Could Retail Investors Have Detected Luckin Coffee’s Potential Business Fraud?

Barely a month passed since Luckin Coffee Inc‘s (NASDAQ: LK) fell from grace. The usurper to Starbucks Corporation (NASDAQ: SBUX) as the king of retail brewed coffee in China is in trouble.

In early January 2020, an 89-page research on how Luckin Coffee alleged fraud surfaced. Muddy Waters Research LLC blew the whistle after receiving and making the research public. They also went short. But it wasn’t till end Mar’20 we saw Luckin Coffee’s share price came crashing down.

The report, titled “Luckin Coffee: Fraud + Fundamentally Broken Business” provides damning points with proof on how Luckin Coffee manipulated numbers. Even the professionals have no idea of the fraud. So does that mean retail investors are unable to spot them too?

We will go through each point provided to see whether a retail investor, could have detected and avoided Luckin Coffee

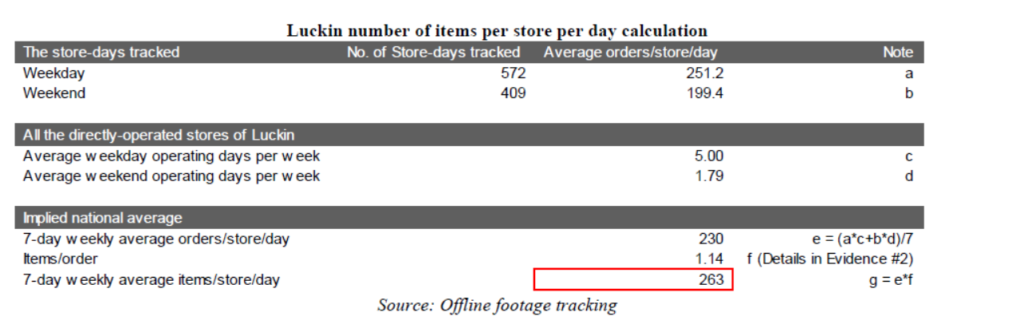

1. Smoking Gun Evidence #1: Inflation of number of items per store per day

The mysterious author of the report, codenamed Coffee_Detective, had 1,500 people on the ground to observe and record videos. They managed to cover 96% of locations of Luckin stores. Stores were also grouped into subcategories, example office, mall, school, residential and more.

All stores have foot traffic and videos were taken. Recordings of the days that have 10 minutes of footage missing will not be counted. Hence, the data is of 100% integrity, with no possibility of miscalculations.

In short, with the manpower and hours invested, Coffee_Detective‘s findings is as solid as it gets. Items are accurately counted. The approach was foolproof in obtaining the actual sales numbers.

Unless you are personally in China, have resources, this task would be highly impossible to execute by a retail investor.

Verdict: Retail Investor Blindspot

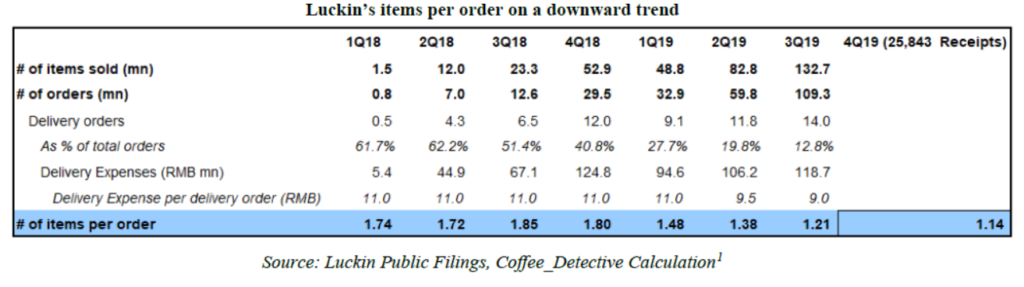

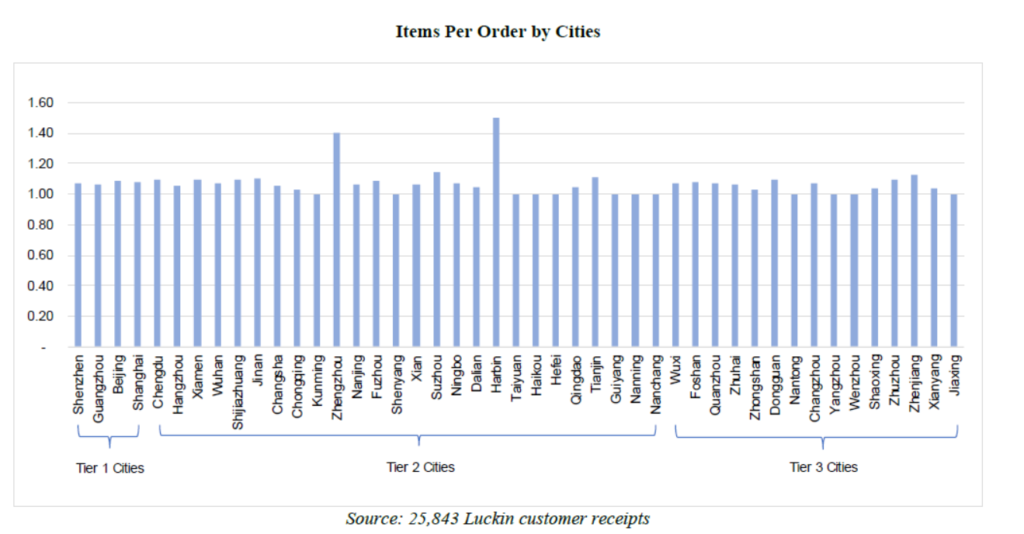

2. Smoking Gun Evidence #2:Decline of “Items per order” in 2019 2Q to 2019 4Q

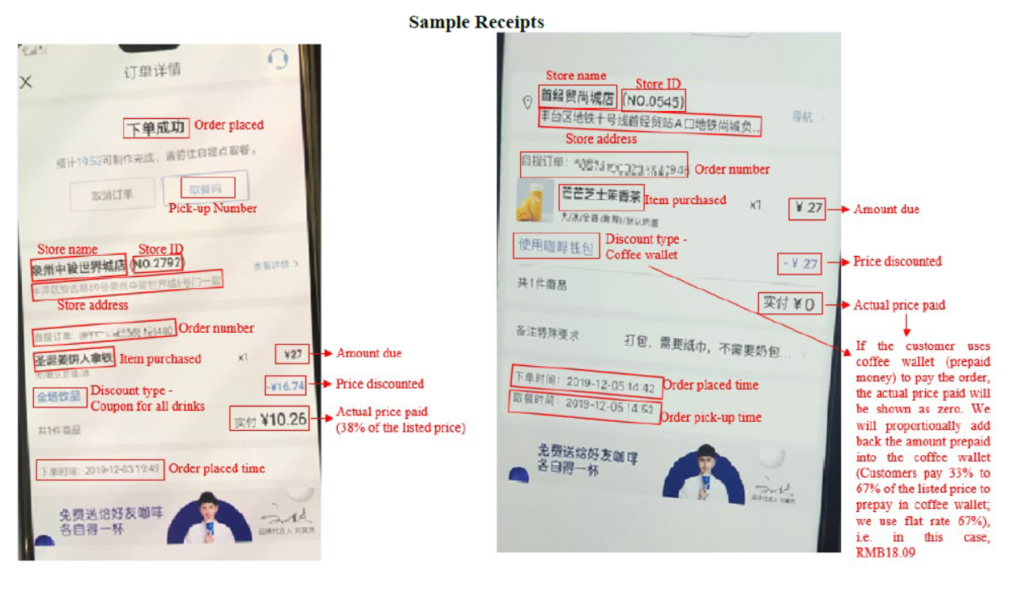

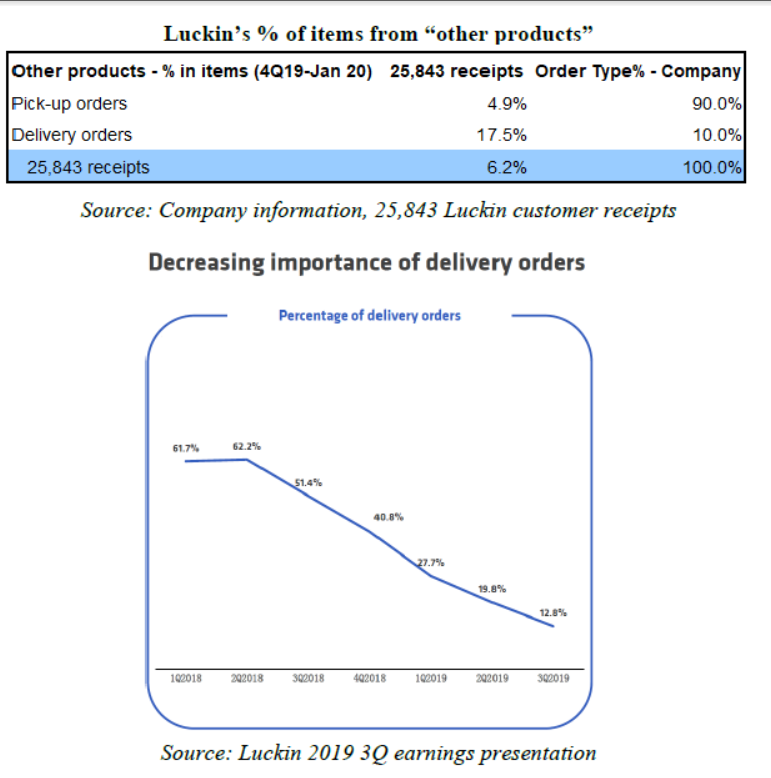

For their second evidence, Coffee_Detective gathered 25,843 customer receipts from 10,119 customers in 2,213 stores. Out of all the receipts, the average items per order ranged from 1.08 to 1.75 for pick-ups and delivery orders. This information actually shows a continued downward trend of items per order from 1.74 in 2018 1Q to 1.14 in 2019 4Q.

Since each receipt contains vital information, the report has utilized all available information to form a thesis. The information includes information such as pick-up or delivery order, types of coupon applied, listed price and actual price.

Again, this is another workforce intensive exercise. A retail investor would not have had the insight nor the resource to mount such investigations

Verdict: Retail Investor Blindspot

3. Smoking Gun Evidence #3: Inflation of Net Selling Price Per Item

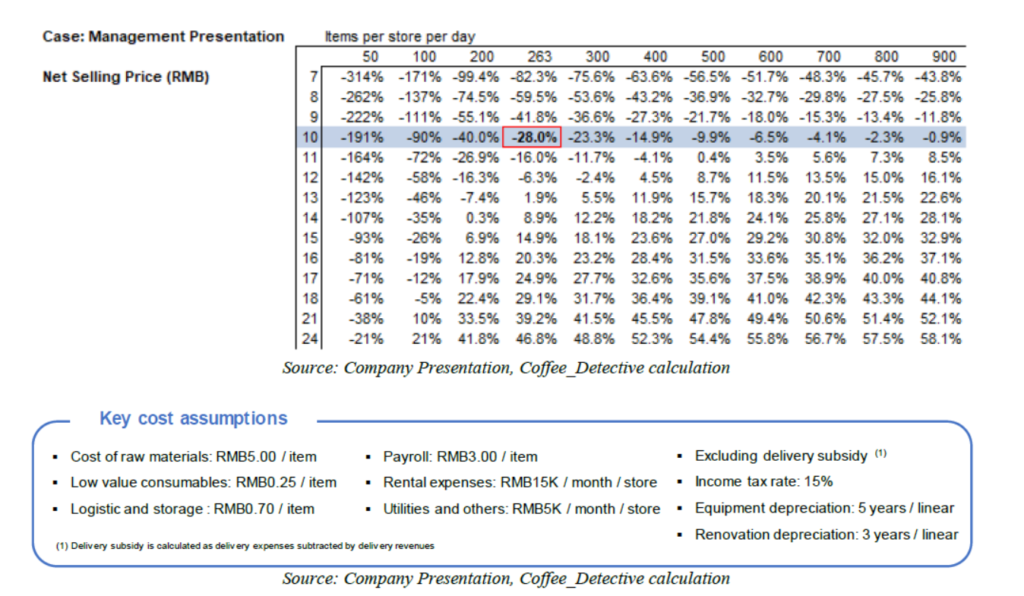

Yet another attack by leveraging on the collected receipts. Net selling prices of items in the 25,843 receipts collected only showed a price of RMB 9.97. Compared to Luckin’s reported selling price of RMB11.2, there was a 12.3% difference.

The study went in deeper to simulate that with an actual sales of just RMB 9.97 per receipt, each store should not be reporting a profit. There would be a loss of 28% instead.

Even by using back the key cost assumptions from the company’s presentation but coupled with the actual sales per receipt, the paper owners found it almost impossible to claim for any store-level profits.

Verdict: Retail Investor Blindspot

4. Smoking Gun Evidence #4: Third-party media tracking showed Luckin overstating advertising expenditure

Being a company eager to grow its market share, Luckin Coffee burnt a ton of cash in advertisements.

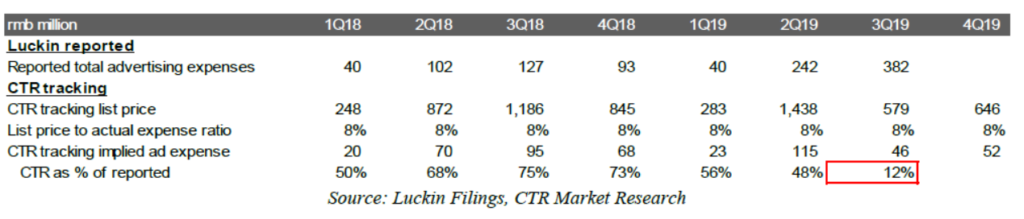

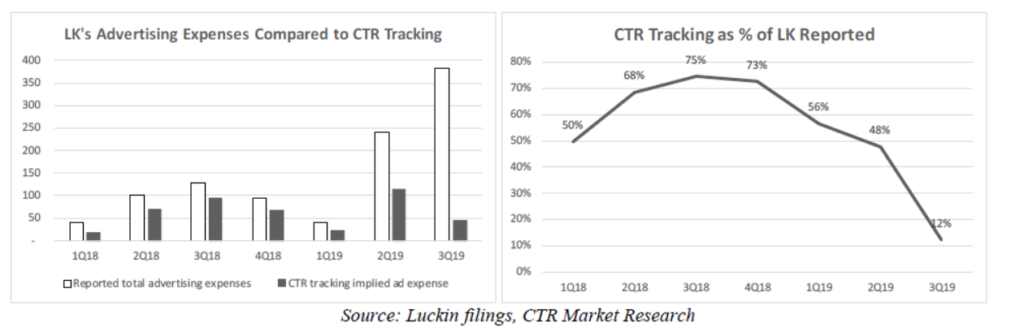

However, it was soon noticed that there were some discrepancies of information between Luckin’s claim and CTR Market Research.

On the credibility of CTR Market Research, it tracks actual advertising broadcasting of different brands on various media channels. These include LCD display network, poster/digital frame network and others.

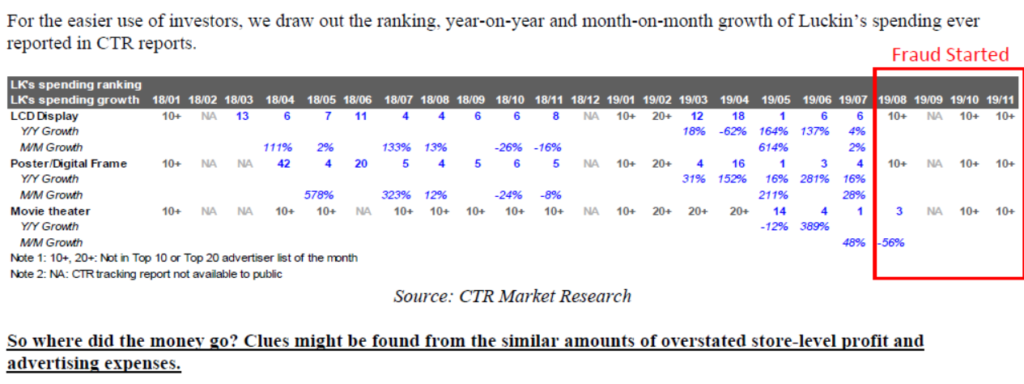

Unlucky for Luckin, CTR’s revenue in terms of their customer’s contribution on a monthly basis, down to the categories. According to CTR, Luckin’s ranking in LCD Display and poster fell quicky in June and July 2019.

This contradicted with Luckin’s own report on their advertising spending ranking.

Someone hell-bent on finding a fault on Luckin can actually pull this off.

Verdict: A retail investor is able to snuff out this smoking gun

5. Smoking Gun Evidence #5: Inflated revenue contribution from “other products”

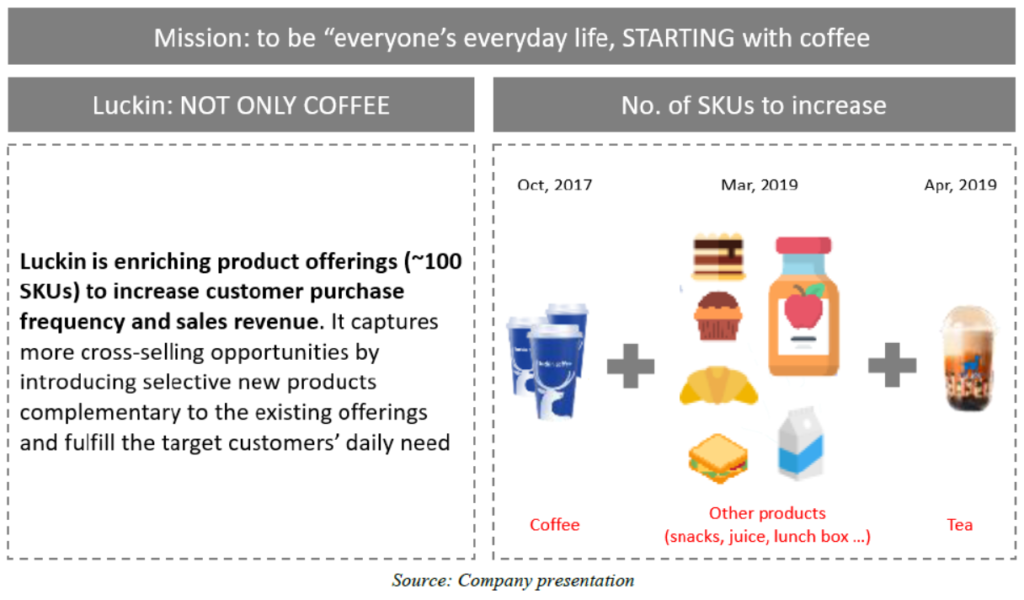

Luckin Coffee was never going to be a pure coffee play company like Starbucks. Coffee is one of the initial product offerings. Hence, it places heavy emphasis on juices, nuts and snacks to increase its portfolio of products.

For this particular smoking gun evidence, the Coffee_Detective tabulated data yet again from their collection of receipts. They found that only 2% of pick-up orders consists of “other products” (products other than coffee). While the number seems higher for take-away orders, it was then deduced that “other products” were added to delivery orders to meet free shipment requirement. Coupled with the fact that delivery orders have been plummeting, it seems impossible to show the growth of other products.

Verdict: Retail Investor Blindspot

MyKayaPlus Verdict

After going through all 5 smoking gun pieces of evidence found in this report, a normal retail investor would have only detected 1 point out of the 5 points. Hence it does explain why even fund managers got duped into investing in a company that faked its growth.

But, the second part of the report, detailing the red flags by going more in-depth to the management team, could shed some limelight. Perhaps that limelight, would have given retail investors like you and me, a chance to spot a potentially fraudulent company before it implodes?

Stay tuned for the second part of the Luckin Coffee post mortem!