Weighted Average Lease Expiry (WALE): REIT Analysis 101

Property investing has always been one of the most sought after ways for passive income.

First, you buy a property, then you find a quality tenant. After that, you sign a tenancy agreement with your tenant. Inside this agreement, the key information encompasses the rental rate, tenure, key information between the landlord and tenant.

The exact same thing applies when it comes to REIT investing.

But, the only difference is that perhaps there are REIT manager and property managers managing the REITs. These are a team of professionals that run the daily operations, maintenance and sales and purchases of properties. Hence, REIT unitholders are typically having no headaches and stress of handling an investment property.

So what can unitholders monitor to gauge whether a REIT is well managed? What if there is something unitholders can check to anticipate a potential problem?

Weighted Average Lease Expiry (WALE)

A REIT is just as similar to a normal personal investment property in terms of the modus operandi.

Example, rental spaces are assets that are able to generate rental income to all REITs. Depending on what kind of REITs you are investing in, the kind of tenants, risk profile and lease expiry will differ.

But one thing that is similar across all REITs is there will always be a ticking clock until each rental lease reaches expiry. So, as a responsible REIT unitholder, it is important to check out the Weighted Average Lease Expiry (WALE) profile.

Why Check The Lease Expiry

Going back to a situation where you are managing a personal investment property. Usually, before the tenancy agreement ends, the landlord will always discuss with the tenant on the renewal of a new rental agreement.

REITs and their tenants operate in the same way as well. If a landlord is unable to strike an agreement with a tenant, the landlord will have to find a new tenant. The Weighted Average Lease Expiry (WALE) gives unitholders an insight into how REIT managers renew or obtain better leases for a REIT.

How Is WALE Calculated?

There are 2 factors that can impact the WALE of a REIT. Usually, the average tenure to the expiry of a collective of leases will determine the WALE. That means if you have 20 rental leases and 80% of it expires in 5 years time, your WALE would be longer.

The size of the tenant can also impact the WALE significantly. If a bigger tenant contributes more % to a gross rental, the WALE would expire faster as the rental lease of this tenant approaches.

WALE information is most of the time easily available in Annual Reports of REITs. So as investors we just need to check them out.

What Is a Good WALE?

There is no official yardstick that determines an optimum WALE. Depending on how valuable the investment property is, a short WALE can be good or bad at the same time.

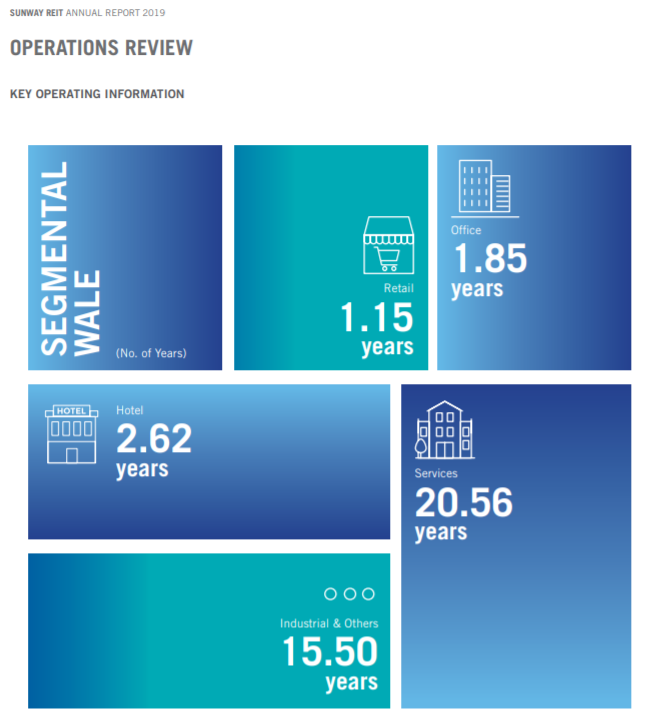

As an example, looking at Sunway REIT‘s 2019 WALE, we can see that its retail properties have shorter WALE. Every time a lease of a valuable property is expiring, the landlord or the REIT can negotiate a better and higher rental lease moving forward.

Conversely, the services and industrial properties have typically longer tenures and WALE. Industrial properties usually have just one or two tenants per building. Sometimes it can go up to 10 tenants depending on property sizes. But as a total, the tenancy size is significantly smaller than retail properties.

Hence, it is vital to ensure that these existing tenants are locking in longer tenure. So that the REIT is more confident in its upcoming and future earnings. Plus, there will be ample time to find new tenants to take over before the existing tenancy ends too.

MyKayaPlus Verdict

A good and well manage WALE will ensure that the occupancy rate of a REIT stays at high levels. Furthermore, it also ensures that the REIT is growing its rental income to distribute more value to shareholders.

Depending on what type of REITs you invest in, and what kind of investment property they own, the yardstick of the WALE can be subjective.

But all in all, we can safely say, if the REIT boasts an excellent crown jewel, the WALE can be short for further rental hikes. But if the property is just normal, it would be safe to have a longer WALE.

P/S: Our upcoming thematic transcripts (23 Apr 2022) – REIT RAIDS will be focusing on potential REITs in Malaysia and Singapore to compound your dividend investing mastery. Premium Club members have FREE ACCESS to this event at no ADDITIONAL FEE! You might want to signup now and enjoy the full benefits of being a Kaya Plus Premium Club member!