HEINEKEN MALAYSIA BERHAD

Business Summary

Heineken Malaysia Berhad (KLSE: HEIM) is an alcoholic beverage brewer that has a strong market presence in Malaysia. It is also one of the 2 breweries operating and listed on the main board of Bursa Malaysia.

Previously known as Guinness Anchor Berhad, the name was revised to Heineken Malaysia Berhad when Heineken NV (AMS: HEIA) acquired Diageo Plc’s (LON: DGE) stake in GAPL Pte Ltd (GAPL), which holds 51% of Guinness Anchor Berhad.

Update 28.08.2020

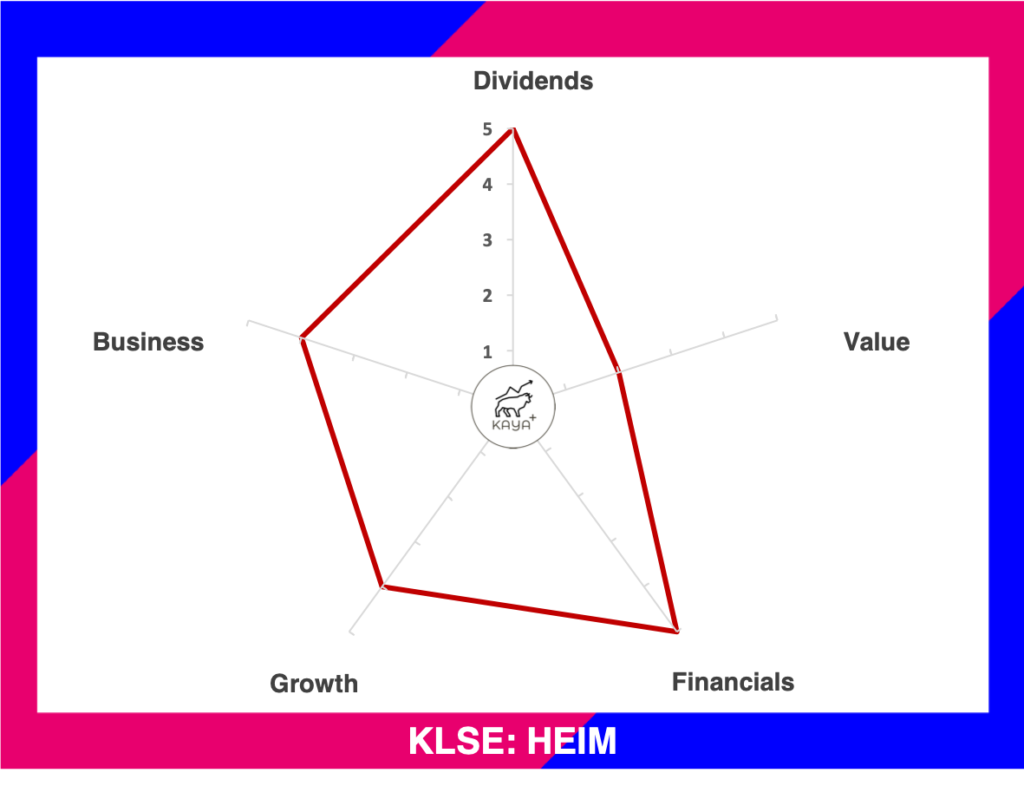

Dividends (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Value (2/5): ⭐ ⭐

Financials (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Growth (4/5): ⭐ ⭐ ⭐ ⭐

Business (4/5): ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Brands & Portfolio

Source: heinekenmalaysia.com

Heineken Malaysia is home to plenty of famous alcoholic brands. Example, It has beers under its Heineken brand and the famous Tiger beer as well. It is also famous for Jolly Shandy and its cider brands like Strongbow and Apple Fox

2019 Geographical Statistics

Heineken Malaysia Bhd’s principal operating country is in Malaysia. The company is focusing only on malt liquor brewing including production, packaging, marketing and distribution of its products. Hence as of 2019, approximately 1% (2018: 1%) of the total sales are export sales, mainly to Asian countries

Management And Major Shareholders

Heineken Malaysia has a tendency to promote and groom its management team internally. This is true when we look at their current batch of executive management.

Heading at the top is Mr Roland Bala, who is the current Managing Director. Mr Roland Bala is currently in his 3rd year as managing director. Prior to this, he was the managing director of Cambodia Brewery Ltd (CBL), which is Heineken’s operating company in Cambodia. Earlier, he was the General Manager for the Vietnam breweries. In summary, he has almost 10 years of service within the Heineken Group.

Mr Szilard Voros, a Hungarian, is the current Finance Director. He joined the Heineken group in the year 2015 back then. After 2 years of impressive performances, he is transferred and currently is on his 2nd stint within the group, serving as Finance Director.

The current Sales Director and Marketing Director are Mr Vasily Baranov and Mr Pablo Chabot respectively. Both of them have more than 10 years of experience within the Heineken Group. Their placements around the Heineken group of global companies and career growth definitely further solidifies the management team of Heineken Malaysia.

Other key management executives like Ms Renuka Indrarajah, Ms Salima Bekoeva, Ms Janina Vriesekoop all have been long-serving servants of the Heineken group as well. The only executive which is new is Mr Kuhan, the Human Resource Director. Nevertheless, he brings with him 17 years of experience in Human Resource.

In the year 2019, the total remuneration of the non-executive directors and managing director sums up to RM 3.3 million. As a ratio comparison, this amount accounts to just 0.14% of Heineken Malaysia’s FY 2019 revenue.

GAPL Pte Ltd, the subsidiary of Heineken NV, is the largest shareholder of Heineken Malaysia, with a stake of 51%. The rest of the top 9 shareholders are fund and insurance firms’ holdings.

Financial Performance

Heineken Malaysia has stable growth in both its revenues and profits. There is a noticeable spike in revenue in FY 2016 due to a revision of its fiscal year. Hence some quarterly revenue and profits got recognized in FY16. Putting the one adjustment spike aside, sales and profits have grown upwards steadily. Of course, with the recent COVID-19 pandemic, the company is definitely set to break its continuous growth and profit track record.

Return on equity and assets are at 76.12% and 30.04% respectively. Again the one-off spike of the ROE and ROA in 2016 is due to fiscal year change which causes an additional quarter of revenues to be included.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Current Ratio |

| 2019 | 1,081,494 | 702,691 | 394,101 | 1.06 |

| 2018 | 940,323 | 569,176 | 371,147 | 1.13 |

| 2017 | 867,780 | 507,265 | 360,515 | 1.22 |

| 2016 | 813,641 | 421,086 | 392,555 | 1.38 |

| 2015 | 692,653 | 316,505 | 376,148 | 1.89 |

Heineken Malaysia Bhd’s FY 2019 total assets are at RM 1.08 billion. Liabilities is at RM 703 million while Equity is at RM 394 million. The current ratio is stable above the healthy ratio of 1.

All in all, it is looking at a stable growth in its assets and also retained earnings, while the current ratio remains stable.

Operating Cash Flow & Dividend Paid Out

Source: Heineken Malaysia Berhad Annual Report

The one-off spike effect due to the change of fiscal year impacts the cash flow statements as well. But generally, the operating cash flow for Heineken Malaysia is on a gradual uptrend, which means the company is raking in more and more cash from their operations. Dividends paid out are also on a gradually increasing trend as well. Then again, with the latest pandemic forcing their Sungai Way plant into shutdown, its FY 2020 dividends will definitely take a hit.

Price

MyKayaPlus Verdict

Contrary to what most people feeling that Heineken is big and slow, it is actually one of the multi-baggers that has a proven track record. Of course, the financials and dividends are proof.

The company has a wide array of alcoholic beverages to satisfy a wide range of consumers. From its world-famous Heineken to Tiger, brewed to suit Asian’s taste buds, there is a beer for each personality. On top of that, customers who appreciate German beer can opt for Paulaner, while Stout lovers swear by the taste of Guinness. There is of course cider and shandy in their product portfolio as well.

Of course, the year 2020 comes as a black swan for Heineken. With their Sungai Way plant experiencing a shutdown of 2 months, sales is impacted. Nevertheless, the company leverages on E-commerce by setting and focusing on drinkies.my, which allows beer lovers to buy chilled beer from the comfort of their home.

Moreover, by focusing on their new product Heineken 0.0, a de-alcoholised beer, also allows them to sell their products to more customers too. 0% alcohol beer would be perfect during weekdays lunchtime, or even weekdays nights.

As of its latest price, Heineken Malaysia trades in the region of a Price to Earnings (P/E) ratio of 27x. Yet based on trailing dividend yield, it does present itself as a fair reasonable dividend stock at a yield of 5.25%.

Is Heineken Malaysia a stock for you to buy for its dividends return? Or do you prefer it’s competitor Carlsberg Brewery Malaysia Berhad?