geopolitical events. Materials and commodities that keep the world economy running will experience price surges due to uncertainty.

It can also be due to a lopsided distribution of wealth and liquidity. Quantitative easing might resuscitate the general working class from falling into recession, but it also subconsciously makes the rich, richer.

Solving Stagflation is not straightforward

Solving inflation can be straightforward. Unwanted inflation can be nipped in the bud while skirting around recession easily through monetary policy. This means raising and lowering interest rates at the right time and pace, depending on the market conditions.

But now, with stagflation, how do you play the game?

Raise interest rates to curb inflation while jeopardizing economic growth?

Maintain interest rates to incite economic growth and stoke more inflation?

It certainly does not seem that straightforward if stagflation comes knocking. To be frank, no one would want to be sitting on the Fed’s chair calling the tough shots. It is a balancing act never seen before.

And whether it skews too much to stagnant or inflation, we would arrive at the same unwanted outcome – a recession. However, it would not be the blip we saw during a pandemic. This time around, it would be a tough nut for everyone to crack.

Even though the markets crashed during COVID-19, most economic activities remained resilient. On top of quantitative easing, the markets staged a sudden bounceback on the back of flushing liquidity.

This time around, should recession hits, will be due to systemic market risk.

MyKayaPlus Verdict

Even if a recession looms, not all is lost. Mankind has experienced plenty of economic downturns throughout its civilization.

Equity markets have a long-running track record to come back better after every market downturn. Stocks are still fundamentally the best way to grow and compound our wealth.

However, the same cannot be said for cryptocurrency. Cryptocurrencies and their derivatives, due to their infancy, are just experiencing their first selloff. And with application and integration not reaching their full potential, it will be the first to fall.

Whether it survives an economic recession remains yet to be seen and verified.

Just because it went to the moon, it does not mean it will not come crashing down back to earth.

A larger stock exposure and allocation towards equities would definitely help ensure an investor escape unscathed when things recover.

p.s. if you really want to take advantage of the 2022 stocks selloff, we are actually sharing some of the best companies to look at as these companies are still solid. The recent selldown only makes it cheaper to buy more prior to recovery.

Head on to Kaya Plus Premium Club to take advantage of the 2022 Market Selloff!