DBS GROUP HOLDINGS LTD

Business Summary

DBS Group Holdings Ltd is a public listed bank in the Singapore Stock Exchange (SGX). Previously known as The Development Bank of Singapore Limited, it was set up by the Singaporean government on the 16 July 1968 to take charge of the industrial financing activities from the Economic Development Board.

As Singapore slowly grew and transformed into the financial hub of South East Asia, DBS Group Ltd has also grown to become the biggest bank in South East Asia by assets. It has wide market presence in Asia in many different market-dominant positions, such as consumer banking, treasury and markets, asset management, securities brokerage, equity and debt fund-raising.

In the year 2019, DBS Bank was crowned World’s Best Bank by Global Finance. It became an example to all the banks worldwide, as it taps heavily into technology to make banking much more convenient and efficient.

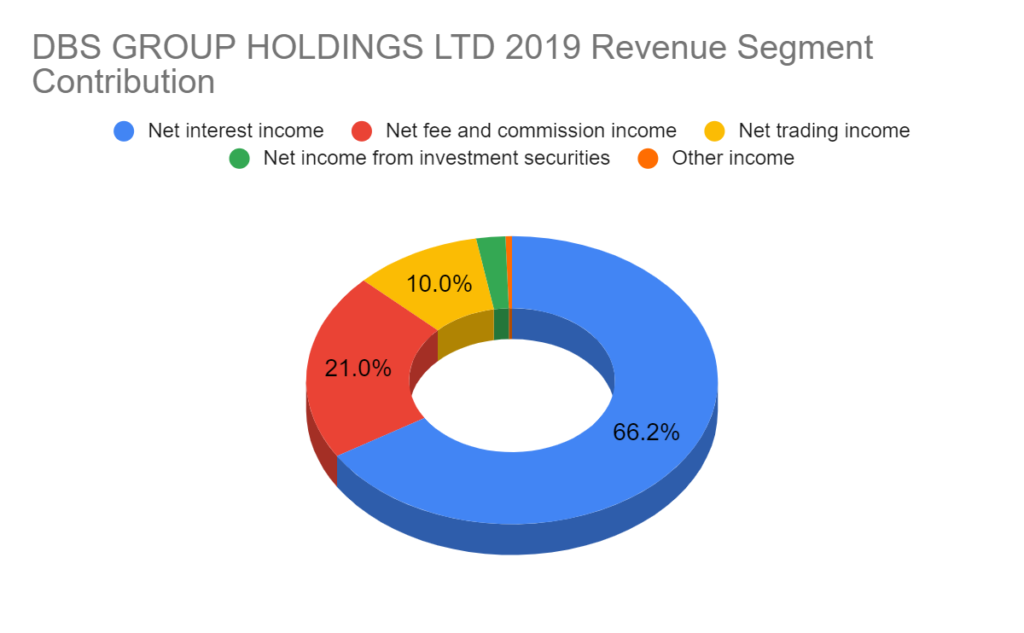

As fo 2019, interest income contributes to around 66% of DBS Group Ltd’s revenue. Income from fees and commission is the 2nd largest segment at 21%. Trading income, investment income and other income contribute to the balance of 13% of its remaining revenue stream.

Last update: 19.04.2020

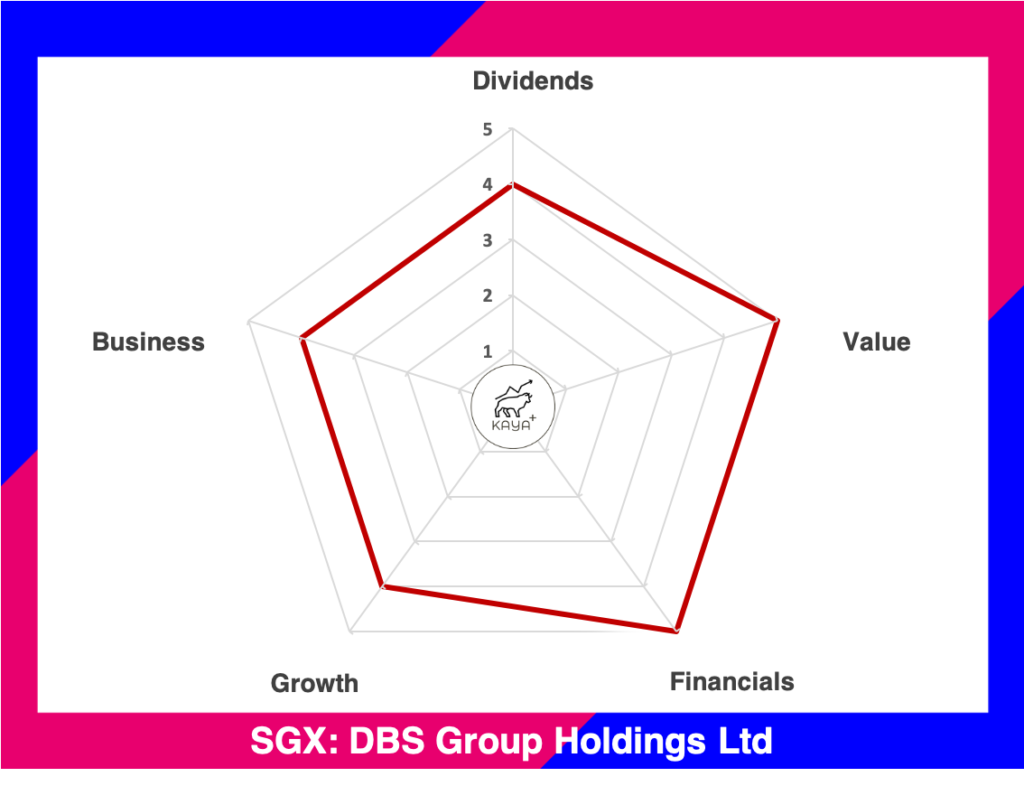

Dividends (4/5): ⭐ ⭐ ⭐ ⭐ ⭐

Value (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Financials (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Growth (4/5): ⭐ ⭐ ⭐ ⭐

Business (4/5): ⭐ ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Management & Substantial Shareholders

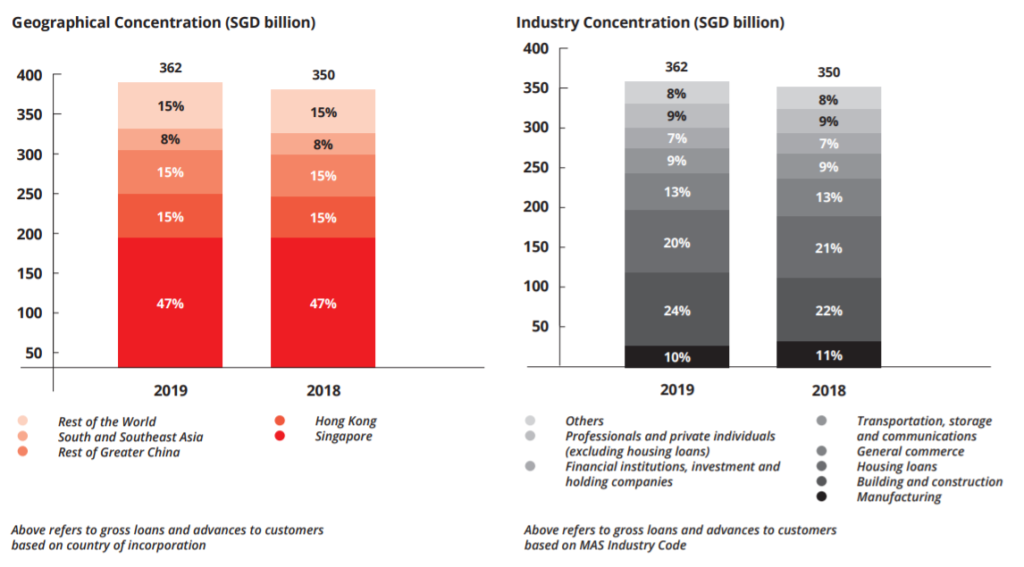

The current CEO of DBS Group Holdings Ltd is Mr Piyush Gupta. Mr Gupta joined DBS Bank in the year 2009 as Group CEO and has been pivotal to the bank’s growth. Under his tenure, DBS bank grew into an ASEAN strong house and also has a great presence in the Asian region. More than half of its revenue is derived from outside of Singapore, with its large presence in Hong Kong and China

DBS is a state-owned bank. Temasek Holdings, Singapore’s 2nd largest sovereign fund, owns 47.87% of DBS shares (11.11% under Temasek Holdings and 17.94% under Maju Holdings Pte. Ltd., wholly-owned subsidiary of Temasek Holdings.

Financial Performance

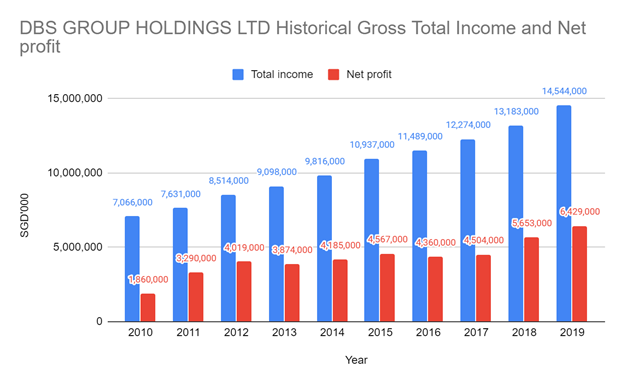

DBS Group Holdings Ltd has since continuous growth for both revenue and profits over the last 10 years. Ever since the 2008 economic downturn, it took a few years for DBS bank to pick themselves up and to stage an impressive growth. Gross income doubled in the span of 10 years, while net profit grew at a 10-year CAGR rate of 9.76%.

As of the year 2019, DBS bank has a cost-to-income ratio of 43%.

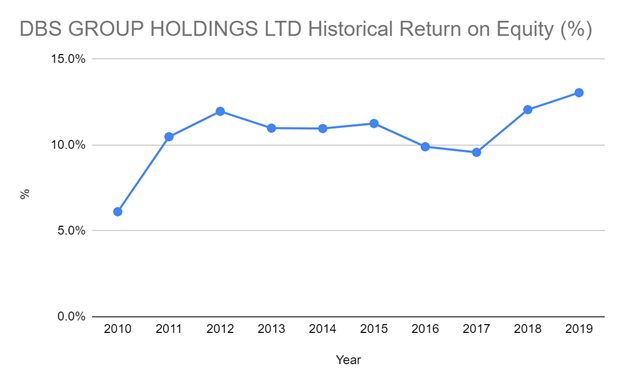

Return on Equity (ROE) also trended higher after the year 2010. This means that DBS bank was able to generate more returns to shareholders without raising more capital from its shareholders.

Balance Sheet

| Year | Assets (SGD’000) | Liabilities (SGD’000) | Equities (SGD’000) | Capital Adequacy Ratio (%) |

| 2019 | 578,946,000 | 527,147,000 | 51,799,000 | 16.7 |

| 2018 | 550,751,000 | 500,876,000 | 49,875,000 | 16.9 |

| 2017 | 517,711,000 | 467,909,000 | 49,802,000 | 15.9 |

| 2016 | 481,570,000 | 434,600,000 | 46,970,000 | 16.2 |

| 2015 | 457,834,000 | 415,038,000 | 42,796,000 | 15.4 |

In the year 2019, DBS Group Holdings Ltd has Assets of around SGD 579 billion, liabilities of SGD 527 billion and equities of SGD 0.52 billion. The Capital Adequacy Ratio is at a high of 16.70%, which is well above the minimum 10% + 2.5% buffer set by the Monetary Authority of Singapore, in accordance with Basel III.

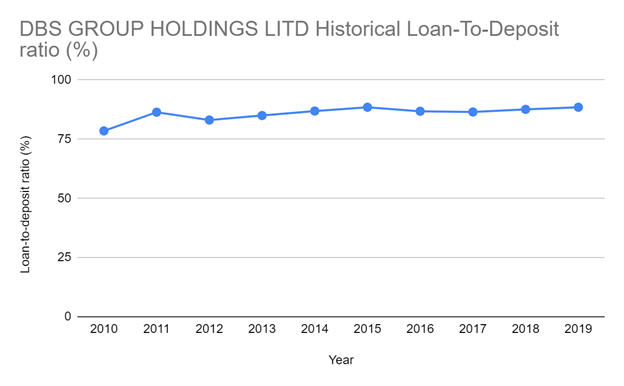

Its Loan To Deposit ratio is also consistently above 75%. As of 2019, it has a stable Non-Performing Loan ratio of 1.5%

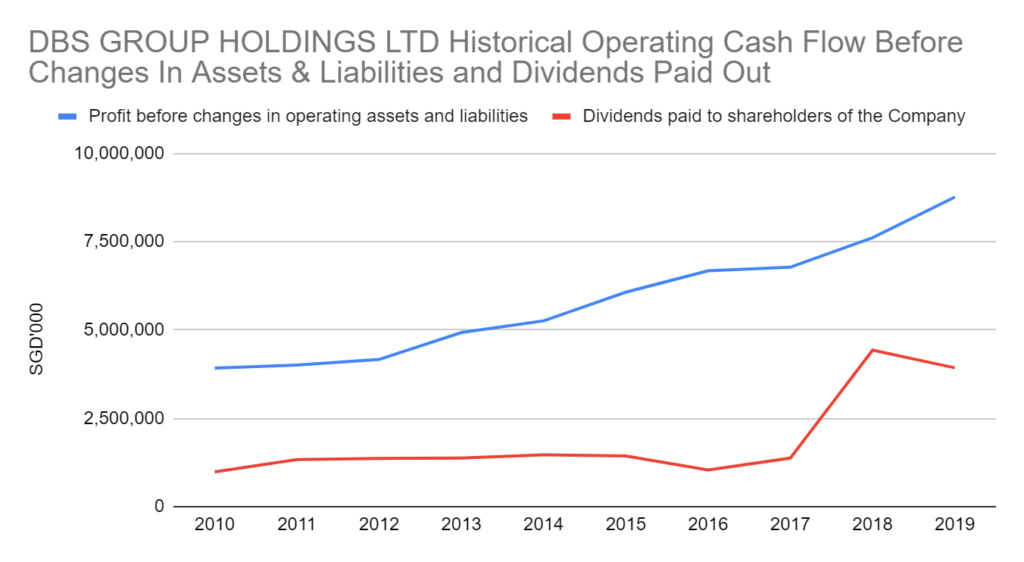

Operating Cash Flow & Dividends Paid Out

A traditional bank’s main business is to earn money on top of its depositor’s money. Over the years, the banking industry has added so much more product offerings on top of the money lending business.

DBS Group Holdings Ltd has seen its operating cash flow increases over the years. This comes in tandem with its increased profits. Dividends paid out was relatively flattish but stable. As of the year 2018, there was a huge spike in dividends paid out due to its 50th anniversary, which also coincides with the year it took home the bank of the year award.

Source: DBS GROUP HOLDINGS LTD ANNUAL REPORT

Share Price

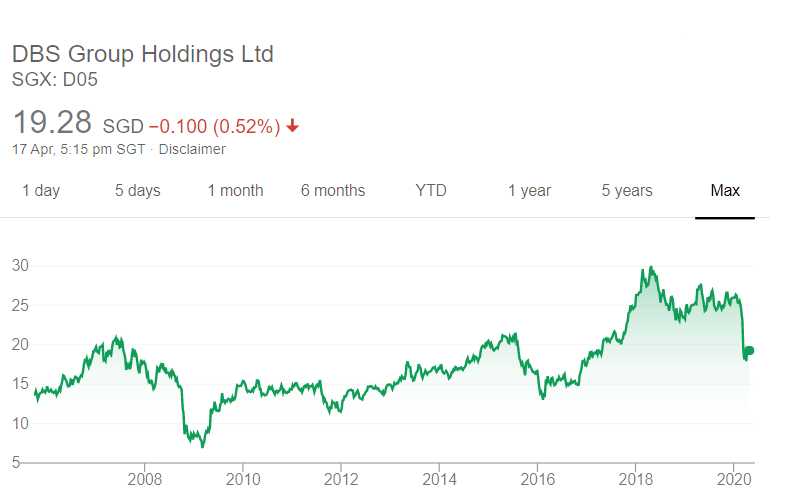

The beauty and logical explanation of a share price is that it will always follow and tag along with the company’s performances. DBS Group Holdings Ltd was the bank originally formed to handle the development projects ever since Singapore got independence and started growing and expanding.

Fast forward the years, it has now grown into a world-class bank and having a strong presence in Asia. Since a bank’s business model is not confined to any geographical challenges, DBS share price has climbed to an all-time range of around SGD 25 -30 per share.

Of course, due to the latest uncertainty caused by COVID-19, the share price has corrected downwards.

MyKayaPlus Verdict

DBS Bank being crowned as the bank of the year in 2018 means that it has achieved the ultimate recognition in the world of banking. But nevertheless, it’s still working relentlessly to grow day and night. It has also launched a plan to expand to India and the Middle East.

Although the contribution from these regions will definitely start from a small, but judging from how DBS grew from a small island in Singapore into the bank of the year in 2018, if everything is managed and executed well, we could well see DBS replicating its success in its India and the Middle East exposure in a few years time.

Would you ever consider to become a shareholder of DBS Group Holdings Ltd? Let us know in the comments section below.

Thank you for the analysis. Interesting to read. It’s very tempting to get some of DBS shares in my portfolio. As DBS is in SGX, any known drawbacks for potential investors from Malaysia? Eg: taxes etc

Hi Siti,

The only downfall of investing Singapore shares via a Malaysia brokerage is that the brokerage costs might be more expensive.

It might incur a higher costs upfront, but eventually, the accumulated dividends down the road can recoup back the costs. And also, there are no additional taxes to invest in the Singapore market as a Malaysian.

JP