Why Vote YES For A Better Mapletree Commercial Trust?

Some Mapletree Commercial Trust holders might be furious about this. But as an MCT unit holder myself, I will be voting “FOR” the merger between Mapletree Commercial Trust and Mapletree North Asia Commercial Trust.

For those who are not aware of what is happening, Mapletree Commercial Trust, a Singapore pure-play REIT will be merging with its sister REIT. An EGM will convene pertaining to this merger. And unitholders of MCT will be taking up their responsibility to vote for or against the merger.

If you are unaware of how to vote, please do refer to our MCT and MNACT voting guide here.

Here is why I am voting FOR the merger.

1. Accretive DPU and NAV per unit post-merger

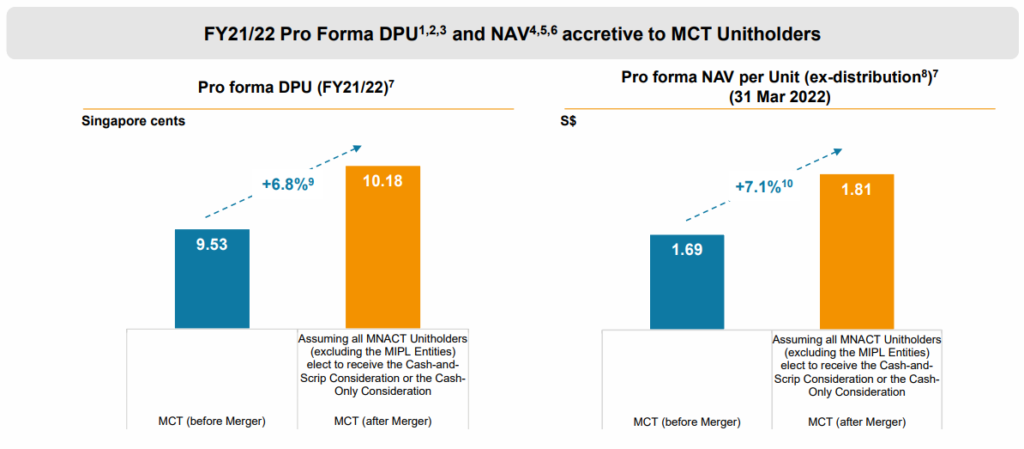

The first rule of thumb for any REIT corporate exercise is the gauge accretiveness. Accretive means an improvement of a REIT on a per-unit basis. Meaning, for every unit of REIT you hold, post-exercise, they generate more returns on a per-unit basis.

Naturally, the accretiveness will revolve around the distribution per unit (DPU) and net asset value (NAV) per unit. When a REIT or company undergoes a merger or acquisition, its outstanding units will increase. This is due to the issuance of new shares or units as a capital raising exercise. However, if the returns of the merger outweigh the dilution, the net returns or net asset per unit can be better.

This is accretiveness.

On a pro forma basis, the DPU of MCT will increase by 6.8%, while the NAV per unit will increase by 7.1%. Thus, if based on the near term aspect, MCT unitholders will be getting a boost in their DPU and NAV.

2. Lower tenant concentration

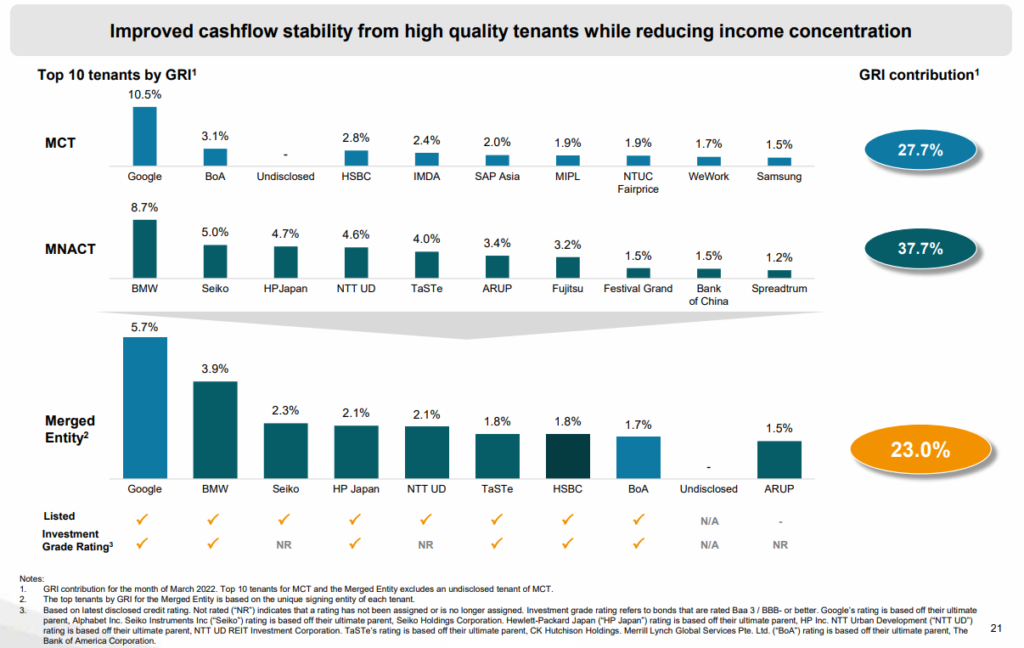

All REITs derive their rental revenue from their tenants. Hence, how dependent a REIT is on their tenants are leading indicator when doing tenant concentration assessment.

MCT boost some of the best and most stable world-class tenants. It counts Google, Bank of America, HSBC, and SAP Asia as its anchor tenants. These tenants would definitely be able to weather through uncertain periods, posing virtually zero risk of rent default.

However, when their lease tenure ends, they might not have the obligation to continue renting MCT properties. Imagine Google not continuing their lease with MCT, would see a 10.5% impact to their gross rental income.

With the merger going on, MNACT properties and its tenant will dilute the concentration risk of the existing tenant pools. The acquisition of MNACT will see the merged entity increasing its property portfolio. Together with that are also the key anchor tenants of MNACT that will dilute Google’s contribution down to 5.7%.

The overall top 10 tenant concentration risk also drops from 27.7% to 23.0%.

3. Larger debt headroom

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 9

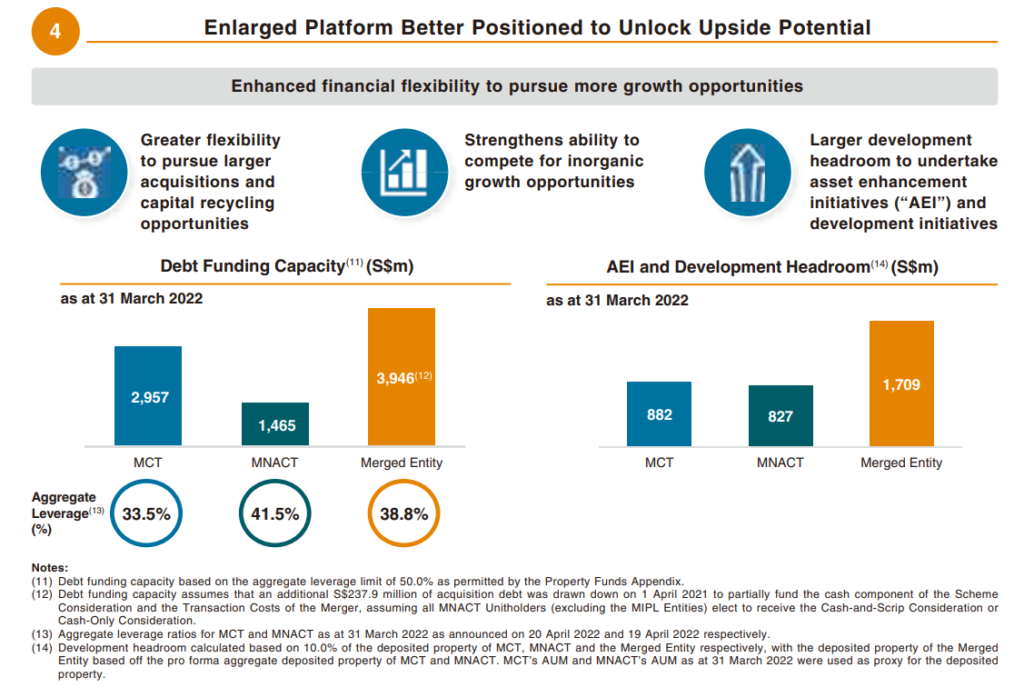

Most people might stay away from debt. But debt is one of the most vital instruments that a great REIT needs. Apart from just relying on unitholders’ capital, REIT managers must also be prudent in employing debt.

Although debt is important, REITs are regulated not to be over-leveraged. This means that at any one time, a REIT must always stay within its leverage ratio. A near to limit leverage ratio can be detrimental. It means a REIT most likely needs to undergo a capital raising exercise to pare down its leverage. Also, it might not have enough debt headroom to undergo acquisitions.

The benefit of 2 REITs merging together is the combination of their respective debt headroom. The debt headroom of 1 REIT might not be sufficient to acquire new properties. But when combined together, it could allow the merged entity to make an accretive acquisition that benefits unitholders.

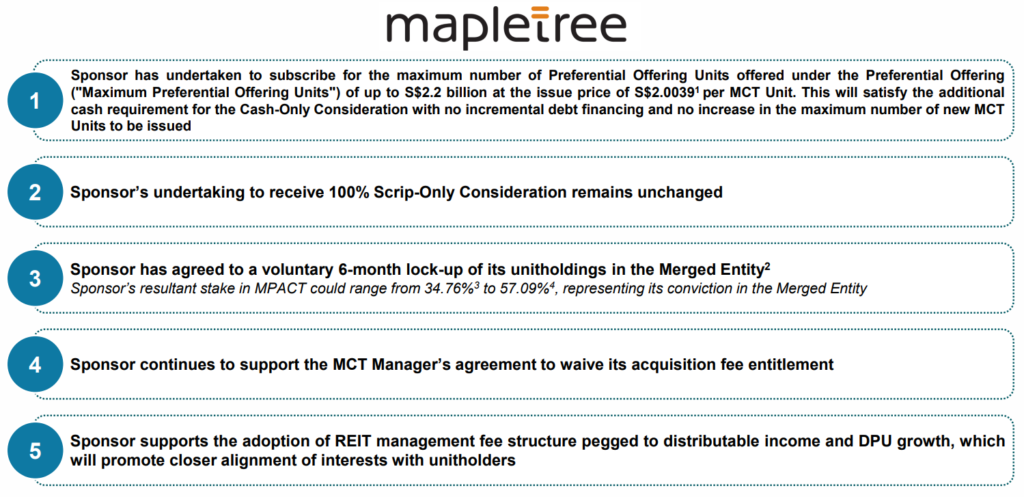

4. Strong sponsor commitment

The decision to vote for or against the merger might be split among the retail shareholders. But a glimpse at the sponsor’s commitment, we see significant skin in the game.

The acquisition of MNACT would require funding. The initial preferential offering would require entitled unitholders to subscribe to the capital raising exercise at S$2.0039 per unit. It provides unitholders with the opportunity to increase their holdings for an accretive acquisition.

However, the market price of MCT currently languishing at S$1.80 per unit, unitholders can actually increase their holdings off the market. The preferential offering is definitely “out of the money”. However, should the vote to proceed with the merger comes around, the sponsor will actually foot the bill by subscribing to all the units required.

In layman’s terms, retail voters will be voting for the merger to proceed, and the sponsors, Mapletree Investment Pte Ltd will foot the bill!

On top of that, the sponsor has also agreed to a voluntary 6-month lock-up of its unit holdings in the merged entity. Meaning, that regardless of unit price movements, the first 6 months would see the sponsor not selling off their holdings post-merger.

If the unit price does not move above S$2.0039, it would be highly unlikely for the sponsor to liquidate their holdings at a loss, even post the 6-months lock-up period.

5. Waiver of the acquisition fee

When REITs undergo acquisitions and divestments, there is a structure within the management fee that rewards the REIT manager. REIT managers are tasked to manage and grow a REIT. Hence, fees that are attributable to property acquisition or divestments are necessary.

The REIT managers of MCT would have stood to profit tremendously if they maintained their rights for the acquisition fee for the MNACT merger. Instead, by showing gestures and commitment, they chose to waive the acquisition fee.

Thus, there will not be any incurring of a massive one-off acquisition fee payable to the REIT managers for this merger.

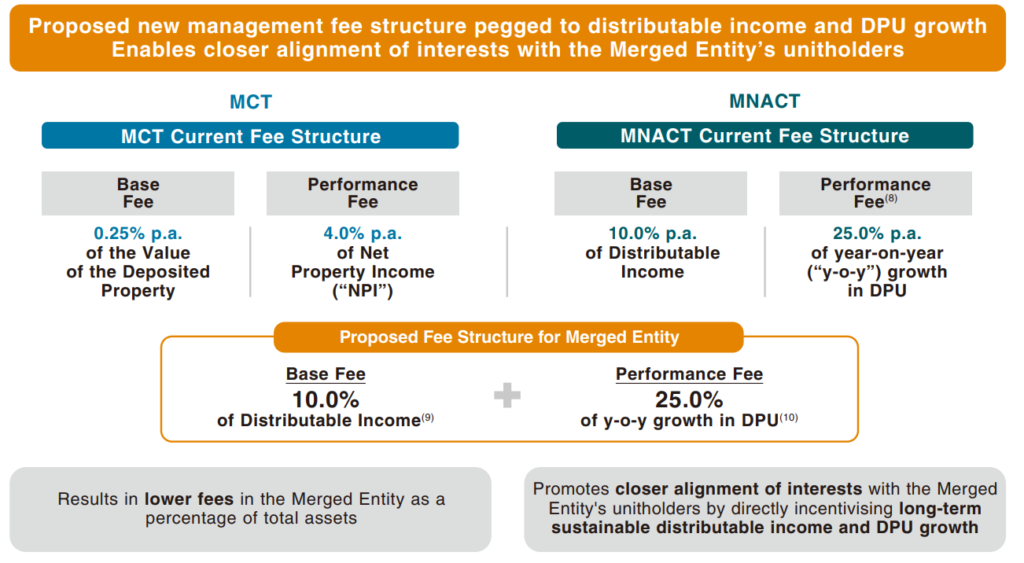

6. Favourable amendments to the management fee

Circular to MCT Unitholders dated 29 April 2022 in relation to the Proposed Merger of MCT and MNACT pg. 4

Furthermore, the REIT managers of MCT decided to go one step further. Not only choosing to waive off the acquisition fee, but the opportunity for a favourable fee structure is also on the table.

The current fee structure of MCT sees the REIT manager taking a base fee of 0.25% p.a. of the value of deposited properties. On top of that, there is a performance fee of 4% of net property income. Upon the successful merger, unitholders can also vote for Resolution 4 which will see the fee structure change to a base fee of 10.0% of MPACT’s distributable income. The performance fee will tag along with the growth of the DPU at a 25.0% rate.

What this means is that, only if the management can increase and grow the DPU on a y-o-y basis, only then they can unlock their performance fee. The previous fee structure guarantees them to receive a 4.0% p.a. of net property income, regardless of a per-unit growth.

A REIT can be growing its top line and distributions but not on the accretiveness of a per-unit basis. Thus, this can only show that the REIT managers are fairly confident in achieving DPU growth and accretiveness post-merger.

7. Rebuttal: MNACT is lousy

From the unit price movements after the merger news broke out, the tanking of MCT gives a hint that the general reaction is negative.

MNACT’s largest portfolio is Festive Walk, and the unit price actually tanked hard when the Hong Kong 2019 protests happened. Festive Walk is one of the malls that suffered arson attacks during the protests.

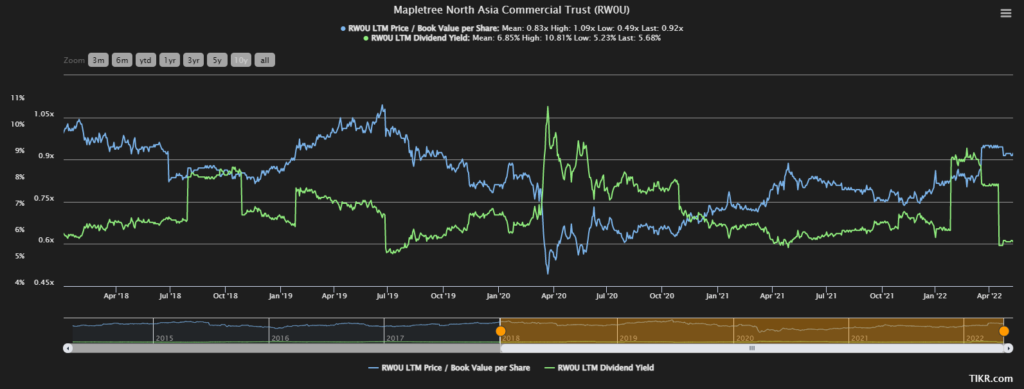

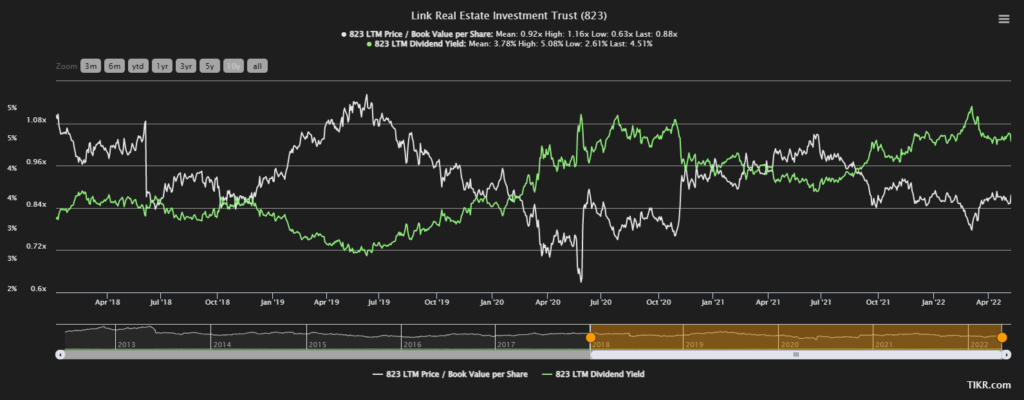

Ever since then, MNACT prices continue to trade at a relatively steep discount. Its price to book ratio pummeled and remained below 1x.

MNACT was not alone in the selldown. Asia’s largest REIT – Link REIT (SEHK: 0823) experienced a similar selldown and trades at a discount as well based on trailing P/B valuation.

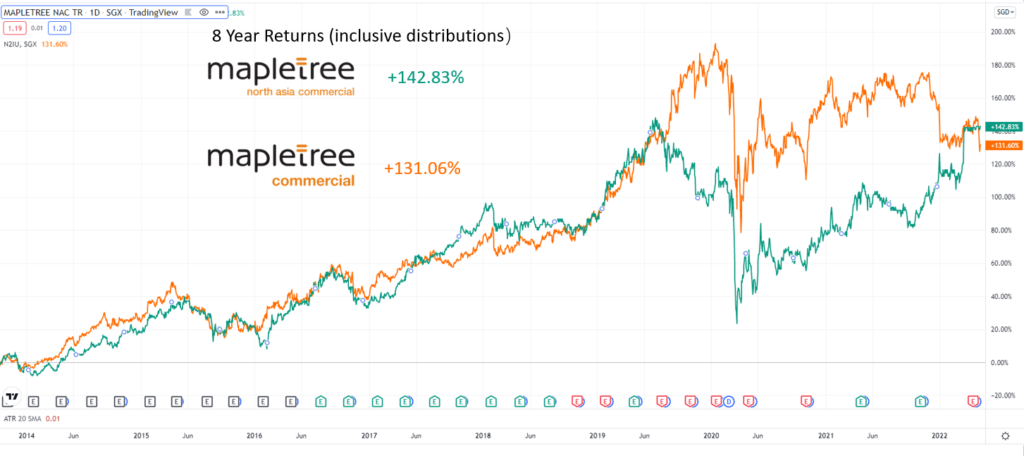

Adding in MNACT into MCT means taking on an inherent geopolitical risk in the merged entity. But prior to the merger news breaking out, we have already seen recovery shoots and an uptick in MNACT’s performances and overall returns.

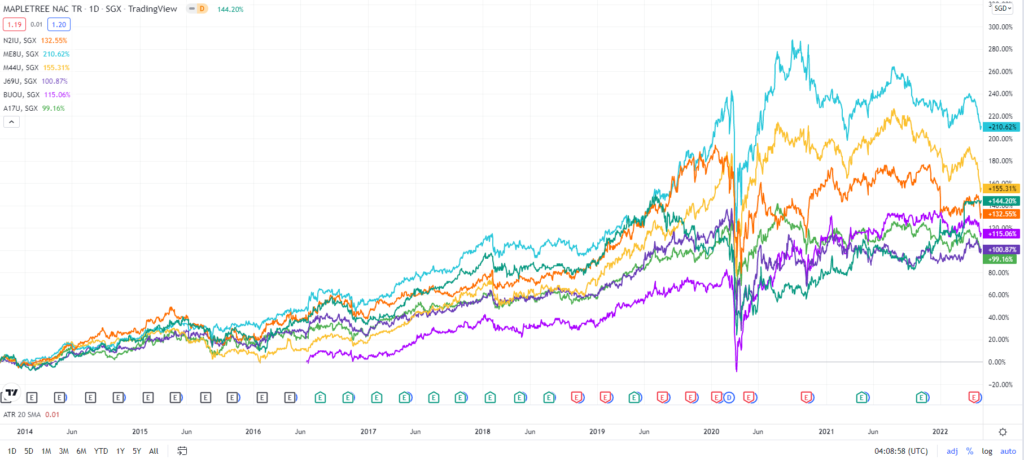

Data has proven that MNACT has provided superior returns versus MCT. Even without the post-merger news rally, their historical total returns are comparable, both doing around 120+% for the last 8 years.

MNACT is not lousy. MCT unitholders who do not analyze and make baseless statements are.

8. Rebuttal: Pure-Play Singapore REIT is superior

There are 2 camps that will vote “Against” the merger. One camp, with whom we have rebutted that MNACT is lousy, and another camp thinks that pure-play Singapore is better.

The above chart shows the historical returns of a mixture of S-REITs from different sectors. Their returns are adjusted for distributions and plotted on a % basis. Below is a table of the S-REITs picked, their historical adjusted returns and their geographical footprint.

| REIT | Returns | Sector | Country Exposure | |

| 1 | Mapletree Industrial Trust (SGX: ME8U) | +210.62% | Industrial, Data Center | Singapore, USA |

| 2 | Mapletree Logistic Trust (SGX: M44U) | +155.31% | Logistic | Singapore, Australia, China, Hong Kong, India, Japan, Vietnam, Malaysia, South Korea |

| 3 | Mapletree North Asia Commercial Trust (SGX: RW0U) | +144.20% | Diversified (Retail & Commercial) | China, Hong Kong, Japan, South Korea |

| 4 | Mapletree Commercial Trust (SGX: N2IU) | +132.55% | Diversified (Retail & Commercial) | Singapore |

| 5 | Frasers Logistics & Commercial Trust (SGX: BUOU) | +115.06% | Diversified (Logistics & Commercial) | Singapore, Australia, Germany, The Netherlands, UK |

| 6 | Frasers Centrepoint Trust (SGX: J69U) | +100.87% | Retail | Singapore |

| 7 | Ascendas REIT (SGX: A17U) | +79.25% | Diversified (Industrial & Commercial) | Singapore, Australia, UK, USA |

From comparing some of the best-in-class REITs by performances, there is no suggestion that a pure-play Singapore REIT gives superior returns.

The cream of the crop, Mapletree Industrial Trust and Mapletree Logistic Trusts, count their country exposure in USA and ASEAN as their key stronghold areas.

However, pure-play SG REITs like MCT and Frasers Centrepoint Trust come in at 4th and 6th place respectively.

Hence, even though Singapore is the de-facto place to look for great REITs, one must not think that a home-ground only approach is superior to diversifying out of Singapore.

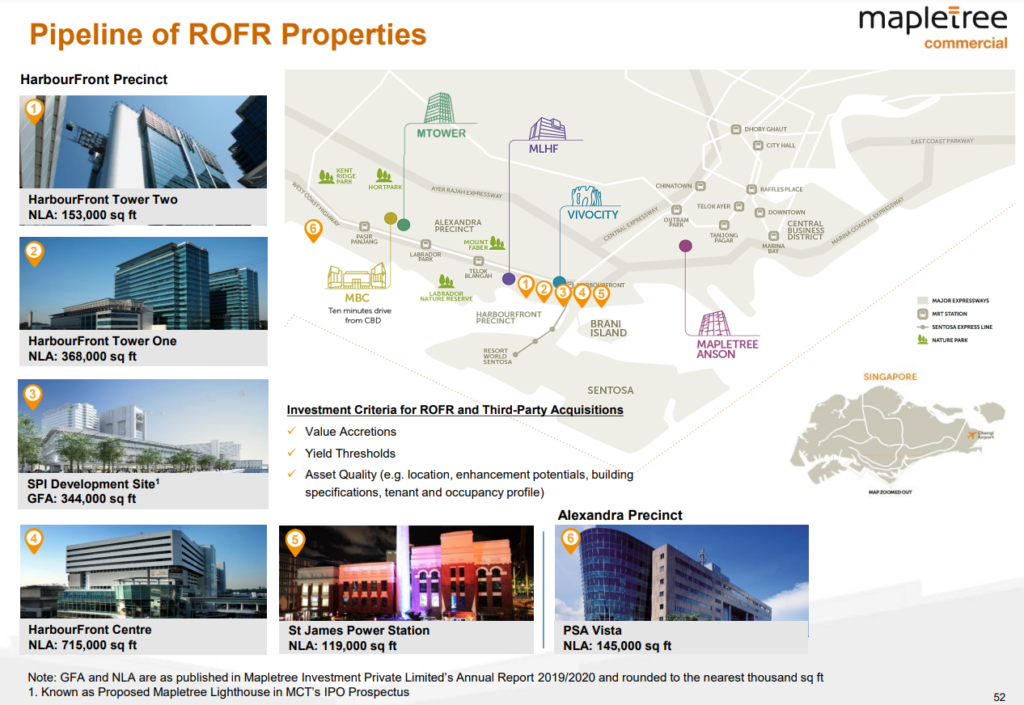

9. Limited ROFR Opportunities

REITs can grow via organic or inorganic expansion. While organic expansion is crucial in the long run, inorganic expansion can really expedite the growth rate of a REIT.

Organic expansion occurs when REITs undergo Asset Enhancement Initiatives (AEI). AEI helps not only ensures properties remain in pristine condition but also increases the net lettable area. When the net lettable area increases, so will the number of tenants and the rental revenue growth.

Inorganic expansion, on the other hand, requires REITs to undergo acquisitions. Whenever a new property gets acquired, it will straight away generate an extra revenue stream to a REIT’s overall revenue.

While it is true that REITs are considered a stable and defensive component of a portfolio, that does not mean they can stay complacent. Growth still needs to occur for long term feasibility and holding.

Furthermore, Mapletree prides itself on being one of the best in class property investment managers. Thus, they have the mandate and responsibility to grow the REITs under their management for superior long term returns.

Voting against the merger will only confine MCT managers to just acquiring any Right of First Refusal (ROFR) properties in Singapore. As of the latest list, it has just 6 properties to further grow.

MyKayaPlus Verdict

Most REIT investors think that a growing REIT is an oxymoron. But put aside the capability and regulations that require a REIT to payout 90% of its net rental income, they still need to grow in some ways.

Perhaps most Singapore REIT investors do not really understand the predicament Malaysia REIT investors experiencing right now. Malaysia REITs are still languishing at low price levels, even as the borders open and an uptick in economic activities.

Diversification, at an accretive end result, is already the best in case outcome a REIT investor could hope for.

We urge MCT unitholders to not be penny wise and pound foolish. Thus, we hope that this article and its analysis provide sound points to vote for a better MCT!

Curious to know how we employ our framework and blueprint to analyze REITs for growing and long-lasting dividends? Find out more in our free training here!

After going through this sharing, you would be able to screen out dividend stocks. No more going to other elementary dividend courses that do not even highlight the risks and criteria of each group of companies!