AEON CREDIT SERVICE (M) BERHAD

Business Summary

Aeon Credit Service (M) Berhad (KLSE: AEONCR) is a subsidiary of AEON Financial Service Co., Ltd., Japan (AFSJ). Incorporated on 6th December 1996, it started off as a company that provides Easy Payment schemes for purchase of consumer durables (in other words groceries and also home use electrical appliances) through appointed retail merchants and chain stores.

Since then, it has grown into a much bigger company. Today, it’s other businesses includes the issuance of Credit Cards, Easy Payment and hire purchase financing for motor vehicles, Personal Financing schemes, insurance sales business and other services.

AEON Credit Bhd currently serves and operates its business 100% entirely in its home base Malaysia.

Last update: 12.09.2020

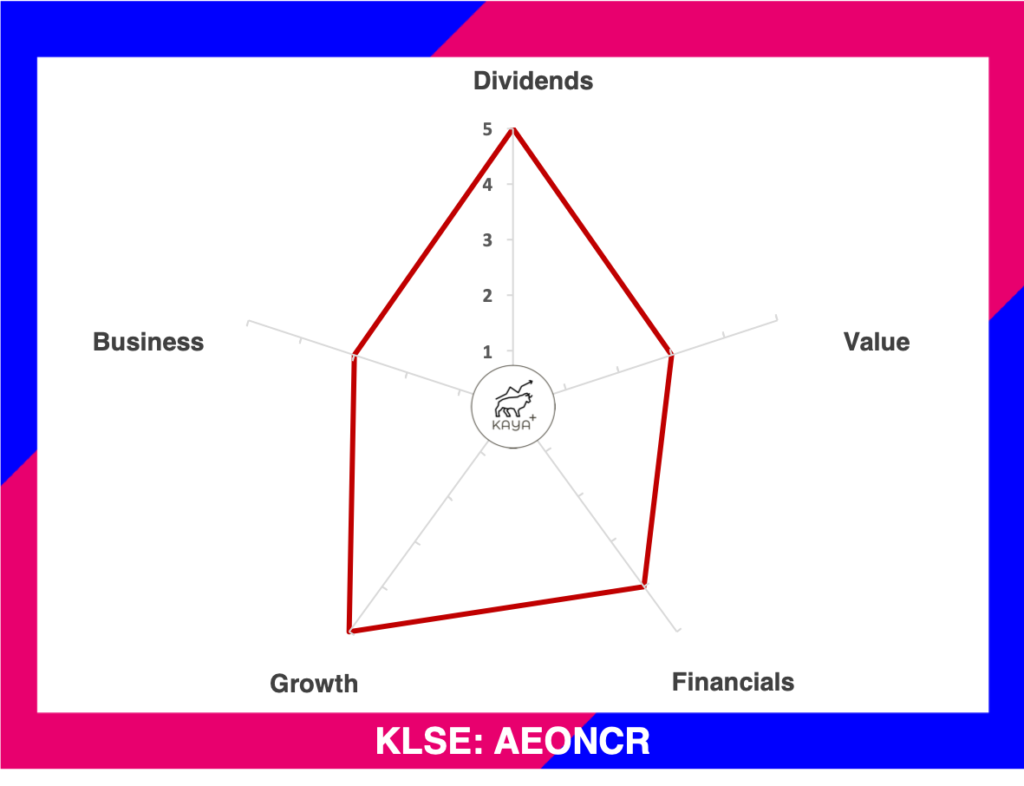

Dividends (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Value (3/5): ⭐ ⭐ ⭐

Financials (4/5): ⭐ ⭐ ⭐ ⭐

Growth (5/5): ⭐ ⭐ ⭐ ⭐ ⭐

Business (3/5): ⭐ ⭐ ⭐

Reference: (i) MyKayaPlus Metrics Definition (ii) MyKayaPlus Metric Evaluation Scale

Management And Major Shareholders

Source: AEON Credit Service Berhad Annual Report

AEON Credit Bhd is part of the AEON Financial Service Group, a subsidiary of the AEON Co., Ltd. AEON Group is a Japanese based multinational retail and financial conglomerate. So there is a tendency for it to appoint high flying individuals within its group for expatriation to listed entities outside of Japan.

The current Managing Director is Mr Yuro Kisaka. Mr Kisaka takes over from Mr Kenji Fujita, who is expatriated to his next mission in AEON Thana Sinsap (Thailand) PLC. Mr Kisaka brings with him ample senior management expertise and experiences. He previously served as the Managing Director of AEON Microfinance (Myanmar) Co., Ltd. He is no new face within AEON Credit Bhd as he personally managed the Marketing, Credit Card and New Business Development from Dec 2007 till 2011.

Miss Lee Tyan Jen currently serves as the Executive Director. She is also the Chief Information Officer. Her career with AEON Credit stretches back to 1998, where she started off as an Officer in the Credit Assessment Department. She has undergone various promotions, serving as General Manager, Head of Credit Assessment Group and also Head of Business Operations. In April 2016, she was designated as the Chief Operating Officer and as Head of Customer Service and Operations. Since April 2019, She was redesignated as Chief Information Officer and Head of IT Division.

The ex-Chief Financial Officer of AEON Credit Bhd is Mr Lee Kit Seong. With 20 years of experience in Finance and Accounting, Mr Lee has been CFO of AEON Credit since 2013. He is currently the Chief Corporate Officer and the CFO position is succeeded by Miss Lee Siew Tee. Ms Lee has held plenty of positions throughout her career. But her career experiences also included stints within AEON Co. (M) Berhad and within AEON Credit Service (M) Berhad.

Mr Ajith and Mr Ishida both serve as the Chief Business Officer and Chief Marketing Officer respectively. Both of them have vast experience within the AEON group. Overall, the top management team looks solid into leading AEON Credit in a highly challenging business segment that can still grow within Malaysia.

The total remuneration and salary package of AEON Credit Service Berhad as of FY 2020 is at RM 6.5 million. By percentage-wise, the director’s fees and management salaries against total revenue are at around 0.4%.

The substantial shareholder of AEON Credit is none other than its Japanese based holding company, AEON Financial Service Co Ltd. At 61.91% of total shareholding, AEON Financial Service Co Ltd basically controls the appointment of directors, management and also all major corporate actions. This is not out of the norm as other multinational corporations with listed entities in Malaysia like Ajinomoto (Malaysia) Berhad and Nestlé Malaysia Berhad also have similar shareholding structure.

The rest of the top 8 shareholders are mostly fund houses and equity funds.

Financial Performance

AEON Credit Service Bhd’s business model is somewhat similar to a bank. It provides financing options (lending money) but as of the moment for consumer durables and also motor vehicles.

AEON Credit latest FY 2020 revenue is at RM 1.6 billion. They do pose some challenges to traditional banks, as they do compete in consumer spending financing, credit cards, and also motor vehicle financing.

Although the financing business space does have a fair share of players already, AEON Credit has shown it has its advantages to secure and grow its top line and bottom line YoY. Of course, the latest 3 years do show flattish profits, contributed by higher operating expenses and also higher allowances for impairment. This should not be a straight red flag on its misperformance, as it is normal for a company to incur more expenses during the expansion phase.

But as of its latest FY 2020 report, profits attributable to shareholders is 23% lesser at RM 292 million compared to RM 380 million in FY 2019. A huge chunk of this is due to allowances on impairment losses on its loan that most financial services and banks also saw an increase, due to the COVID-19 impact and moratorium.

Return on Equity also inches down to 16.62%, while the Return on Assets, dropped to around 2%. Capital adequacy ratio also reduced by 4% to around 18% as of FY 2020.

Balance Sheet

| Year | Assets (RM’000) | Liabilities (RM’000) | Equities (RM’000) | Current Ratio |

| 2020 | 10,434,657 | 8,677,298 | 1,757,359 | 1.22 |

| 2019 | 8,655,754 | 6,780,773 | 1,874,981 | 1.99 |

| 2018 | 7,705,685 | 5,848,182 | 1,857,503 | 0.97 |

| 2017 | 7,272,069 | 6,041,082 | 1,230,987 | 2.33 |

| 2016 | 6,097,507 | 5,036,689 | 1,060,818 | 2.86 |

In the year 2020, AEON Credit Service Bhd has total Assets of RM 10.43 billion, liabilities of RM 8.68 billion and Equities of RM1.76 billion. The current ratio is stable at 1.22, and Total Capital Ratio is at 18%, much higher than the safety limit set by Bank Negara Malaysia.

Operating Cash Flow And Dividends Paid Out

Source: AEONCR BHD ANNUAL REPORT

Usually, dividend-paying stocks are big, stable and hardly see exciting growth. AEON Credit Service on the other hand has seen tremendous growth for the past 10 years. Revenue and operating cash flow are on a healthy growth trend. Dividends paid outgrew around 13 times during that period of the year.

Price

AEON Credit’s share price has also mirrored its company performances. Even though during the year 2012 till 2017 there are a few corporate actions and rights issues, the share price still manages to improve as capital raised was put to good use to grow the company. Eventually, the share price increased along with the company’s growth. Of course, since the start of the year 2020, share prices have corrected as financial services all around Malaysia and the world got badly impacted by the COVID-19 pandemic.

MyKayaPlus Verdict

AEON Credit Service Bhd has proven that it is possible to grow a business in saturated segments. Moreover not being a bank with multiple faucets of revenue streams, the business achievements it has had along the years only amplifies the success.

Also, as FinTech slowly becomes more and more relevant and important in our lives, AEON Credit has ventured into the e-wallet segment as well. Their e-wallet that has seen positive uptake ever since its inception. This also compliments the AEON membership and AEON malls offerings, which might give their e-wallet a niche space to survive and grow.

Of course, as the company’s share price is still down due to the pandemic, it will be up to retail investors to consider this a buying opportunity or deem it as a value trap.

Do you think the current price is value for a bargain, or a value trap?