CARLSBERG BREWERY MALAYSIA BHD VS HEINEKEN MALAYSIA BERHAD

The brewery business is a niche sector in the food and beverage business. People might tend to overlook it since the products manufactured by them are only for those aged 18 and above (depending on each country’s age limit).

But still, it is a lucrative business nonetheless. Especially in Malaysia, where there are only two licensed breweries. Heineken Malaysia Berhad and Carlsberg Brewery Malaysia Berhad.

But to choose the best among the two, which one would be an investor’s choice, rather than a drinker’s choice

1. Revenue

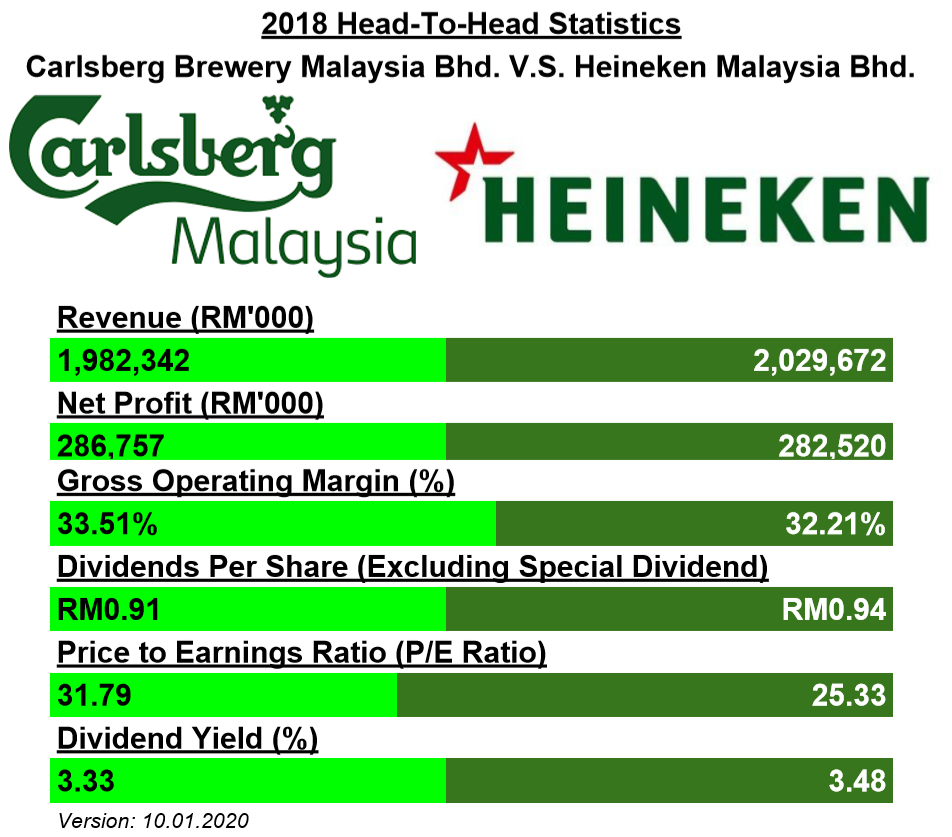

Both companies are neck-to-neck when it comes to sales. But Heineken Malaysia inched out more sales compared to Carlsberg Malaysia in latest the fiscal year 2018. However, in the latest 3 trailing quarters, Carlsberg Malaysia actually is turning the tide around, recording RM 1.683 billion revenue versus Heineken Malaysia, who is a little behind at RM1.64 billion.

Verdict: Very close call, but we have to give Carlsberg Bhd the win for potentially pipping Heineken Bhd to recording higher revenue.

2. Net Profit

Net profit-wise, Heineken Bhd recorded an operating profit of RM 283 million versus Carlsberg Bhd, who again edged out a win with a profit of RM 287 million.

However, it is worth noting that Carlsberg Bhd has an investment stake in Lion Brewery, a brewery operating in Sri Lanka. As of 2018, the profit contribution of Lion Brewery to Carlsberg Malaysia’s total profit amounted to RM 21 million. So by stripping off the RM 21 million and compare just the Malaysian operations, Heineken Malaysia actually achieved a better report card in terms of profits.

Verdict: Very close call, but we have to give Carlsberg Bhd the win for potentially pipping Heineken Bhd to recording higher profits this time around! Plus point too for having an investment in another growing region.

3. Gross Operating Margin

Both companies are pretty close. Carlsberg Bhd yet again pipping Heineken Bhd by a marginal win. A higher gross margin means Carlsberg Bhd is actually more cost-competitive than Heineken Bhd. Historically, Carlsberg Bhd has proven to be consistently more cost-competitive than Heineken Bhd.

Verdict: Carlsberg Bhd takes it home again with a marginal win over Heineken Bhd

4. Dividends Per Share

Both companies are quite close too in dividends paid out per share. This time around, Heineken Bhd is more generous, with a trailing dividend per share of RM0.94 versus Carlsberg Bhd which has a trailing dividend per share of RM0.91. Both companies actually pay out almost 100% of their earnings as dividends, so they are really a dividend investor’s favourite.

Verdict: It is a tie since both companies are dividend powerhouses. To award Heineken Bhd a win with a marginal 3 cents dividend isn’t that much justified.

5. Valuation – Price to Earnings and Dividend Yield

Both companies are trading at a price to earnings ratio ranging from 25 times to 31 times. Heineken Bhd appears to be cheaper by a little bit. Dividend yield wise Heineken Bhd also pips Carlsberg by a bit.

Verdict: Straight forward win for Heineken Bhd

MyKayaPlus Wrap-Up

Remember our Ultimate Glove Maker comparison where we compare 4 of Malaysia’s biggest glove makers? In that article, the cheapest company in valuation turn out to be the smallest, which justifies the lower valuation.

In this case, however, both Heineken Bhd and Carlsberg are equally big and well managed. So even though Carlsberg may have many winning points, valuation wise it is 20% more than its competitor Heineken Bhd.

Personally we do not think the gap should be that big. So, by comparison, Carlsberg bhd is indeed on the higher side.

Would you invest in either company? Let us know in the comments section below.

Need more info on Carlsberg Brewery Malaysia Bhd? Check out our in-depth report here

Need more info on Heineken Malaysia Bhd? Check out our in-depth report here