Why The 2022 Market Crash Is Important To You?

There is a market crash. Let’s address the elephant in the room.

This crash is a bit of an antithesis of versus what happened last year. Even though the markets were choppy and volatile for the past 2 years, big tech flourished.

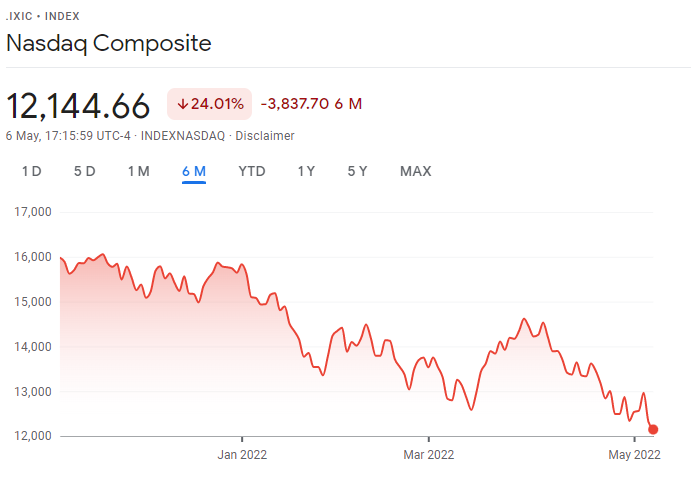

This time around, tech companies got their worst selloff. The NASDAQ Composite is officially in the bear territory since it has already fallen 20% from its height.

Back then, with Cathie Wood’s ARK funds showing out of the world returns, retail investors hop on to the tech and hypergrowth wagon. Funds and stocks that were in hypergrowth and tech were all in rage.

Everyone became a long term investor. Until the cracks of short term losses appear.

The recent market’s favour switch sides to “boomer” stocks, leaving tech languishing and in bear territory. Even though the selldown is tough, here’s why it’s important. Experiencing a full cycle of ups and downs will help us understand what kind of investor we are deep down.

Not just by mere luck and riding the upside momentum during good times. But also having the tenacity to survive the downside and the falling knife.

A few categories can accurately describe what you should do with your wealth and funds after experiencing a full bull and bear market during the latest selldown.

1. The Market Pantophobic

Investment knowledge: ☆☆☆☆☆

Volatility appetite: ☆☆☆☆☆

Patience: Unknown

Ideal investment products: Unit trusts & mutual funds with little to no withdrawal flexibility

This is a group of people that have a severe fear of investing their own money in the stock markets. Their fear of a market crash could be due to inexperience, or a long-lasting post-traumatic stress disorder caused by previous market crashes.

They cannot withstand even a thread of floating losses. And will always be looking at their watchlist not knowing what to do. Or worst still, holding onto losing stocks and businesses for a foolish hope of a rebound.

Due to the inability to make sound decisions, the best investment for this category of investors will be unit trusts and mutual funds. The flexibility of Robo advisors will not serve them well too, as they tend to be loss aversive. Any signs of losses plus the flexibility to withdraw their capital will exacerbate their capital.

2. The Newbie

Investment knowledge: ★☆☆☆☆

Volatility appetite: ★★★☆☆

Patience: ★☆☆☆☆

Ideal investment products: Robo advisors and blue-chip stable companies & index funds

The Newbie investor is the first ascension path of all great investors. They have a basic understanding of how the stock market works. They know how to operate their brokerage account, and know where to find important information.

Often, they might not fully comprehend and connect the dots of the info obtained. The daily price fluctuations do not really worry them. Their biggest weakness is the inability to fact check and analyze information.

They know the good and bad companies. Sometimes their appetite for volatility and sudden upside gains might lead them to make greedy decisions. But when a correction beckons, they too will suddenly be lost of what to do next.

The Newbie will make mistakes in his investment journey. And that is part and parcel of learning. If the losses do not break them, they stand to ascend to the next level in their investment journey. The ideal investment products for the newbie include robo-advisors and blue-chip stocks. Robo advisors will help new investors understand more about portfolio allocation. Blue-chip companies on the hand will provide the much-needed mental strength reassurance and training when the overall market tank.

p.s. If you need to signup for a StashAway account, head to the link below depending on where you are from to get you started.

Malaysia StashAway Signup Link

Singapore StashAway Signup Link

3. The Common Sense Investor

Investment knowledge: ★★★☆☆

Volatility appetite: ★★☆☆☆

Patience: ★★★★☆

Ideal investment products: Robo advisors, blue-chip stable companies & index funds

The Common Sense Investor understands the game of the capital markets. This is more than just what goes up must come down, rebound, correction. They know clearly how to distinguish a good company from a great company. Common sense investors also know how to stay away from stock tips that might be traps as well.

They have patience. And they are also aware that staying invested for a long term period will yield them returns that surpass unit trusts and mutual funds. But, they might prioritise other aspects of life more than spending it on studying reports. Taking care of the family, or working overtime might take up the bulk of their time, but investing is still a must.

Hence, channelling their wealth into proven products and companies that will eventually help them grow their wealth will be the go-to option. They might not see any multi-baggers in their portfolio, but they should see their returns turning out pretty well as long as they retain their common senses.

They might not have a clear blueprint for distinguishing a great company from a good company. Hence, they might not be able to make the best decisions to increase their returns.

p.s. a subscription channel that offers them the best of dividend and growth investing would cut short the time needed to make any investing decisions. If you need more time but still vital information, do check out Kaya Plus Premium Club!

4. The Income Investor

Investment knowledge: ★★★★☆

Volatility appetite: ★★☆☆☆

Patience: ★★★★★

Ideal investment products: Blue-chip stable companies & dividend index funds

These are a class of investors that prioritize cash above all else. They might be less receptive to loss-making companies. But when it comes to cash-printing businesses and bargains, their eyes lit up immediately.

They understand that great dividend stocks need time to grow. They also understand that not even the wisest can time the market. But they are wary of what and how much to pay. They might have relatively higher cash to investment ratio. But when there is really blood on the streets, they will go after the big and mega-cap dividend-paying prey.

Focusing on a proven business model that pays dividends, means that they go the extra mile to profile and analyze similar companies from the same industry. They can clearly distinguish great dividend companies from normal ones. They would fork out a premium to buy the better horse, as great dividends are always generated in the long run.

5. The Growth Investor

Investment knowledge: ★★★★★

Volatility appetite: ★★★★☆

Patience: ★★★★★

Ideal investment products: Growth companies & hypergrowth companies

This class of investors had gone to the moon even before crypto bros invented “to the moon”. The word of choice when talking to a growth investor is “bagger”.

A one-bagger is a stock that goes up by 100%. A two-bagger is a stock that goes up by 200%.

If there is a stock that goes up by multiple 100%, then it’s a multi-bagger.

Stocks can purely go up by 100% due to luck. But if a stock can go up by a few hundred per cent, credits need to go to the stock picker.

Having the knowledge and understanding of the company and industry, on top of an unwavering belief of the company even during bearish periods.

Last but most importantly, having the patience to ride the first 100% and still hold on.

Their ability to spot gems, and make a calculative bet on top of being diligently waiting for the company to grow by multiple times is the true epitome of a growth investor.

Even with the latest crash, they feel excited more than fear. Because the multi-bagger experience will just get better when everything recovers.

MyKayaPlus Verdict

Not everyone will make it past the 3rd stage, which is to be a Common Sense Investor. We live in a world of capitalism. As long as great businesses and economies grow, the cream of the crop will definitely continue to be better as times go by.

Thus, it really does no harm to either invest in an index fund, or let the professionals grow your wealth for you. Nothing in this world is free, let alone fantastic investment returns. If you are not willing to work it out, best leave it to someone else who will do it for a fee.

Again, if you really want to up your investing game, and want to master the art of income investing and also hypergrowth investing, we created the best experience for you!

We see the best sides of both dividend and growth investing, and have put what we learned into practice. It is a blueprint that will serve everyone well if they really have the initiative to work on it.

If you really want to make a difference before the year comes to an end, we challenge you to make a change for yourself.

Join us in Kaya Plus Premium Club, and start to invest in dividend and growth stocks the right way.