What You Need To Know About P2P Lending and Stock Investing

We cannot deny that investment opportunities these days have gotten easier and easier. As of today, there are multiple ways for an ordinary person to grow their wealth.

I still remember back then in the older days, when internet was not publicly available (or even invented), my mum used to check stock prices on the television, and then would need to call up her remisier, giving instructions whether to buy or sell a stock. Nowadays, anyone can buy or sell a stock at ease on a trading platform with internet connection. Not only that, there are plenty of channels apart from stock investment for us to generate our wealth as of recently. One of it is Peer-to-Peer Lending (P2P Lending).

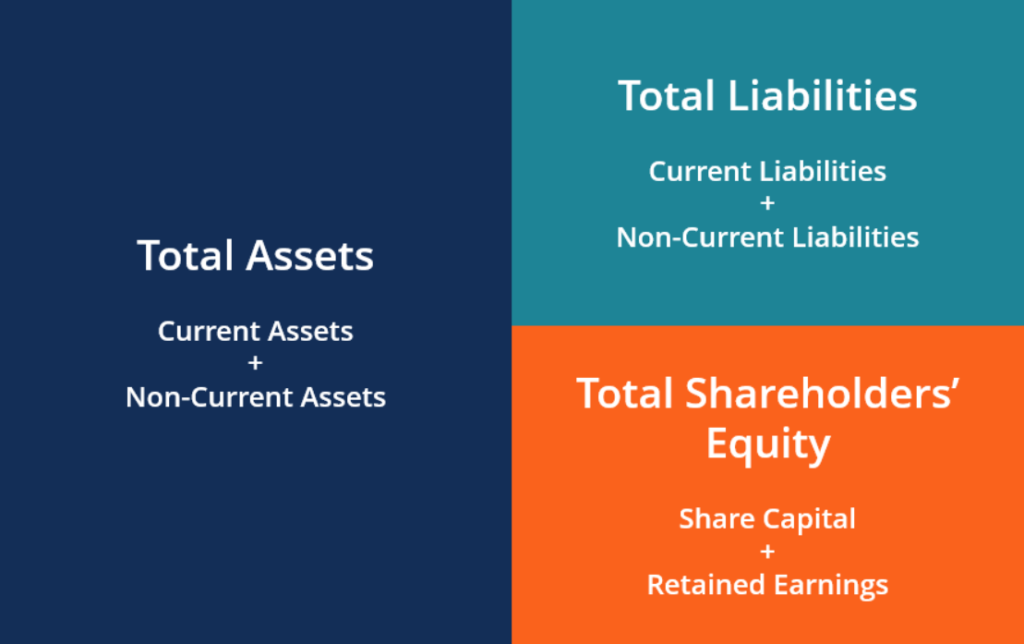

There is quite a misconception on P2P lending and stock investments. Both helps to generate returns but they are done in very different ways and come with different factors and risks. Before we go into their differences I would like to touch more on the basics first, debt financing and equity financing. And that leads us to our very fundamental accounting equation:

Assets = Liabilities + Equity

Assets are the items that a company requires to continue running a business. It could range from raw materials, cash, a factory, business offices and others. Of all the assets, a company needs cash the most, since cash is the world’s most recognized and accepted form of settlement.

Cash would be required for a myriad of reasons and purposes. It could be a small amount to pay back suppliers at a stipulated time for raw materials or services, or it could be a huge amount for capital expenditures (building new factories and buying new machinery for example)

So how does a company gets one lump sum of cash in a shortest amount of time possible? They either get it from borrowing (liabilities) or from issuing company shares (equity).

Equity financing can be a bit far off reach for small companies, since only companies registered as Sdn. Bhd. and Bhd. are only able to issue shares for equity financing. For smaller companies they usually get obtain cash under debt financing (which is borrowing cash from banks or licensed money lender).

But there are situations where small companies find it challenging to obtain bank borrowings due to multiple reasons. So P2P lending services is an alternative for them to obtain cash and liquidity.

P2P lending services is a platform which finds a willing lender (not the banks) to lend money to the company or party that requires money. As a token of appreciation, the borrower will then pays back the borrowed money + interests back to the lender. In essence, the lenders will assume the risk and reward by playing the role of a bank in a P2P lending scenario.

What are the upsides of P2P lending? Higher than normal interest rate returns. Risk free rate interest returns offered by commercial banks hover around 4% per annum (p.a.). So by being a lender, we stand to profit from a higher interest rate, which is agreed by both lender and borrower before a lender agrees to transfer his/her money to the borrower.

What is the biggest risk of borrowing money? A Default! A default happens when your borrower fails to pay up the stipulated payments as agreed in an agreement. Being a lender who is facing a default means you are facing a high possibility of not being able to collect back the money you lend.

So a quick recap back on liability financing and equity financing. When you lend or borrow money, it’s a liability. P2P lending is an atypical way to generate higher than normal returns from conventional bonds and notes, where big corporation or blue chip companies sometimes borrow money from the public with a low single digit return p.a. Inherently, by targeting a higher rate of return, the risk level will also elevates accordingly.

Compared to equity financing, an investor who buys into the share of a company becomes an owner of the company (not a lender). If the company does well and earns more, shareholders also stand to be rewarded more and vice versa if company does not perform. Where else a lender will collect a fixed and agreed upon interest % on the amount of money he/she has lend.

So in conclusion, below is a table comparison of the key differences between P2P Lending v.s. Stocks Investing

At MyKayaPlus, we truly believe that a holistic approach to scout, analyze, compare and strategize our investment portfolio to generate and optimize our returns. We believe with careful risks assessment, it is possible to negate the downside and risks of loss in a stock investment.

What do you personally think of P2P Lending and Stocks Investments? Let us know it the comment section below!