Good Investing Principles: 4 Reminders To Succeed In 2022

Good investing principles tend to be overlooked during investing. Putting aside the skill requirements on fundamental or technical analysis, principles govern the way we react in every market condition. It also helps us filter and optimize our thoughts and preferences on stock selection, exclusion and prioritization.

Good investing principles also help us make hard but accurate decisions. As humans, most of us will never be always right even with hours spent on analyzing and due diligence. Hence, here are 4 good investing principles as timely reminders, especially if you are an investor.

1. Growth and value investing are joined at the hip

In a time when hyper-growth stocks rally while staples crawl, it is easy to misunderstand and misuse this quote from Warren Buffett. At face value, it is easy to justify loss-making high growth companies as being valuable.

For the last 2 years, low-interest rates have encouraged plenty of investors to seek out high-risk high-return hyper growth stocks. The meteoric rise of Cathie Wood’s ARK Invest in the year 2020 has seen her crowned as the modern female Warren Buffett.

Fast forward to today, ARK Invest has tanked from its high to just a whisker’s away from Berkshire Hathaway’s returns. A shift in paradigm where the Feds tapering kicks in on top of a hawkish stance saw hyper-growth stocks tumbling down from their glorious days.

Growth and value investing are joint at the hip. Actual growth can miss estimates and lofty expectations. Just because a company has been growing rapidly, it should not assure it to continue growing at an accelerated pace. A pandemic induced catalyst is not a forever push factor for accelerated growth nor lofty valuations.

2. Manage the downside; the upside will take care of itself

One of Kaya Plus’ core principles when it comes to investing is to focus more on a company’s downside rather than its upside. A stock can only move in 3 directions – down, sideways and up. While stock technicians rely on a plethora of metrics to determine stock price movements, investors rely on due diligence.

In simple terms, we try to find as many faults as we can in a company. This includes companies that show bright prospects and are seemingly no brainer. Nothing is certain in the world of investing. Although great businesses do not fall overnight, it would be wise to check for cracks.

Will the plans to drop buying Arm play into the valuation discount of Nvidia Corporation (NASDAQ: NVDA)? Is their gross margin of 67%, which is lower than Analog Devices, Inc. as reported by the news a true concern?

Due diligence has been a virtue long gone missing. This is especially true in an age where valuation becomes more self-perceived rather than backed by fundamentals. But just because the tide is still high, does not mean you can swim in the waters nakedly!

3. Differentiate & determine the outperformer and underperformer

It is easy to justify hypergrowth companies’ widening losses with their growth. But when there are more than just 1 player in a similar industry, a simple comparison can help us differentiate between the outperformer and underperformer.

For example, Lazada’s YoY growth of its GMV to $21 billion might seem impressive. But when compared against its strongest competitor, Shopee, Lazada pales in comparison. Lazada might have grown its GMV to about USD 21 billion over the past 12 months, Shopee manages to do USD 56 billion in the same 4 quarters.

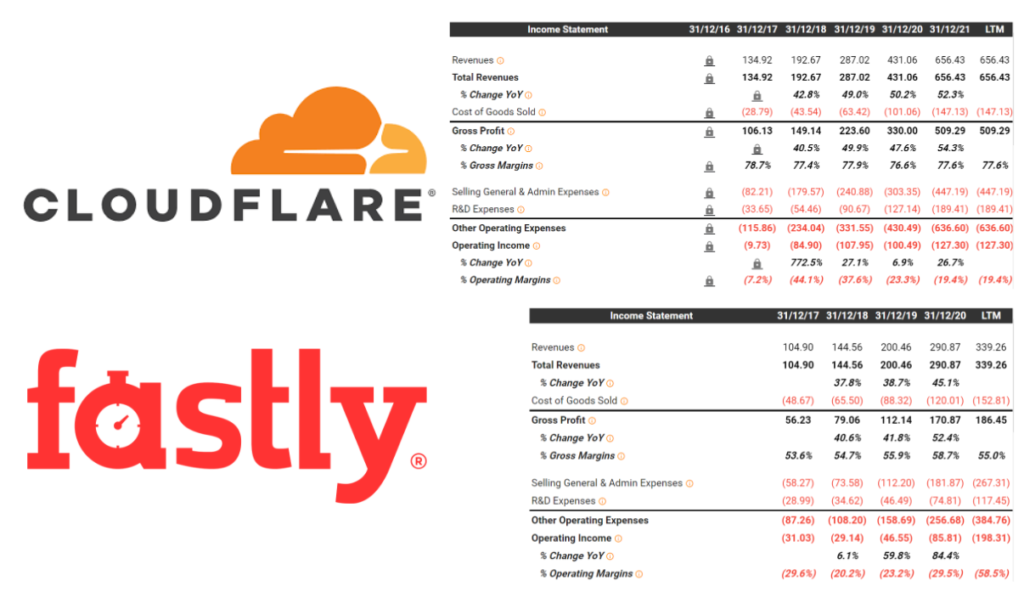

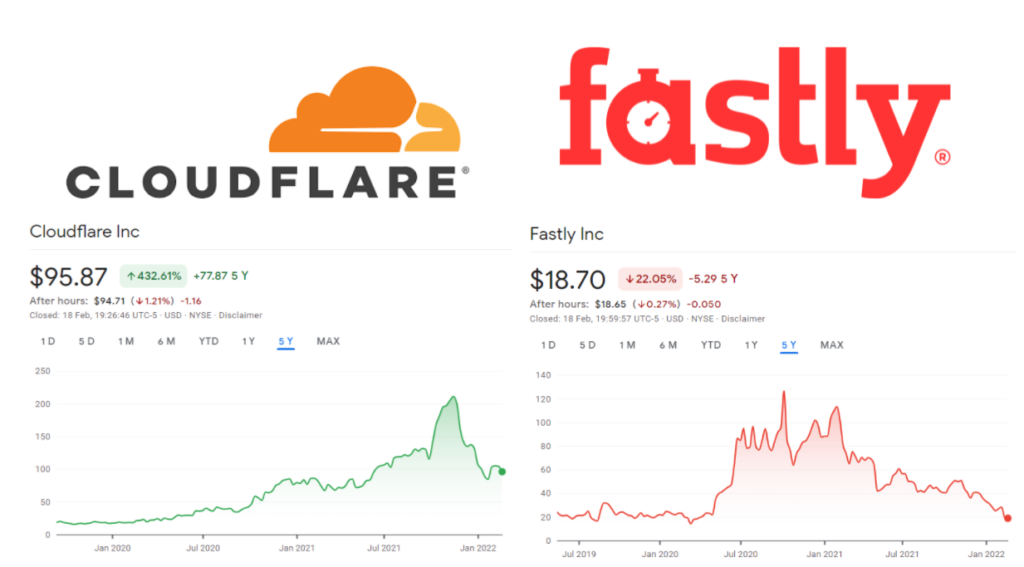

Or take another example, disrupting content delivery network players Cloudflare Inc (NYSE: NET) and Fastly Inc (NYSE: FSLY). Both are the same size but in terms of margin superiority, Cloudflare seems to be firing all cylinders.

Both stocks are down due to the recent tech selloff, Cloudflare is currently down by 54% from its historical peak, while Fastly is already down by 85%! Clearly, there are some underperforming aspects by Fastly as of now, and Cloudflare seems to be better.

Choosing the outperforming company might not yield you gains this time around, but it definitely has protected your downside, while giving you the confidence to increase your position.

4. Consumer tech hardware is an enabler, not an asset-intensive business

Software companies might have been grabbing the headlines for their explosive growth, but when Apple Inc announces new iPhones and Macbooks, the attention switches back to them.

Apple’s dominance as a tech company started off as being the best in class consumer tech hardware company. Its operating system and software also slowly help shape Apple’s user experience into the infamous walled garden as we know of.

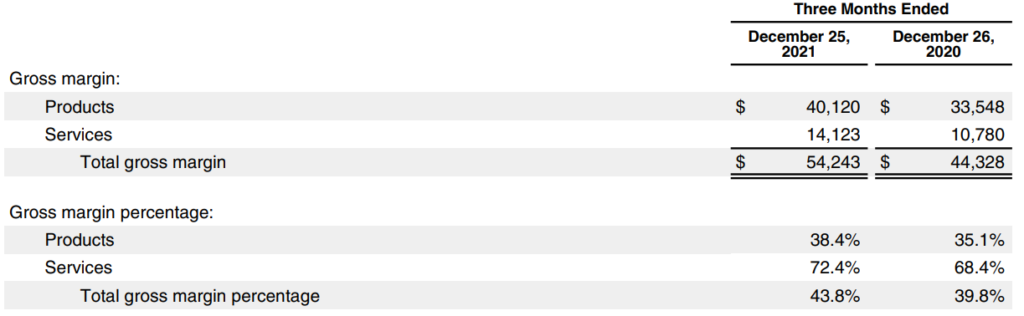

Even in a time when the whole world is facing severe chip shortages and logistical uncertainty, Apple still manages a revenue growth of 19.6% YoY, with gross margin improving by 400 bps.

Apple’s latest round of data privacy change revokes access to the identifier for advertisers which definitely impacts Meta’s upcoming prospects. Granted margins for hardware and software are at two different ends of the spectrum. But whoever controls hardware holds power as an enabler to the internet and app store.

Apple 1 – Meta 0.

MyKayaPlus Verdict

Hypergrowth stocks are exciting since any estimate beat will see the stocks go up significantly in a short timeframe. But, investing has never been about doing quick returns on short time frames.

Although beating estimates and seeing price appreciation going up by double digits in a short time frame can be fulfilling, do also take note of the downsides as well. Any estimate miss, relative peer underperformance can see stock price plummeting down too.

At Kaya Plus, our core belief is always a durable portfolio to withstand any occasion. Be it the next pandemic, or even a hawkish Fed stance, a portfolio of 10 quality stocks to help us achieve market-beating returns.

Our strategy for 2021 worked out as we crushed the Dow Jones Index with a 24.5% annualized return. Our picks for 2022 is out as well! Sign up to our Premium Club to get access instantly!