Interest Coverage Ratio: REIT Analysis 101

Compound Interest is the 8th Wonder of the world. He who understands it, earns it. He who doesn’t, pays it.

– Albert Einstein (reportedly)

Gearing and borrowing when correctly use can grow a business with leaps and bounds. Cost of borrowing is also cheaper than the cost of equity.

But things can suddenly go very wrong if a company tries to bite off more debt than it can chew. The same nightmare too will happen to individuals when we get into too much debt.

Interests and investments work wonder (or horror) by the very same concept, which is compounding. In very layman terms, compounding is the sudden drastic increase in numbers of something, as time goes by.

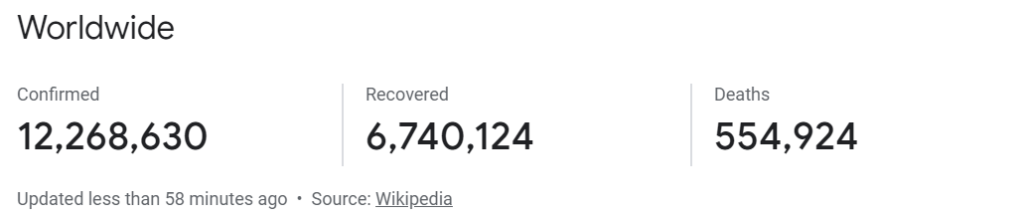

It is also the same theory or concept that causes a pandemic outbreak, like the COVID-19 outbreak.

Compounding Interest: Hurting Your Bank Account More And More If Left Unattended

Probably one of the key rules of thumb in investing is to pay off all high-interest debt before investing. Good investments need time to compound. Bad debts with high-interest rates can erode any investment gains faster than we build them!

Investing is never just about looking for the potential best return. It is also ensuring our financial health is intact without the fear of high-interest bad debts. A big jump in your pay rise doesn’t mean you end up saving more money. A lot can go wrong if you let bad debts run riot.

The same rationale applies to REITs.

Interest Coverage Ratio: Measuring How REITs Manage Their Borrowing Costs

REITs are special investment instruments that combine the benefits of equity and property investing. It is also a balancing act in terms of collecting rental, on-time servicing of borrowings and generous distributions to unitholders.

Sometimes, you may come across REITs which are reporting higher gross revenue and net rental income. But the distribution may just stay flat. Most likely something is awry with the interest expense!

Put simply, even though a REIT may be growing their gross revenue, but if interest expense is not well-managed, it would erode the net profits attributable to the unit holders!

How To Calculate The Interest Coverage Ratio?

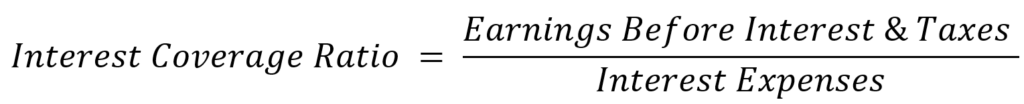

Generally. the Interest Coverage Ratio (ICR) measures how much the earnings before interest and taxes (EBIT) is as a ratio over the interest expenses.

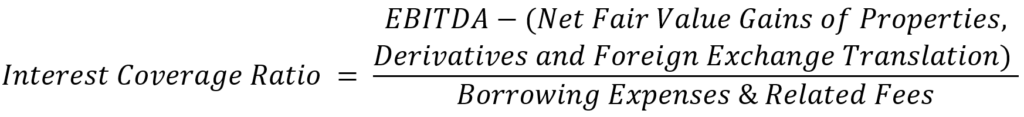

However, if you are choosing to invest in Singapore REITs (S-REITs), there are some differences versus the ICR calculation in other regions and countries. The minimum ICR requirement by the Monetary Authority of Singapore is EBITDA of 2.5 times above borrowing expenses and fees. (excluding effects of any fair value changes of derivatives and investment properties, and foreign exchange translation).

This formalized definition of the interest coverage ratio applicable to S-REITs is definitely more stringent. But it is mandatory pre-requisite for S-REITs who want to raise their gearing ratio from 45% to 50%. Hence, the official formula for the Interest Coverage Ratio for S-REITs is as below:

Interest Coverage Ratio works effectively with the gearing ratio. This is to ensure that a REIT is well-capitalized and its interest expenses in check.

Of course, the higher the ICR, the more liquid the REIT is. The less likely the risk a REIT will screw up its debt repayment.

Benefits of A High-Interest Coverage Ratio?

If a REIT exhibits a significantly high-Interest Coverage Ratio, it means the REIT or a company is in good condition to take up more loans for expansion. Banks and lending institutions will be more likely to lend out money to such REITs.

Borrowings if executed well can grow a REIT and a company. But there has to be some measure to gauge how well a REIT or company is capable to repay their dues. The interest coverage ratio provides a yardstick to determine the prudence of the REIT or company management.

The Same Theory On Whether Individuals Qualify For Bigger Loans Or Not

Like it or not, there are some similarities to when it comes back to an individual level. Whenever we apply for loans for a bigger car or house, we undergo the same check by the banks. Once a bank is confident that our monthly wage is sufficient to commit to future loans and borrowings, only then the approval stamp gets stamped.

MyKayaPlus Verdict

In many ways, listed companies are no different than normal individuals like you and me. Borrowings and loans play an important part in growing our assets as much as a REITs’ asset. However, taking too many loans and letting interest payments run riot could spell danger.

Compounding interests will break down individuals and companies faster than they can tap on it to build and grow. So, best to keep a close eye on the interest coverage ratio when you decide to invest in a REIT!