Link REIT: 8 Things To Know Before Investing

Link REIT (HKEX: 0823) is a REIT listed on the Hong Kong stock exchange. Its historical unit price reached a peak of close to HKD 100 per unit.

It is currently trading at roughly HKD 72 per unit as of the time of writing. As Link REIT is traded on the Hong Kong stock exchange, it will be traded in lot sizes. Its lot size is 100 units per board lot.

Here are 8 points you need to know about Link REIT before you consider investing in it.

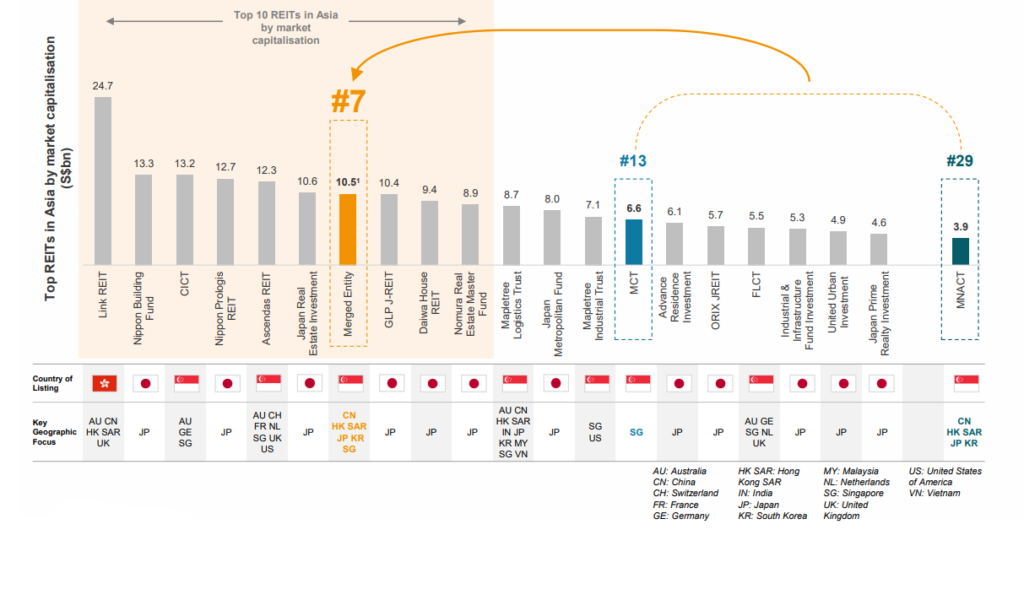

1. Link REIT is Asia’s largest REIT

Most people might not be well aware of this, but Link REIT is Asia’s largest REIT. As of the time of writing, it has a market capitalization of HK$ 137 billion. That roughly translates to S$ 25 billion. Even Singapore’s largest REIT – Capitaland Integrated Commercial Trust only has a market cap of S$ 14 billion, which is almost just half the size of Link REIT!

2. Link REIT was established by the Hong Kong government

Across Asia, we would have come across banks that are originally established by the government but then privatized and floated on the stock exchange. Rarely do we come across a government-established REIT.

Link REIT is one of the few examples. It was formed to hive off assets from the Hong Kong Housing Authority. It subsequently went public on 25th November 2005 at a valuation of HK$ 22.02 billion.

Comparing that against its market cap as of today, that represents an increase of approximately 522%!

3. It has more than 100 properties under its management

Question. How many properties does Asia’s largest REIT have?

More than 100 properties. In fact. 151 to be precise.

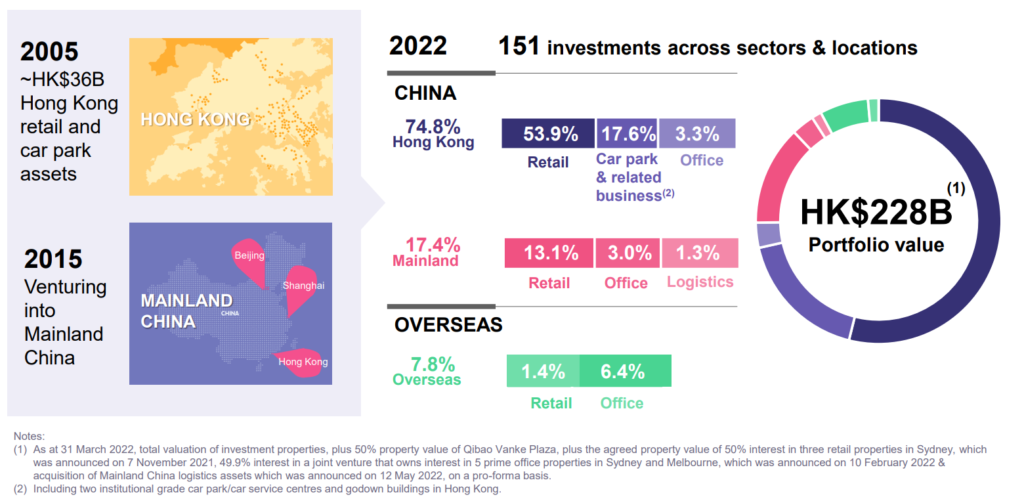

For 10 years it remained a pure-play Hong Kong REIT after listing. In the year 2015, it made its maiden venture into investing in Mainland China properties.

As of 2022, it also has properties in Australia and the United Kingdom. Properties in these 2 countries represent around 7.8% of its total portfolio value, while Mainland China contributes 17.4%. The remaining bulk of 74.8% are properties from Hong Kong.

Its properties are also very diversified. It counts retail, car parks, commercial and even logistics properties as its key sector.

4. Total property occupancy is more than 90%

Properties need to be occupied by tenants to generate rental income. In the light of the Hong Kong protests, many investors might have shunned Hong Kong REITs due to the fear of occupancy rates.

However, by taking a look at the occupancy rates of Link REIT’s properties, all of their properties have an average occupancy of more than 90%. Apart from Mainland China properties notching an occupancy rate of 92.3%, the rest of their properties, even Hong Kong, came in at above 95% occupancy rates.

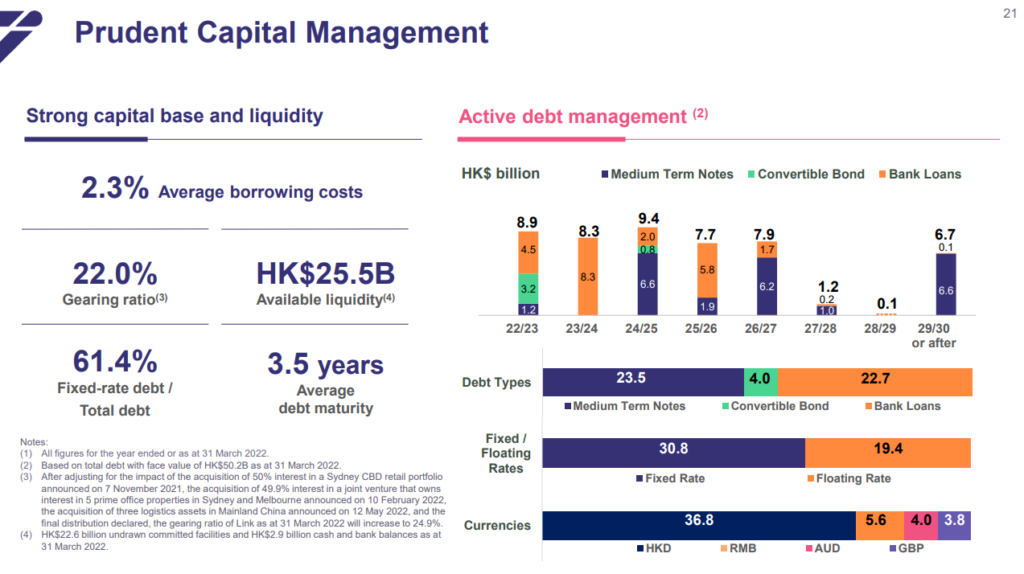

5. Low gearing and well-staggered debt maturity

Unitholders’ capital and debt are a REIT’s most valuable assets. Used wisely, it can help this asset-heavy sector achieve great gains, both from a capital and dividend perspective.

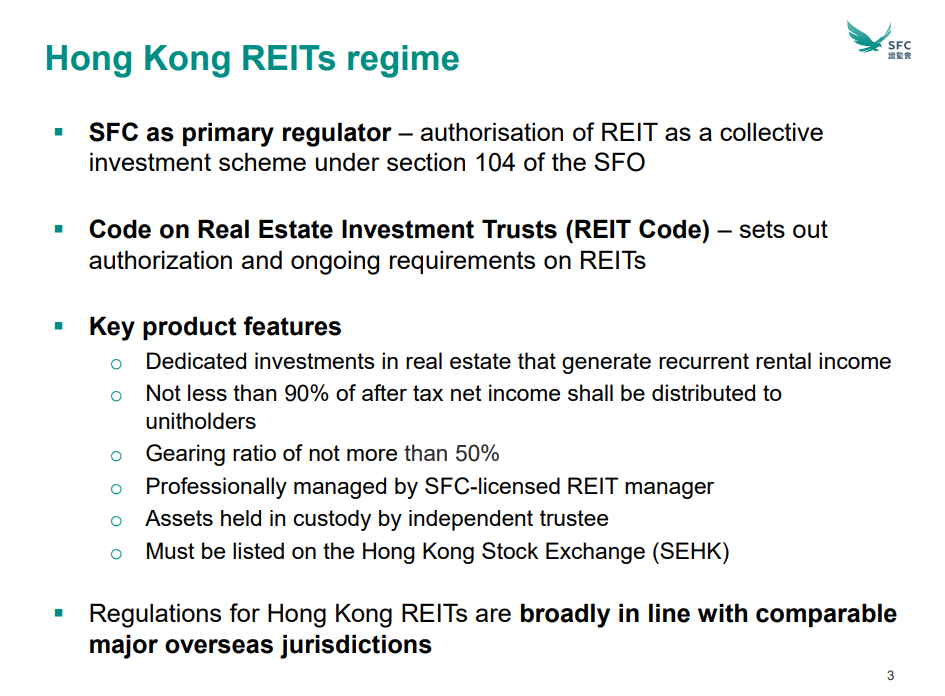

However, the debt level of a REIT is regulated. According to the Hong Kong Securities and Futures Commission (SFC), REITs listed on the Hong Kong market must have a gearing ratio of not more than 50%.

As of their latest report, Link REIT only has a gearing of 22%. It has more than ample debt to take on and grow its portfolio of investment properties.

Not to mention that their debt maturity is well staggered across the next 8 years. Link REIT’s debt maturity for each of the coming fiscal years will not be more than 10%.

6. Hong Kong and China properties are showing recovery shoots

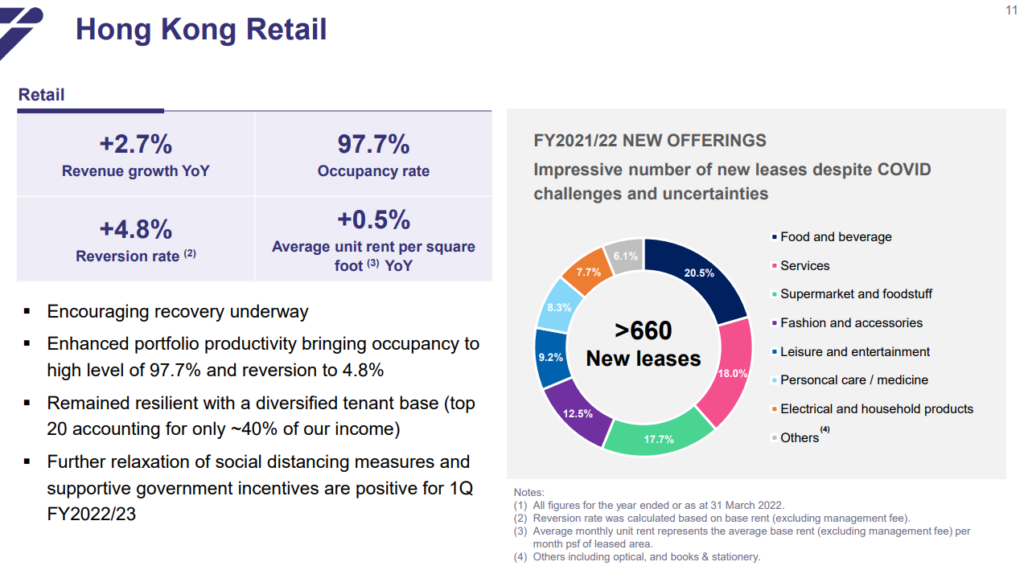

Although Hong Kong and China faced a relatively prolonged battle with the pandemic, recovery shoots have been logged in by Link REIT.

Both Hong Kong and China retail properties notch an impressive positive rental reversion.

Source: Link REIT 2021/2022 Analyst Presentation

Even though office buildings in Mainland China registered a negative 8.1% reversion rate, with the recovery from the pandemic, this negative reversion should be one-off.

7. Link REIT’s valuation got impacted badly due to the Hong Kong protests and riots

At its richest valuation, Link REIT traded at more than 1x Price to Book ratio. However, after the 2019-2020 Hong Kong protests, its price-to-book ratio dropped below 1x.

During the height of the pandemic, it even hit as low as 0.62x!

Currently, it trades at a range of 0.8x for the past 2 years.

8. It has a track record of growing its distribution per unit

For REIT investing, distribution per unit is king. So long as the business fundamentals are intact, there is accretion and YoY improvement on the distribution per unit, a REIT is most likely doing a great job.

Amidst the selldown and the discount of its price to book, Link REIT reassures that it can still provide its unitholders with the best return it can give. Investors might be sceptics of Hong Kong’s future prospects, but post protests, Link REIT is still able to grow its distribution per unit.

It currently trades at a dividend yield of roughly 4.8% as of the time of writing.

MyKayaPlus Verdict

How do you build a REIT into Asia’s biggest REIT? Just like Rome, one property at a time, brick by brick.

So long as it is accretive for both its net asset value and distribution, things should not be far too wrong.

However, with the current steep discount, is Link REIT a value trap?

Thankfully, you can find that out using our Dividend Gems blueprint. Think of it as a rule-based checklist to help you screen through criteria to gauge any dividend stock from any part of the world.

After going through this blueprint, you would be more certain to either invest or stay away from Link REIT.

Sign up now, and unveil the truth on your own!