Why Singapore REITs Are Better Than Malaysia REITs?

REITs are important investments assets that play significant roles from an income play perspective. Great REITs not only generate perpetual growing distributions, but they also can see significant capital gains as well.

However, when it comes to finding great REITs, you would find more opportunities in the Singapore stock market. Malaysia REITs can offer good returns, but the quality and prospects are nowhere close to Singapore REITs.

Why are Singapore REITs are so prospective versus Malaysia REITs? Here are 5 points to prove our argument.

This is a Premium Club Premium article made free to view for the public. Sign up for our Premium Club subscription to get premium analysis, articles and also access to Stock Plus 2022

1. Superior track record

Track records play a significant role in dividend and income investing. And things look crystal clear when the iEdge S-REIT index is compared against Bursa Malaysia REIT Index.

Over the past 4 years, the iEdge S-REIT caps an overall return of 10.31%. The Bursa Malaysia REIT index, on the other hand, is down by 25.69%. Both REIT indices got impacted during the peak of the pandemic and are still below their historical high.

However, the S-REIT index has overall rebounded from its COVID-19 selldown while M-REIT is still languishing at historical lows.

Even prior to the pandemic, the S-REIT index has been on a stable uptrend. M-REIT, on the other hand, has been trading sideways for a long period of time. If trends and track records continue to pan out, S-REITs will show more growth and prospects than M-REITs.

2. Quality and Quantity

In most circumstances, quality and quantity are mutually conclusive. But for S-REITs, the Singapore Stock Exchange is blessed both by the abundance and quality of REITs.

As of to date, there are 44 listed S-REITs, while there are only 18 M-REITs. With more than 2 times the quantity of REITs listed on SGX, investors will be torn for choices in finding world-class REITs for their long term holdings.

Also, with 5G and cloud themes rampaging, S-REITs are also home to some of the world’s best in class data centre REITs (DC REITs)

3. Favourable tax incentives

Tech and growth stocks might find the US markets as their choice of listings, but when it comes to REIT IPOs, Singapore ranks as the best market for a public float.

This is due to the fact that the US markets usually provide superior market liquidity and participation. But when it comes to REITs, market regulations, especially taxation, make Singapore a better choice for REIT listings.

REITs listed on Singapore Exchange (SGX) are granted tax transparency treatment generally on rental and related income from Singapore properties.

Those investing in foreign properties, (including the REITs’ wholly-owned Singaporeresident subsidiaries) are currently exempt from taxation on certain foreign income derived with respect to those properties acquired.

With clear and transparent tax incentives, Singapore finds itself as the de facto market for IPOs of REITs on a global stage.

What you see reported as a distribution by an S-REIT, is what you get. For M-REITs, the withholding tax is at 10%, even if you are a Malaysian resident.

4. Significant outperformance of S-REITs versus M-REITs

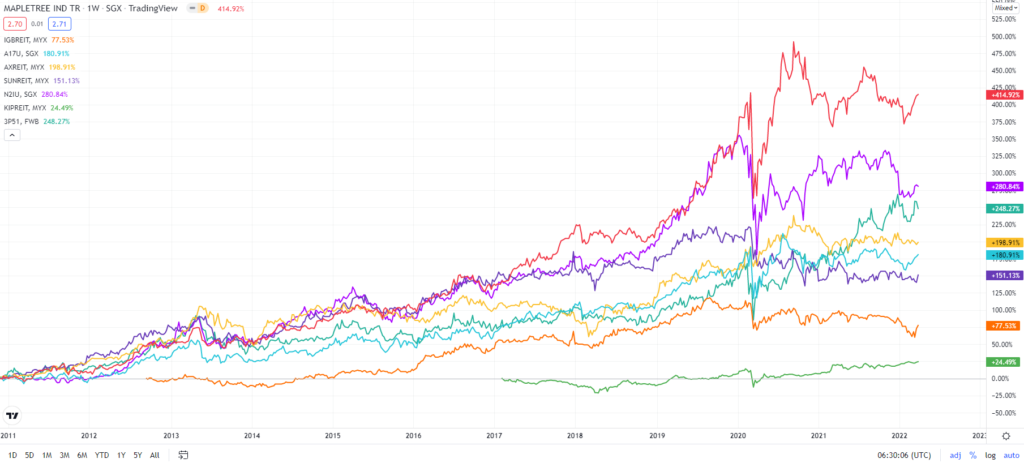

By cherry-picking and comparing the best S-REITs against M-REITs, S-REITs overall show a significant outperformance.

Below is a table summary of the 10-year returns, inclusive of distributions of the top S-REITs and M-REITs, dividends adjusted.

| REIT | 10-Year Returns | Country |

| Mapletree Industrial Trust | +396.37% | Singapore |

| Mapletree Commercial Trust | +280.84% | Singapore |

| Parkway Life REIT | +244.81% | Singapore |

| Axis REIT | +209.68% | Malaysia |

| Ascendas REIT | +180.91% | Singapore |

| Sunway REIT | +158.86% | Malaysia |

| IGB REIT | +77.53% | Malaysia |

Even when we shorten the horizon to 5 years, S-REITs still report a higher return on average than M-REITs.

| REIT | 5-Year Returns | Country |

| Mapletree Industrial Trust | +120.39% | Singapore |

| Parkway Life REIT | +99.14% | Singapore |

| Ascendas REIT | +78.07% | Singapore |

| Mapletree Commercial Trust | +66.88% | Singapore |

| Axis REIT | +44.76% | Malaysia |

| IGB REIT | +27.53% | Malaysia |

| KIP REIT | +24.49% | Malaysia |

| Sunway REIT | +4.05% | Malaysia |

No matter if it’s for a long term or midterm horizon, S-REITs have proven to outperform their peers in Malaysia significantly. The longer our time horizon, the more certain we are on S-REITs outperforming M-REITs, compounding our returns.

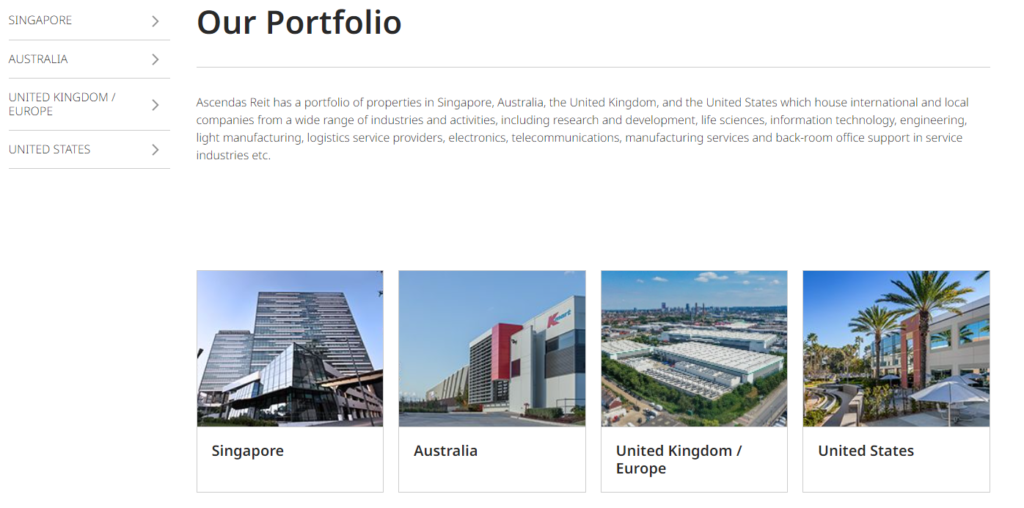

5. World-class & International

S-REITs are not just home to some of the world’s best real estates companies and REITs. Over the years, it has also attracted plenty of other well-known REITs to seek listings over here.

Access to the Singapore stock exchange means access to the world’s best REITs. This can be local home grown REITs or REITs with international exposure.

Just last year, Japanese real estate company Daiwa House Industry Co., Ltd. (TYO: 1925) chose to list its latest REIT – Daiwa House Logistics Trust (SGX: DHLU) on the Singapore Exchange. During the same period, data centre experts Digital Realty Trust, Inc. (NYSE: DLR) too have chosen Singapore to spinoff their portfolio, under Digital Core REIT (SGX: DCRU).

On top of that, the local homegrown REITs too have overseas and international exposure in terms of their property portfolios. Ascendas REIT (SGX: A17U), Singapore’s largest REIT, has around 200 properties spanning Singapore, Australia, Europe and the United States.

As for M-REITs, the only REIT listed that has properties out of Malaysia is YTL Hospitality REIT. Hence, any negative sentiments and macroeconomic factors of Malaysia will surely put a dent on M-REITs’ growth and prospects.

MyKayaPlus Verdict

If investing is all about buying the best companies (and REITs), the S-REITs have proven to be the no-brainer candidates when compared to M-REITs.

A favourable and transparent tax regulation will only drive more REITs to seek public listing on the Singapore stock market. And as strong supporters and investors of S-REITs, it won’t be a surprise to see S-REITs continue to outperform M-REITs even by a larger margin.

With a variety of online brokerages easily available now, you can get access to the best REITs around the world just by signing up for an account digitally.

And if you are curious to find out the best REITs to compound your wealth, do join us in our upcoming Thematic Transcripts: REIT Raids as we will deep dive into more data, info and metrics. Take the opportunity to change how income investing should be like, by investing in the best available S-REITs available.