FACEBOOK INC.

Business Summary

Facebook Inc. is an online social media and networking company listed on the Nasdaq Stock Market in the United States of America.

It was famously founded by Mark Zuckerberg with the help of his friends, namely Eduardo Saverin, Andrew McCollum, Dustin Moskovitz and Chris Hughes. Originally launched as a website to profile all the students at Harvard University, it then slowly expanded to other universities. It wasn’t long then it slowly was opened to the public, for anyone above the age of 13 to be able to create their own Facebook profile.

The Facebook app has gone through multiple evolutions. It started from an online personal profile where everyone can create for free. By using Facebook and the internet, people around the world can connect with each other. Family members and friends can view photos, statuses, updates of one another. In a nutshell, Facebook Inc. is a company that develops and own apps that connect people.

Facebook Inc. filed for IPO in the year 2012. At that time it was just a company that owns and operates the Facebook platform and app. Over the years, it has grown bigger by acquiring other companies and apps. You might have heard or seen these apps before, but could be unaware that they are under the Facebook family.

Facebook Inc. earns most, if not all of its revenue from selling advertisement placements to marketers. These ads can be filtered down to meet certain target criteria, including age, gender, location, interests, and behaviours. Marketers purchase ads that can appear in multiple places including on Facebook, Instagram, Messenger, and third-party applications and websites.

Last update: 22.05.2021

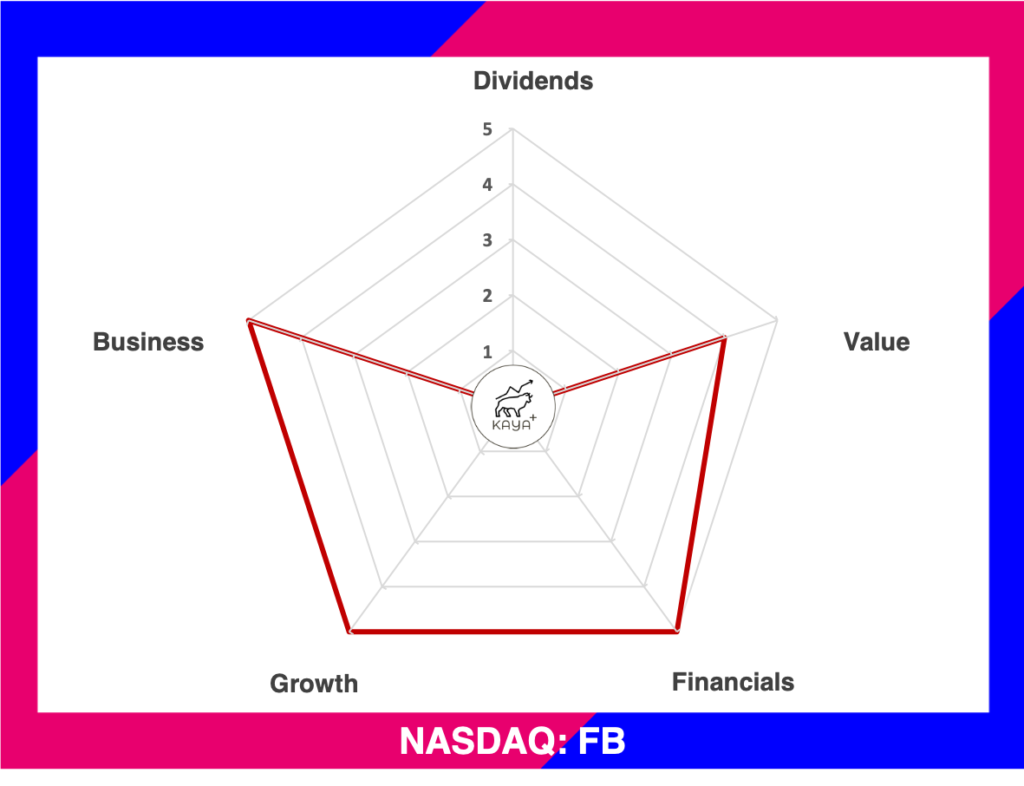

Dividends (0/5):

Value (4/5): ⭐ ⭐ ⭐ ⭐

Financials (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Growth (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Business (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Facebook Family of Apps & Technologies

- Facebook: Facebook enables people to connect, share, discover, and communicate with each other on mobile devices and personal computers. There are a number of different ways to engage with people on Facebook, including News Feed, Stories, Marketplace, and Watch.

- Instagram: Instagram brings people closer to the people and things they love. It is a place where people can express themselves through photos, videos, and private messaging, including through Instagram Feed and Stories, and explore their interests in businesses, creators and niche communities.

- Messenger: Messenger is a simple yet powerful messaging application for people to connect with friends, family, groups, and businesses across platforms and devices.

- WhatsApp: WhatsApp is a simple, reliable, and secure messaging application that is used by people and businesses around the world to communicate in a private way.

- Oculus. Hardware, software, and developer ecosystem allow people around the world to come together and connect with each other through our Oculus virtual reality products.

Competitors

Even though the monetization of advertisement revenue is still relatively a new way of marketing over in the Asian region, Facebook Inc. is no stranger to competition in the ads segment.

Notable competitors in the advertisement segments and videos are Google and YouTube. Messenger apps wise there are a handful of competitors which include Apple Messaging, Telegram.

Over at the social media verticle, there is strong competition from TikTok and not to mention Twitter and Snapchat.

Virtual Reality is also highly competitive, where there are a handful of startups and companies also venturing into the next phase of connectivity.

Management

Facebook Inc. has one of the talented team put together. The Chairman and Chief Operating Officer is none other than Mark Zuckerberg. Zuckerberg remains the only founder that is currently involved as a director and management of Facebook Inc.

Sheryl Sandberg is the Chief Operating Officer of Facebook Inc. For the past 13 years, she has been with Facebook Inc. Prior to that, she has been Vice President of Google’s Online Sales and Operation for 6.5 years, and Chief of Staff at the United States Treasury Department.

Also worth mentioning is Chief Financial Officer Dave Wehner and Chief Technology Officer Mike Schroepfer, who both have been with the company for 8 years and 12 years respectively.

Ownership wise, Mark Zuckerberg holds the highest amount of controlling shares in Facebook Inc. giving him 57.9% shareholder rights. Co-founders Eduardo Saverin and Dustin Moskovitz also hold substantial amounts of shares respectively.

Perhaps what is more interesting is that both the COO and CTO of Facebook Inc. also have a stake in the company. Sheryl Sandberg indirectly holds 1.341 million Class A shares through trust, according to April 10, 2020, proxy statement. Michael Schroepfer comes in as Facebook’s sixth-largest shareholder. According to the company’s April 10, 2020, proxy statement, Schroepfer has a total of 1,027,456 Class A shares and no Class B shares.

This shows that the Management and board of directors have skin in the game, and would make decisions that would benefit the company and all of the shareholders.

Financial Performance

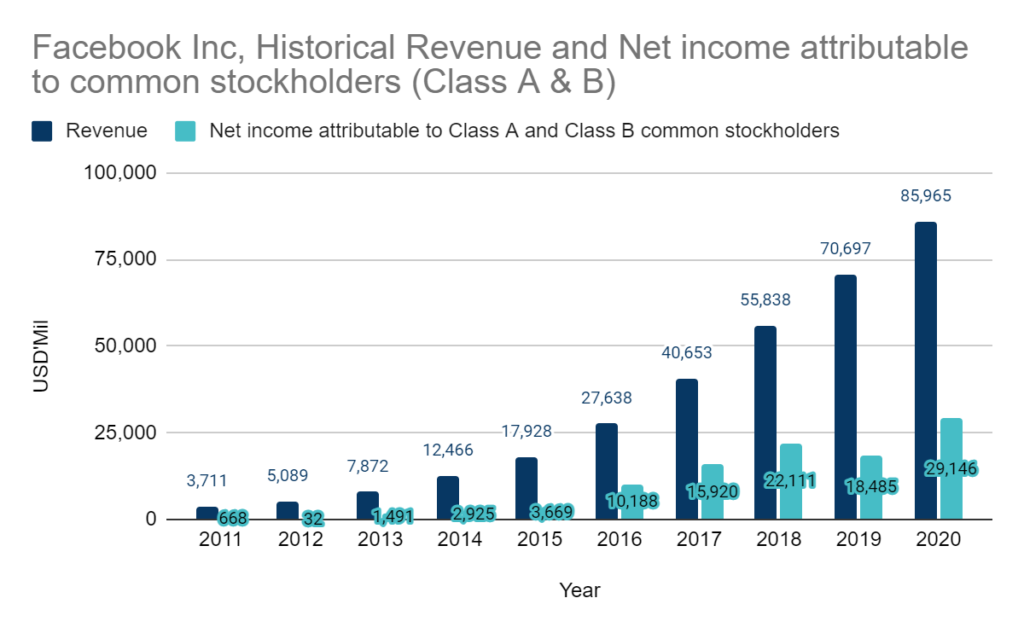

Facebook Inc. is a high growth and high potential company. As of the year 2020, it registered revenue of USD 86 billion. FY 20 net income attributable to shareholders is at USD 19 billion. For the past 9 years, revenue grew at 41.79% CAGR, while net income expanded at a rate of 68.37% CAGR.

Facebook Inc.’s business model is asset-light and highly scalable. After building a successful social media platform that has high public traffic, Facebook Inc. is able to monetize its platform by selling advertisement spaces to businesses.

In fact, Facebook advertisement became much more efficient from conventional advertisements since it is able to track clicks and conversion. Businesses are now able to track the effectiveness of a particular advertisement and are able to get feedback on the style of ads to show and market. With all the data and metrics all readily available on a live update basis, it has certainly changed the advertising landscape.

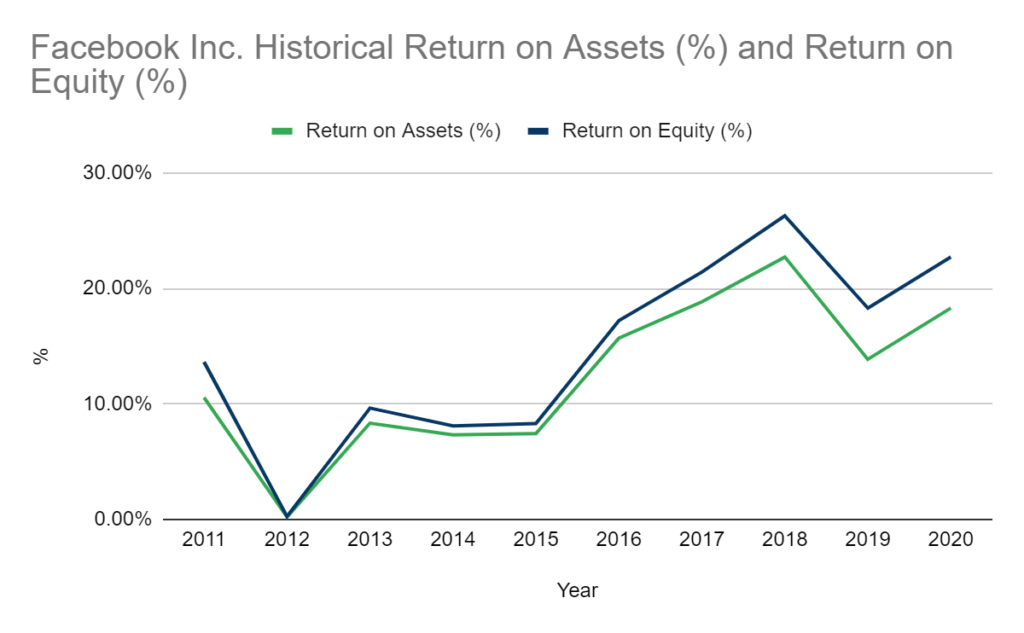

Facebook Inc.’s Return on Assets and Equity has also been on an upward trend. Only in the year 2012 and 2019, there was a slight downward turn. As Facebook Inc. is still a growing tech company, the cost of revenue and research and development will sometimes outgrow the revenue growth as the company prepares for future manpower requirement and technological breakthrough. The lower ROA and ROE in 2012 eventually trended upwards to a high 22% and 26% respectively in the year 2018. Facebook’s ROA and ROE for FY 2020 is 18.3% and 22.7% respectively.

Balance Sheet

| Year | Assets (USD’Mil) | Liabilities (USD’Mil) | Equities (USD’Mil) | Gearing Ratio |

| 2020 | 159,316 | 31,026 | 128,290 | 0 |

| 2019 | 133,376 | 32,332 | 101,054 | 0 |

| 2018 | 97,334 | 13,207 | 84,127 | 0 |

| 2017 | 84,524 | 10,177 | 74,347 | 0 |

| 2016 | 64,961 | 5,767 | 59,194 | 0 |

Facebook Inc. has been increasing its assets at an accelerated rate. As of the year 2020, Facebook Inc. has an asset worth USD 159 billion. Retained earnings make up a huge chunk of the equities portion. The liabilities portion of Facebook Inc. worth USD 31 billion as of 2020 is majority payables. Hence, Facebook Inc. does not have any borrowings, which means it has a gearing ratio of 0.

Cash Flow Activities

Source: FACEBOOK INC. ANNUAL REPORT

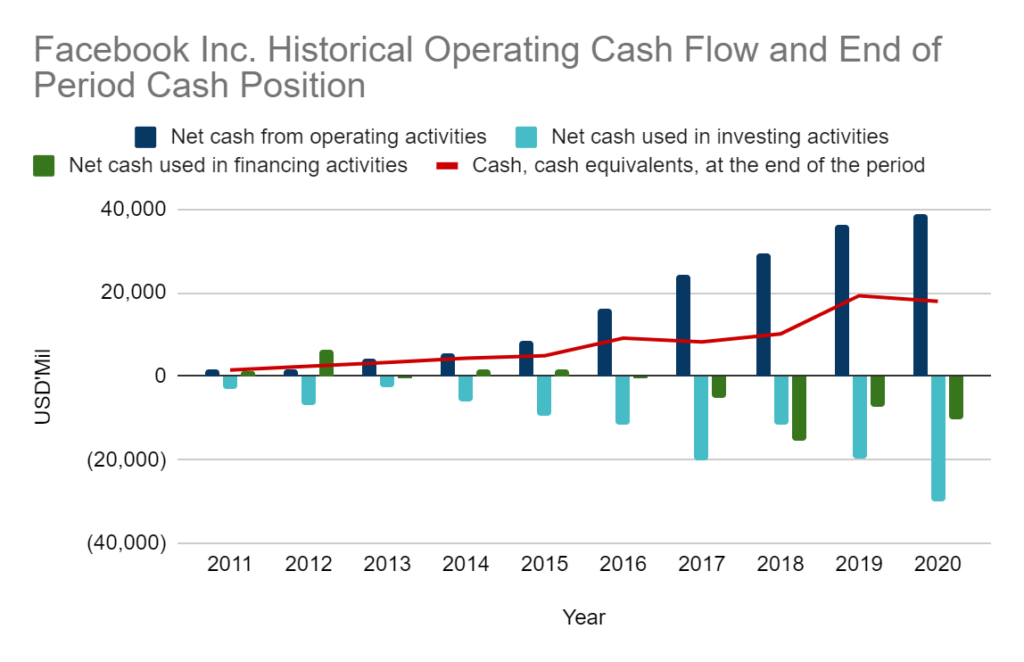

Facebook Inc. business brings in tons of operating cash. Net cash flow from its advertising business trends along with its explosive revenue growth. Even though Facebook Inc. has also increased its capital expenditure investments, its cash position at every year-end is still on an increasing trend.

Facebook Inc. is not a dividend-paying company. So it creates returns to shareholders by doing share buybacks since dividends are taxable in the United States of America.

Price

Just like its business performance, the share price has grown from $38 per share to $316 as of writing, giving a total return of nearly 8 times. Online advertising has just slowly started to replace conventional advertising spaces, hence the share price of Facebook Inc. would potentially go up higher should there is more adoption of advertising trends towards online.

MyKayaPlus Verdict

Facebook Inc. is one of the outperforming stocks of our century. The shrewd evolution from a social media company into an online advertising company has changed Facebook. However, Facebook Inc.’s vision has never strayed away, which is to connect people and bring people closer.

Being a tech company that monopolizes and has such a huge user base, it is bound to invite some controversies. The data breach of the Cambridge Analytica scandal is proof that Facebook Inc. is not a perfect company. Data leak incidents will always be a risk when it comes to investing in tech companies that hold vital user details and information.

But, rather than being too focused on the downside risk and threats of being a Facebook shareholder, it is more important to also look at the potential Facebook can grow. Its social media user coverage is still increasing, and even Google’s G+ was unable to pose any significant challenge.

There is definitely room for Facebook Inc. to grow further. But be always prepared for some regulatory challenges and risks it would encounter on the way to its growth.

Investing in companies outside of our home country should not be a scary endeavour. Interested to explore the world of stocks on the international market? Join us in our Premium Club!

Great article. I believe FB’s huge investment in VR/AR sector, if successful, will be able to push them to greater heights.

Yeap. But for AR/VR to really succeed, 5G and its infrastructure needs to be mature to support the bandwidth and data.

JP