Malaysia’s Big 4 Glove Companies’ Growth Story

Malaysia As A Global Gloves Supplier & The COVID-19 Price Rally

Malaysia has been a global supplier of gloves, especially gloves for healthcare. Our local glove manufacturers supply more than 60% of the world’s demands today.

As of today, there is definitely no country spared from the vicious spread of COVID-19. Hence, this has led to an extreme surge in demand for medical gloves. And our Big Four glove makers – Top Glove Corporation Berhad, Hartalega Holdings Berhad, Supermax Corporation Berhad and Kossan Rubber Industries Berhad are the key benefactors. Gloves are essential items these days. All four companies’ share prices were moving up tremendously (and unrealistically) for the past few weeks.

Hence, the questions came rolling in. “Have you invested in any glove stocks?” “Are these companies overvalued now?” “Can I go in now to follow the uptrend?”. Before that though, it is important to understand the business and the outlook of the business. Only after that, you can make a decision to invest or not.

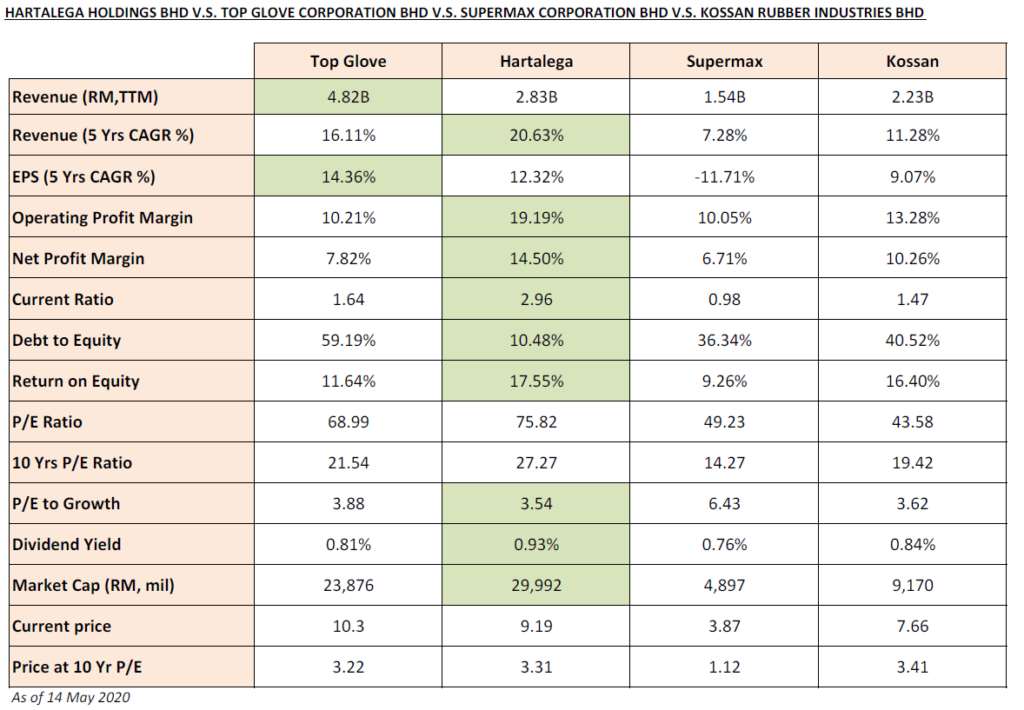

May 2020 Table of Comparison of Top 4 Glove Makers

We did a simple comparison between the Big Four glove companies based on the table above. Hartalega outperforms its peers in most areas, especially profitability, liquidity and valuation.

Historical Revenue Growth

Hartalega recorded the highest CAGR in revenue at 20.63%, with a value of RM 28.27 billion in FY19. To put in perspective, this is equivalent to approximately 27.2 billion pieces of nitrile gloves. Hartalega also has the highest net profit margin at 14.50%, almost double that of its next biggest competitor Top Glove.

Liquidity & Gearing

During critical times like now, with MCO in place, liquidity is important. And one of the key ratios to calculate liquidity is the current ratio. As of latest information, Hartalega has the highest current ratio of 2.96, far above its peers. This means that Hartalega has sufficient current assets to cover up to 2.96 times of its current liabilities. Also, with the lowest debt to equity of 10.48%, Hartalega is also in a less risky financial position. It’s gearing or leverage is much lower, that is it has much less debt at this moment.

Return on Equity

A higher Return on Equity (ROE) often means the company is able to generate better returns on its shareholders’ equity. Again, Hartalega stood out among its peers with an ROE of 17.55%. Hence, this indicates Hartalega is more efficient in generating returns with the equity they have.

Valuation

The Price to Earnings ratio (P/E ratio) is one of the methods to determine if a stock is currently under- or over-valued. Backtracking our previous video “The Tricks of Analysing a High P/E Ratio Stock”, there is the need to consider the potential future growth of a company. Thus, we will be using the P/E to Growth ratio. In this case, Hartalega has a P/E to Growth ratio of 2.95. Though relatively lower than its peers, we still think it is on the higher side. Interestingly, all four glove companies having a higher trailing P/E ratio compared to their 10 Yrs P/E ratio with the recent spike in share prices.

Capacity

Hartalega is now the largest glove maker in Malaysia by market capitalization, with a market cap of RM 25.66 billion. This is despite it only produces 36% of what Top Glove does. One key finding is that Top Glove produces around 73.8 billion gloves with 800 production lines. While Hartalega produces around 27.2 billion gloves with 122 production lines. By simple ratio, Top Glove churns out 91.5 million gloves per production line while Hartalega appears to much more efficient at 222.9 million gloves per production line.

Verdict

In short, we like Hartalega compared to its peers due to:

- Stronger business growth

- Better profitability and margins

- More liquid and less debt

- Relatively less expensive

- Engineering excellence

But the price is definitely on the high side to invest in any glove companies. What do you think? Let us know in the comments section!

Want to see a more graphical comparison? Check our Ultimate Top 4 Malaysia Glove Companies!

You need to revise again once Harta + Kossan reported their quarter report next week.

Their EPS will definitely increase significantly.

Hi David,

Financial information is changing every day. That is why the data is true as of the date of written.

But the argument point of view does not change. Even a spike in earnings to halve away the price to earnings ratio still makes all glove companies in the pricey region.

Thanks!

Joo Parn

Do you have any info of Kossan production line

Hi,

As of the latest expedition of expansion, it would rise from 29 billion pcs per annum in FY 2019 to a forecasted 35 billion pcs per annum.

Thanks

Joo Parn