The Inverted Yield Curve. The world’s favourite words at the moment.

Chances are you are confused if you do not have financial background.

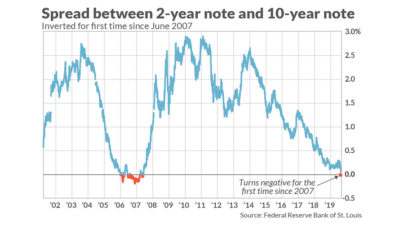

In its very own words, an inverted yield curve plots the return rate of a 2 year government bond return v.s. a 10 year bond return.

Under very normal circumstances, a 10 year bond return should give a higher return than a 2 year bond return. Just like your fixed deposits giving a better return per annum (p.a.) because you are force to keep the money longer.

The yield curve becomes inverted when your normal savings account is giving more return than a fixed deposit. That’s like the banks telling you “Oi, too many people are putting too much money in FD. If I continue paying 4% interest rates p.a. to you guys I will go out of business. I am going to reduce the interest rates of fixed deposits!!”

Fun Fact: There are actually banks in some countries that are charging negative interest rates! That means you are actually losing money if you deposit money into a bank!

Think about it. When the market is bullish, people believe that price will go up, and tend to buy more, pushing up the prices. You have high belief that prices will go up. You buy with the intention to profit in the span of a few days to few months or few years.

Then suddenly, everyone thinks it is impossible for equity prices to go further up. Everyone becomes cautious. Suddenly switching to buying 10 year bonds instead of plowing funds into the share market.

Just like being skeptical of Man City and Liverpool’s performance in the 2019-2020 Premier League season…

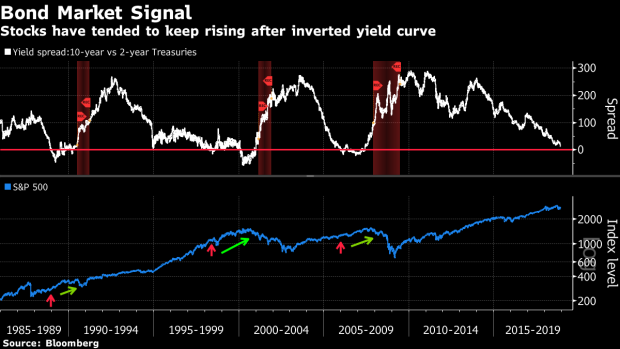

While there are circumstances, where an inverted yield did manage to come before the subprime mortgage crisis, it is not a 100% guarantee prediction of a recession and market crash

While we do not deny an inverted yield shows that the broader public is more fearful than greedy in the near term, as investor we should step back and devise a suitable investment strategy to navigate through such uncertain times.

The best thing an investor should always do is to stay invested. But do tweak your investment to cash ratio accordingly.

Stay hungry and stay vested!