3 Things That Went Wrong For AirAsia X Bhd Q2’19

On the 22nd of August 2019, AirAsia X Berhad (AAX Bhd) published its second-quarter report. And it wasn’t good to be frank.

However, rather than pinpoint the main root cause of what caused the quarter loss, it would be wise to also gauge the report holistically. Here are things that did not go well for AAX Bhd:

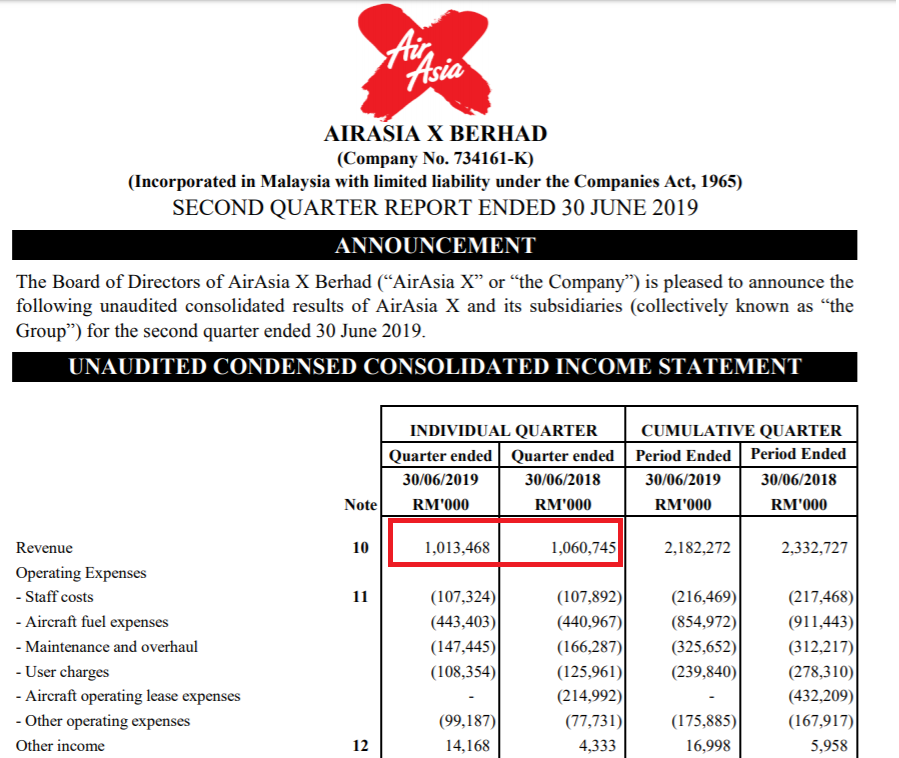

1. Lower revenue

The basic rule of thumb of a business is always growth. The magnitude of it could be debatable. But AAX Bhd recorded not only lower revenue quarter on quarter (QoQ), it also recorded a lower revenue from its predecessor quarter. But a quick check reaffirms that the 2nd quarter is always a weak quarter for the airline company (seasonal performance).

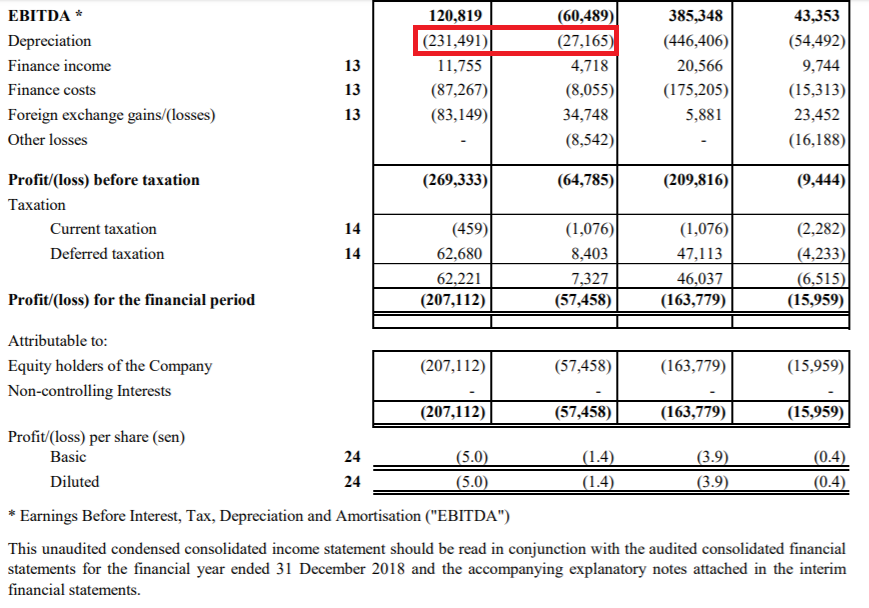

2. Higher depreciation

As of Jan 2019, MFRS 16 states that assets that are leased to run operations are considered as Right of usage assets, and depreciation of such assets have to be considered as an expense to AAX Berhad.

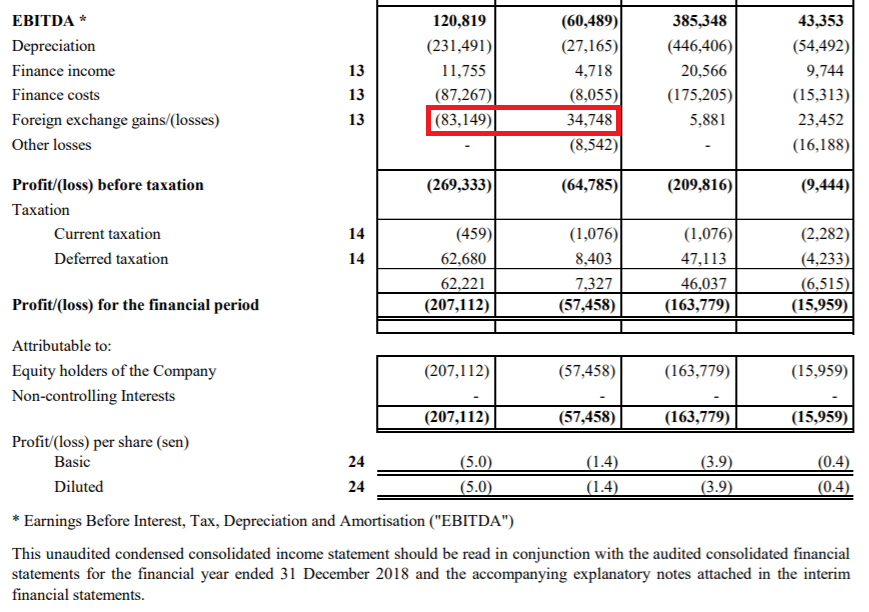

3. Forex Losses

Due to the weakening Malaysian Ringgit, AAX Bhd suffered around RM 83 million of foreign exchange losses. Do note that the majority of AAX Bhd’s borrowings are denominated in USD, so any further weakening of the Malaysian Ringgit would squeeze the profit margins.

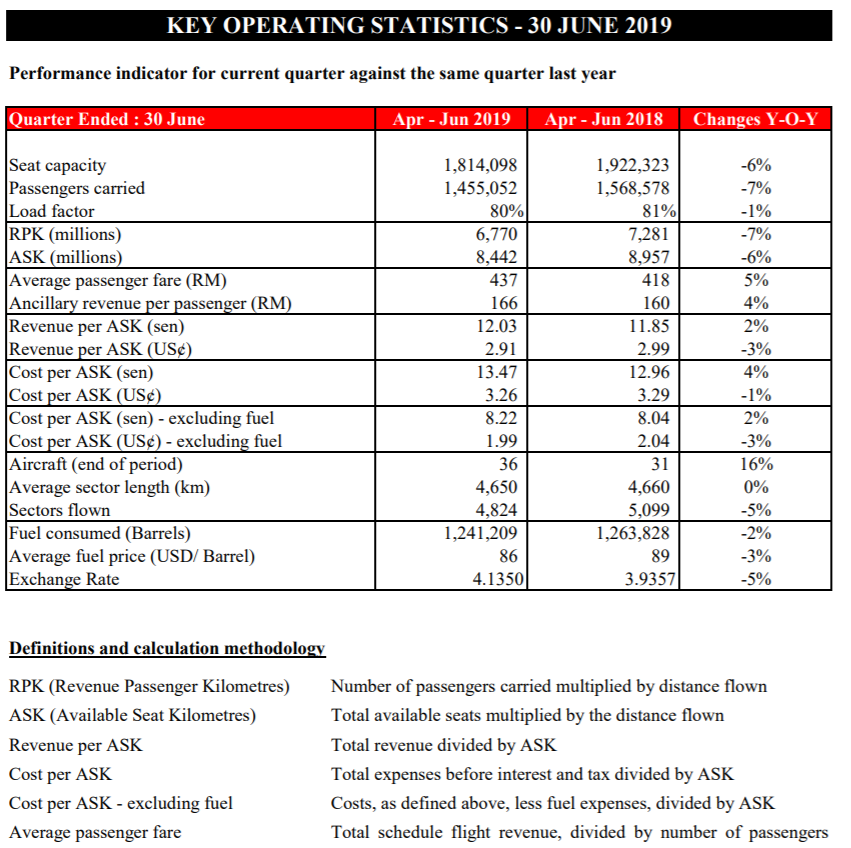

Review of Key Operating Statistics

Passengers carried edged lower by 7%, which is in line of the QoQ reduced revenues. But other than the reduced passengers compared QoQ, we believe that other measures are still in check and in place.

Upcoming Future Prospects

AAX is well aware of the headwinds it is facing currently. Efforts will be put in to secure more revenue and ancillary services to mitigate higher operational costs. But it is also worthwhile mentioned that there is a slowdown of growth in the tourism sector. This challenge will be countered by shifting upcoming flight capacity to other more performing core markets.

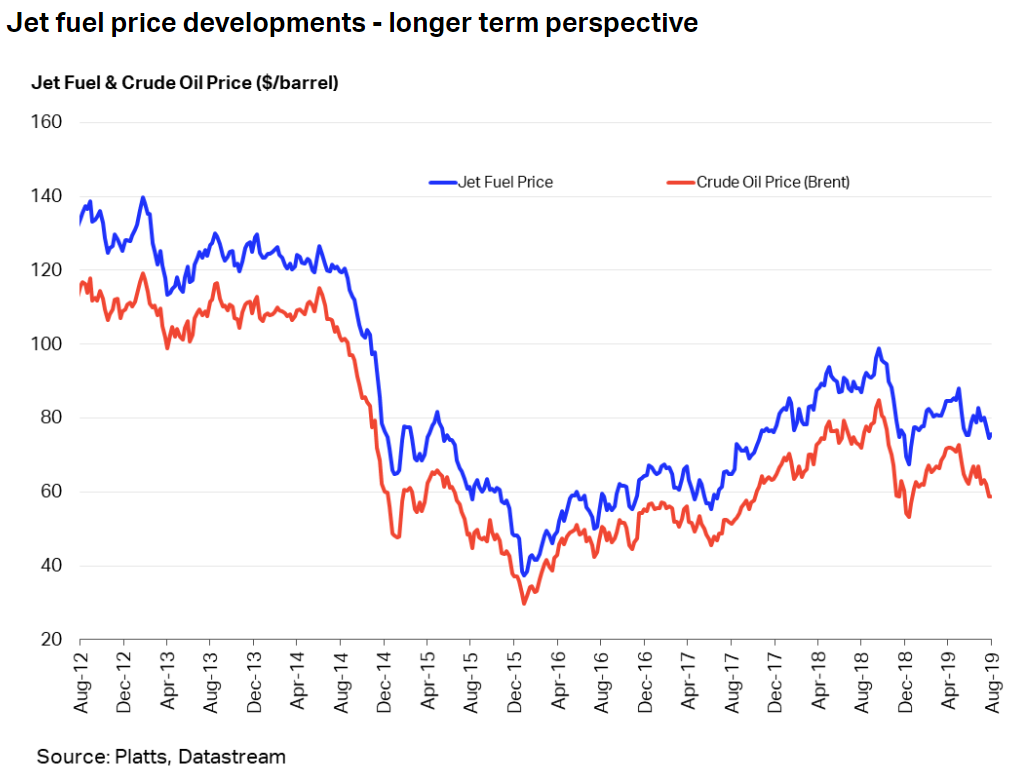

One key factor not mentioned that could exacerbate AAX Bhd’s profits further will be fuel costs. Fortunately, fuel costs have been surprisingly stable for the year 2019 till now. A drop in fuel price would definitely lift some burden off AAX Bhd’s heavy shoulder, while a sudden surge would definitely harm the company’s upcoming operations and profits.

Do you think AAX Bhd will be able to turn the tide around this time round?

Let us know in the comment section!