7 Things You Need To Know Before Investing In ThaiBev PCL (SGX: Y92)

Thai Beverage Public Company Limited, or more commonly known as ThaiBev (SGX: Y92) is a Thai fast-moving consumer goods company. The company’s operations are mainly in Thailand and the Indochina region but it is listed on the Singapore Exchange.

Here are 7 things you need to know about ThaiBev before you consider investing in them.

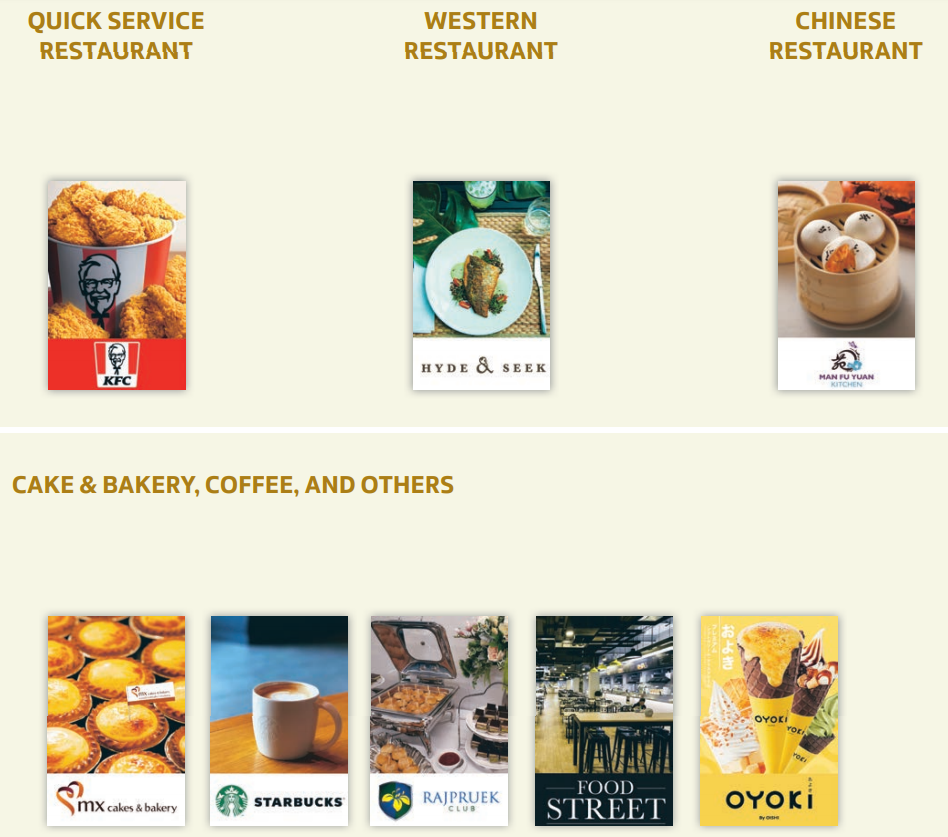

1. It is a diversified Food And Beverage Company

ThaiBev is well known for its signature Chang Beer. But it is not a pure brewery business. It has also chains of restaurants offering Thai cuisine, Western food and Asian cuisine.

It is also the master franchisee of the Kentucky Fried Chicken and Starbucks chains in Thailand.

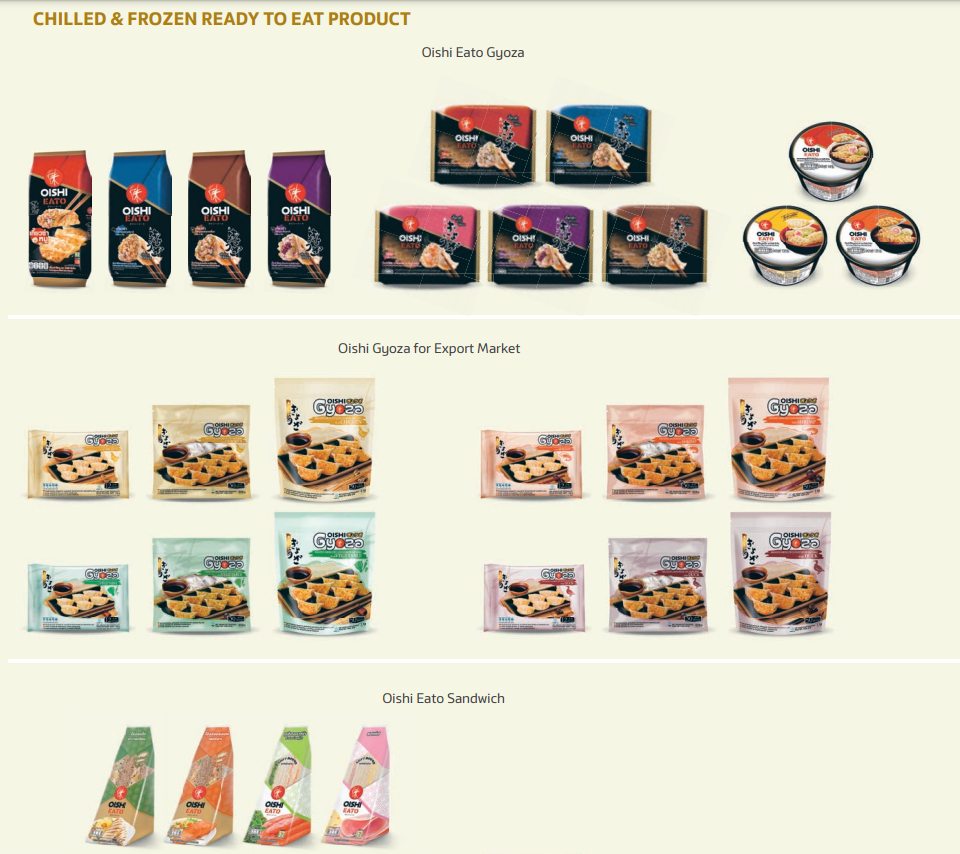

Not only that, it has also launch frozen food and ingredients under its Oishi brand.

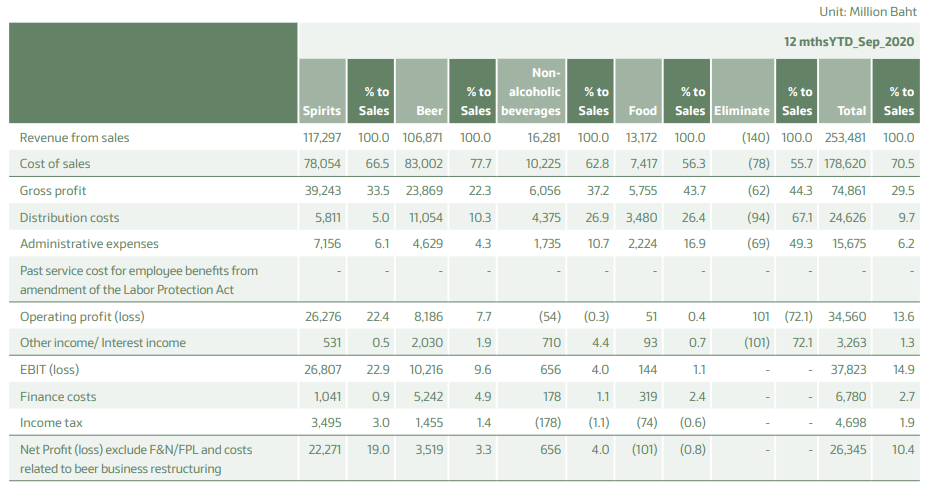

2. Famous For Its Chang Beer, But Spirits is The Main Profit Contributor

Most of us know Chang beer as an iconic brand of ThaiBev. But, it is their Spirits business that is contributing a major amount of their profit. Their spirits business accounts to around 85% of its core operating FY 2020 net profit (excluding F&N/FPL and other one-off costs)

3. It Owns a Diversified Portfolio of Spirits

Most of ThaiBev’s spirits brands are famous only in their local markets. Brands like Mekhong, SangSom, Hong Thong, Mungkorn Thong, and Blend 285 dominate the local spirits scene.

But for an international presence, ThaiBev also has a collection of Scotch brands. Its brand portfolio for Scotch includes names like Old Pulteney, anCnoc, Speyburn and Balblair.

Not to also mention, it also owns a Myanmar based whisky distillery Grand Royal Group and a Baijiu distillery Yu Lin Quan.

4. It owns 53.59% of Saigon Alcohol, Beer and Beverage Corporation (SABECO)

SABECO is South East Asia’s largest beer brewery. But when ThaiBev acquires a major stake in SABECO in 2019, the brewing capacity of SABECO plus ThaiBev’s brewing capacity catapults ThaiBev to the largest beer brewery in South East Asia.

Now, ThaiBev is also tapping on the potential beer consumption growth of the Vietnamese population with the SABECO acquisition.

5. It owns 28.4% of Fraser & Neave Limited

After successfully building its own spirits and beer vertical, ThaiBev wanted to diversify out from its alcohol heavy reliant business. In the year 2012, ThaiBev acquired a majority stake in Sermsuk Public Company Ltd. and Fraser and Neave, Limited. With F&N Limited, ThaiBev opens up a new growth funnel as the company is already having a wide variety of products and a huge brand presence in Malaysia and Singapore.

Not only the F&N Limited acquisition diversified the products segment offerings of ThaiBev, but it also offered the opportunity to diversify geographically.

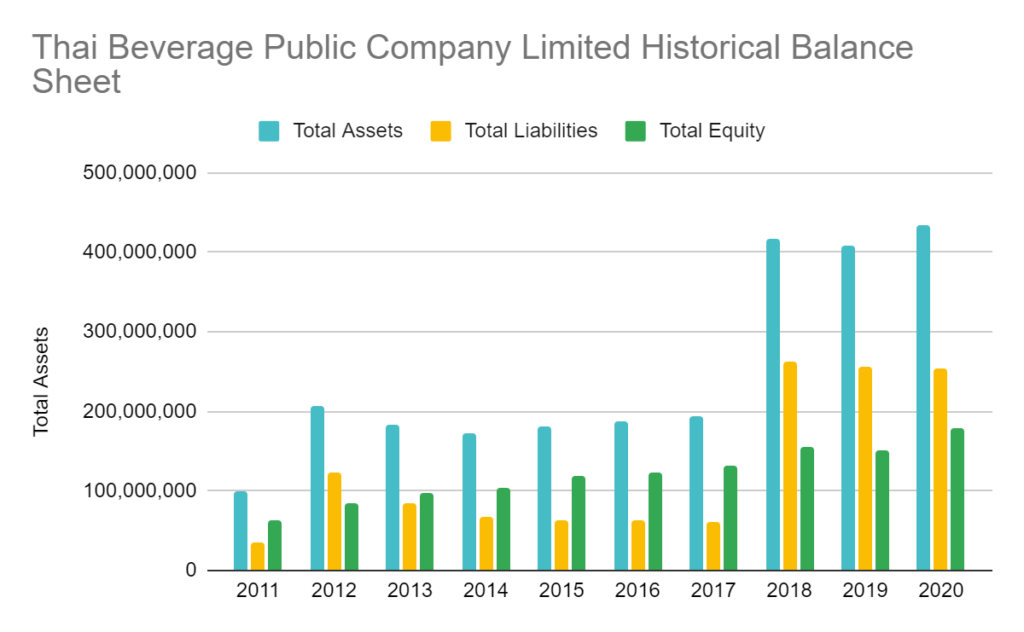

6. Its Balance Sheet is Highly Geared

ThaiBev’s balance sheet is not for the faint hearted. Total assets increased as the company has been on an aggresive acquisition spree for the past 10 years.

However, moving in tandem with the company’s total assets is its total liabilities, specifically debt. ThaiBev has been funding its acquisition mainly via debts. These debts are a collection of bank borrowings and debentures. So investors might be spooked by the high debt and leveraged position that ThaiBev is currently in.

7. Revenue is growing, but profit is not

ThaiBev’s aggresive acquisitions paid off as it managed to break a flattish growth period during the early 5 years period for the latest 10 years. Its revenue surged close to 100% after successful optimization of its acquisition of F&N Limited, Sabeco and others.

But profits remain flattish, as most of ThaiBev’s acquisitions are funded by debt. The financing costs incurred increases in tandem with its increasing debt, hence preventing growth in its profits even though revenue is growing.

MyKayaPlus Verdict

ThaiBev is truly an exciting growth company. The management has been very consistent with their approach of growing their exisitng verticals but are als not afraid to building new business verticals.

However, some retail investors will definitely feel uneasy with the high leverage that ThaiBev is currently in. But rather than dismissing a highly leveraged company, perhaps it is wiser to look deeper into its cashflow activities?

Click here for a more detailed fundamental analysis of ThaiBev.

Is ThaiBev a dividend stock in the making? Well, our Dividend Gems might help you decipher this question!