Why A High Dividend Yield Could Be Dangerous In Investing

A listed company’s main objective is to grow its business and earn more money.

As money and profit grow, there are two things that the company could do with the earnings. The earnings can be reinvested for further business expansion or working capital. But the management can also distribute part out the earnings to shareholders. A profit-sharing in the form of cash payment to shareholders is called a dividend.

Income investors look at companies that consistently distribute dividends with good yields. Dividends are a form of passive income return. The payout range from once every quarter, half-yearly or yearly. There are investors living off dividends as their main source of income after accumulated growing investments along the years.

The usual form of measuring a dividend return is via the Dividend Yield (D.Y.). By dividing the dividends received against the current share price, we are able to find out the yield or return.

Of course, the higher the dividend yield, the higher indication of an investment return. But, a high dividend yield happens under 2 scenarios: 1. Increase in dividends received 2. Decrease in share prices

If you are getting a higher dividend yield at the expense of falling share prices, this particular investment might not give you the positive return you are looking for.

Let’s look at one example here using HEKTAR Real Estate Investment Trust (KLSE: 5121) with historically increasing dividend yields. HEKTAR REIT is a retail REIT that owns shopping malls like Subang Parade in Subang Jaya and Mahkota Parade in Malacca.

From 2016 to 2019, HEKTAR REIT achieved a slow but steady increase in gross revenue. But net income per unit actually decreased -23% during this 5 year period. Net distributions per unit have also fallen by 26%!

A decrease in net income will usually result in the share price fall over the years. HEKTAR REIT reported decreasing net income and distributions per unit. Hence unit price has been falling faster than the distribution fall. This illustrates increasing dividend yield trends, a good 17% increase over the period.

Hence, even though sporting high dividend yields, it is a clear sign to stay away from it due to the decreasing profits and payout.

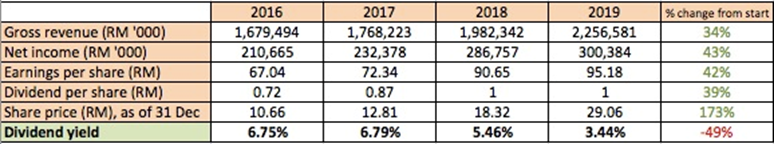

On the flip side, let’s look at an example of a stock that has falling dividend yields. For this instance, we will be looking at Carlsberg Brewery Malaysia Bhd (KLSE:2836).

Carlsberg Bhd has achieved a consistent increase in gross revenue. Net income and Earnings Per Share (EPS) reported high growth % than revenue growth. The drastic growth in profits actually drove the share price up by 173% in the span of 4 years.

In this example, share price appreciates at a faster rate than dividends declared. This cause the dividend yield to reduce. The dividend yield almost halved despite more increasing dividends year on year. Investing in Carlsberg Bhd 4 years ago not only gave more dividends every year, and share price also saw a steep increase.

MyKayaPlus Verdict

A company’s dividend will tag along with its business growth. So does the share price. Solely looking at a dividend yield would be a costly mistake to commit. It is better to go for a reasonable but steadily growing yield return.

Otherwise, choosing high trailing dividend yields caused by falling share price would eventually end in a loss in falling share prices.