Bye Hyper-growths, Welcome Staples?

Hyper-growth stocks were the darlings of the stock market for the past few years. The heavy focus and outperformance of some investors have amped up the gains and publicity.

Hyper-growth stocks tend to be small but upcoming scalable companies that have grown miraculously during the pandemic. The urgency back then for businesses to transform during a worldwide lockdown, opened up opportunities for tech companies to grow at a scintillating pace.

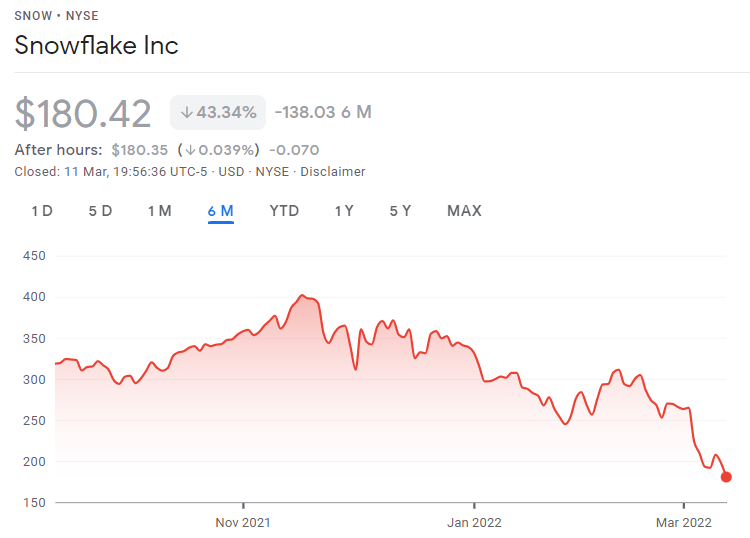

However, with the recent shift in macroeconomic sentiments, investors with a skewed portfolio would find themselves in a precarious situation. Simply name one hyper-growth they would be easily down by at least 30-40%.

This is a Premium Club Premium article made free to view for the public. Sign up for our Premium Club subscription to get premium analysis, articles and also access to Stock Plus 2022

What is a Hyper-growth Stock?

Hyper-growth stocks, sometimes called super stocks, are companies that have disruptive technology and growing at breakneck speed. The growth rate of topline per annum can be in the ranges of triple digits, accompanied by widening losses as well.

Although widening losses and with no road to profitability, this class of stocks found favour in growth investors. Hyper-growth especially those from the SaaS or internet-related businesses saw their stock prices triple and more.

These companies usually come riding on new waves of technology or approaches. It can be either transforming the digital payment industry, productivity at work, or even changing the digital finance landscape.

Seeing the stock price of hyper-growths going up in multiples in short time frames eventually entice more and more investors to up their risk levels. Who does not want to see their wealth multiply within a shorter time frame?

Pandemic induced low interest rates

Even from a productivity point of view, most of us holed up in our residences can still fulfil our job deliverables. Work from home was the default way of operating. Traditional companies found themselves making a hard switch to survive during a period of no face to face interactions.

Video conferencing, cloud storage, digital signatures, all stimulated electrifying growth rates to companies within this sphere and expertise.

It seemed like a no brainer that these companies are poised for higher growths as interest rates nosedived to ensure the global economy remained resuscitated, while also ensuring capital is flushed to fuel more growth and valuation of these companies.

Disappearing Catalyst and Rising Interest Rates

Back then, it seems almost impossible to see the end of the tunnel when COVID-19 ravages across the globe. So long as COVID-19 is not beaten, things should stay as it was, which ensures hyper-growth continue to grow.

Fast forward to today, even though COVID-19 remains far from eradication, vaccines have helped push back the fight. Governments all around the world are more focused on the impending enemy after long periods of low-interest rates – hyper-inflation.

For most of the working classes, the eutopia of working from home did not persist forever. In reality, most of us find ourselves back at the office. Even some pre-pandemic ways of getting work done seem to slowly return as fear of the pandemic subsides.

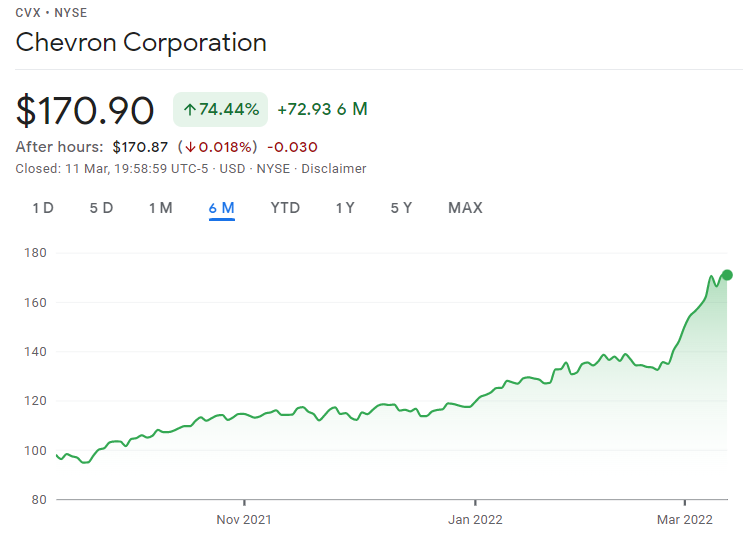

With hawkish stances all around the world, hyper-growth stocks might still be in business. But their lofty valuations came crashing down. The old school businesses, dubbed the staples, conversely see huge gains.

Commodity related companies, especially oil and gas, have seen bigger share price appreciation on top of escalating oil prices.

MyKayaPlus Verdict

It is no easy feat to time and balance our funds actively as the tides ebb from one sector to another. The markets can be finicky when macroeconomics and geopolitics become factors to consider in valuing a business.

That said, a highly skewed portfolio, be it towards any particular sector, might not be the best way for investing. If it is all for the greater good of reaping the upside of being patient on potential companies, such investing thesis might still hold ground.

But if you find yourself nervous about your portfolio’s widening loss, it is solid proof that you have bitten off more than you can afford to chew. What might seem like a no-brainer buy a few years back might not be the case today.

For us, it is always a balanced portfolio to withstand any shocks and unexpected scenarios. Potential upsides should not be unnecessarily jeopardized by a sector related risk. Quality hyper-growths would still grow and compound well given enough time. But the thought of having a portfolio full of hyper-growths with no idea how to rebalance does give us shudders.